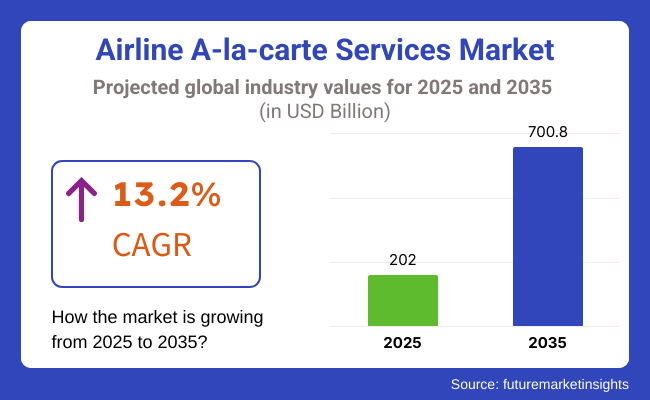

The global airline a-la-carte services market is projected to witness substantial growth, reaching a CAGR of 13.2% throughout the period from 2025 to 2035. Market forecasts suggest that the market value will rise from USD 202 billion in 2025 to USD 700.8 billion by 2035, primarily driven by the increasing demand for personalized and flexible travel experiences.

A-la-carte services that can be bought by travelers without-increasing the base cost, e.g. luggage allowance, in-flight meals, favored seating, Wi-Fi, and priority boarding are the ones offered. This approach gives the fliers a chance to handle their finances in a more efficient manner while the airlines are getting extra income through it. Digitization in the airline sector is a supplemental benefit of both the online and mobile booking systems that are now eliminating the hurdles associated with the choice and purchase of optional services.

A major driver of market expansion is the customization, as the demand of passengers who need to control their experiences on board is increasing rapidly. Airlines have increasingly begun the bundled service closely to add client value, besides maximizing profit at the same time. The deployment of the online booking system, a mobile app-based service selection, and the provision of the automated check-in has made the access to these add-ons easier for passengers.

Additionally, as a result of the rising use of artificial intelligence and data analytics, airlines can now produce incredibly specific invitations which also promote customer involvement and satisfaction. The growing customer base of both cost-cutting and flexibility is simply promoting the success of this method making it the top trend in aviation.

The increase in-demand for a-la-carte services particularly in airlines has been significantly helped by the sustainability initiatives. Airlines are incorporating green service proposals such as carbon offset programs, green travel packages, and local food options in conjunction with the offering of these services which aims to deal with the big issue of aviation being a greenhouse gas major polluter.

The introduction of such services not only captivates the environmentally-friendly tourists but they also contribute to achieving the sector's comprehensive sustainability targets. The airlines thereby deviating their profile are not only making a responsible corporate play but also creating new income streams through the sale of such programs.

The airline sector is on continuous change accelerated by the introduction of digital projects and the renovation of the service proposal. Airlines are interacting with their ancillary revenue systems by the redistribution of the workforce that will be using big data and predictive analytics to narrow down customer preferences.

Between 2020 and 2024, the airline industry moved toward a-la-carte services as their mode of operation which basically involved unbundled fares to passengers. This opened up more opportunities for ultra-low-cost carriers. All of these services included but are not limited to: premium selection of seats, baggage fees, priority boarding, and in-flight Wi-fi, for which the airlines opened new avenues. Digital booking platforms and an AI-based personalization pattern helped them optimize revenue achieved from add-ons.

The 2025 to 2035 period is set to observe AI-enhanced hyper personification, green initiatives toward sustainability, and service delivery via subscription. Predictive analytical matching of ancillary preferences would thus personalize the going green choices such as carbon offset programs and sustainable meal offerings.

Moreover, subscription plans for baggage, seating services, and priority services will provide cost-effective options for frequent clients. Finally, biometric check-in systems on-the-go will leave the rest covered under the secured Blockchain transactions between service providers and onboard micro-transactions. Together, these factors will make air travel more flexible, personal, and profitable.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Transparent fee disclosure laws introduced | Stricter consumer protection, AI-driven pricing compliance |

| AI-based personalization in booking systems | Blockchain-based ticketing, biometric service upgrades |

| Expanded pay-per-use services | Subscription-based airline service bundles |

| Mobile booking apps for add-ons | In-flight AI-powered concierge services |

| Carbon offset options added to bookings | Eco-friendly ancillary services, reduced plastic usage |

| Dynamic pricing for baggage, seat selection | AI-driven personalized travel bundles |

| Fluctuations in ancillary revenue due to pandemic recovery | Sustainable sourcing of onboard products, cost-effective logistics for premium services |

| Passenger demand for customized travel | Expansion of digital-first airline services, hyper-personalization |

Frontier Airlines Not Leaving Money on the Table

Ultra-low-cost carrier Frontier Airlines is also good at generating ancillary revenue, especially from bag fees. It promotes tiered pricing - with baggage being cheaper if you buy it early, but check-in or gate fees much higher if you wait until the last minute. It helps facilitate operational planning and ensures that those last-minute bags are premium revenue. Frontier even charges to carry on your luggage with a price that is almost as high as checked luggage, and it will levy a steep fee (USD 75-USD 100) if not paid for gate bag.

Negative sales based on bag size leads to staff bonuses for catching oversized bags. The airline also packages ancillaries in products such as “The Works,” which includes baggage, seat selection and flexibility, to bind high-spending customers. Such strategies have made Frontier one of the leaders in ancillary revenue per passenger, and show how structured fees that are also firmly enforced can extract more revenue.

Singapore Airlines focuses on Premium Experiences

Singapore Airlines (SIA) adopts a luxe-fuelled attitude to ancillaries, promoting a better flying experience rather than charging for essentials. Its “Book the Cook” service enables premium cabin passengers to pre-order gourmet dishes, which helps justify selling up to a heavier class. Special dining events - such as transforming an A380 into a temporary restaurant - have also generated buzz and money, too.

SIA does sell extras, such as class-based things (extra-legroom seats, Wi-Fi) that would have been free but doesn’t make you pay for service, which they keep up high on the baseline; instead, they charge for how good of an add-on to your seat you want. This tactic helps cement its brand cachet, while reaping additional revenue. Other full-service airlines are following their lead, launching premium ancillaries that come across as luxuries rather than surcharges.

| Airline | Dynamic Pricing Strategy |

|---|---|

| airBaltic | Based on demand and booking behavior, airBaltic AI-powered pricing recalibrates seat and baggage costs. With the goal of maximizing revenue per passenger, prices change based on willingness to pay and give them an opportunity for ancillary revenue where possible. More demand, more premium pricing; shoulder-bookings might come with discounts. |

| Lufthansa Group | Gains AI-driven ancillary pricing for multiple carriers. Baggage and seat selection fees vary depending on whether it is peak or off-peak season, route demand, and date and time of booking. Through personalized pricing, passengers pay that is right for them resulting in higher conversion and a higher total revenue per booking. |

| Delta Air Lines | Dynamic upgrade pricing for premium seating. Prices for upgrades from economy to premium cabins fluctuate based on demand, remaining availability, and competitor pricing. The airline also tests bidding systems where passengers submit offers for available premium seats. |

| JetBlue | Peak compared to off-peak baggage pricing, charging higher fees during peak travel periods. The price for checking bags also goes up by USD 5-USD 10 in the summer and during the holidays - maximizing revenue while keeping base fares low and competitive. |

| Ryanair | Priority boarding and baggage fees differ according to demand, route and when they are booked. There’s no premium for exit-row and front-row seats in the off-peak seasons, and checked baggage fees increase the closer to departure you get. Pricing modifications allow airlines to maximize revenue on each flight while maintaining low base costs. |

| Spirit Airlines | Algorithmic pricing for checked bags and seat selection Fares depend on route, during booking and demand at peak travel times. What constitutes exact charges for bags differs greatly, so early purchase is encouraged and late purchase maximizes revenues. Ancillary fees account for more than 50% of airline revenue. |

Baggage fees are one of the main contributors to ancillary revenue for airlines, which is fueled by industry-wide transition from bundled fare structures to a-la-carte pricing. The model permits passengers to shape their travel experience according to their needs by choosing luggage options, saving costs for those who pack light, and enhancing airline revenues.

