The air blade dryer market, valued at USD 1.76 billion in 2025, is projected to reach approximately USD 3.98 billion by 2035, growing at a compound annual growth rate (CAGR) of 8.5% over the forecast period. In 2024, the air blade dryer landscape saw sustained growth through rising adoption in commercial restrooms, airports, and healthcare.

Growth was driven by increased hygiene awareness, particularly due to concerns about airborne disease transmission, leading to greater adoption of touchless drying solutions.

Various companies replaced conventional paper towels with air blade dryers to promote sustainability and cost savings. Moreover, producers launched quieter and more energy-saving models with HEPA filtration capabilities, tackling both noise pollution and air quality issues.

The landscape for air blade dryers is led by the rising need for energy-saving hand-drying solutions, technological progress in sensors, and heightened hygiene consciousness in commercial environments. The global movement towards touch-free and eco-friendly drying solutions continues to drive growth across the world.

This significant growth is driven by ongoing technological advancements, enhanced hygiene regulations, and growing adoption of high-speed drying systems in public and private facilities.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.76 billion |

| Industry Size (2035F) | USD 3.98 billion |

| CAGR (2025 to 2035) | 8.5% |

Explore FMI!

Book a free demo

The Air Blade Dryer landscape is seeing robust expansion driven by demand for clean, green, and energy-saving hand-drying equipment in commercial, public, and institutional settings.

This growth trajectory is primarily driven by hygiene trends, technological advancements, and cost-efficiency factors. Companies and operations valuing touchless with high-speed drying solutions are rapidly buying these systems as a way of enhancing hygiene levels and minimizing long-term operational expenses.

On the other hand, conventional paper towel producers are experiencing diminishing sales as companies switch to air blade dryers. Companies investing in energy-efficient, low-noise technologies will lead the industry, particularly as smart cities and green buildings rapidly adopt sustainable hand-drying technology.

Invest in Intelligent, Sanitary, and Green Technology

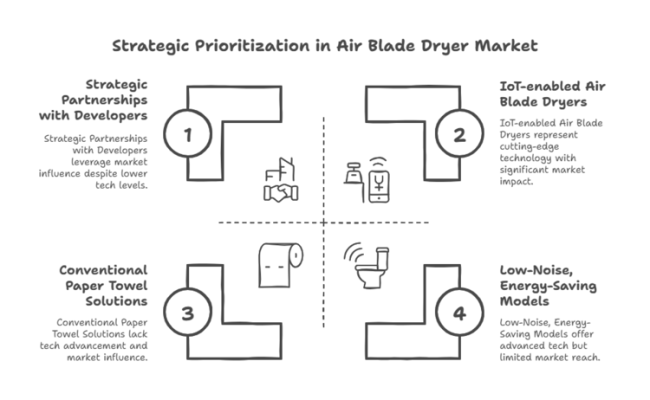

Executives must make IoT-enabled, touchless air blade dryers with HEPA filters and antimicrobial finishes a priority to address increased hygiene requirements and sustainability expectations. Low-noise, energy-saving models will pay dividends in terms of competitive positioning as companies look for environmentally friendly restroom solutions.

Align with Regulatory and Consumer Trends

Businesses need to keep ahead of regulatory requirements promoting low-carbon, waste-minimizing drying solutions while responding to growing consumer demand for intelligent, automated toilets. Collaborations with commercial real estate developers, airports, and hospitals will secure long-term segment congruence.

Increase Distribution and Strategic Partnerships

Strengthening B2B collaborations with facility management companies, hotel chains, and infrastructure developers will drive large-scale adoption. Investing in R&D for lower noise, quick-drying, and AI-based models and forging M&A options with new-tech industry players will additionally boost sector dominance.

| Risk | Probability & Impact |

|---|---|

| Regulatory Changes & Compliance - Stricter environmental laws or hygiene mandates may require costly product modifications. | Medium Probability, High Impact |

| Supply Chain Disruptions - Raw material shortages or logistical delays could impact production and delivery timelines. | High Probability, High Impact |

| Technological Disruption - Emerging drying technologies or alternative solutions may reduce demand for air blade dryers. | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Product Innovation | Invest in IoT-enabled, antimicrobial, and energy-efficient air blade dryers to stay ahead of competitors. |

| Regulatory Compliance | Monitor emerging environmental and hygiene regulations and adjust product designs accordingly. |

| Strategic Partnerships | Strengthen OEM collaborations and distributor networks to expand industry reach and adoption. |

To sustain momentum, companies need to accelerate investments in smart, hygienic, and energy-efficient air-blade dryers that not only meet emerging anti-viral and safety and health regulatory standards but also the sustainability trends capturing global attention. Further developing OEM partnerships and distribution channels with more reach and penetration in the segment will be guaranteed.

This is especially true in rapidly expanding industries like hospitality, healthcare, and smart infrastructure. In addition, it is now time to adopt IoT and AI-powered monitoring systems to differentiate the brand and address the increasing expectations of hands-free restroom experience.

Key Priorities of Stakeholders

Regional Variance:

Adoption of Smart & Connected Technologies

High Variance:

Divergent Perspectives on ROI:

Feature Preferences & Material Trends

Consensus:

Regional Variance:

Price Sensitivity & Investment Appetite

Shared Challenges:

Regional Differences:

Pain Points in the Value Chain

Manufacturers:

Distributors:

End-Users (Facility Managers, Businesses):

Future Investment Priorities

Alignment:

Divergence:

Regulatory Impact

Conclusion: Variance vs. Consensus

High Consensus:

Key Variances:

Strategic Insight: A "one-size-fits-all" approach will not succeed. Manufacturers must adapt strategies regionally:

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| Western Europe (EU) |

|

| United Kingdom |

|

| Germany |

|

| France |

|

| Japan |

|

| South Korea |

|

| China |

|

| India |

|

The USA air blade dryer sector is set to register a CAGR of 7.5% over the period of 2025 to 2035, owing to rising hygiene regulations, sustainability initiatives, and cost-saving implementation in commercial spaces. The Energy Policy Act (EPACT) requires energy-efficient appliances, which pushes businesses and institutions to upgrade their hand-drying systems.

Furthermore, certain states like California and New York are phasing out paper towels, which pushes the air blade dryer industry penetration further. The growing trend toward smart restrooms across airports, shopping malls, and corporate offices has propelled demand for IoT-enabled hand dryers that provide features such as predictive maintenance and energy tracking. Touchless technology is now standard in hospitality and healthcare, with companies leading adoption.

The UK air-blade dryer sector is expected to reach USD 36.2 million by 2035, growing at a CAGR of 8.1% during the forecast period from 2025 to 2035, owing to the increasing presence of net-zero policies and energy efficiency mandates and their growing adoption in commercial buildings. The Building Regulations Part L, which mandates sustainable appliances, is driving an increasing demand for low-energy, high-speed dryers, particularly in new and renovated buildings.

Airports, railway stations, and hotels are also transitioning to hygienic, touchless drying solutions, making the hospitality and transport sectors major growth drivers. Growing awareness of carbon footprints is prompting industries to invest in more environmentally friendly manufacturing models.

The French air blade dryer sector will grow at a CAGR of 7.5% over the forecast period, from 2025 to 2035. The French Energy Transition Law promotes the use of energy-efficient devices among businesses, which makes high-speed, low-energy dryers an interesting investment.

Manufacturers are developing environmentally friendly carbon-neutral drying solutions as important parts of the HQE (High Quality Environmental standard) standard and to counterbalance global warming, as the standard advocates eco-friendly materials and low-energy energy consumption.

The hospitality and public infrastructure sectors in France are early adopters, with airports, universities, and government buildings refurbishing their restrooms. However, the high regulatory barriers and significant competition posed by local EU-based brands are challenges.

From 2025 to 2035, the air blade dryer landscape in Germany is predicted to grow at a compound annual growth rate (CAGR) of 8.0%, which is attributed to energy efficiency directives by the EU, sustainable energy targets, and an increasing need for durable, high-performance products.

The EU EcoDesign Directive requires energy-efficient hand dryers, and the Blue Angel certifies the use of sustainable and recyclable materials. Key industries include Germany’s corporate sector and public infrastructure, with an increasing transition to automated, sensor-based drying solutions. IoT-enabled air blade dryers with energy tracking functionality are increasingly adopted in airports, railway stations, and smart restrooms in commercial spaces

Influenced by increasing tourism to Italy, continuing efforts to improve water efficiency, and modernization to public restrooms, the overall sector for air blade dryers in Italy is expected to grow at a CAGR of 7.3% over the forecast period from 2025 to 2035. The Italian Green Economy Plan encourages companies to replace their non-compliant appliances with ones that are energy-efficient and eco-compatible.

This is generating a constant demand for high-speed and low-energy dryer operational equipment within hotels, restaurants, and cultural sites. Price sensitivity and slow adoption of IoT-enabled dryers. Incentives from the government for carbon-neutral appliances for touchless solutions are reinforcing growth.

The sector for air blade dryers in South Korea is poised to grow at a CAGR of 8.7% from 2025 to 2035, underpinned by urbanization, tech-driven infrastructure, and increasing hygiene awareness among consumers. KEMCO's Energy Labeling Program makes a strict energy efficiency specification, while KC certification ensures higher safety and durability.

Strong growth is expected for smart restrooms, where IoT-connected dryers are fitted in malls, airports, and high-rise office buildings, while UV disinfection products features are also gaining traction. Further driving growth is the government’s focus on smart city infrastructure and public hygiene awareness.

Due to the greater cost sensitivity and preference for compact and minimalistic designs, Japan’s air-blade dryer landscape is the slowest-growing, with a CAGR of 7.2% for the period from 2025 to 2035. But JIS certification and Energy Conservation Act policies are transitioning companies toward energy-efficient appliances.

Public restrooms in train stations, offices, and commercial buildings have already moved to relatively quiet, but there's been no real uptick in smart, IoT-enabled dryers. Consumers and small businesses focused on price prefer low-energy, inexpensive dryers to more expensive dryer models.

China will emerge as one of the fastest-growing sectors for air blade dryers, with a CAGR of 9.1% from 2025 to 2035, aided by urbanization, government sustainability programs, and increasing need for hygiene. The CCC certification guarantees that products meet energy efficiency and safety standards in China, and for the Green Manufacturing Policy, they encourage the use of recycled materials during dryer production.

Among them, the hospitality, healthcare, and commercial real estate industries are the major end-users, driving mass adoption of IoT-based energy-efficient dryers in smart city projects.

Strong hygiene regulations, sustainability mandates, and the increasing adoption of touchless technology are driving the Australia-New Zealand air blade dryer sector, which is expected to grow at a CAGR of 8.3% between 2025 and 2035.

Promotion of low-energy appliances through the National Construction Code (NCC) in Australia and New Zealand’s EECA Energy Efficiency Program has driven a high level of uptake of these air blade dryers throughout both commercial and public spaces.

Airports, malls, and restaurants are driving the transition, with tourism, corporate sustainability goals, and high urbanization rates serving as pillars of growth. Government subsidies for energy-efficient appliances also provide extra encouragement to adoption.

The landscape for air blade dryers in India is anticipated to register a growth at a CAGR of 8.5% over the forecast period of 2025 to 2035. The demand for touchless, energy-efficient dryers in public restrooms, metro stations and commercial buildings is growing due to initiatives like the Smart Cities Mission and Swachh Bharat Abhiyan.

The hospitality, healthcare, and corporate verticals are also driving increasing adoption owing to high set hygiene standards. Though BIS certification ensures implementation of safety and quality, future energy-efficiency guidelines released by BEE are likely to escalate demand for eco-friendly models.

Cost sensitivity and import dependency for high-end models, however, continue to pose major challenges. Local manufacturing is likely to receive an impetus on the back of government incentives under the Make in India initiative.

With other enhancements like power sources, end-user applications, and technological features, the air blade dryer landscape is changing. Electric air blade dryers are the most common type because of their high efficiency, quick drying times, and high traffic handling at places like airports, shopping malls, and healthcare locations.

However, the energy consumption and retrofit challenges of older structures limit deployment in some segments. Now, battery-driven air blade dryers are becoming a flexible solution particularly in off-grid areas, eco-conscious enterprises, and public toilets that lack extensive electrical installation.

While improvements to lithium-ion battery performance have made them a more potent drying force, battery replacement costs and low airflow efficiencies remain a challenge.

Different end-users have varied air blade dryer demand based on their unique needs. Commercial users prioritize hygiene and sustainability, and low energy use and HEPA filtration are key features in office and retail establishments.

Some educational institutions are incorporating touchless, quick-drying air blade dryers to minimize the proliferation of germs and also to minimize paper towel waste, but budget constraints can limit the hesitation of adoption of such devices.

Healthcare facilities, including hospitals and clinics, require high-performance dryers equipped with HEPA filters and antimicrobial coatings for effective infection control, even though they involve a higher initial investment. Public areas such as airports, stadiums and transportation hubs need high-traffic vandal-proof dryers, but balancing cost, energy consumption and maintenance needs is easier said than done.

Technological features are the most important attributes shaping the air blade dryer sector, as well as noise reduction technology, HEPA filtration, and touchless operation. Noise-reduction technology is becoming the preferred choice in offices, hotels, and healthcare environments where quiet operation promotes user comfort.

HEPA filters can make a strong selling point in industries with strict hygiene compliance requirements, like hospitals, food service and cleanroom facilities, although the upfront cost of maintaining them is a deterrent. Meanwhile, smart dryers that are compatible with networks and offer real-time operating status information, as well as predictive maintenance notifications, are also emerging in the big commercial buildings.

Leading players in the air blade dryer landscape are competing on the basis of price strategies, technology innovation, strategic alliances, and expansion. Dyson, the segment leader, competes on the basis of premium pricing and innovation, combining energy-efficient motors, HEPA filtration, and noise reduction technology to make its Airblade series stand out.

The growth in this sector is predominantly fueled by emerging sectors, sustainability efforts, and product improvements. Firms are further investing in touchless technology and IoT-connected dryers to respond to expanded hygiene needs in the post-pandemic period.

Dyson Airblade

Excel Dryer (XLERATOR)

Mitsubishi Electric (Jet Towel)

World Dryer

Bobrick

Toto

American Dryer

Others (Smaller Brands)

Industry News Websites:

Company Press Releases:

Trade Publications:

Financial Reports:

Google Alerts:

Social Media:

Greater emphasis on hygiene, power efficiency, and sustainability is fueling the use of air blade dryers. Companies and public places like to use touchless dryers in order to limit the germination of germs while minimizing maintenance costs with paper towels.

Air blade dryers employ high-velocity air to strip away moisture rapidly, shortening drying times and energy use. In contrast to traditional warm-air dryers, they reduce bacteria transmission by eliminating the requirement for extended hand exposure to warm airflow.

Other sectors like hospitality, healthcare, commercial property, and public transport stand to gain substantially from their heavy foot traffic and requirement for cost-effective, low-maintenance bathroom facilities. Industrial environments also implement them for cleanliness regulations.

Recent innovations are HEPA filtration for better air quality, noise-reduction technology for quieter machines, and IoT-monitoring capability for predictive maintenance. Some designs also include adjustable temperature and airflow controls to promote user comfort.

Challenges to manufacturers include compliance with regulations, variable raw material prices, and competition from substitute drying technologies. Satisfying energy efficiency, price, and high-performance functionality remains a focus.

Electric Air Blade Dryers and Battery-operated Air Blade Dryers

Commercial Buildings, Industrial Facilities, Educational Institutions, Healthcare Facilities, and Public Facilities

Noise Reduction Technology, HEPA Filters, Touchless Operation, and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and The Middle East & Africa

Power Tool Gears Market - Growth & Demand 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

External Combustion Engine Market Growth & Demand 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.