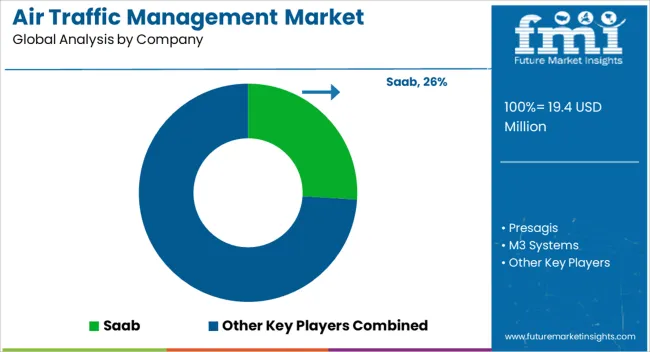

The Air Traffic Management Market is estimated to be valued at USD 19.4 million in 2025 and is projected to reach USD 30.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Air Traffic Management Market Estimated Value in (2025 E) | USD 19.4 million |

| Air Traffic Management Market Forecast Value in (2035 F) | USD 30.6 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The Air Traffic Management market is being influenced by the growing need for safer, more efficient, and highly automated airspace operations. In 2025, the market is witnessing accelerated investments in modern technologies that enhance traffic flow, reduce congestion, and improve communication between aircraft and ground control systems. The rising volume of air travel, both in commercial and defense sectors, is pushing the demand for scalable solutions that can process real-time data and enable predictive management of airspace.

Increasing concerns regarding airspace safety, environmental sustainability, and fuel efficiency are driving the adoption of integrated platforms that offer better coordination and decision-making. Software-driven systems that support dynamic routing, collision avoidance, and networked surveillance are being preferred over legacy systems that lack adaptability.

Future growth opportunities are expected in areas where communication and navigation systems are being combined with artificial intelligence and machine learning algorithms, allowing automated threat detection and traffic optimization With regulatory frameworks increasingly encouraging smarter air traffic solutions, the market is expected to see sustained growth across various regions.

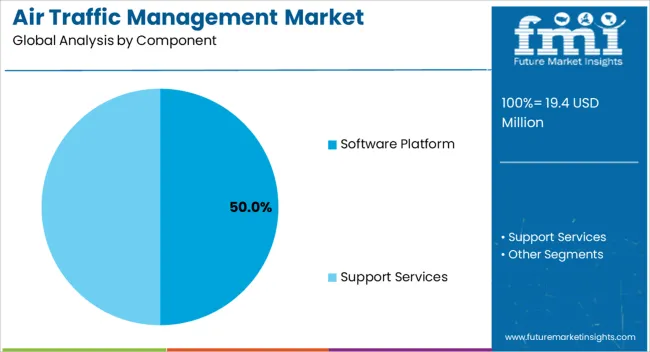

The Software Platform component is expected to hold 50.00% of the Air Traffic Management market revenue share in 2025, making it the leading segment in terms of components. This dominance is being attributed to the growing reliance on software-driven systems for real-time data processing, decision support, and airspace monitoring. Software platforms are being favored because they allow seamless integration with existing hardware infrastructure while enabling advanced analytics, automation, and dynamic control features.

The need for scalable and customizable solutions in both civil and military aviation has accelerated investment in software development. Furthermore, the rising volume of air traffic has increased demand for platforms capable of handling vast amounts of data from multiple sources, including radars, sensors, and communication systems. Software platforms also enable predictive analytics and traffic optimization, which are critical for improving operational efficiency and safety.

The ability to upgrade and extend functionalities through software enhancements has further solidified the preference for this component As aviation authorities seek cost-effective, future-proof solutions, the Software Platform segment is expected to retain its leadership.

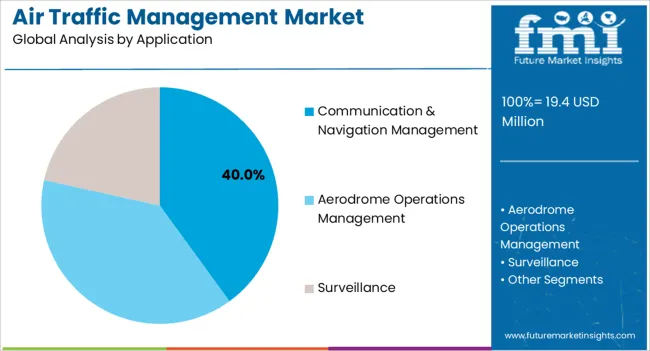

The Communication and Navigation Management application is projected to account for 40.00% of the Air Traffic Management market revenue share in 2025, making it the largest application segment. This growth is being supported by increasing requirements for reliable and uninterrupted communication between air traffic control and aircraft. Navigation systems that offer real-time positioning and route adjustments are being heavily adopted as air traffic density rises.

The segment’s prominence is further strengthened by regulatory mandates aimed at ensuring flight safety and reducing collision risks. Communication platforms are also being integrated with advanced navigation solutions to enhance situational awareness and optimize flight paths. The adoption of satellite-based communication and automated control systems is being fueled by the need to reduce pilot workload and enhance coordination across airspaces.

Additionally, the shift towards digital air traffic control towers and cloud-based communication systems has accelerated the use of such applications The growing adoption of unmanned aerial systems and urban air mobility solutions is expected to further boost demand for robust communication and navigation management systems, securing the segment’s continued growth.

Rising Airports

The demand for air traffic management is primarily driven by the increase in airports globally during the forecast period. In addition, there has been a constant increase in airports in developing regions such as India and China. This factor is likely to fuel the global air traffic management industry share in the coming future.

