Airless packaging is growing at a high rate as manufacturers create innovative, sustainable, and tamper-proof dispensing systems. As there is growing demand from personal care, pharmaceuticals, and food industries, the manufacturers concentrate on long-lasting, leak-proof, and environmentally friendly packaging. Businesses incorporate automation, AI-based quality control, and recyclable components to streamline manufacturing and adhere to strict regulatory guidelines.

Industry trends focus on biodegradable plastics, precision dispensing, and hermetic designs to optimize product durability and sustainability. The industry is moving towards lightweight, convenient, and recyclable airless packaging systems with improved safety and lower environmental footprint.

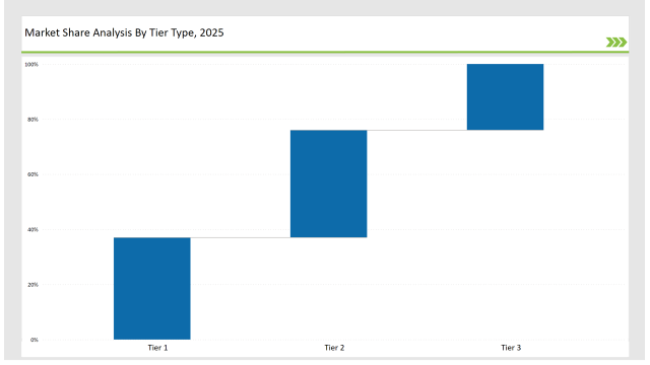

Tier 1 companies like AptarGroup, Silgan Holdings, and Albéa dominate 37% of the market by utilizing massive production, innovative dispensing technologies, and international distribution networks.

Tier 2 players such as Lumson, Quadpack, and HCP Packaging command 39% market share, targeting customization, environmental-friendly designs, and high-performance production.

Tier 3 players that include regional and niche companies provide 24% of the market, specializing in biodegradable materials, refillable packaging, and smart dispensing systems.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (AptarGroup, Silgan Holdings, Albéa) | 18% |

| Rest of Top 5 (Lumson, Quadpack) | 12% |

| Next 5 of Top 10 (HCP Packaging, Raepak, LUMS Packaging, East Hill Industries, Nest-Filler) | 7% |

The airless packaging sector is used across various industries in which product integrity, sustainability, and accurate dispensing are essential. Businesses incorporate smart dispensing devices and AI-enabled monitoring of production to increase efficiency and customer experience. Producers design precision-engineered nozzles to maximize product flow. They use advanced sealing technologies to avert leakage and contamination.

Manufacturers refine airless packaging solutions with biodegradable materials, refillable designs, and AI-enhanced production techniques. AI-driven defect detection improves quality assurance and reduces waste. Companies integrate automated filling systems to enhance production efficiency. They develop ultra-lightweight containers to minimize material usage and shipping costs. Businesses implement RFID technology to track product lifecycle and improve inventory management.

Companies accelerate airless packaging innovations by adopting high-precision molding, AI-powered defect detection, and refillable systems. They refine lightweight yet durable packaging solutions to enhance sustainability and usability. Industry leaders implement smart dispensing technology to improve consumer convenience and reduce product waste. Manufacturers develop customizable packaging solutions to enhance brand differentiation. Companies integrate UV-resistant coatings to extend product shelf life. Firms enhance production efficiency by adopting AI-driven workflow automation. Businesses explore modular packaging systems to enable multi-use applications. Industry leaders invest in antimicrobial additives to improve product safety.

Technology suppliers must focus on sustainability, automation, and precision dispensing to propel market expansion. Innovation and uptake will be supported by partnership with personal care, pharmaceuticals, and food industries. Companies must invest in AI-driven production monitoring to optimize efficiency. They must create next-generation recyclable materials to ensure regulatory compliance.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | AptarGroup, Silgan Holdings, Albéa |

| Tier 2 | Lumson, Quadpack, HCP Packaging |

| Tier 3 | Raepak, LUMS Packaging, East Hill Industries, Nest-Filler |

Leading manufacturers enhance AI-driven production, sustainable materials, and smart dispensing technology. They integrate lightweight, tamper-proof features to improve safety and durability. Companies develop cloud-based defect detection systems to optimize manufacturing efficiency. Businesses implement robotic automation to streamline assembly and reduce errors. Firms enhance material transparency by integrating blockchain technology. Companies explore advanced printing techniques to enable high-quality branding on packaging.

| Manufacturer | Latest Developments |

|---|---|

| AptarGroup | Expanded biodegradable airless packaging (March 2024) |

| Silgan Holdings | Developed tamper-proof dispensing solutions (April 2024) |

| Albéa | Introduced refillable, eco-friendly containers (May 2024) |

| Lumson | Released AI-powered defect detection (June 2024) |

| Quadpack | Innovated luxury sustainable packaging (July 2024) |

| HCP Packaging | Strengthened recyclable dispenser production (August 2024) |

| Raepak | Enhanced smart dispensing technology (September 2024) |

The airless packaging market evolves as companies invest in automation, smart materials, and sustainable packaging. Firms integrate AI-driven defect detection, lightweight materials, and tamper-proof features to improve product safety and efficiency. Companies adopt high-speed molding technologies to enhance production rates. They implement predictive analytics to optimize material usage and reduce waste. Manufacturers develop multi-layered packaging for improved product protection.

Manufacturers develop AI-driven customization, ultra-lightweight materials, and tamper-proof packaging. They refine recyclable and refillable airless containers while integrating IoT-enabled smart dispensing solutions to enhance functionality and reduce waste. Companies adopt advanced material blending techniques to enhance durability and flexibility. They optimize high-speed production processes to increase efficiency and reduce costs. Firms develop anti-clogging mechanisms to ensure smooth product dispensing. Businesses integrate smart sensors into packaging to monitor product usage and optimize refill cycles. Manufacturers implement laser engraving for enhanced branding and authentication. Industry leaders explore bio-based coatings to further reduce environmental impact.

AptarGroup, Silgan Holdings, Albéa, Lumson, Quadpack, HCP Packaging, Raepak, LUMS Packaging, East Hill Industries, Nest-Filler.

The top 3 players collectively hold 18% of the global market.

The market shows medium concentration, with top players holding 37%.

Companies focus on sustainable materials, smart dispensing technology, and AI-powered quality control to enhance efficiency and meet consumer demand.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.