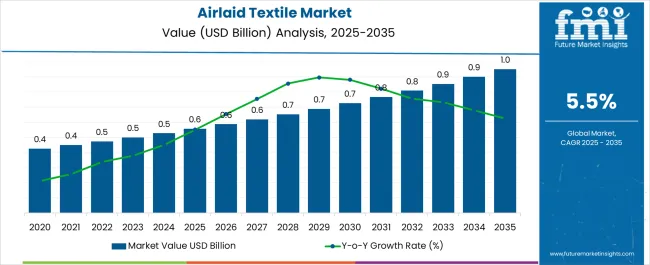

The Airlaid Textile Market is estimated to be valued at USD 0.6 billion in 2025 and is projected to reach USD 1.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Airlaid Textile Market Estimated Value in (2025 E) | USD 0.6 billion |

| Airlaid Textile Market Forecast Value in (2035 F) | USD 1.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The airlaid textile market is experiencing strong growth driven by the rising demand for disposable hygiene products, sustainable nonwoven solutions, and enhanced absorption capabilities in consumer goods. Increased use of airlaid materials in personal care, healthcare, and specialty applications has been supported by their softness, absorbency, and versatility compared to traditional textiles.

Manufacturers are investing in eco friendly fibers, advanced bonding techniques, and improved production technologies to meet both performance standards and sustainability goals. Growing regulatory pressure to minimize plastic content in hygiene products is further boosting the adoption of biodegradable and recyclable airlaid textiles.

The future outlook is positive as the industry continues to shift toward premium, skin friendly, and environmentally sustainable solutions that align with consumer expectations and corporate sustainability commitments.

The latex bonded product type segment is projected to hold 48.70% of the total market revenue by 2025, making it the leading product type. Its dominance is attributed to its superior bonding strength, structural integrity, and cost efficiency in large scale production.

Latex bonding enhances durability while maintaining softness, making it suitable for high volume hygiene applications. The ability to integrate natural and synthetic fibers in latex bonded airlaid products has also expanded their application scope.

Continuous innovation to improve eco friendliness and reduce chemical content has further strengthened adoption. These attributes have ensured that latex bonded remains the preferred product type in the airlaid textile market.

The feminine hygiene application segment is expected to account for 44.20% of total market revenue by 2025, positioning it as the most prominent application area. This growth is being propelled by rising awareness of menstrual hygiene, increased product accessibility, and growing preference for comfortable and skin friendly materials.

Airlaid textiles are valued for their high absorbency, softness, and ability to provide discreet protection, which aligns with consumer expectations in the feminine hygiene segment. Furthermore, investments in sustainable fibers and biodegradable materials are supporting long term adoption.

As global demand for high performance and eco conscious feminine hygiene products continues to expand, this segment remains the cornerstone of growth for the airlaid textile market.

According to the latest research by Future Market Insights, Airlaid Textile market is set to witness steady growth from 2024 to 2035. Demand for the market has not been impacted to a great extent in the long term and maintains an optimistic growth outlook in the long run. Wipes and Feminine hygiene are currently the most popular applications and account for more than half of the market share

There is high demand for Airlaid Textile in developed countries for feminine hygiene and adult incontinence products, combined with rapid population aging and growing spending on elderly care. The adoption of feminine hygiene products in developing countries has grown by leaps and bounds in the wake of dedicated campaigns by civil society and government departments.

The improved access to sanitation products for the female population in developing countries, particularly in rural areas has contributed to substantial growth in the market.

Strong demand for wipes and food pads, improving economic conditions, sophisticated cultural preferences, and high use of hygiene products are the factors driving the Airlaid market growth.

A wipe is a wet, disposable cloth and which is used for cleaning surfaces. It is also used as an antiseptic fabric for skin cleaning. Wipes are an efficient carrier for cost-effective application of a wide range of active ingredients. The wipes market consist of sales of wipes and related services used in the personal, industrial sectors and household application.

The growing usage of these products has had a positive impact on the demand for airlaid textiles.

In the wake of the COVID-19 pandemic there is an increased focus on maintaining personal hygiene and cleanliness. Such factor will further contribute to the demand for personal hygiene and care products thus enabling market growth.

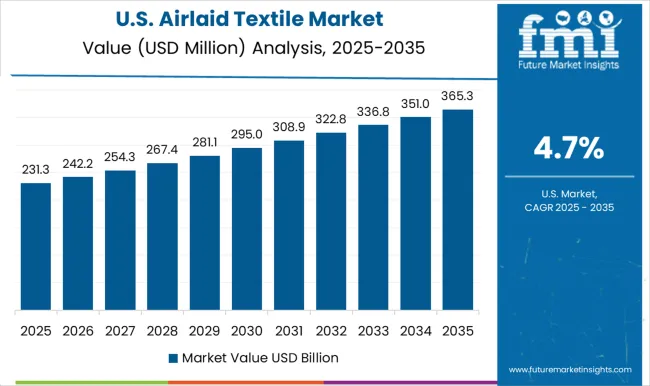

The USA is one of the most prominent markets, with strong domestic demand for personal as well as industrial applications. Although the restrictions relating to the pandemic did have a significant impact on the overall supply chain of the market, demand witnessed only a marginal impact. Demand is expected to rebound fully by the second quarter of 2024 as the country eases previous restrictions on the movement of people and goods.

The textile industry in the United States is a supplier to three major industrial end-use sectors: apparel, floor coverings, and home textiles, as well as technical textiles used in manufactured industrial production.

The USA Airlaid Textile sales will also be impacted by the Industrial sector recovery in 2024. The USA Industrial sector faces various challenges, however, there is growing optimism that a successful nationwide vaccination drive will ensure the economy opens up sooner rather than later, helping boost demand.

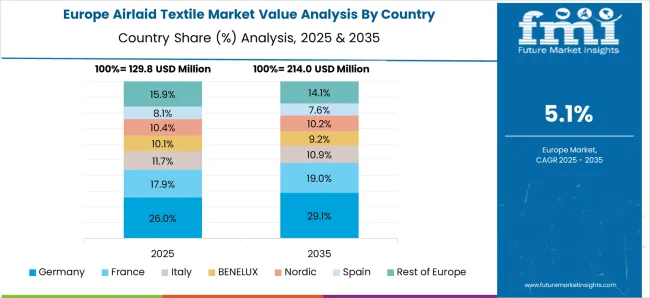

Most of the countries in the EU have been severely impacted by the COVID-19 crisis, which has led to a decline in economic activities. Restrictions on mobility, a drop in personal incomes, and a weak industrial sector had strong repercussions on the overall state of the economies.

However, demand for personal sanitation and hygiene products managed to hold its own to some extent. Supply-side restrictions did exert additional strain on the overall balance of the market. However, the gradual resumption of factories in East Asia in the second half of 2024 eased the supply constraints. The market in Europe is forecast to continue on an upward growth trend during the forecast period.

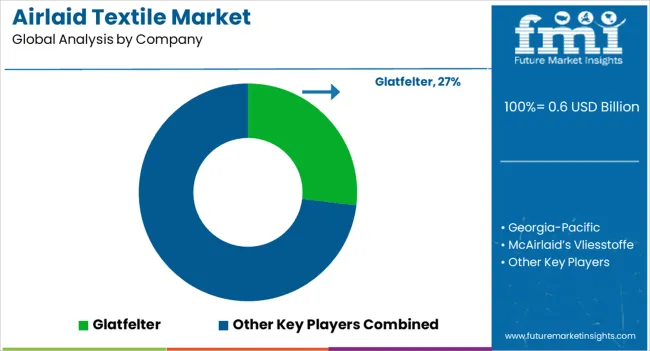

Some of the leading manufacturers and suppliers of airlaid textiles include

Many leading manufacturers are developing new and much more efficient products to stay ahead of the competition. For instance, Latex-Bonded Airlaid fabrics with high wet strength and softness were developed which are used as dry/wet towels as well as toilet paper. Increasing focus on research and development by the key players will ensure rapid new product developments, which will increase the overall intensity of competition in the market.

The report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macroeconomic indicators, and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global airlaid textile market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the airlaid textile market is projected to reach USD 1.0 billion by 2035.

The airlaid textile market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in airlaid textile market are latex-bonded, thermal-bonded and multi-bonded.

In terms of application, feminine hygiene segment to command 44.2% share in the airlaid textile market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Textile Colorant Market – Trends & Forecast 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Textile Tester Market Growth – Trends & Forecast 2025 to 2035

Textile Colors Market Growth - Trends & Forecast 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Textile Auxiliaries Market Trends 2024-2034

Textile Printing Ink Market

Geotextile Tube Market Growth – Trends & Forecast 2024-2034

Agri Textiles Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Agro textiles Market

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA