The above mentioned regions are anticipated to hold significantly high market share in the global airlift bioreactors market over the analysis period of 2025 to 2035, due to increasing demand for efficient downstream processing in food and beverage applications.

Compared to conventional stirred-tank bioreactors, airlift bioreactors exhibit superior mass transfer characteristics, and lower shear forces and energy consumption which makes them suitable for shear-sensitive cell cultures and microorganisms. Market growth is also being propelled by the increasing usage of single use bioreactors as well as recent advancements in bioprocessing automation.

This development has caught the attention of many researchers, as well as advances in synthetic biology and bioengineering, which has fuelled the growth of airlift bioreactor applications and the development of new applications for use with cell-based therapies, enzyme production, and renewable biofuels. Such advancements will likely lead to improved process efficiency and overall bio production capacities and help them to strengthen their foothold in the global bioprocessing sector.

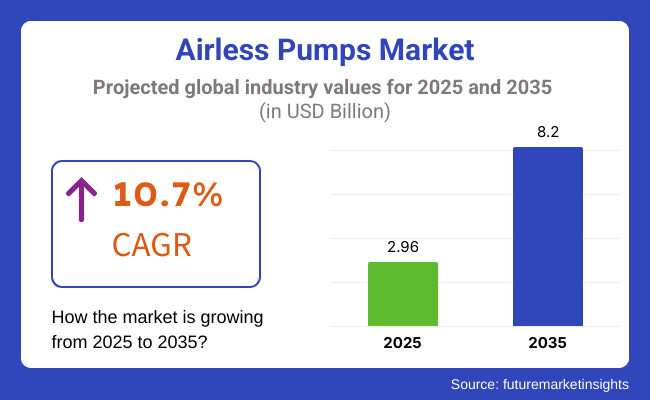

The airlift bioreactors market size in 2025 stood at USD 2.96 Billion and will reach USD 8.20 Billion in 2035, at a CAGR of 10.7%. Increasing biopharmaceutical production, growing applications in cell culture-based vaccine manufacturing, and the demand for cost-effective bioprocessing solutions are some major factors driving market growth.

Moreover, significant investments in pipeline biopharmaceuticals and existing ventures are providing substantial funds for regional innovation, which in turn, are supporting the adoption of airlift bioreactors across multiple industries, owing to increasing focus on sustainable and continuous bioprocessing techniques.

Modular and automated bioreactor systems have also been developed and have begun to streamline operations, minimize contamination risk, and increase scalability. Manufacturers are now focusing on bioreactor design optimization for increasing the productivity and upgrading efficiency by using a variety of cell lines and fermentation requirements as per the need due to increase in demand for biologics and personalized medicines.

North America dominates the airlift bioreactor market due to significant investments in biopharmaceutical research and cell therapy development as well as industrial biotechnology. There is a surge in demand for advanced bioprocessing solutions in the USA and Canada, bolstered by government funding of bio manufacturing innovation.

The increasing emphasis on regenerative medicine, monoclonal antibody production, and precision fermentation is also contributing to the market growth. Academic-industry partnerships are also enabling a new frontier in airlift bioreactor design.

The growing use of AI-based process control systems and real-time monitoring solutions are improving the efficiency of airlift bioreactors, particularly for large-scale production and research projects. These bioreactors are also getting a thrust in market confidence with better regulatory compliance and process validation.

Europe is continuously growing in the airlift bioreactors market due to their strong pharmaceutical and biopharmaceutical industry. Countries such as Germany, France and the UK are investing in advanced cell culture technologies to be used for vaccine production, biosimilar and gene therapies.

Similar trends in the market are instigated by regulatory support for continuous bioprocessing and bio manufacturing automation. Moreover, the focus on minimizing carbon footprints in bio manufacturing is propelling the increasing utilization of energy-efficient airlift bioreactors.

Moreover, smart sensors and advanced analytics integration in bioprocessing workflows is enhancing process control and optimization, maintaining products quality. As European companies look to implement closed-loop systems that minimize waste and resource use to enhance bioprocess sustainability, demand continues towards market growth.

High growth in biopharmaceutical manufacturing and increasing investment toward biotechnology research in the Asia-Pacific region are anticipated to drive the airlift bioreactors market. China, India, South Korea, etc., are investing significant resources into biologics manufacturing and fermentation-based production.

The increasing adoption of biosimilar, the rising research activities in cell therapy, as well as the establishments for vaccine production are anticipated to accelerate the market progress. Moreover, government efforts to develop bio manufacturing centres and research partnerships with international stakeholders have facilitated the uptake of airlift bioreactors in the region.

Localized manufacturing facilities, increased focus on GMP-compliant bioprocessing, and growing interest in bioprocess automation will drive Asia-Pacific’s lead in the market. Also, the abundant availability of cost efficient raw materials and labour skill set is making this area a strategic location where companies want to expand their bio manufacturing and upscaling units.

High Operational Costs and Scalability Constraints

By continuing to help a lift bioreactors market faces challenges such as high operational costs and complex of scalability and process optimization. Airlift bioreactors provide better oxygen transfer efficiency and lower shear stress but require massive capital expenses and high operational costs that are disadvantages for small and mid-size biotech companies.

Furthermore, achieving high-density cell cultivation needs consistent bioprocess control while also ensuring sterility, which adds to the challenge. To improve scalability and reduce operational burdens, companies need innovative and cost-effective bioprocessing strategies, automation technologies and advanced monitoring systems.

Increasing Demand for Biopharmaceuticals and Industrial Bioprocessing

Significant opportunities are projected in the increasing application of airlift bioreactor in biofuel generation, biopharmaceutical manufacturing and industrial fermentation. The increasing bioprocessing requirements in cell culture, microbial fermentation and enzyme production are bolstering innovations in airlift bioreactor designs.

The transitioning towards single-use bioreactors, bioprocessing focusing on low energy, as well as optimized aeration strategies is further increasing market potential. Organizations working towards improving cost per cell, minimizing the energy requirement and real-time bioprocess monitoring will be positioned to fare better in the evolving airlift bioreactors market.

The airlift bioreactors market has been widely adopted in the biopharmaceutical industry due to the increased demand for high-efficiency bioprocessing systems from 2020 to 2024. Investments were made in research and development for scalable and energy-efficient bioreactor technologies.

However bioreactor design limitations, aeration inefficiencies, and the complexities of regulatory compliance hindered widespread adoption. This pressure forced companies to come up with new reactor types, new oxygen transfer technologies and digital bioprocess control systems.

For 2025 to 2035, we can expect a second wave of innovative technology adoption, such as, bioprocess intensification, hybrid reactor technology, and automation breakthroughs. The growing demand for personalized medicine, regenerative therapies, and bio-manufacturing will push the adoption of airlift bioreactors even more.

Other trends shaping the future phase of the market include sustainable bioprocessing, reduction in water and energy usage, and modular bioreactor systems. Continued investment in process optimization, smart bioreactor monitoring, and hybrid bioreactor solutions will drive the evolution of the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | GMP and process validation in biopharmaceuticals |

| Technological Advancements | Advances in aeration systems and bioreactor automation |

| Industry Adoption | Increased use in the biopharmaceuticals, enzyme, and biofuel processing sectors |

| Supply Chain and Sourcing | Reliance on patented traditional bioreactor manufacturers as well as specialist bioprocess suppliers |

| Market Competition | Established biotech firms and bioprocessing solution providers |

| Market Growth Drivers | Need for scalable and energy efficient bioprocessing solutions |

| Sustainability and Energy Efficiency | Initial focus on energy-efficient aeration and bioreactor sterilization |

| Integration of Smart Monitoring | Limited adoption of real-time process analytics and remote monitoring |

| Advancements in Bioprocessing | Use of traditional batch and fed-batch bioprocessing techniques |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulation of advanced bioprocessing, increased emphasis on environmental sustainability |

| Technological Advancements | Advances in aeration systems and bioreactor automation |

| Industry Adoption | Tissue-Culture Research & Applications Regenerative Medicine, Tissue Engineering Synthetic Biology Applications |

| Supply Chain and Sourcing | Shift toward modular bioreactor systems, single-use airlift bioreactors, and sustainable supply chains. |

| Market Competition | Emergence of niche bioreactor manufacturers, utilization of automation-based bioprocess optimization solutions |

| Market Growth Drivers | Expansion of investment in biopharma manufacturing bioreactor sustainability initiatives, and real-time process monitoring. |

| Sustainability and Energy Efficiency | Large-scale implementation of low-energy bioprocessing, waste reduction strategies, and carbon-neutral bioreactor systems. |

| Integration of Smart Monitoring | Expansion of AI-powered bioprocess control, predictive analytics, and adaptive bioreactor automation. |

| Advancements in Bioprocessing | Evolution of continuous bioprocessing, intensified bioreactor designs, and hybrid bioreactor technologies. |

The USA airlift bioreactors market is driven by an upsurge in demand for biopharmaceutical production, regenerative medicine, and cell culture applications. Growing investments in bioprocessing technologies and biopharma research are propelling the adoption of advanced airlift bioreactors in commercial and academic environments.

Airbio group aims at the pioneers of efficient cell growth conversion, minimizing contamination risk and optimizing the production of biologics with bioreactors. The market growth is also augmented by government initiatives in support of bio manufacturing and process automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

The UK airlift bioreactors market is anticipated to expand at a steady growth rate during the forecast period from 2023 to 2031, as demand for bioprocessing solutions in the pharmaceutical and biotechnology sectors continues to rise. Market expansion is supported by rising focus on sustainable bio manufacturing, enumerates strong academic and industrial collaborations.

These industry-wide developments, coupled with government funding of cell therapy and biologics research, offer favourable opportunities for airlift bioreactors in the field of bioprocessing technology. Moreover, the growing focus on minimizing production costs and enhancing efficacy in vaccine development is contributing to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.5% |

Germany, France, and the Netherlands are spearheading biopharmaceutical innovation in the European Union, where the airlift bioreactors market is booming. The growing adoption of single-use bioreactors and process intensification strategies is driving its market growth.

The growth of biopharmaceutical contract manufacturing organizations (CMOs) and academic research institutions that specialize in biotechnology is also supporting industry expansion. Furthermore, regulatory efforts aimed at promoting sustainable bioprocessing are also driving companies to invest in advanced bioreactor systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.7% |

The Japanese airlift bioreactors market is expanding judgment, MIIs investments in biopharmaceutical production, regenerative medicine and industrial biotechnology to the akaline airlift bioreactors market. The strong research ecosystem and industrial focus on precision medicine in the country is translating to demand for advanced bioreactor systems.

Japan one of the first markets to adopt Airlift bioreactors to improve their biologics productions and facilitate the new Personalised medicine innovations. Moreover, governmental investments in bioprocessing infrastructure, automation, and related technologies could be further opportunities for market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.2% |

Kosher airlift bioreactors market in South Korea is on the rise as the country entrenched itself in the biopharmaceutical production worldwide. This is propelling the demand for high-performance bioreactor systems due to the rise of biosimilar production and additional investments for bioprocess optimization.

Airlift bioreactors have become increasingly popular among leading biotech companies and contract manufacturing organizations (CMOs) to address challenges associated with scaling up cell culture operations and process efficiency. Moreover, governmental entities are encouraging biopharma R&D to stimulate the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.9% |

Segment Overview: The airlift bioreactors market is dominated by the internal airlift loop bioreactors and 10L capacity segments, owing to the increasing adoption of high-efficiency, low-shear, and energy-efficient bioreactors in microbial, cell culture, and enzymatic processes by biopharmaceutical companies, research institutions, and bioprocessing industry.

Bioreactor technologies, vital in ensuring efficiency of fermentation, increasing rates of oxygen transfer, or the efficacy of large-scale bio production, are indispensable to biotech firms, pharmaceutical companies or academic research institutes.

So-called airlift bioreactors have transformed both biopharmaceutical production, vaccine development and industrial fermentation as a non-mechanical agitation system that allows for the reduction of shear stress and improved process control.

The growing transition towards sustainable and high-yield bio production approaches has increased the demand for these bioreactors, providing better scalability, decreased operational costs, and better efficiency of bioprocessing.

Bioreactors: Internal Airlift Loop Bioreactors for Efficient Cell Growth and Bioprocesses

Among bioreactor designs, internal airlift loop bioreactors are arguably the most widely used due to their high oxygen transfer efficiency, excellent mixing performance and low shear, rendering them ideal for the cultivation of sensitive mammalian cell lines, microbial fermentations and biofuels production.

Internal airlift loop systems, as opposed to stirred-tank bioreactors, utilize no mechanical agitation and circulation of culture is dependent on gas flow, saving power and preventing cell injury.

The adoption has been fuelled by the demand for high-efficiency airlift bioreactors that employ optimized oxygenation, nutrient circulation, and bubble column dynamics control. The large share of 65% indicates that majority of biopharmaceutical manufacturing facilities rely on internal airlift loop bioreactors for commercial production of large scale biologics, thus creating a strong demand for this segment.

Growth in bioprocessing applications, including monoclonal antibody (mAb) production, vaccine development, and recombinant protein synthesis, has bolstered market demand for an improved yield consistency and production scalability.

Additionally, the real-time monitoring of bioprocesses powered by artificial intelligence (AI) and closed-loop automated process control systems with remote-controlled feeding strategies and real-time pH and dissolved oxygen (DO) adjustment have significantly increased the implementation of cell culture.

Hybrid bioprocessing solutions with single-use airlift bioreactors, modular design configurations, and high-performance filtration systems have driven significant market growth, enabling scalable production of biologics or cell-based therapies, while maintaining cost-effective manufacturing.

This limitation, although has advantages like improving bioprocess efficiencies, decreasing energy requirements, and reducing mechanical stress on delicate cultures, is acting as a restraint on the internal airlift loop bioreactors segment due to several factors such as their inability to control shear forces, an inherent relatively low mixing rate compared to the stirred bioreactors, and higher capital investment costs.

However, newer technological advancements such as microfluidic airlift bioreactors, AI-based oxygenation modelling, and continuous bioprocess monitoring systems will enhance process efficiency, adaptability, and cost-effectiveness, maintaining a robust growth of internal airlift loop bioreactor market globally.

Bioprocess engineering improvements have facilitated the development of dedicated internal airlift bioreactors for stem cell expansion, synthetic biology and biofuels applications. Such innovations equate to improved precision, better nutrient distribution, and highly scalable bioreactors for high value bioprocesses across the board.

10L Airlift Bioreactors: Ideal for Biopharmaceutical and Industrial Bioprocesses

They also show that, specifically, the airlift bioreactors segment by 10L is growing rapidly due to increasing adoption among biopharmaceutical manufacturers, contract research organizations (CROs), and academic research laboratories, driven by organizations' need to use medium-scale bioreactors to help with process optimization, experimental trials, and commercial bioprocessing.

And 10L bioreactors provide a balance between the low-volume 5L or 7L bioreactors with a sufficient scale for development to scale up the production processes for the commercial manufacturing process.

Adoption of medium-capacity bioreactors, which feature high-precision process control, adaptive gas flow regulation, and optimized nutrient distribution, has been driven by their demand. Research estimates that more than 55% of bioprocessing companies use 10L airlift bioreactors for small-batch production of biologics, which will lead to a constant demand for this segment.

Compression After determining the time for harvesting a sample, the next step is to explore the advantages of each cell therapy after based on the indications and demographic(s) political (MSC expansion, CAR-T cell therapy development, and induced pluripotent stem cell (iPSC) culturing market) that have propelled market growth to the peak as higher process reproducibility and regulatory compliance becomes a significant factor in clinical-scale manufacturing.

The pending bioreactor automation technologies to date featuring real-time process analytics, AI-powered predictive maintenance and cloud-connected batch monitoring have all but ensured a greater adoption, greater control of fermentation kinetics and process variability as well.

Modular bioreactor designs with replaceable culture vessels, configurable aeration systems, and built-in waste elimination systems are driving the market with faster growth and greater flexibility for multiproduct bio manufacturing.

Although the 10L bioreactor single-use segment has the upper hand in process scalability, operational flexibility, and culture viability, etc., factors like limited scalability for large-scale production application, higher initial setup costs than smaller bioreactors, and variability in oxygen mass transfer efficiency are considered a hindrance for this bioreactor type.

Nevertheless, novel advancements from bio-inspired aeration approaches, artificial intelligence-assisted protocols, and hybrid bioprocessing systems enhance cost-efficiency, cell viability, and production consistency, extending growth for airlift bioreactors targeted at 10L capacity worldwide.

In addition, improvements in single-use 10L airlift bioreactors have lowered contamination risk and improved process flexibility. Such package demand has only been bolstered by the increases in preclinical and early-phase drug development activities and the need for small-scale control and efficient bioreactor systems.

As well, while the global biopharmaceutical industry continues to advance towards precision medicine, personalized therapies and high-value biologics production, the global 10L capacity airlift bioreactors market is expected to sustain its growth trajectory while enabling further improvements in regenerative medicine, vaccine development and production of biocatalysts.

Cloud-based data analytics, digital twins, and AI-enhanced process control in 10L airlift bioreactors will revolutionize biopharmaceutical production as the world moves towards smart bioprocessing and digitally optimized manufacturing systems.

The market for airlift bioreactors is expected to grow at a healthy pace, owing to the increasing adoption of bioprocessing technologies, growing demand for sustainable bio production processes, and growing implementation of AI-based process control methods.

Among end-users, the internal airlift loop bioreactors segment dominates the market share owing to high oxygen transfer efficiency, low shear stress, and their scalability during commercial bio production. We have since seen rapid uptake of 10L airlift bioreactors, which have offered balanced capacity for medium-scale process development, clinical-stage bioprocessing, and precision fermentation use cases.

Airlift Bioreactor Market is expected to see continued growth and innovation as biopharmaceutical expansion continues along with increased R&D investments and technologies for real-time process monitoring.

The demand for biopharmaceuticals, industrial biotechnology, and sustainable bioprocessing are driving the growth of the airlift bioreactors market. Typically these bioreactors are used for cell culture applications, microbial fermentations and bio-based production processes. Hence, their benefits such as low shear stress, enhanced mass transfer efficiency, and scalability make them suitable for pharmaceutical production, biofuel generation, and enzyme synthesis.

With a growing trend towards single-use technologies and automated bioprocessing systems, leading players are also focusing on features such as AI-driven process optimization, real-time monitoring, and hybrid bioreactor design to enhance efficiency and yield.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sartorius AG | 18-22% |

| Thermo Fisher Scientific | 15-19% |

| Eppendorf AG | 12-16% |

| Pierre Guerin (Engie Group) | 9-13% |

| Solaris Biotech (Donaldson Company, Inc.) | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sartorius AG | Provides advanced single-use airlift bioreactors, real-time bioprocess monitoring, and scalable solutions for biopharmaceutical applications. |

| Thermo Fisher Scientific | Develops automated bioprocessing systems, hybrid airlift bioreactors, and AI-driven fermentation control technologies. |

| Eppendorf AG | Specializes in compact and modular airlift bioreactors for research, pilot-scale production, and biopharmaceutical process development. |

| Pierre Guerin (Engie Group) | Offers stainless steel and hybrid airlift bioreactors with integrated process automation and high-precision control. |

| Solaris Biotech (Donaldson Company, Inc.) | Focuses on sustainable bioprocessing solutions, customizable airlift bioreactors, and industrial-scale fermentation technologies. |

Key Company Insights

Sartorius AG (18-22%)

These companies are well-positioned to capitalize on the growing demand for airlift bioreactors, as they offer state-of-the-art single-use bioreactor technologies that can provide better control of the cultivation environment, enabling real-time monitoring of the bioprocess, optimizing cell culture performance for a broad range of applications.

Thermo Fisher Scientific (15-19%)

Biopharma and industrial bioprocessing companies use Thermo Fisher Scientific's AI-integrated bioprocessing solutions which contribute to market growth, such as hybrid airlift bioreactors and automated fermentation systems.

Eppendorf AG (12-16%)

Eppendorf AG excels in compact and modular airlift bioreactors, providing scalable solutions for laboratory research, pilot-scale production, and biopharmaceutical manufacturing.

Pierre Guerin (Engie Group) (9-13%)

Pierre Guerin specializes in stainless steel and hybrid bioreactors, integrating advanced process automation, high-precision control systems, and efficient mixing technologies for large-scale bioprocessing.

Solaris Biotech (Donaldson Company, Inc.) (7-11%)

Solaris Biotech focuses on sustainable bioprocessing, offering highly customizable airlift bioreactors for industrial-scale fermentation, enzyme production, and biofuel applications.

Other Key Players (30-40% Combined)

Several other companies contribute to the airlift bioreactors market, driving advancements in bio-based production and biopharmaceutical innovations. Notable players include:

The overall market size for Airlift Bioreactors Market was USD 2.96 Billion in 2025.

The Airlift Bioreactors Market expected to reach USD 8.20 Billion in 2035.

The top 5 countries which drives the development of Airlift Bioreactors Market are USA, UK, Europe Union, Japan and South Korea.

Internal Airlift Loop Bioreactors and 10L Capacity lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airlift Pump Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Rocking Bioreactors Market

Microbial Bioreactors Market

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Small-Scale Bioreactors Market Analysis by Product, Capacity, End-User, and Region through 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Portable Bioprocessing Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA