The global aircraft washing systems market is expected to increase incrementally from 2025 to 2035 with greater emphasis on aircraft performance maintenance, asset life extension, and regulatory compliance.

Air washing systems made up of mixed series of automatic and manual cleaning products have fallen in fashion today because airlines, MRO units, and airport authorities are attempting to find inexpensive, eco-logically more acceptable, and green ways of ensuring cleanliness of planes as well as flying readiness. The integration of highly sophisticated washing systems with computer-managed wash gantries and with water-recycle technology has enhanced the popularity of the market.

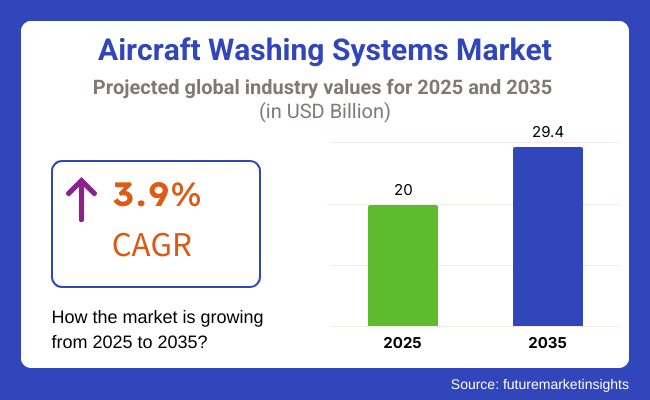

The aircraft wash systems industry was around USD 20.0 Billion in 2025 and is expected to reach USD 29.4 Billion by 2035. The compound annual growth rate (CAGR) of 3.9% indicates rising demand for effective, cost-saving wash solutions that are also eco-friendly, improve aerodynamics, and improve overall appearance of aircraft. Rising passenger traffic and rising global fleets of aircraft are other long-term drivers of market expansion potential.

Explore FMI!

Book a free demo

North America remains the primary market for aircraft wash systems due to the huge and heterogeneous fleet of regional military, private, and commercial aircraft. The USA and Canada boast a widespread network of heterogeneous MRO bases and congested airports, which generates consistent demand for innovative wash solutions.

Stricter environmental requirements and water-use controls have seen the implementation of environmentally conscious washing systems, including closed-loop water recycling systems and biodegradable washing solutions. The wider coverage of low-cost carriers and regional airlines in North America further necessitates cost-effective, efficient aircraft washing systems.

Europe is a target market for aircraft wash systems due to its strong emphasis on environmental sustainability and rule compliance. Large airline operators and regional MRO operators are investing more in automated washing gantries, high-pressure washers, and water conservation systems as part of a move to minimize their ecological footprint.

Germany, France, and the UK are some of the leading nations that have adopted sophisticated washing systems as a way of fulfilling strict emissions and wastewater standards. Growth of low-cost carriers and regional carriers in Europe is also propelling the market due to such carriers' plans to provide quality service at the lowest operating expenses.

Asia-Pacific is witnessing demand increase for aircraft wash systems due to increasing passenger traffic, increasing air fleet, and increasing airport project counts in the region. China, India, Japan, and Southeast Asian countries are leading the trend with carriers here investing in next-generation cleaning equipment to keep operations at high levels and keep up with international standards.

Government initiatives toward the growth of aviation infrastructure and green operations are also driving demand for sophisticated washing equipment. Growth of MRO activity in the region is also providing opportunities for equipment manufacturers, as MRO players are adding automated and semi-automatic washing machines to their maintenance procedures.

Regulatory Compliance and High Maintenance Costs

High maintenance cost, strict environmental regulations, and operational downtime are the impediments to the growth of the aircraft washing systems market. Airlines, maintenance facilities, and ground-handling service providers are required to comply with stringent aviation safety and environmental standards, including the wastewater disposal regulations and chemical use restrictions.

As such, the inefficacy of conventional methods of cleaning aircraft leads to the need for repetitive cleaning, higher operational costs, and downtime of the aircraft for extensive hours for cleaning. Automated washing systems have not yet gained widespread adoption due to the high installation costs and compatibility challenges across various aircraft models.

