Air Pollution Control Systems Market Share Analysis Outlook 2035

This air pollution control systems market is expected to see an increase of 7.8% with the industry valuation at approximately USD 207.6 billion by 2035. Heavy environmental regulations, strict standards of emission, and heightened awareness about the quality of air are some reasons behind industries adopting high-end technologies related to air pollution control.

There are strict restrictions to limit their dangerous emissions of air pollutants imposed by environmental conditions, on industries dealing with the production of electricity and cement manufacturing along with processing industries of iron and steel. As electrostatic precipitators, scrubbers, and catalytic converters increasingly enter into practical uses, these pollutant's PM, VOC, and Green House Gases have been cut back. This sets the scene of more rigid rules of emissions of governments along with agencies of pollution control. Like the US's Environmental Protection Agency and Europe's European Environment Agency.

| Attribute |

Details |

| Projected Value by 2035 |

USD 207.6 billion |

| CAGR (2025 to 2035) |

7.8% |

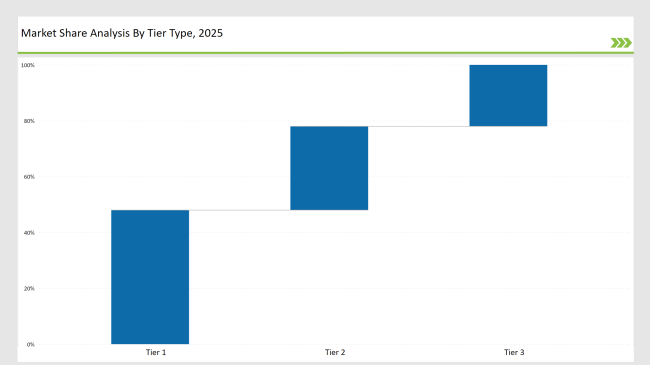

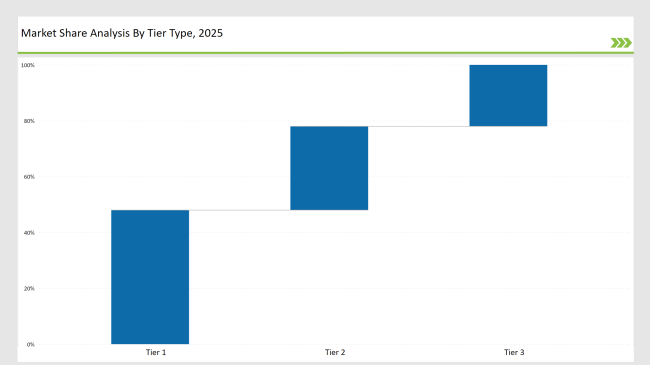

The market is still moderately consolidated, where Tier 1 players (Thermax Limited, AAF International, and Babcock & Wilcox Enterprises) hold 48% of the market share. By Product, scrubbers dominate, with 38% share of the market and by application, the power generation sector is the largest to account for 42% of market demand, which is highly dependent on pollution control technologies.

Explore FMI!

Book a free demo

Industry Landscape

| Category |

Industry Share (%) |

| Top 3 Players (Thermax Limited, AAF International, and Babcock & Wilcox Enterprises) |

32% |

| Next 2 of 5 Players (CECO Environmental, Donaldson Company Inc.) |

38% |

| Rest of the Top 10 |

30% |

The market is fairly consolidated, with leading firms investing in AI-powered pollution monitoring, hybrid filtration systems, and next-generation emission control solutions.

Segmental Analysis

By Product

- Scrubbers (38% Market Share): Scrubbers remain the dominant emissions control technology, mainly because of their high efficiency in removing sulfur dioxide (SO₂), acidic gases, and particulate matter from industrial exhausts. They are much used in power plants, cement factories, and chemical industries. Thermax Limited and Babcock & Wilcox Enterprises are leaders in wet and dry scrubber technologies.

- Electrostatic Precipitators his technology is preferred for fine particulate matter (PM) removal from exhaust gases.

- These are mainly used in industries like iron & steel, cement, and thermal power plants for dust and ash collection. AAF International works with high-technology electrostatic precipitators, with real-time emissions monitoring:

- Catalytic Converters: Catalytic converters are most popular and effective in reducing levels of NOx and hydrocarbons for the automotive, power generation, and larger industrial applications. Donaldson Company Inc provides high-performance industrial catalytic converters for emission-intensive applications.

- Thermal Oxidizers: Used more often in control of emission from VOCs and HAP. High-quality, efficient regenerative RTOs, such as CECO Environmental offers for chemical and petroleum refining plant industries.

- Others: Hybrid filtration systems with carbon adsorption systems or even plasma-assisted air purification systems

By Application

- Power Generation (42% Market Share): The power plants consume the maximum number of air pollution control systems as these are major emitters of SO₂, NOx, and particulate matter. All governments of the world are imposing carbon capture, flue gas desulfurization (FGD), and nitrogen oxide reduction technologies. The market leader in this segment is Babcock & Wilcox Enterprises with integrated emission control solutions.