Customer complaints, logistical challenges and regulatory scrutiny remain. Instead, innovations such as digital baggage tracking, AI-fueled flexible pricing, and better customer communication are helping airlines increase service efficiency and tackle worry.

According to a study by the International Air Transport Association, tiered pricing allows airlines to effectively capture consumer surplus when one of the most powerful brands is in high demand, with dynamic pricing models enabling frequent travelers to avail low-priced tickets as low as USD 85 in peak seasons; but, all of these strategies to increase profitability have been led by major airlines, i.e., Delta and American Airlines, and have trembled even global agencies as Lufthansa on the verge of emotional consumer marketing.

Business-class seats have emerged as a new key revenue driver for airlines, providing an ideal combination of luxury and affordability for business travelers, road warriors, and long-haul fliers. Amenity-laden features such as lie-flat beds, direct aisle access, upgraded meals and perked-up boarding have helped meet overwhelming demand for comfortable and convenient route.

High-profile airlines including Qatar Airways, Delta and Cathay Pacific are channeling money into improved business-class cabins featuring private suites, multi-purpose seats and Artificial Intelligence seat selection systems. Airlines may also implement dynamic pricing models, adjusting fares depending on demand, which can maximize revenues from this area.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

| UK | 7.5% |

| European Union | 8.1% |

| Japan | 7.9% |

| South Korea | 8.3% |

In the USA, the airline a-la-carte services market is undergoing a vigorous growth phase as airlines and ticket sellers lay weight on passenger-centric upgrades and thus increase the profit. With the preference of travelers for more personal travel, airlines take a step ahead and allow passengers to customize their add-ons according to their own needs and wishes.

This market growth is mainly propelled by the transition toward ancillary revenue models, which transfigure airlines into the profit-generating companies beyond the ticket sales. The flights specialized in seating, speedy boarding, baggage deals, and subscriptions of in-flight entertainment have rapidly become the major income found. FMI is of the opinion that the USA airline a-la-carte services market is set to experience 7.8% CAGR during the forecast period.

Growth Factors in the USA

| Key Factors | Details |

|---|---|

| High Demand for Premium Services | Major USA airlines are focusing on upselling premium services, such as enhanced seating and in-flight amenities, to boost profitability. |

| Regulatory Scrutiny | The USA government is increasing oversight on ancillary fees, aiming to enhance transparency and protect consumers from unexpected charges. |

| Technological Advancements | Integration of advanced technologies, including mobile apps and data analytics, allows airlines to offer personalized ancillary services, enhancing passenger experience and increasing uptake. |

The UK market is witnessing gradual growth driven by the boom of low-cost carriers and high-end service provision. With travelers seeking greater control of their travel spending, airlines are focusing on module pricing models whereby passengers pay only for the services they really need. The UK industry is slated to depict 7.5% CAGR during the study period.

The UK tourist and business sectors have been the wind behind the sails for the introduction of lounge access, onboard Wi-Fi, meal pre-selection, and seat upgrades. The new digital payment systems and mobile app providing service customization have reduced steps for customers spending on flight personalization.

Growth Factors in the UK

| Key Factors | Details |

|---|---|

| Expansion of Low-Cost Carriers | UK-based low-cost airlines are innovating by introducing subscription models and diversifying ancillary offerings, such as in-flight retail and premium seating options, to attract a broader customer base. |

| Consumer Willingness to Pay for Comfort | There is a growing trend among UK passengers to opt for premium economy options, reflecting a willingness to pay more for enhanced comfort and services during flights. |

| Competitive Market Dynamics | The competitive landscape in the UK aviation sector drives airlines to continuously enhance their ancillary services to differentiate themselves and capture market share. |

The airline a-la-carte services market in the European Union is growing substantially with airlines' shift toward customer-oriented service modules. The super-low-cost airlines (ULCCs) have disrupted the airlines translating, making it more affordable while the additional services have become the main source of profit.

Germany, Spain, and France are the leaders of the campaign deploying tier service models, where customers can choose extra perks such as more legroom on the flight and free on-demand in-flight entertainment. Additionally, the E.U. airlines implement a subscription loyalty scheme so that the frequent travelers will enjoy a bunch of exclusive services and rewards.

Lufthansa, Ryanair, and Air France-KLM are the top players who are leading the e-business segment, by seeking to create automatic service bundling that helps flyers manage service configurations and preferred choices easily. FMI is of the opinion that the European Union market is slated to observe 8.1% CAGR during the study period.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| Rise in Ancillary Revenue | European airlines have seen a significant increase in revenue from ancillary services, with low-cost carriers leading the charge by unbundling services and offering a variety of paid add-ons. |

| Regulatory Environment | EU regulations emphasize transparency in pricing, compelling airlines to clearly disclose ancillary fees, which influences how services are marketed and sold. |

| Diverse Consumer Preferences | The varied preferences across EU member countries encourage airlines to tailor their ancillary offerings to meet regional demands, enhancing customer satisfaction and loyalty. |

The airline a-la-carte services market in Japan is on the rise as carriers relate to technology-driven personalization to boost passenger loyalty. As they are strong in both domestic and international tours, Japanese airlines upgrade premium services and include flexible ticket choices.

Japanese airlines such as ANA and Japan Airlines (JAL) are the forerunners in providing in-flight meals of exceptional quality, access to premium cabins, and customized travel insurance plans. Swift Airport has made the most use of branding through the fast-track security, baggage delivery service, and board upgrade products. FMI is of the opinion that the Japanese airline a-la-carte services market is poised to register 7.9% CAGR during the forecast period.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Technological Integration | Japanese airlines are leveraging advanced technology to offer innovative ancillary services, such as in-flight connectivity and personalized entertainment options, catering to tech-savvy consumers. |

| Cultural Emphasis on Service Quality | The cultural focus on high-quality service in Japan leads airlines to offer premium ancillary services, including gourmet in-flight dining and exclusive lounge access, appealing to discerning travelers. |

| Domestic Travel Demand | A strong domestic travel market in Japan provides opportunities for airlines to offer a-la-carte services tailored to frequent domestic travelers, enhancing their travel experience. |

The South Korean industry is expected to grow strongly, due to numerous factors such as international travel, existing tech-savvy consumer bases, and innovative business models of airlines. South Korean carriers today, are diversifying their product offering and passenger experience by building on AI solutions, self-service channels, and mobile payment collections.

Jeju Air and Jin Air are the low-cost airline companies that are posing a strong challenge to existing services, as they push for on-demand in-flight experiences, such as added features like. FMI is of the opinion that the South Korean market is anticipated to observe 8.3% CAGR from 2025 to 2035.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Growth of Low-Cost Carriers | The proliferation of low-cost carriers in South Korea has led to the unbundling of services, with airlines offering various paid ancillary options to maintain competitive base fares. |

| Tech-Savvy Population | High internet penetration and smartphone usage enable South Korean airlines to effectively market and sell ancillary services through digital platforms, increasing accessibility and convenience for passengers. |

| Focus on In-Flight Services | South Korean carriers place emphasis on enhancing in-flight services, such as offering a variety of meal options and duty-free shopping, to boost ancillary revenue and improve passenger satisfaction. |

The market is dynamic and competitive with all the major players strategizing different plans for more revenue. Delta Air Lines and United Airlines, for instance, have turned their attention to much more than low prices.

They are introducing things like premium seating, even more personalized in-flight services, and more onboard retail offerings that cater to leisure and business travelers alike, who will be willing to pay more for good comfort and convenience. These measures have ramped up their profitability, providing these carriers with some remarkable shares of the profits within the industry in recent periods.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ryanair Holdings | 18-22% |

| American Airlines Group | 15-20% |

| Delta Air Lines | 12-16% |

| Lufthansa Group | 10-14% |

| Southwest Airlines | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ryanair Holdings | Concentrates on ultra-low-cost a-la-carte pricing for extras like prepaid seats, baggage fees, and sales on board. |

| American Airlines Group | Extends the option of the premium seat selection, priority boarding, and entertainment bundle on airlines for an extra charge. |

| Delta Air Lines | Adds subscription Wi-Fi with premium in-flight food options for passengers who want to enjoy more. |

| Lufthansa Group | Leverages online channels to offer custom add-ons like the lounge option and carbon offset schemes. |

| Southwest Airlines | Has the ability to waive baggage charges while also making a profit by selling early exit and upgraded boarding. |

Key Company Insights

Ryanair Holdings (18-22%)

Ryanair dominates the a-la-carte services segment by aggressively pricing unbundled services, maximizing ancillary revenue through baggage fees, seat selection, and in-flight purchases.

American Airlines Group (15-20%)

American Airlines is a leader in premium ancillary services, integrating tiered seat selection and paid upgrades to optimize passenger revenue while enhancing travel experience.

Delta Air Lines (12-16%)

Delta Air Lines is innovating with subscription-based Wi-Fi and flexible premium services, aligning its ancillary offerings with frequent flyer preferences and digital convenience.

Lufthansa Group (10-14%)

Lufthansa drives ancillary revenue through personalized digital offers, such as in-flight retail, lounge access, and carbon-offset purchases tailored to eco-conscious travelers.

Southwest Airlines (6-10%)

Southwest remains unique in offering free checked bags while capitalizing on upgraded boarding fees and early check-in services to maintain profitability.

Other Key Players (30-40% Combined)

Numerous other airlines and travel technology firms contribute to the evolving airline a-la-carte services market by leveraging digital engagement, AI-driven personalization, and strategic bundling.

By product type, the market is segmented into baggage fees, on-board retail & a la carte, airline retail, and FFP miles sale.

Full-service carrier & low-cost carrier are two types of segments under carrier type.

In terms of class, the market is divided into first class, business class, and economy class.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific (APAC) & The Middle East & Africa (MEA).

The overall market size is forecasted to be USD 202 billion in 2025.

The market is expected to reach USD 700.8 billion by 2035.

The demand will grow due to increasing consumer preference for personalized travel experiences, airline revenue diversification strategies, and digital transformation in airline services.

Some of the key companies include United Airlines, Inc., Delta Airlines, Inc., American Airlines, Southwest Airlines, Air France/KLM, Ryanair DAC, EasyJet PLC, Deutsche Lufthansa AG, Qantas Airways Ltd, and The Emirates Group.

South Korea, poised to grow at 8.3% CAGR from 2025 to 2035, is slated to witness fastest growth.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Class, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Carrier Type , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Class, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Class, 2023 to 2033

Figure 19: Global Market Attractiveness by Carrier Type , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Class, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Class, 2023 to 2033

Figure 39: North America Market Attractiveness by Carrier Type , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Class, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Class, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Carrier Type , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Class, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 77: Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Class, 2023 to 2033

Figure 79: Europe Market Attractiveness by Carrier Type , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Class, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Class, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Carrier Type , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Class, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Class, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Carrier Type , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Class, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Class, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Carrier Type , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Class, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Carrier Type , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Class, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Class, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Class, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Carrier Type , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Carrier Type , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Carrier Type , 2023 to 2033

Figure 157: MEA Market Attractiveness by Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Class, 2023 to 2033

Figure 159: MEA Market Attractiveness by Carrier Type , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Airline Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Airline Crisis Management Software Market Size and Share Forecast Outlook 2025 to 2035

Airline Reservation Software Market Size and Share Forecast Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

M2M Services Market – Trends & Forecast through 2034

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Walk-in Services Market Growth – Trends & Forecast 2024-2034

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA