The airless pumps market is projected to grow at a steady rate between 2025 and 2035, owing to increasing applications of airless pumps in cosmetics, pharmaceuticals, and personal care industries.

The growing demand for enhancement of shelf life of products while reducing wastage, the introduction of airless pump technology which also eliminates the need for dip tubes and prevents the contamination of products are among the factors driving the market. Increasing demand for preservatives-free and organic formulations in skin care and beauty products is likely to drive the use of airless pump systems.

The market is also benefitting from sustainability concerns, regulations mandating eco-friendly packaging. There is a drive towards recyclable and refillable airless pump solutions for environmentally conscious consumers, and manufacturers are investing in such products.

Moreover, the pharmaceutical industry has been embracing airless pumps that offer accurate and clean dispensing of liquid medication, especially in dermatology and specialty drug formulations.

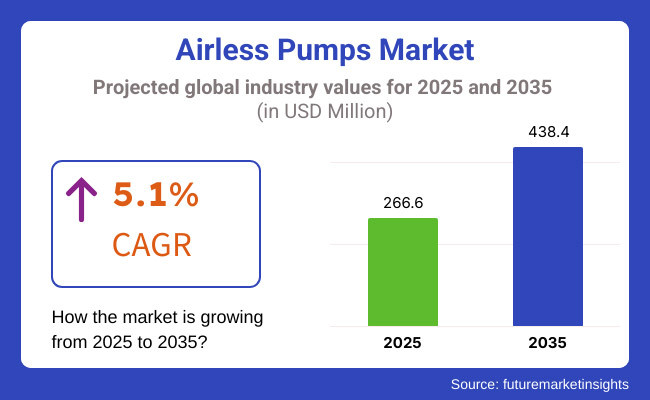

5.1% CAGR from 2025 to 2035 illustrates that airless pumps are dynamically growing in number across multiple industries. Factors such as innovations in pump mechanisms, advancements mathematical device and the rising e-commerce beauty and wellness markets are likely to significantly contribute to market development.

Explore FMI!

Book a free demo

North America is expected to dominate the airless pumps market due to large-scale demand from cosmetics and pharmaceutical manufacturer. The growing demand for airless dispensing systems for skincare, haircare, and medical products in the United States and Canada is primarily attributed to consumer preference for hygienic and sustainable packaging with minimum wastage and maximum product preservations.

Encouragement for innovative airless pump designs from manufacturers comes with the region's goal of reducing plastic waste and increasing recyclable materials. Increased number of clean beauty brands are being launched along with direct-to-consumer e-commerce channels which are boosting the market growth even further.

As a consequence of such rigid environmental rules and availability of public preference for ecologically balanced ling labels packaging methods, Europe remains the largest airless pumps market.

Airless pumps are increasingly being used in cosmetics, dermatological treatments and pharmaceutical applications in the premium beauty product categories across countries including Germany, France and the UK. EU regulations on reducing single-use plastic are inspiring producers to develop recyclable and biodegradable airless pump systems.Growing inclination toward minimal-contact dispensing in personal care and healthcare applications is further boosting the market traction.

The airless pumps in the Asia-Pacific region are expected to grow at the highest rate, owing to the rapid growth of the beauty and personal care industry in countries such as China, Japan, South Korea, and India. The increase in disposable revenues of consumers and the acceptance of the new trends such as K-beauty and J-beauty have a positive impact on the required airless pump packaging in skincare and cosmetic products.

In addition, the airless pumps are being used by pharmaceutical companies in the region for accurate dispensing of drugs and contamination prevention. In addition, government efforts toward sustainable packaging solutions and the rapid growth of e-commerce platforms are further fuelling the market growth.

High Production Costs and Material Compatibility Issues

The high production costs, especially for high-end and sustainable packaging solutions, is one of the key restraining forces in the airless pumps market. In contrast, airless pump systems must be designed to ensure airtight sealing, precise dosing, and interchangeable product formulations.

These might be multi-layer barriers, piston-based dispensers, ultra-vacuum seals, etc., all of which makes them expensive to manufacture and expensive compared to a standard pump or squeeze dispenser. For small and mid-sized brand owners, this poses a huge problem because (a) airless is not really affordable and (b) they’ll have to spend time and budget on their packaging for products that don’t need it.

Another obstacle is material incompatibility, a problem most notably seen in the pharmaceutical and cosmetics industry, where product stability is paramount. Certain formulations respond with plastic or metal vessel parts, particularly when possessing volatile or reactive substances, causing degradation or loss of efficacy.

Sure, manufacturers have begun dabbling in both chemically-resistance and even eco-friendly materials but the widespread adoption, without sacrificing performance, remains a tall order.

By investing in cost-efficient production, automation, and material innovation, companies can reduce these challenges. This includes developing mono-material airless pumps that can be more simply recycled and reduce the number of components, which can help drive down costs.

Also, to increase the compatibility of materials they will ensure better compatibility between packaging manufacturers and product formulators, leading to much broader adoption across the industry.

Rising Demand for Precision Dispensing and Sustainable Solutions

The growing consumer demand for precision dispensing, product preservation and hygienic packaging is further driving the demand for airless pumps and its applications in industries from skincare to pharmaceuticals and nutraceuticals that use airless pumps to protect their active ingredients from damaging oxidation, contamination and degradation.

Unlike traditional pumps that let in air after each use, airless systems create a vacuum seal that traps product fresh and maintains its consistency. Another path for growth lies in sustainability-driven innovation. Under pressure from both regulatory bodies and consumers to embrace sustainable packaging, brands are looking for alternatives to traditional plastic-based airless pumps.

Solution: Refillable airless systems, biodegradable dispenser components, and PCR (post-consumer recycled) plastics other companies are looking into using aluminium-based airless pumps and bio-resin materials that are both durable and possibly recyclable.

Another factor that enhances the market potential is the diversification of airless pump applications beyond cosmetics and pharmaceuticals-into food, automotive lubricants, and household products. Metered dispensing, touchless pump systems, IoT-integrated smart pumps are some of the innovations that can enhance the user experience and help packaging manufacturers create new revenue streams.

During 2020 to 2024, the airless pumps market evolved with an increase in airless pump adoption in the beauty and personal care industry. The rise was linked to the advent of preservative-free formulations, high-precision dispensing, and extending product shelf life by skincare companies.

Simultaneously, pharma companies adopted airless pumps for medications that required precise dosage control. Ecosystem players also experimented with sustainability, with some using recycled plastics and introducing the refill concept. The market growth slowed from the entire industry adoption due to cost issues and limited materials.

Changes occurring from 2025 to 2035 will focus on sustainability innovation, smart packaging use, and cross-industry adoption. Biodegradable and mono-material airless pumps will develop to address the limitation on recycling. Regulatory frameworks will enhance mandatory usage of eco-package usage.

IoT-based dispensing solutions will rise to provide usage tracking and real-time alerts during refill, enhancing consumer engagement. The airless pump will transcend the beauty and personal care industry into medical and food industries, providing contaminant-free packages and waste reduction.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial push for sustainable packaging alternatives |

| Technological Advancements | Growth in precision airless pump dispensers and barrier protection |

| Industry Adoption | Dominance in skincare, pharmaceuticals, and cosmetics |

| Supply Chain and Sourcing | Early-stage adoption of recycled plastics and lightweight materials |

| Market Competition | High-end beauty brands leading adoption |

| Market Growth Drivers | Demand for extended shelf life and contamination-free dispensing |

| Sustainability and Energy Efficiency | Limited use of eco-friendly materials and recyclability concerns |

| Integration of Smart Monitoring | Early-stage QR code tracking and authentication features |

| Advancements in Experiential Packaging | Consumer preference for ergonomic and travel-friendly dispensers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stringent eco-packaging regulations, mandatory recyclability requirements, and tax incentives for green packaging |

| Technological Advancements | Smart dispensing integration, biodegradable pump materials, and refillable airless systems |

| Industry Adoption | Expansion into food, household goods, medical applications, and industrial lubricants |

| Supply Chain and Sourcing | Widespread use of PCR plastics, aluminium-based airless pumps, and bio-based resins |

| Market Competition | Entry of mid-sized brands and mass-market expansion through cost-efficient airless packaging solutions |

| Market Growth Drivers | Rise of sustainable airless packaging, regulatory-driven material shifts, and touchless pump systems |

| Sustainability and Energy Efficiency | Large-scale adoption of biodegradable pumps, energy-efficient production techniques, and zero-waste packaging solutions |

| Integration of Smart Monitoring | IoT-connected pumps, real-time usage monitoring, and automated refill systems |

| Advancements in Experiential Packaging | Customizable dispensing mechanisms, AI-powered dose control, and voice-activated airless pumps |

Growth in this demand is driven by the growing need for upscale skincare, cosmetics and pharmaceutical products which require accurate and contamination-free packaging. Sustainable airless pump manufacturing is being promoted by the tendency toward environmentally-friendly and reusable packaging solutions.

Moreover, the extensive rise in the adoption of airless pumps in the food & beverage sector for use in sauces and condiments also provide lucrative opportunities for the market to grow. This, in turn, is spurring the market growth in USA such as innovations in technology such as controlled dosage mechanism smart dispensers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

In the UK, the increasing awareness regarding sustainable packaging for personal care, cosmetics, and pharmaceuticals will, in turn, effectuate the airless pumps market. Another key factor for the growing demand for refillable and biodegradable airless pumps is government mandates to reduce plastic waste.

Airless dispensing solutions are being used by a number of leading beauty and skincare brands in the UK to extend the life of products, making it easier for consumers to benefit from their use. Growth in market is further expected as innovations in material like bio-based plastics improve.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

With a sound presence of luxury cosmetics, skincare and the pharmaceuticals industry, Germany, France and Italy commands the chunk of market in the airless pumps across EU. Single-wall packaging airless pumps that are recyclable and reusable are being used by manufacturers driven by EU's harsh regulations on single-use plastics and sustainability movement.

And France is setting the stage for airless dispenser innovation for luxury beauty, while Germany is increasing the uptake of airless pumps within the pharmaceutical sector that demand precise dosage control. According to a data bank report published by Laboratory, the demand for sustainability dispensing solutions in food and beverage packaging is growing rapidly, which will contribute to the growth of sustainable dispensing solutions market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

The growth of Japan's airless pumps market has been aided by advances in precision dispensing in cosmetics, skincare and medical use. Furthermore, the Japanese beauty companies emphasize the nature of quality products with innovative packaging solutions that have resulted in the growth of airless pumps to allow shelf-life longevity of a product along with providing controlled dispensing.

Meanwhile, the country’s growing interest in sustainable materials is pushing manufacturers to explore refillable airless pump options. The rising reliance of the pharmaceutical industry on sterile and airless dispensing solutions further facilitates the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Notably, the country’s K-beauty scene is among the largest influencers in the global marketplace, and the airless pumps segment is developing progressively in the region.

Demand for airless pump solutions for travel-able beauty and skincare brands is also on the rise, with airless designs that are biodegradable and refillable part of an official push for sustainable packaging now gaining interest. In addition, in South Korea, the pharmaceutical and food sectors are increasingly implementing airless pumps, further bolstering market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Conducting an airless pumps market segment with the application into skincare and pharmaceutical segments will cover demand for innovative, contamination free and accurate dispensing among manufacturers.

They encourage product shelf life and controlled product dispensing whilst enhancing user functionality leading airless pumps, becoming a highly sought-after product for the personal care, medical solutions and high-performance cosmetic formulations.

Skincare Applications Lead Market Demand as Airless Dispensing Technology Gains Traction

Due to advantages like product protection, shelf life and dispensing accuracy, segmenting applications of skincare the airless pumps have emerged as one of the most promising segments in the airless pumps market. Airless pumps are also more beneficial than traditional packaging, than usual, packaging they minimize oxidation and bacterial contamination, therefore it helps to the active ingredients of skin care formulas last longer.

Due to the rise in demand for airless packaging and even more so from brands wanting to improve packaging quality , airless skincare packaging is also getting adopted in the market for moisturizers, serums, sunscreens, anti-aging products, etc. Studies indicate that over 65% of premium skincare are adopting airless pump solutions, providing consistent demand for this range.

The demand in the market is further fuelled by the launch of personalized airless pump designs, which include double-chamber dispensing options, dosing systems based on vacuum structure, and re-fillable packaging in an eco-friendly format for an efficient and flexible portioning of the skincare products.

The collaboration of leading brands and the start-ups at regular intervals along with the inclusion of the digital skincare packaging has driven the demand for smart sensors, exact dosage tracking and interactive user experience which is further driving the adoption of the intelligent skincare as it allows for seamless product application and increased involvement with the consumers.

As homes are expanding, manufacturers creating eco-friendly airless pump equivalents made from biodegradable material, recyclable components and less use of plastic consumption have found to fall in line with global sustainability initiative.

Despite its apparent benefits over its liquid counterpart in terms of product preservation, precision dispensing and user convenience, challenges present themselves in the form of high production costs, intensive production processes and compatibility issues in the case of thicker formulations.

However, there are far newer and efficient and effective innovations of custom packaging like 3D printing, AI-assisted material selection and nanotechnology-based dispensing systems, making the market highly efficient, and across cosmetics and skincare globally, there are growth opportunities in the airless packaging market.

Pharmaceutical Applications Drive Market Growth as Safe and Accurate Dispensing Becomes Critical

The regulatory uses include topical medicine, medical ointment, and prescription skin care formulations, to name a few, especially in the pharmaceutical industry. Airless packs will be contamination free with metered dispensing as compared to traditional packs and they are therefore most preferred for pharmaceutical product formulations.

The growing demand for pharmaceutical-grade airless packaging including, but not limited to, sterile drug dispensers, single-use pump systems and preservative-free formulations is expected to accelerate the adoption of airless packaging in the pharmaceutical industry to meet medical safety standards. With over 50% of all new topical pharmaceutical products utilizing airless pump technology, demand for this category is ensured.

High safety margin and drug delivery efficiency of high-end pharmaceutical pumps coupled with new designs like tamper-resistant closures or child-resistant and exact dosing have improved market demand.

Moreover, the adoption is further expanded due to the increasing application of airless pumps in medical devices including wound care formulations, transdermal drug delivery systems, and controlled release formulations as it ensures better patient compliance and treatment outcomes and effectiveness.

The advent of smart pharmaceutical packaging along with integration of tracking with RFID, real time dispense monitoring and connected health solutions will further the market growth and facilitate easy accessibility for integration with digital healthcare ecosystems.

The pharmaceutical segment faces advantages such as sterility, correct dosed administration, and long shelf life, but is also challenged by concerns such as complicated regulatory compliance, expensive manufacturing, and low consumer awareness.

However, efficacy imaging technologies, artificial intelligence (AI) guided quality control methods, and eco-friendly pharmaceutical packaging materials, are improving operational efficiency, accessibility, and compliance with regulatory authorities, thus offering growth dimmable spend from global pharmaceutical industry for airless pump solutions.

The increasing demand for an accurate, clean, and sustainable dispensing for cosmetics, personal care, pharmaceuticals, and food packaging are the key factors fuelling the growth of the airless pumps market.

Revolutionary for cosmetics, plastic-free pumps and dispensers, new dispensing technologies for dosage control, premium refillable pump and dispenser solutions. New plastic-free and eco-materials are being developed for brands along with superior pump technology to deliver a better consumer experience and reduce product waste.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AptarGroup, Inc. | 20-24% |

| Silgan Dispensing Systems | 14-18% |

| Albea Group | 10-14% |

| Quadpack Industries | 8-12% |

| Lumson S.p.A | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| AptarGroup, Inc. | Develops innovative airless pumps with eco-friendly and precision-dosing features for cosmetics and skincare. |

| Silgan Dispensing Systems | Specializes in customizable, lightweight airless pumps with recyclability and controlled dispensing technology. |

| Albea Group | Offers premium and sustainable airless pump solutions with PCR (post-consumer recycled) materials. |

| Quadpack Industries | Focuses on luxury airless pump packaging, integrating unique dispensing mechanisms for high-end beauty brands. |

| Lumson S.p.A | Manufactures glass and plastic airless pump systems with advanced product protection and aesthetic appeal. |

Key Company Insights

AptarGroup, Inc. (20-24%)

AptarGroup dominates the airless pumps market, offering high-performance, eco-friendly dispensing systems for personal care, beauty, and pharmaceutical applications.

Silgan Dispensing Systems (14-18%)

Silgan provides innovative and recyclable airless pump solutions designed for precision dosing and extended product shelf life.

Albea Group (10-14%)

Albea leads in sustainable packaging, integrating PCR materials and lightweight airless pumps for personal care and cosmetics.

Quadpack Industries (8-12%)

Quadpack specializes in high-end airless pump solutions with custom designs for luxury skincare and fragrance brands.

Lumson S.p.A (5-9%)

Lumson focuses on elegant and protective airless pump systems, ensuring product integrity with stylish and functional packaging.

Other Key Players (35-45% Combined)

Several global manufacturers contribute to the airless pumps market with specialized and sustainable solutions across industries. These include:

The Airless Pumps Market was valued at approximately USD 266.6 million in 2025.

The market is projected to reach USD 438.4 million by 2035, growing at a compound annual growth rate (CAGR) of 5.1% from 2025 to 2035.

The demand for Airless Pumps Market is expected to be driven by the rising demand for preservative-free skincare products, increasing use in pharmaceutical packaging for precision dosing, and the shift toward sustainable, refillable, and hygienic dispensing solutions in cosmetics and healthcare.

The top 5 countries contributing to the Airless Pumps Market are the United States, China, Germany, France, and Japan.

The Skincare and Pharmaceutical Applications segment is expected to lead the Airless Pumps market, driven by the growing preference for airless dispensing technology in premium skincare, medical formulations, and sensitive liquid-based products requiring extended shelf life and contamination-free delivery.

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Ultra High Bond (UHB) Tape Market Analysis by Type, Thickness and End Use Through 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Strapping and Banding Equipment Market – Key Trends & Growth Outlook 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.