- Iron & Steel The steel mills generate a lot of dust, fumes, and toxic gas emission requiring electrostatic precipitators, scrubbers, and baghouse filters. Thermax Limited and AAF International deliver specific pollution control solutions for the steel plants.

- Cement production requires emitting vast quantities of CO₂ and dust particles to need more advanced filtration and gas scrubbing techniques. CECO Environmental and Donaldson Company Inc. are specialized in cement plant emission control systems.

- Chemical: In chemical processing, the hazardous air pollutants are controlled with thermal oxidizers, catalytic converters, and hybrid filtration. AAF International is a market leader in VOC and gas phase filtration technologies for the chemical industry.

- Others: Pharmaceuticals, food processing, and waste-to-energy plants fall under the category of others, which require special air pollution control solutions.

Who Shaped the Year?

Several key players contributed to market advancements in 2024

- Thermax Limited launched next-generation wet scrubbers with real-time monitoring and automated efficiency controls.

- AAF International expanded its high-efficiency electrostatic precipitators for iron & steel and cement industries.

- Babcock & Wilcox Enterprises introduced hybrid air filtration systems, integrating scrubbers and catalytic oxidation for power plants.

- CECO Environmental developed low-energy regenerative thermal oxidizers for petroleum refineries and chemical industries.

- Donaldson Company Inc. strengthened its industrial catalytic converter portfolio, focusing on low-emission power generation systems.

Key Highlights from the Forecast

- Scrubbers Dominate the Market: These systems hold 38% of total demand, driven by strict SO₂ emission regulations in power plants and heavy industries.

- Power Generation Leads in Application: This segment holds 42% of the market, with utilities prioritizing flue gas treatment and carbon capture technologies.

- AI-Driven Air Pollution Control: Smart monitoring systems with real-time data analytics and predictive maintenance are transforming the industry.

- Adoption of Low-Emission Technologies: Governments are enforcing stricter NOx and CO₂ reduction policies, driving demand for next-gen pollution control systems.

Tier-Wise Industry Classification

| Tier |

Examples |

| Tier 1 |

Thermax Limited, AAF International, Babcock & Wilcox Enterprises |

| Tier 2 |

CECO Environmental, Donaldson Company Inc. |

| Tier 3 |

Regional and niche players |

Market KPIs

- Stricter Emission Norms: Companies need to adapt to changing international and domestic pollution management standards.

- Integration of IoT & AI: Smart monitoring helps monitor efficiency in real-time and allows for predictive maintenance.

- Carbon Capture & Storage (CCS) Adoption: Developing CCS technologies lower CO₂ emissions from large industrial plants.

- Hybrid Pollution Control Systems: Companies are investing in multi-functional air filtration technologies to achieve higher efficiency.

Key Company Initiatives

| Company |

Initiative |

| Thermax Limited |

Released automated wet scrubbers that feature real-time advanced emission tracking. |

| AAF International |

Introduced high-performance electrostatic precipitators for industrial use. |

| Babcock & Wilcox Enterprises |

Designed hybrid air filtration systems that combine scrubbers and catalytic oxidation. |

| CECO Environmental |

Enhanced low-energy thermal oxidizer solutions for chemical and refinery industries. |

| Donaldson Company Inc. |

Improved catalytic converter solutions for low-emission power plants. |

Recommendations for Suppliers

- Invest in Smart Pollution Monitoring: AI-powered real-time air quality tracking will become the new standard of the industry.

- Expand Carbon Capture Technologies: CCS solutions will become mainstream due to international carbon reduction requirements.

- Enhance Multi-Stage Filtration Systems: Hybrid pollutant control technology has more efficiency.

- Target Stricter Regulatory Markets: There is high demand from the industries of Europe, North America, and Asia-Pacific.

Future Roadmap

By 2035, air pollution control systems will be quite different, integrated with smarter AI-driven technologies and increased energy efficiency. Industrial emissions management will become more automated and will use AI and machine learning algorithms to optimize the processes in pollution control.

The systems will continuously monitor the quality of the air in real time, adapt controls based on environmental data, and predict spikes in emissions ahead of time so that proactive measures can be taken instead of a reactive response.

There will be advanced material and design concepts driven by the search for energy efficiency while preserving high performance. Smart technologies will integrate with other industrial processes, thus improving overall operational efficiencies and sustainability.

The impacts of this could help industries meet upgraded regulations regarding environment, diminishing carbon footprints and combating climate change. It will result in cleaner, more sustainable operations in the industrial sector.

Frequently Asked Questions

Which Companies hold significant share in the Air Pollution Control Systems Market?

Thermax Limited, AAF International, Babcock & Wilcox Enterprises command about 35% share in the overall market.

Which is the leading product segment in Air Pollution Control Systems Market?

Scrubbers have a market share of 38% of the overall market.

How much share does regional and domestic companies hold in the market?

Regional and domestic companies hold nearly 35% of the overall market.

How is the market concentration assessed in the Air Pollution Control Systems Market?

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

By application which type offers significant growth potential to market players?

Power generation hold the biggest 42% offering significant growth potential to the market.