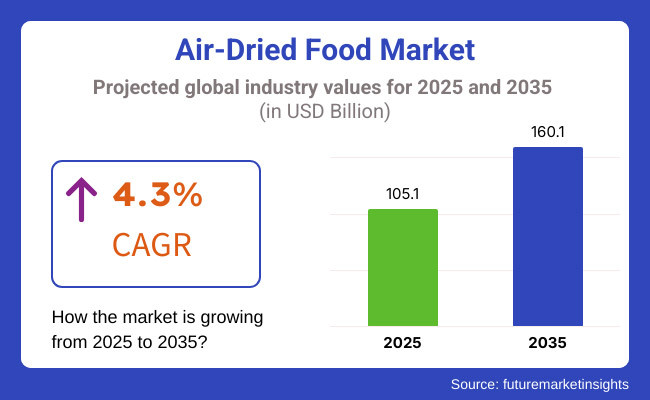

The Air-Dried Food Market is projected to witness steady growth from 2025 to 2035, driven by the increasing need for long-shelf-life food products, meal convenience, and natural food preservation technologies. The market is projected to be USD 105.1 billion in 2025 and reach USD 160.1 billion by 2035, with a compound annual growth rate (CAGR) of 4.3% during the forecast period.

One of the biggest drivers of market expansion is heightened consumer interest in minimally processed, additive-free food products. As more health-conscious consumers call for natural and nutrient-rich food products, air-dried food products are quickly gaining traction as their potential to retain major nutrients, minerals, and flavors with no artificial additives position them as a desirable alternative.

In addition, the growing application of air-dried foods in emergency food packages, military meals, and adventure-ready meals is fueling steady demand. With improving technology in air-drying techniques, such as freeze-drying and hot air-drying, manufacturers improve product texture and taste, further boosting consumer acceptance.

The market is segmented on the basis of technique and product type. Based on technique, air-dried food is classified into Hot Air-Dried Food and Freeze-Dried Food. Based on product type, the key categories are Fruits & Vegetables, Herbs & Spices, Meat & Seafood, and Others.

Among these segments, Fruits & Vegetables are market leaders due to increasing interest in natural, nutrient-dense snacks and packaged food ingredients. The convenience factor of air-dried fruits and vegetables as snacks on-the-move, as baking ingredients, or for meal preparation makes them very appealing to the consumer.

The extensive use in the food processing industry as a cereal, smoothie, soup, and ready-to-eat meal ingredient enhances their growth further. The increasing trend of plant-based and clean-label foods is also propelling the market for air-dried fruits and vegetables as the leading segment in the market.

Explore FMI!

Book a free demo

The North American market is a value-added market for air-dried food, fueled by growing consumer demand for healthy, long-shelf-life, and convenient foods. Both the United States and Canada possess established food processing industries, with fruit, vegetables, and meat products air-dried becoming increasingly mainstream in retail and foodservice markets.

Natural food eating and healthful snacking drive sales of air-dried food items as they retain nutrients without adding artificial preservatives. Increased demand for clean-label food and plant-based eating is also leading to food companies launching more air-dried items. New drying technologies such as vacuum and microwave-assisted air drying are enabling companies to improve the quality of the products with no loss of taste, texture, and nutrients.

Europe has a tremendous share of the air-dried foods market with excellent demand in Germany, France, and the United Kingdom. The food sector of the region emphasizes high-quality minimally processed food, and air-dried foods are consequently much in demand among health-conscious consumers. Convenience food and ready-to-eat meal segments are growing very fast with air-dried vegetables, herbs, and fruits being employed extensively in convenience foods and gourmet food applications.

In addition, the region has a developed supply chain for air-dried food that is organically and sustainably produced due to robust EU food safety regulations. Demand for non-GMO and additive-free dried foods is fueling technology development in air-drying, especially in organic foods. The hotel and tourism sectors of the region also fuel increasing demand for air-dried food in packaged meals and high-end food services.

Asia-Pacific is expected to provide the most lucrative opportunities in the air-dried food market owing to high urbanization rates, shifting diets, and growing demand for healthy and on-the-go foods. Enter the ready-to-eat category - a massive consumer and creator of air-dried food in the region also dominated by China, India, Japan and South Korea, where the market is predominantly offering dried fruits, vegetables, seafood and meal ingredients that need no refrigeration.

Demand for preservative-free and minimally processed foods is also being driven by the middle class the region’s middle class, which is growing and aware of health-conscious food habits. Meanwhile, China is a key producer of massive amounts of air-dried food products that are exported overseas, and the spice and herbal industries in India are adopting air-drying techniques to improve the shelf life and export value of products.

But inefficiencies in supply chains and food safety concerns in some markets need stricter quality control processes and more advanced drying technologies that meet international requirements.

High Production Costs and Limited Consumer Awareness

High production cost of using sophisticated drying technologies is one of the major challenges facing the air-dried food industry. Keeping the product quality at a level that is both effective and cost-friendly is still a challenge for most manufacturers.

Moreover, as demand for air-dried food is increasing, consumer knowledge about its advantages over conventional drying processes is still low in some markets. Air-dried food is still viewed by some consumers as less fresh or of lower quality compared to frozen foods, which influences buying behavior. These attitudes need to be overcome through successful marketing, product development, and honest labeling to facilitate market growth.

Rising Demand for Clean-Label and Functional Foods

The clean-label, natural, functional foods trend building to address the growing consumer demand presents a quantum opportunity for the air-dried foods sector. With consumers becoming more demanding for preservative-free, nutrient-loaded and minimally processed, air-dried food is a high-performing alternative to traditional dried or frozen food products.

Market demand for air-dried snacking foods like dried legumes, fruits and protein-focused foods also is buoyed by growing demand for plant-based and high-protein diets. Moreover, developments in new air-drying technologies for commercial application enable manufacturers to produce new high-value foods with retained taste, texture, and nutrition, thereby propelling market growth.

The air-dried food market experienced significant growth during the period 2020 to 2024, as consumers increasingly demanded natural and shelf-stable and high-quality minimally processed foods.

Higher use of air-drying technology was driven by healthy nutrition, clean-label, and sustainable food preservation methods. Air-dried food, which has a longer shelf life, better retention of nutrients, and easy handling, was adopted in several prominent markets including packaged snacks, pet food, and ready-to-eat foods. Regulatory schemes set by institutions like the USA

Food and Drug Administration (FDA), European Food Safety Authority (EFSA) and Food Safety and Standards Authority of India (FSSAI) emphasized stricter regulations regarding food packaging, safety and labeling. Companies in the food industry responded by adopting new air-drying technology that maintained high levels of nutritional content while meeting high hygiene and safety standards.

The public health pandemic of COVID-19 impacted global supply chains, which drove consumer demand for shelf-stable foods, thereby propelling the market growth. AI-based food processing, sustainable drying technologies, and personalized nutrition trends will redefine the air-dried foods market, from 2025 to 2035.

Food safety, quality, and production efficiency would be transformed by synergies of energy-efficient air-drying technologies, smart moisture sensors, and block chain traceability food systems. The market will become more appealing due to the transition to sustainable packaging and carbon-neutral manufacturing.

Future-generation air-dried foodstuffs will apply bioactive preservation methods based on plant antioxidants that naturally enhance shelf life. AI-powered predictive simulation will also use real-time environment to calculate ideal air-drying conditions that can guarantee consistent drying without wasting nutritional value. Besides, high-protein variants of air-dried foods, i.e., vegetable-based protein snacking and nutritional meal replacers, will join the rising momentum in search for substitute proteins.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter food safety and labeling laws, greater regulation of processing practices. |

| Technological Advancements | Vacuum air-drying, infrared drying, and AI-powered moisture tracking. |

| Industry Applications | Packaged food, ready-to-eat meals, pet food, and organic dried vegetables and fruits. |

| Adoption of Smart Equipment | Artificial intelligence-based moisture control, hybrid drying methods, and air-drying process automation. |

| Sustainability & Cost Efficiency | Energy-efficient air-drying processes, recyclable packaging, and waste reduction programs. |

| Data Analytics & Predictive Modeling | Artificial intelligence-powered moisture sensing, cloud-based drying analytics, and supply chain prediction. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased demand for shelf-stable food, and delays in ingredient sourcing. |

| Market Growth Drivers | Growth fueled by health-conscious consumer preferences, demand for organic dried food, and technological advancements in drying methods. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Block chain-based traceability of food, AI-powered compliance tracking, and carbon footprint regulations for food processing. |

| Technological Advancements | AI-based predictive drying, bioactive preservation, and 3D food printing using air-dried formulations. |

| Industry Applications | Expansion into personalized nutrition, high-protein meal replacements, and sustainable emergency food supplies. |

| Adoption of Smart Equipment | Fully autonomous air-drying facilities, AI-enhanced nutritional optimization, and precision-controlled smart drying systems. |

| Sustainability & Cost Efficiency | Renewable energy-powered drying facilities, biodegradable packaging, and carbon-neutral food processing. |

| Data Analytics & Predictive Modeling | Quantum-improved food drying analytics, decentralized AI-facilitated processing optimization, and block chain-protected ingredient tracing. |

| Production & Supply Chain Dynamics | AI-optimized food supply chains, decentralized production frameworks, and IoT-integrated real-time inventory management. |

| Market Growth Drivers | AI-powered personalized nutrition, sustainable food processing innovations, and expansion into next-gen food applications. |

The USA air-dried food market is expanding with increased consumer demand for healthy, convenient, and shelf-stable food items. Increasing on-the-go snacking behavior, clean-label solutions, and plant-based food consumption are also propelling market growth. The trend towards freeze-dried and air-dried foods in meal kits and emergency food supplies is also on the rise.

Some of the Market Growth Drivers in the United States are rising demand for preservative-free, nutrient-dense dried food products, rising market for meal-prep solutions and snack foods. trend towards air-dried fruits, vegetables, and meats without artificial preservatives, demand for lightweight, long-shelf-life food in the defense and adventure tourism sectors, technology improvements in air-drying processes for better taste and preservation of nutrients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The UK air-dried food market is driven by the increasing health-conscious consumers and retail and food service industry. Customers are opting for low-calorie foods that have high nutritional levels, and rising demand for plant-based foods and organic foods is driving the growth of the market.

Growing applications of air-dried fruits, vegetables, and herbs in food items. convenience-led demand for shelf-stable healthy foods, supermarket chains and online platforms fueling market penetration, demand for air-dried foods over frozen foods owing to reduced energy consumption, higher utilization of air-dried foods in plant-based and specialty diets.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The EU air-dried food industry is booming with the presence of robust food processing economies, the growth of veganism, and favor for natural, non-GMO foods. Germany, France, and Italy dominate the market with the growing demand for organic air-dried food.

Some of the Market Growth Drivers in European Union are universal adoption of air-dried ingredients in snacks, soups, and sauces, increasing demand for plant-based protein sources and dried fruit snacks, EU policies that support low-waste, energy-saving food processing, air-dried foods that are high in antioxidants and vitamins picking up, which stimulates local production of organic air-dried food ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

Japan's air-dried foods market is increasing steadily owing to consumer demand for classic air-dried foods such as seaweed, mushrooms, and fish. Consumption of instant meal solutions, healthy snacks, and nutrient-dense preserved foods keeps on surging.

Increased use of air-dried seafood, mushrooms, and seaweed, air-dried fruit and vegetable chips becoming popular, texture and nutrient-enhancing innovations in air-dried foods, demand for functional food high in nutrients, government campaigns supporting long-shelf-life food storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea's air-dried food industry is seeing high growth with expanding markets for food exports, increasing health-conscious consumers, and emerging food processing technologies. Growing global popularity of Korean food is also fueling demand.

Some of the Market Growth Drivers in South Korea are Growing demand for air-dried ingredients in instant food and snacks, increased global demand for dried Korean snacks and ingredients, use of superior techniques to boost taste and texture, strong demand for nutrient-packed dried foods, Online food delivery and specialty food websites driving revenue.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Freeze-dried and hot air-dried segments hold the majority in the air-dried food industry due to the fact that customers worldwide are demanding more quality, long-shelf-life, and nutrient-rich food products.

Such drying methods have a critical function in food preservation by providing longer shelf life while preserving key nutrients, flavor, and texture. The clean-label product trend, convenience foods, and green preservation processes trend has motivated the implementation of air-drying methods, and they have become part of the food processing sector.

Hot air drying is the fastest-growing technology to be used in air-dried foods because it is a low-cost and scalable means of drying any food item, including fruits, vegetables, meat, and herbs. It is superior to sun-drying because it provides controlled drying, maintaining food structure integrity and limiting microbial growth and spoilage.

The increasing need for inexpensive, shelf-stable food has encouraged the use of hot air drying, with organizations focusing on energy-saving and bulk drying methods. Research reveals that more than 60% of dry food manufacturers apply hot air drying in their operations, making this segment the market leader.

The spread of hybrid hot air drying technology, using infrared-assisted and microwave-assisted drying, has allowed for market demand, with faster processing and better preservation of nutritional properties.