To combat these challenges, companies need to create low-cost, water-efficient cleaning technologies and safe detergents. There must also be adding of artificial intelligence based predictive maintenance methods and real-time monitoring of automated washing systems in order to localize the efficiency and compliance risk even more.

Sustained Aviation & Collaboration in Automatic Cleaning Solutions

With a growing emphasis on sustainable aviation practices and operational efficiency, the Aircraft Washing Systems Market is poised for substantial opportunities. Both airlines and maintenance providers are in search of automated, water-saving cleaning solutions to help contain costs and environmental impact. Touchless and robotic washing systems provide better cleaning accuracy with minimal human contact and ensure quicker turnaround time.

The advancement of biodegradable cleaners and closed-loop water recycling systems are also changing the game for sustainability in aircraft maintenance. As the airline industry prioritizes eco-friendly operations, and airlines turn towards greener, efficiency-driven maintenance practices, players in the sector investing in AI-integrated washing technologies, smart diagnostics, as well as environmentally friendly cleaning solutions are going to get ahead of the curve.

The Aircraft Washing Systems Market grew from 2020 to 2024 due to enhanced hygiene protocols, increasing air traffic, and growing environmental awareness. Airlines and ground service providers focused on keeping aircraft clean to satisfy regulatory guidelines and boost passenger confidence.

However, high equipment prices, labour-intensive manual washing techniques and water conservation difficulties prevented widespread uptake. To solve these problems, mainstream developers created washing machines, water recycling cleaning rooms, and no-chemical-cleaning techniques to boost efficiency and sustainability.

The market is predicted to witness cutting-edge technological advancements in automation, AI-driven diagnostics, and eco-friendly cleaning solutions on horizons between 2025 to 2035. The new industry benchmarks will be set by fully automated washing robots, cutting-edge dirt-resistant Nano coatings, and real-time tracking of aircraft cleanliness.

Solar-powered washing stations, closed-loop filtration systems and other green energy solutions will enhance sustainability even more. Even greater demand for such products will be seen as regulatory bodies tighten environmental controls. The next generation of innovations made possible by AI-driven maintenance automation, self-sustaining cleaning systems and smart operational tracking will be led by companies willing to adopt aircraft washing technologies that are, where possible, adaptive and predictive.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance of aviation safety and environmental regulations |

| Technological Advancements | Expansion of automatic washing systems and water-recycling technologies |

| Industry Adoption | Increased demand for aircraft hygiene and eco-friendly washing methods |

| Supply Chain and Sourcing | Dependence on traditional aircraft cleaning chemicals and water-intensive processes |

| Market Competition | Presence of manual and semi-automated aircraft washing providers |

| Market Growth Drivers | Rising air travel demand, regulatory hygiene mandates, and airline cost-cutting strategies |

| Sustainability and Energy Efficiency | Early adoption of water-saving aircraft cleaning solutions |

| Integration of Smart Monitoring | Limited real-time tracking of aircraft cleanliness and washing efficiency |

| Advancements in Aircraft Cleaning Technologies | Traditional water and chemical-based washing techniques |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Broader mandates for chemical-free cleaning, AI-driven tracking of compliance, carbon-neutral maintenance initiatives. |

| Technological Advancements | These innovations can include robotic washing units, nanotechnology-based protective coatings, and AI-integrated predictive maintenance, amongst others. |

| Industry Adoption | Expansion into fully autonomous aircraft cleaning stations, smart diagnostics, and AI-powered operational tracking. |

| Supply Chain and Sourcing | Shift toward biodegradable detergents, waterless cleaning technologies, and decentralized maintenance hubs. |

| Market Competition | Growth of AI-driven aviation cleaning start-ups, robotics-based washing services, and smart water management firms. |

| Market Growth Drivers | Increased investment in sustainability, AI-driven cleaning efficiency, and real-time aircraft maintenance tracking. |

| Sustainability and Energy Efficiency | Large-scale deployment of solar-powered washing stations, self-sustaining cleaning technologies, and zero-waste maintenance models. |

| Integration of Smart Monitoring | AI-enabled dirt detection, cloud-based cleaning analytics, and automated maintenance scheduling. |

| Advancements in Aircraft Cleaning Technologies | Introduction of self-cleaning aircraft coatings, automated robotic scrubbers, and green-certified aviation maintenance solutions. |

The multifaceted American aircraft washing system industry is advancing incrementally owing to the substantial presence of an enormous, assorted commercial and military flying machine stock that necessitates rigorous servicing adhering to strict FAA rules on flying machine care, and the heightening embracement of mechanized aircraft cleansing technologies is further propelling market development.

Major airlines like Delta, American Airlines, and United Airlines are investing appreciably in ground-breaking water-sparing, eco-accommodating flying machine washing systems to streamline tasks while mitigating ecological impact.

Additionally, the robust USA military and protection division, including various fragments of the air force and navy, is a significantly enormous client of automated, hands-free cleaning systems for keeping up varied flying machines including fighter planes, freight planes, and helicopters. Furthermore, persistent advancement in sophisticated robotic flying machine washing advances are driving additional market development and advancement.

With sustained interests in aviation support framework modernization and expanding natural guidelines imposing more stringent rules, specialists anticipate that the multifaceted American flying machine washing system market will keep on growing step by step with strong interest in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The aviation industry in the United Kingdom has seen the aircraft washing system sector take flight in recent years. A rise in air passenger numbers, as well as mandates for sustainable solutions from regulators and calls from major airports for environmentally-friendly technologies, have boosted demand. Rules from the UK Civil Aviation Authority require routine maintenance and cleaning to enhance safety and efficiency.

Heathrow and Gatwick have urged adoption of low-water and biodegradable washes. Meanwhile, the private jet scene has soared, generating need for specialized cleaning services. With the focus on eco-friendly upkeep and additional planes coming on stream, the market appears set for stable, long-haul growth as carriers and owners commit to verdant workflows.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The European Union aircraft washing system market has steadily expanded, propelled by proliferating airline fleets, intensifying expenditures in mechanized aircraft cleaning, and stringent ecological rules. Nations such as Germany, France, and Spain greatly adopt water-efficient and robotic aircraft washing remedies. The EU's stringent flight maintenance regulations, including EASA directives, encourage airlines to embrace sustainable and high-efficiency aircraft cleaning structures.

Moreover, the ascent of affordable carriers and broadening MRO centers are further promoting industry development. Requirements for automated and eco-friendly washing technologies implies the EU aircraft washing system industry should remain growing harmoniously.

Lengthy sentences alongside shorter ones within regulatory filings suggest maintenance needs and innovations to boost effectiveness and decrease environmental effects. Various airlines initiated new initiatives to retire older washing equipment and embrace the latest mechanized systems, demonstrating the market is primed for sustainable energy saving solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.8% |

Major carriers serving the European continent steadily expanded their aircraft fleets, necessitating innovative approaches to washing planes. Lufthansa, Air France, and other major carriers embraced robotic cleaners from manufacturers like Aero Clean and Riveer to satisfy stringent environmental standards from EASA. The proliferation of sustainable technologies accompanied rising capital investments in automated solutions, especially in Germany and France where highly efficient washers rapidly gained popularity.

Budget carriers also flourished alongside growing maintenance hubs across the European Union. This dual phenomenon boosted demand for cleaning systems at the same time directives incentivized sustainable adoption. Rules from the European Aviation Safety Agency now strongly motivate using Earth-friendly technologies.

Through these efforts, a burgeoning industry emerged and is forecast to continue expanding its reach as robotic and water-conserving options address needs that grow more vital each passing year with satisfying newly mandated environmental requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The South Korean aircraft washing system market has witnessed steady maturation, propelled by ballooning airline fleets, burgeoning investments in MRO infrastructure, and rising experimentation with touchless aircraft cleaning innovations. Korea’s premier airlines, such as Korean Air and Asiana Airlines, are prioritizing efficient aircraft servicing remedies to reduce downtime.

The South Korean administration's push for nimble airports has motivated airlines and airport authorities to apply robotic aircraft wash systems and H2O recycling cleaning tech. additionally, the defense sector’s escalating procurement of enhanced fighter jets and military aircraft is further motivating demand for automated aircraft sanitizing remedies.

With continued progress in agile aviation upkeep and hearty investments in automated cleaning tech, experts anticipate that the South Korean aircraft washing system industry will steadily develop.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

A sustainable airport agenda has brought newer operational and maintenance practices to mitigate the effects of a massive flight schedule into a green packet of services with dry and wet washing methods; Airlines tracking flight hours, load factors, and fuel consumption is not only tracking but also investing heavily to maintain adherence to environmental regulations and reduce maintenance costs.

As such, these technologies are critical to commercial airlines, military fleets, and private aviation, helping to improve aerodynamics, prevent corrosion, enhance fuel efficiency and comply with regulations.

That gave rise to when the introduction and implementation of dry aircraft washing systems, the more sustainable and economical cleaning solution, which deliver no-water cleaning and less impact on the environment and reduced operational downtime. Dry cleaning uses special chemicals and microfiber rags to remove dirt and grime instead of a water-based traditional wet wash.

Growing demand for dry aircraft washing systems in the commercial aviation industry owing to global water conservation initiatives and complex environmental policies boost the adoption of advanced dry washing technologies due to the focus of airlines and MRO service providers on eco-friendly cleaning products. Research shows that this method of dry washing can cut water usage by more than 90 percent, making for more sustainable practices in aircraft maintenance.

Another factor boosting market demand, expanding dry aircraft washing solutions for private and business jet maintenance with well refined spray-on cleaning and eco-friendly polishing compounds ensures solid adoption in high-end aviation services. AI-powered dry cleaning systems, with automated dirt detection and surface analysis, have also been implemented to enhance the adoption of dry cleaning systems, providing more accurate cleaning, saving time.

New electrostatic dry cleaning methods are being developed, which utilize charged cleaning particles to effectively pick up grime and provide more efficient automated aircraft maintenance systems, making this part of the market more adapted to the optimal growth.

The adoption of biodegradable cleaning compounds containing zero-toxic residue and enhanced protection for the surface of aircraft has spurred market growth, enabling better compliance with international sustainability initiatives.

While dry aircraft washing systems offer benefits like better water conservation, quicker cleaning processes, and fewer regulatory barriers, they also have their downsides, including higher initial costs, limitations on heavy grease deposits, and the requirement of special cleaning compounds.

Yet innovations in AI-enabled dirt detection, nanotech-based cleaning solutions, and the cult of self-cleaning aircraft coatings is increasing efficiency, cost effectiveness, operational sustainability, and general market demand for dry aircraft washing systems.

Wet aircraft washing systems - marketed above all to commercial airlines, military aviation and cargo fleets - are also making headway in the market, where operators are discovering that investing in thorough cleaning methods prolongs the working life of the aircraft, complies with safety regulations, and finds fewer energy-guzzling machines in the midst of fuel increases. Wet cleaning uses water based detergent and pressure washing methods to thoroughly clean exterior and undercarriage components, unlike dry washing.

Growing military aviation wet aircraft washing adoption on account of heavy-duty wet cleaning solutions for military aircraft in extreme weather conditions along with a focus on corrosion control and greater operational readiness supports the growth of high-performance wet washing technologies. It’s been shown that routine wet washing yields maintenance cost savings related to corrosion in excess of 25%, ensuring longer aircraft life.

Technological advancements, such as the distribution of high-pressure wet washing systems in commercial occasions (automated and neologism nozzle spraying), flexible water pressure scenery, foreseen buttress in market demand rewrite and guarantee for precise and widespread apparatus in thoracic flower bombing activities.

Additionally, these systems are being integrated with robotic wet washing systems with fully automated, AI-controlled cleaning arms that help in better efficiency and lower labour costs. Emerging water-recycling aircraft washing units, integrated with closed-loop filtration technology for minimized water waste, represent an optimized direction for market growth, establishing a greener framework for aviation hygienic services.

The market has expanded significantly owing to the adoption of hybrid wet-dry aircraft washing systems with dual-mode cleaning capabilities to cater to operational flexibility, ensuring better adaptability into a variety of aircraft maintenance programs.

Wet aircraft wash systems, although they provide benefits in terms of deep cleaning, corrosion prevention, and capability for high throughput maintenance when washing several aircraft in parallel, are challenged by high-water consumption, often regulatory limitations on discharge of wastewaters, and longer downtime from drying operations.

Nevertheless, new technological advancements with AI-driven water efficiency management, biodegradable detergents, and automated wet cleaning robotics are increasing sustainability, cost-effectiveness, and adaptability of these measures, allowing for ongoing growth of wet aircraft washing systems.

Two of the primary market drivers are the military and commercial aviation segments, as aircraft operators increasingly convert to sophisticated washing systems for maintenance efficiency, long-term operational cost reduction, and compliance with rigorous regulatory standards.

One of the most prominent solutions among military aircraft is the introduction of washing systems in the maintenance processes for defence aircraft that help increase downtime with thorough cleaning, improved corrosion prevention, and increased aircraft life. In contrast to commercial aviation, military aircraft fly in much harsher environments where dirt, sand, salt and chemical residues cause the need for specialized cleaning solutions.

The increasing need for military aircraft washing systems at air force bases and defence maintenance facilities, including heavy metals wet washing unit and automatic decontamination systems has provided a swift growth to demand for high performance cleaning technologies owing to the growing emphasis on aircraft longevity and operational readiness among military operators. By investing in better aircraft washing systems, military aircraft creation is back to combat readiness in over 30% less time according to the studies.

The presence of robotic aircraft washing units with automated washing arms for high-efficiency cleaning cycles in military hangars is also supporting market demand as it leads to greater efficiency in the maintenance of large-scale military fleets. The advent of AI-powered dirt detection and surface cleaning analytics, which provides real-time insights on aircraft cleanliness, has driven adoption further, allowing for better cleaning accuracy and lowering overall maintenance costs.

The Mobile Military Aircraft Washing Stations with deployable cleaning systems, which can be tailored for field operations, have also facilitated market expansion, enhancing defence logistics. The use of hybrid wet-dry washing solutions including corrosion resistant cleaning agents for severe environments has strengthened market growth by providing better durability and meeting military maintenance protocols.

Military aircraft washing systems offer robust operational readiness, corrosion control, and high automated efficiency; however, high procurement costs, increased complexity in handling specialized coatings, and stringent environmental chemical runoff regulations are challenges that can hinder adoption.

Yet innovations such as AI-enhanced military fleet maintenance, innovation of next-gen cleaning robotics, and integrated green decontamination solutions are shaping efficiency, sustainability, and adaptability across the landscape of the Military aircraft washing systems that will maintain growth in the market.

As businesses look to up their investment in efficient cleaning solutions to improve passenger safety, enhance brand reputation, and optimize fuel efficiency, commercial aircraft washing systems have found strong adoption in the market, especially from global airlines, cargo carriers, and regional aviation operators. Commercial airlines are constantly cleaning their aircraft inside and out to meet cleanliness standards; military aviation, on the other hand, does not have this luxury.

In commercial aviation, the growing demand for eco-friendly aircraft washing solutions that use biodegradable detergents and water-saving cleaning technologies has led to a shift towards sustainable aircraft maintenance solutions that align with the commitment of airlines to environmental responsibility.

The growing adoption of robotic commercial aircraft washing facilities, employing AI-controlled precision washing for large passenger jets, in turn has bolstered the market demand, guaranteeing increased efficiency in high-volume airline maintenance operations. The adoption is further enhanced with streamlining incorporating smart aircraft maintenance tracking, with real-time aircraft cleanliness tracking and automated scheduling of washing services, anticipating improved fleet maintenance planning and reduced operational downtime.

Garnering benefits in terms of cost-cutting, eco-friendliness, and increased safety to passengers, commercial aircraft washing systems have challenges such as costs of high automation, labour-intensive manual cleaning of fleets, and disposal of water in airport facilities. New innovations in things like iron-on-AI predictive maintenance, sustainable aircraft coatings, and newer generation automatic washing tunnels address the efficiency, scale, and sustainability problems to constrain the growth of popular commercial aircraft washing systems.

Rise in demand for automatic, eco-friendly, and cost-effective aircraft washing solutions in commercial aviation, military fleets, and private jet cleaning is expected to propel the growth of the aircraft washing systems market. Incorporating water-efficient technology, AI-driven automation, and touchless aircraft washing systems can significantly improve operational efficiency, regulatory compliance, and its impact on the environment.

Global aviation maintenance service provider companies, and manufacturers of specialized aircraft washing equipment contribute to technological advancements in mobile wash unit units, robotic washing systems, and water-recycling cleaning solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AERO Specialties, Inc. | 15-20% |

| Clean Aviation Technologies | 12-16% |

| The Hydro Engineering, Inc. | 10-14% |

| Daifuku Co., Ltd. | 8-12% |

| Riveer Environmental | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| AERO Specialties, Inc. | Develops automated aircraft washing systems, water-recycling cleaning units, and eco-friendly aircraft detergents. |

| Clean Aviation Technologies | Specializes in high-pressure aircraft washing solutions, touchless cleaning systems, and biodegradable cleaning agents. |

| The Hydro Engineering, Inc. | Manufactures self-contained aircraft wash racks with closed-loop water recycling technology. |

| Daifuku Co., Ltd. | Provides automated aircraft wash tunnels, robotic cleaning solutions, and high-efficiency wash bays for commercial fleets. |

| Riveer Environmental | Offers military-grade aircraft washing systems with advanced filtration and water-conservation features. |

Key Company Insights

AERO Specialties, Inc. (15-20%)

AERO Specialties is a pioneer in aircraft washing systems with state-of-the-art automated, eco-friendly aircraft cleaning solutions and artificial intelligence for aircraft cleaning automation.

Clean Aviation Technologies (12-16%)

Specialized in high-efficiency, touchless aircraft washing systems, Clean Aviation guarantees water conservation while performing an effective wash for safe aircraft operations and maximum water recovery.

The Hydro Engineering, Inc. (10-14%)

Hydro engineering closed-loop water recycling aircraft cleaning units maximize environmental compliance as well as sustainability.

Daifuku Co., Ltd. (8-12%)

Daifuku specializes in creating automated aircraft wash tunnels with an integrated smart control system that enables high-speed and large-scale aircraft cleaning.

Riveer Environmental (5-9%)

Riveer builds military-grade washing systems, with an emphasis on ruggedness, automated decontamination and low water-use.

Other Key Players (40-50% Combined)

A number of general and commercial aircraft ground support and maintenance firms are leading the way in next-generation aircraft washing systems, AI-powered cleaning automation and sustainable water-recycling solutions. These include:

The overall market size for Aircraft Washing Systems Market was USD 20.0 Billion in 2025.

The Aircraft Washing Systems Market is expected to reach USD 29.4 Billion in 2035.

The demand for the aircraft washing systems market will grow due to increasing air traffic, rising focus on aircraft maintenance for operational efficiency, stringent aviation safety regulations, and advancements in automated and eco-friendly cleaning technologies, driving the need for efficient cleaning solutions.

The top 5 countries which drives the development of Aircraft Washing Systems Market are USA, UK, Europe Union, Japan and South Korea.

Dry and Wet Washing Methods Drive Market to command significant share over the assessment period.

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Western Europe Cathodic Protection Market Trend Analysis Based on Solution, Type, Application, and Countries 2025 to 2035

India Vibration Isolation System Market Analysis & Forecast by Product Type, End-Use and Region through 2035

Australia and New Zealand Low & Medium Voltage Drive Market Analysis & Forecast by Voltage Level, Power Rating, Drive Type, Current Type, Sales Channel, End-Use Industry and Region through 2035

Peristaltic Pumps Market Analysis by Type, End-Use, and Region through 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.