The air compressing filter and compressing air drying system market is set for moderately healthy growth from 2025 to 2035, primarily driven by the evolution of industrial automation, heightened thirst for energy-efficient compression systems, and stringent air quality regulations. They ensure air remains clean, operations are efficient and industry compliance standards are maintained.

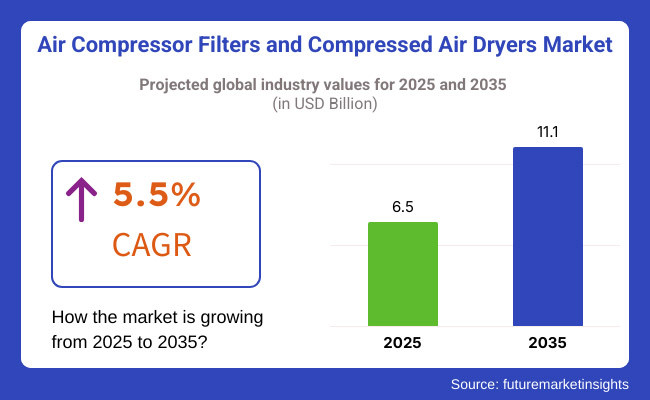

The market is expected to cross a valuation of around USD 11.1 Billion by 2035, at a 5.5% CAGR during the forecast period. Technological innovations like the implementation of smart monitoring systems and green filtration solutions are anticipated to propel adoption across all sectors, including manufacturing, food & beverage, healthcare and electronics.

According to the reports, there will be a boom in the air compressor filters and compressed air dryers market due to stricter industry regulations, the demand for increased air quality, and the increased usage of energy-efficient compressed air consumers.

Explore FMI!

Book a free demo

North America holds the largest market for the industry due to its advanced category of industrial sector, stringent air quality norms and prompt acceptance of advanced filtration and drying technology. The MEA region's emphasis on energy-efficient manufacturing processes bodes well for high-performance air compressor filters and dryers. Health care, food processing and electronics are also required to use high quality compressed air solutions to meet the stringent regulatory standards, further supporting the market growth.

Stricter environmental regulations are expected to drive the growth of these companies across England and Europe alongside increasing automation in the pharmaceutical, automotive, food processing, among others. Growing emphasis on carbon emissions reduction and energy efficiency in the region further propels market expansion. Demand for specific air compressor filtering and drying solutions is expected to increase in the region parce there are established manufacturing pockets in the region with government promoting sustainable industrial solutions.

Owing to rapid industrialization, increasing manufacturing activities, and growing investments in clean energy solutions, the Asia-Pacific region is projected to register the highest growth rate during the forecast period. Data for Date: Industrial Application: The countries such as China, India, and Japan are driving the growth for air purification systems for industrial applications. Faster deployment of high-efficiency air filtration and drying solutions than the previous one will be driven by growing environmental concerns and the increase of automotive, electronics and semiconductor industries in the region.

Challenges

High Costs and Logistical Complexities

Air Compressor Filters & Compressed Air Dryers Market Dynamics: The Air Compressor Filters & Compressed Air Dryers system, although beneficial, faces a few challenges relating to the high cost of the Air Compressor Filters & Compressed Air Dryers, complexity of the logistics, difference in regulations in various regions and the coverage area among others. Compliance with industry safety standards, energy efficiency regulations, and distribution complexities can also create hurdles for manufacturers and suppliers in market expansion.

Maintenance and Operational Challenges

Air compressor filters & compressed air dryers need regular maintenance and periodic replacement. Industries that depend on air systems are faced with the challenges of high maintenance costs and the risks of downtimes.

Opportunities

Growth in Industrial Automation and Manufacturing

Market Definition: The market for market has favourable prospects as industrial automation demand and manufacturing expansion continues to grow. Also, industries like food & beverage, pharmaceuticals, electronics require quality compressed air which, in turn, fuels the demand for high-performance filtration and drying solutions.

Increase in Energy-Efficient and Eco-Friendly Solutions

The increasing focus on energy efficiency and environmental sustainability is driving the development of energy-efficient air compressor filters and dryers. Our focus will be on solutions that are energy efficient, low maintenance & High Performance whatever that shall result.

The Air Compressor Filters and Compressed Air Dryers Market offered a healthy growth between 2020 and 2024, owing to the rapid industrialization, stringent air quality regulations, and advances in compressed air treatment technologies. High-performance air filtration and drying solutions were increasingly used by manufacturing, pharmaceuticals, food & beverage and other industries in the need for operational and regulatory compliance in 2023.

The growing demand was due to the development of industrial operations in territories North America, Europe, and Asia-Pacific. Yet, high operational and maintenance costs, low awareness of energy-efficient technologies, and supply chain disruptions hampered market growth. To facilitate response, businesses released lean, cost-effective maintenance programs, remote monitoring systems, and advanced filtration technologies to optimize performance further and reduce costs.

Market stakeholders must also focus their energies on building products, better technology, and sustainable systems in their market lives in 2025 to 2035 Air Quality Monitoring System, focusing on some emerging trends such as IoT-enabled air quality monitoring solutions, advanced filtration products, AI-based air quality prediction systems and advanced systems for predictive maintenance. Industry standards will be redefined with the advent of various innovations such as self-cleaning filters, smart moisture detection systems, and highly energy-efficient compressed air treatment solutions.

And, with the implementation of automated solutions, digital transformation, and the need for sustainable manufacturing practices, the future market will be demand-driven. Companies that focus on smart technologies, eco-friendly filtration solutions, and high-efficiency compressed air systems will gain competitive advantage, fuelling the evolution of Air Compressor Filters and Compressed Air Dryers Market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety regulations and industrial air quality standards |

| Industrial Growth | Manufacturing, food & beverage, and pharmaceutical industries grow |

| Industry Adoption | Rising requirement for high-efficiency air filtration and drying solutions |

| Supply Chain and Sourcing | Reliance on legacy material providers and standard filtration technology |

| Market Competition | Established industrial equipment manufacturers and filtration solution providers |

| Market Growth Drivers | A pressure for high quality compressed air, cost-cutting measures and efficiency in operation |

| Sustainability and Energy Efficiency | Focus initially on energy-efficient compressed air dryers and high-performing filters |

| Integration of Digital Planning | Minimal application of smart monitoring and remote diagnostics |

| Advancements in Filtration Technology | Conventional filter media and moisture management methods |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined global regulations, AI-assisted compliance monitoring, and enhanced energy efficiency mandates |

| Industrial Growth | Expansion into renewable energy sectors, automated industrial plants, and smart manufacturing |

| Industry Adoption | Rise of IoT-enabled monitoring, AI-driven predictive maintenance, and self-regulating filtration systems |

| Supply Chain and Sourcing | Shift toward sustainable materials, advanced filtration media, and localized production |

| Market Competition | Growth of innovative startups, AI-powered air quality management solutions, and automation-driven air treatment systems |

| Market Growth Drivers | Increased investment in AI-driven air purification, eco-friendly manufacturing, and digital transformation |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral air treatment systems, sustainable filtration solutions, and energy recovery initiatives |

| Integration of Digital Planning | Expansion of real-time performance analytics, AI-based filtration optimization, and predictive maintenance tools |

| Advancements in Filtration Technology | Evolution of self-cleaning filters, smart moisture detection systems, and next-gen air purification solutions |

The United States air compressor filters and compressed air dryers market is anticipated to observe stable growth in the coming years on the back of accelerating industrial automation, stringent air quality regulations, and growing manufacturing sectors across the various verticals that demand high-efficiency air filtration solutions. This predictability combined сovid-19 with China's push for energy efficiency has increased adoption of advanced filtration systems in the country.

Furthermore, the emerging food and beverage, pharmaceutical, and semiconductor industries require a more significant air quality standard, which aides in the market growth. Demand for air compressor filters and dryers is also being fueled by government programs that promote cleaner industrial processes and smart manufacturing solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

The growth of the UK market can be attributed to the surge in demand for energy-efficient compressed air systems, stringent environmental policies, and the evolution of filtration technology that facilitate industrial and health care applications. Increased adoption of green compressed air solutions due to the government focus on reducing carbon emissions. Gradually, the growing pharmaceutical and food processing industries demand high-quality compressed air in accordance with strict hygiene and safety regulations.

There has also been significant investment in smart air filtration and monitoring systems, driven by the increasing focus on predictive maintenance and the integration of these systems into Industry 4.0 As a result, they can provide real-time detection of deterioration at any point in the filtration process across a broad area.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

Demand for air compressor filters and dryers in Europe has witnessed a steady progression backed by the regional industry standards, growth of the food processing and pharmaceutical industries, and implementation of sustainable technologies. The EU specific measures relating to high level of energy efficiency and environmental protection are driving industries for investing in advanced filtration and drying systems.

The automotive, healthcare, and electronics sectors are significant growth drivers for the market as these industries require high-purity compressed air to carry out production activities. Additionally, the continuous investment in industrial automation and digitalization will drive the potential market for intelligent air filtration systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

Rapid industrialization in South Korea, increased focus of energy efficient air compression systems, technological advancements of smart filtration solutions serving high-tech manufacturing industries are expanding the South Korean market. A significant contributor to the demand for high-quality compressed air solutions is the presence of many semiconductor, automotive, and electronics industry across the country.

The development of smart factories as well as advanced manufacturing processes led by the government is additionally aiding market expansion. Moreover, the rising trend for oil-free compressors and HEPA filtration in essential industries such as pharmaceuticals and biotechnology is aiding the steady growth of the air compressor filters and dryers industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Air compressor filters and compressed air dryers market is growing steadily, fueled by increasing industrial demand, environmental concerns, and advancements in energy-efficient air purification technologies. The integration of smart filtration solutions and predictive maintenance systems is becoming a key trend across all major regions.

| Region | CAGR (2025 to 2035) |

|---|---|

| Global | 5.5% |

Based on Product Type, the Compressed Air Dryer segment holds the largest market share based on its significant requirement for moisture and contaminant-free air in industrial operations. They prevent corrosion and water vapor in compressed pneumatic systems, both of which are critical to the durability of these systems and their continued functionality. High-quality compressed air is vital to the safety of products in industries, like automotive, pharmaceuticals, and food & beverages, thus air dryers are a basic building block in any industrial setup.

Air drying solutions have come a long way because of technological advancements that have produced energy efficient, low-maintenance compressed air dryers. Advanced desiccant and refrigerated air dryers have enabled industries like power generation, electronics and chemicals to provide exact humidity levels while preventing contamination. When it was discovered that eco-friendly, energy-efficient dryers not only reduced environmental impact but also saved costs and aided in regulatory compliance, the demand grew.

Today, modern air dryers come with smart sensors and automation features for real-time monitoring and optimization of air quality and reduced energy usage. Also, sustainability measures make the implementation of advances zero-purge and heatless desiccant dryers a valuable solution to achieve operational efficiency while reducing carbon footprints. With industries expanding their production capabilities, the demand for high-performance compressed air dryers will continue to rise significantly, cementing their market dominance.

Due to the increasing need for clean and high-quality compressed air in several industrial fields, Air Compressor Filter segment is witnessing a considerable growth. They help in removing contaminants including dust, oil, and moisture which can significantly affect the functioning and life of the pneumatic devices. Notably, industries such as pharmaceuticals, food & beverages, electronics, and healthcare, there clean air is vital as it directly influences the quality and safety of the ultimate end product.

With the industries, seeking operations smoothness and adherence to the regulations, the global high-performance air compressor filter market is surging. Sectors such as oil & gas, power generation and metals & machinery are investing significantly toward Greenfield projects capable of providing advanced filtration technologies to meet stringent industry standards.

These solutions eliminate ultra-fine particles and volatile organic compounds, thus decreasing system downtime in addition to lowering maintenance expenses, which is further boosting market growth across the globe. Self-cleaning and nano-filtration technologies are also emerging, as its enhanced filtration efficiency and longer service life are in high demand. As various industries look for more sustainable and cost-saving solutions, the air compressor filter market will continue growing.

The air compressor filters and compressed air dryers market is experiencing steady growth due to rising demand for clean and moisture-free compressed air across industries such as manufacturing, healthcare, food & beverage, and automotive. The market is driven by stringent air quality regulations and the increasing adoption of energy-efficient air purification solutions.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Atlas Copco | 20-25% |

| Ingersoll Rand | 15-20% |

| Parker Hannifin Corporation | 12-16% |

| Sullair LLC | 8-12% |

| Gardner Denver | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Atlas Copco | High-performance air filters, refrigerated and desiccant air dryers, and energy-efficient filtration solutions. |

| Ingersoll Rand | Industrial air compressor filters, moisture separators, and heatless adsorption air dryers. |

| Parker Hannifin Corporation | Advanced compressed air purification systems, coalescing filters, and high-efficiency air dryers. |

| Sullair LLC | Oil-free and lubricated air filtration systems, refrigerated air dryers, and desiccant dryers. |

| Gardner Denver | Custom-engineered compressed air treatment solutions, regenerative air dryers, and high-efficiency filters. |

Key Market Insights

Atlas Copco (20-25%)

Atlas Copco is the market leader that offers highly efficient Air filtration and Drying products to deliver dry, clean compressed air for Industrial applications.

Ingersoll Rand (15-20%)

Ingersoll Rand is industrial air compressor filtration and moisture removal specialists providing energy efficient, dependable solutions.

Parker Hannifin Corporation (12-16%)

Parker offers advanced air purification technologies including HEPA filters and air drying systems.

Sullair LLC (8-12%)

Sullair provides a range of air treatment products, including oil-free air filtration systems and desiccant dryers for various industries.

Gardner Denver (5-9%)

As a specialty manufacturer, Gardner Denver provides precision-engineered solutions for total compressed air treatment with a focus on performance and reliability.

Other Key Players (30-40% Combined)

The market is evolving with innovations in energy-efficient filtration and smart air treatment systems, with contributions from multiple manufacturers and technology providers, including:

The market is expected to grow as industries increasingly focus on maintaining air purity, energy efficiency, and compliance with air quality standards.

The overall market size for Air Compressor Filters and Compressed Air Dryers market was USD 6.5 Billion in 2025.

The Air Compressor Filters and Compressed Air Dryers market is expected to reach USD 11.1 Billion in 2035.

The demand for the Air Compressor Filters and Compressed Air Dryers market will be driven by the rising need for moisture-free air in industrial applications, boosting the adoption of compressed air dryers. Additionally, air compressor filters will experience strong growth due to increasing emphasis on air purity and equipment protection, ensuring efficiency and longevity in various industries.

The top 5 countries which drives the development of Air Compressor Filters and Compressed Air Dryers market are USA, European Union, Japan, South Korea and UK.

Air Compressor Filters Drive Market Growth with Increased Focus on Air Purity and Equipment Protection demand supplier to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.