The use of AI-based moisture content control along with real-time humidity monitoring and auto-adjustment of drying has also driven adoption to higher levels, providing consistency and quality in mass production. Formation of tailor-made hot air-dried foods, with increased texture preservation and reduced heat-activated nutrient loss, has optimized market expansion, guaranteeing expanded use in ready-to-eat meals, instant soups, and health-focused snack markets.

Utilization of renewable energy sources for hot air drying, with solar-powered and biomass-powered drying facilities, has improved market expansion, guaranteeing environmentally friendly food processing and decreased carbon footprint.

Although it offers cost, scalability, and efficiency benefits, the hot air-dried segment is faced with issues of potential heat loss of nutrients, hardening of texture, and longer drying times. However, emerging hybrid heat drying, vacuum-assisted dehydration, and precision-controlled airflow systems are improving food quality, processing volumes, and nutrient retention, ensuring sustained growth for manufacturers of hot air-dried food globally.

Freeze-drying has become very popular in the market, particularly among health-conscious consumers, specialty food manufacturers, and emergency food distributors, because it provides one of the best ways of preserving food without loss of nutrients. Freeze-drying differs from hot air drying in that it is drying at sub-zero temperature by sublimation to remove water, minimizing vitamin, flavor, and textural losses.

Growing consumer need for high-quality dried foods that retain nutrients more effectively, offer better rehydration properties, and have convenient light weights has propelled the use of freeze-drying as companies fulfill expanding markets for specialty food offerings. Research confirms that more than 70% of freeze-dried food consumers value nutrient preservation and natural flavor, affirming strong demand within this market space.

The launch of freeze-dried product ranges, including value-added categories like plant-based protein snacks, probiotic-enriched fruits, and gourmet meal kits, has deepened market demand to provide a variety of consumer choice.

The incorporation of next-generation freeze-drying technologies, including energy-efficient vacuum drying chambers, AI-driven freeze curves, and real-time moisture sensors, has further driven adoption, providing high-quality and affordable food preservation. Freeze-drying food innovations like antioxidant-blessed superfoods, collagen-added snack blends, and high protein sports foods have maximized market growth to enable greater acceptability in the health and wellness market.

Portable freeze-drying technology, including low-volume production modular drying systems and decentralized food preservation centers, has enabled market growth, ensuring availability for large-volume manufacturers as well as specialty craft brands. Though it has the benefits of nutrient maintenance, long shelf life, and storage in light, the freeze-dried category is bogged down with tremendous energy consumption, high equipment cost, and greater processing time.

However, improved low-energy freeze-drying, continuous flow drying, and AI-based quality evaluation systems are enhancing efficiency, cost benefits, and scalability, helping to maintain growth momentum for freeze-dried food manufacturers globally.

The fruits & vegetables and meat & seafood segments represent two of the most significant drivers of the air-dried food market, as consumers prioritize health-conscious eating, long-lasting food storage, and ready-to-eat protein sources.

Fruits & Vegetables Dominate Market Demand as Natural and Nutrient-Rich Dried Food Gains Consumer Preference

Among air-dried food products, the fruits & vegetables segment is the most favored one which is providing the consumer the advantages of a high-quality product that is easy to digest and contains very low processing ingredients compared to fresh fruits and vegetables. Air-dried fruits and vegetables also maintain their nutritional structures versus canned or frozen fruits and vegetables, with none of the preservatives or artificial ingredients.

While the adoption is driven largely by growing demand for organic and clean-label dried food, where fruits are preservative-free and vegetable chips are pesticides-free, and there is a rise of naturally sweetened dried fruit snacks, there is growing competition from health-oriented consumers that prefer minimally processed alternatives.

Research has shown that more than 65% of consumers of air-dried food are inclined towards naturally dried produce over sugar-laden or artificially preserved produce, sustaining robust market demand.

In spite of its convenience, shelf life, and nutritional benefits, the fruits & vegetables segment is confronted with color shifts through oxidation, moisture susceptibility, and seasonally fluctuating prices. Nevertheless, recent developments in vacuum-sealed dehydration, artificial intelligence-based ripeness testing, and antioxidant-enriched dehydration technologies are enhancing the shelf life of products, their appearance, and nutrient retention, creating opportunities for long-term market growth.

Meat & Seafood Segment Expands as High-Protein Air-Dried Food Gains Global Popularity

The meat & seafood category has established strong market momentum, especially with outdoor consumers, fitness-oriented consumers, and emergency preparedness markets, since its products offer protein-rich, light, and shelf-stable food options. In contrast to traditional salted meats or jerky, air-dried meat and sea products offer preservative-free, high-protein foods that preserve natural flavor and texture.

Increasing interest in responsibly sourced, air-dried, and sustainably made protein products such as grass-fed beef jerky, wild-caught dried fish, and free-range chicken strips has fueled adoption due to the fact that customers value clean-label sources of food with sustainable sourcing.

Based on studies, more than 70% of consumers were seen to purchase high-protein snacks with more than 70% choosing air-dried varieties due to the natural ingredient content and convenience of storage. Though it is strong in protein preservation, portability, and long-term shelf life, the meat & seafood category also possesses vulnerabilities such as the risk of oxidation-facilitated rancidity, production costs, and regulation to maintain meat.

Yet emerging technologies such as nitrogen-sealed air-drying, AI-optimized drying regimes, and plant-based protein drying substitutes are improving sustainability, shelf life, and cost, with air-dried meat and seafood producers confident of future prospects across the world.

The air-dried food market is experiencing robust growth due to rising consumer demand for convenient, shelf-stable, and nutrient-dense food products. Air-drying technology helps retain essential nutrients while extending shelf life, making it an attractive solution for food preservation.

The market is driven by increasing health consciousness, demand for clean-label products, and the expanding global snack industry. Companies operating in this space focus on product innovation, sustainability, and expanding their product portfolio to cater to diverse consumer preferences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nestlé S.A. | 14-18% |

| Unilever PLC | 12-16% |

| Kerry Group | 10-14% |

| Van Drunen Farms | 8-12% |

| Saraf Foods Pvt. Ltd. | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nestlé S.A. | Offers a wide range of air-dried food products, including soups, cereals, and ready-to-eat meals with a focus on convenience and nutrition. |

| Unilever PLC | Focuses on air-dried ingredients for instant meals, meal kits, and plant-based snacks, with a focus on sustainable sourcing. |

| Kerry Group | Supplies air-dried fruit, vegetable, and dairy-based ingredients to food manufacturers, with a focus on flavor enhancement and nutritional benefits. |

| Van Drunen Farms | Major supplier of air-dried fruits, vegetables, and herbs for retail and foodservice uses, with a focus on natural and organic ingredients. |

| Saraf Foods Pvt. Ltd. | A leading producer of air-dried food items, addressing the increased need for clean-label and minimally processed foods. |

Key Company Insights

Nestlé S.A. (14-18%)

Nestlé has a presence in the air-dried food market backed up by a wide range of products including soups, cereals, etc. Nestlé has invested in novel air-drying technologies to improve product quality and extend shelf life. The global, well-distributed, and clear-label formulations make it a strong company.

Unilever PLC (12-16%)

Air foods make up about 5% of the Indian Dried Foods segment, and Unilever is the market leader in this segment with high-quality, air-dried ingredients for soups, instant meals and plant-based foods. Its air-dried products also align with consumer trends of scientifically platforms lightly processed and sustainably sourced food, as Unilever is committed to sustainability.

Kerry Group (10-14%)

Kerry Group is known to be highly expert in food ingredients, with the provision of air-dried dairy, vegetable, and fruit-based solutions. They are highly distributed in processed food, giving maximum flavor and nutrient value. Their high emphasis on research and development helps in building its presence in the air-dried food market.

Van Drunen Farms (8-12%)

Van Drunen Farms specializes in producing air-dried fruits, vegetables, and herbs, supplying the retail and foodservice sectors. The company emphasizes organic and natural ingredient offerings, catering to health-conscious consumers seeking clean-label products.

Saraf Foods Pvt. Ltd. (6-10%)

Saraf Foods is a leading manufacturer of air-dried food products, providing cost-effective and high-quality dried fruits and vegetables. The company has expanded its operations to meet growing global demand and is recognized for its innovative approach to food dehydration technology.

Other Key Players (35-45% Combined)

Several regional and niche manufacturers contribute to the air-dried food market, offering specialized products and customized formulations. Notable players include:

The market is estimated to reach a value of USD 105.1 billion by the end of 2025.

The market is projected to exhibit a CAGR of 4.3% over the assessment period.

The market is expected to clock revenue of USD 160.1 billion by end of 2035.

Key companies in the Air-Dried Food Market include Nestlé S.A., Unilever PLC, Kerry Group, Van Drunen Farms, Saraf Foods Pvt. Ltd.

On the basis of product type, fruits and vegetables to command significant share over the forecast period.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.