Investments

There has been an increase in the demand for smart ATM systems. Furthermore, governments have been increasingly investing in airports in the last decade. These pivotal factors are likely to support global market growth.

Remote & Virtual Towers

The deployment of remote and virtual towers has increased in the air traffic management sector. As a result, both developed and developing regions anticipate seeing an increase in the application of air traffic management.

Increased Competition

Due to increasing competition in airport traveling services, the need for efficient airspace management is further growing progressively. The airport management team is also looking to advance the technology, which provides their need for better requirements. These factors are anticipated to drive the air traffic management industry growth over the forecast period.

Safety Awareness

The air traffic management update about the plane or airplane movement, departure, and landing leads to improving the safety of the plane and the passengers. This factor is anticipated to increase the demand for air traffic management.

Along with this, the air traffic management systems are also actively contributing to maintaining the balance between the changing weather and airport activities.

The two main factors holding back the growth of the market for global air traffic management in the predicted term are higher deployment costs and a lack of awareness.

Airlines and airport operators are constantly investing in the modernization of the air traffic management infrastructure. They are also focusing on improving the existing ATM equipment. This considerably aids in the probable acceleration of the market size.

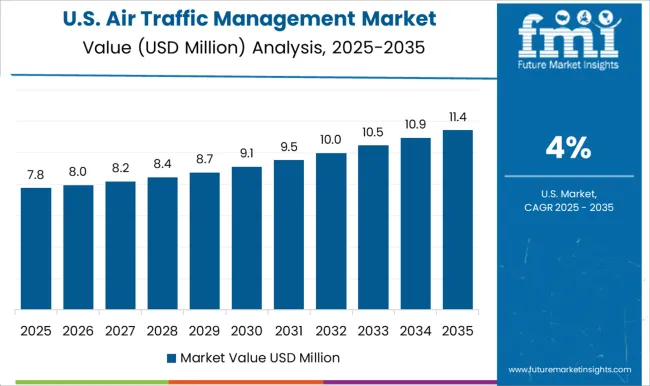

The North American region dominates the air traffic management industry share, acquiring 32.4% of the share during the forecast period.

| Attributes | Details |

|---|---|

| Advance Technology | The North American air traffic management manufacturers are using unique & innovative advanced technology to generate maximum revenue in the market. This increased the adoption of air traffic management in this region in recent years. |

| Surge in Airports | As a dominating region, North America houses several airports in various countries, another reason for the increase in the air traffic management market share. |

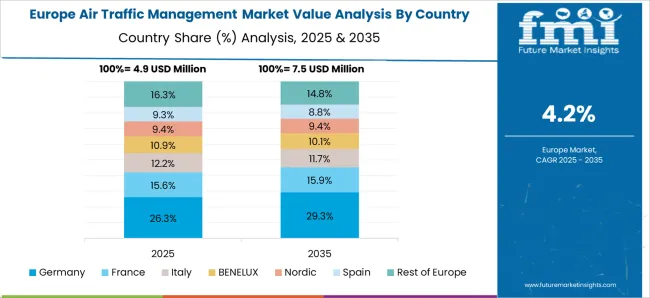

The Europe region is likely to hold the second position in the air traffic management industry share by acquiring more than 23.7% of the share during the forecast period.

Europe’s air traffic management market is rapidly increasing. The transportation industry has increased the production of air traffic management in recent years. In Europe, the increase in infrastructures, education, and tourism are leading to a rise in the market during the forecast period.

Air traffic start-up businesses are emphasizing cutting-edge technologies with their strategies to increase the adoption of air traffic management in a simple manner. Moreover, start-up businesses are identifying several opportunities to create new products and increase the market share for air traffic management.

The leading players operating globally have consolidated the air traffic management industry. To improve their product offerings, the key vendors continually concentrate on new technology developments in air traffic management.

| Companies/ Start-ups | Details |

|---|---|

| TrafficButter | TrafficButter is a Nigerian-based start-up company that helps to reduce traffic congestion. Several cities and countries face traffic jams; hence, the start-up focuses on traffic management solutions with a real-time traffic information system. |

| Nedap | Nedap is a Dutch-based company that provides smart parking solutions for vehicles in the city. It includes an automatic vehicle identification solution with IoT sensors which helps to monitor vacant parking spaces. They utilize RFID sensors and ANPR sensors to recognize the vehicle and pay parking fees automatically. |

| Thales Group | They are a French multinational company that designs, develops, and manufactures electrical systems, devices, and equipment for the aerospace, defense, transportation, and security sectors. |

| FREQUENTIS AG | They are an Austrian high-tech company that develops communication and information systems in air traffic management and public safety & transport. |

| Indra Sistemas | They are a Spanish information technology and defense systems company. They are a world leader in providing proprietary solutions in Transport, Air Traffic, and Defense markets. |

Other Key Participants in the Air Traffic Management Market :

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Component, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; The Middle East and Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | FREQUENTIS AG; Thales Group; Indra Sistemas; Lockheed Martin; Harris Corporation; Presagis; M3 Systems; Saab; Croatia Control; AvitechGmbh |

| Customization | Available Upon Request |

The global air traffic management market is estimated to be valued at USD 19.4 million in 2025.

The market size for the air traffic management market is projected to reach USD 30.6 million by 2035.

The air traffic management market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in air traffic management market are software platform and support services.

In terms of application, communication & navigation management segment to command 40.0% share in the air traffic management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA