The Air Audit Equipment Market is expected to experience steady growth over the next decade, driven by rising industrial demand for energy efficiency, regulatory mandates on air quality, and increasing awareness of sustainable operations.

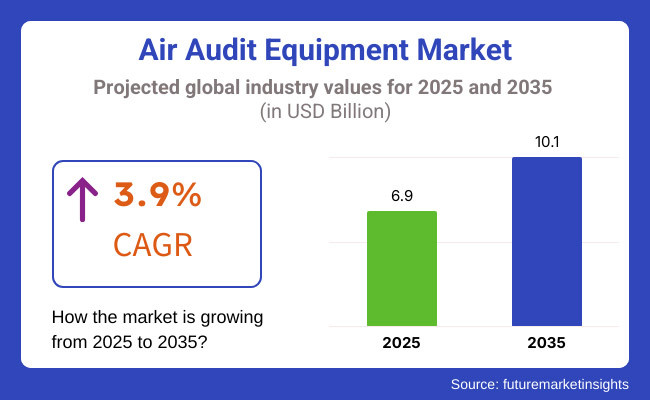

The market is projected to grow from USD 6.9 billion in 2025 to USD 10.1 billion by 2035, reflecting a CAGR of 3.9% over the forecast period. Advancements in sensor technology, automation in air quality assessment, and the integration of artificial intelligence for real-time monitoring are key factors contributing to the expansion of this sector.

The Air Audit Equipment Market is poised for steady expansion due to increasing regulatory enforcement and the industrial sector’s focus on optimizing energy consumption. The rising power prices and sustainability concerns are making the industrial sector of the economy rethink compressed air management, now air audit equipment becoming behind the scenes expert and an irreplaceable part of it.

The technological breakthroughs such as AI-oriented diagnostic tools, the cloud air monitoring as well as IoT-enabled solutions are modifying air auditing, accuracy is higher and reliance on human labor is lower. Transfer to green energies primarily aimed at air audit equipment will be a proving ground in the implementation of carbon cut plans and energy efficiency rules in different sectors, it will continuously foster strong market growth.

The highest demand for air audit equipment comes from such sectors as manufacturing, energy, pharmaceuticals, and automotive where compressed air systems are vital to the operation of these industries. The growing stress on the reduction of energy wastage along with the enforcement of new environment and health safety governmental regulations on emissions is sparking the further market surge. To mitigate losses, enterprises are adopting air audit tools at an accelerated pace, to track inefficiencies, conserve energy, and boost productivity.

The advent of IoT-enabled air monitoring systems, cloud-based analytics, and portable air auditing solutions is the game-changer in the market. Besides, governmental compliance standards of organizations such as OSHA (Occupational Safety and Health Administration) and the EPA (Environmental Protection Agency) in the United States along with similar ones in Europe and Asia - Pacific are the push for the industry to secure health and environmental regulation by the use of the latest air audit appliances.

The Air Audit Equipment Market is a property of North America, a region led by the mechanical safety and efficiency demands thus ensuring the control of air emissions. The Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) control the quality standards of the air, hence plan for the sale of the air audit devices.

The USA and Canada are pushing the boundaries of Greener Factories with IoT solutions as they implement real-time monitoring systems to optimize compressed air usage. Further to that the renovation of Industry 4.0 with smart factories is increasing the need for predictive maintenance solutions.

Air resource conservation deals like those funded by the Department of Energy (DOE) through Energy Efficiency Grant Program are also inspiring industries to cut down the compressed air wastage; hence the North American market of air audit equipment is vibrant with innovation and acceptance.

The European Air Audit Equipment Market stands second to North America but is strong in promotion through environment-protective policies such as the EU Green Deal and Energy Efficiency Directive, which call for industries to push their sustainability efforts further and thus earn the right to high-precision air audit equipment. The western European markets are following the same route with companies in Germany, France, and the UK leading the way in fighting carbon emissions through proper air management practices.

The Green European initiative and the Energy Efficiency Directive make industries seek sustainability, this in turn is the driver for profit maximization through the operation of precision air audit devices. Sectors across Europe have been implementing AI and machine learning technologies for the management of air quality.

The automotive industry and pharmaceutical plants have also provided support for the market expansion because those sectors require air standards in terms of purity and efficiency to be secured by compliance with regulations like ISO 8573 and EN 12021.

The Air Audit Equipment Market growth is projected to be the fastest in the Asia-Pacific owing to the quick industrialization, urbanization, and increasing regulatory enforcement. The spike in manufacturing activities in places like China, India, and Japan has originated subsequent demands on energy efficiency in air auditing solutions.

The move of the acknowledged governments adopting laborious standards is a pocket money into the private businesses pop up new environmental companies in the book of air quality oversight discussions. In South Korea and Taiwan, the rise of smart manufacturing is propounding AI control systems where employees are unsupervised. On the other hand, certain commercial sectors in the area have seen how compressed air energy savings improve productivity and operating costs by adopting the air audit tool.

The Rest of the World (RoW) market driven by industrial growth, and infrastructure projects, the Latin America Middle East, and Africa are growing gradually. As regards Latin America, the country which sees the most energy-efficient air management systems is going to Brazil and Mexico where adoption is on the rise. The Middle East is shifting attention to air audit solutions in the power-intensive sectors such as petrochemicals and desalination by focusing on industrial diversification and sustainability.

Africa, although at the introductory stage, is seeing a surge in industrial modernization, particularly in South Africa and Nigeria. Therefore, the air audit equipment will see a continued increase as the businesses in the regions focus on energy efficiency and the compliance with international regulatory standards.

High Initial Investment

High initial investment cost in terms of the purchase of equipment along with the integration of these solutions remains the biggest challenge in the air audit equipment market. Companies especially small and medium companies in many cases are not able to bear the costs associated with the installation of such systems, especially, in the areas were no regulations are mandatory.

The advanced diagnostics technologies, such as Artificial Intelligence, addition of new sensors, as well as real-time monitoring and analytics push expenses up, which in turn, need specialized personnel for installation and commissioning. Putting the new air audit technology alongside the older and ongoing operations can become sometimes involved and nuisances might arise.

These financial and technical issues make it difficult for companies to adopt it in the first place, especially in industries that are highly sensitive to costs. For such challenges to be overcome, the manufacturers should be innovative in addressing the issues through the development of cost-effective technologies and through flexible financing models.

Variability in Regulatory Standards Across Regions

One more of serious challenges in the global market is the absence of uniformity in the air quality regulation across different regions jointly local manufacturers compliance issues. While North America and Europe have the industrial air quality and energy efficiency standards clearly stated there are regions like Asia-Pacific, Latin America, and Africa who are still working on their regulatory frameworks.

This inconsistency causes it hard for the multinational companies to use the same air audit solutions in all their plants. Besides different sectors of the industries have extra compliance requisites; thus firms are made to get customized equipment to obey local laws. Consequently, this fragmented regulatory framework not only complicates operations but also increases the costs for companies that seek to adhere to varying standards, thus delaying the development of emerging markets.

Growth of IoT and AI-Driven Air Monitoring Solutions

The rising trend of the Internet of Things and the application of artificial intelligence (AI) in air monitoring systems is a golden opportunity for the air audit equipment market's growth. Air quality monitoring systems, which are made smart through the application of real-time monitoring, predictive analytics, and automated diagnostics, this is the main way to better energy efficiency and reduced operational costs.

Many companies now are disposing of internet of things sensors for air quality monitoring which lead to scheduling of preventive maintenance. Through the cloud-based platforms, the companies can remotely monitor and analyze the performance of compressed air systems across different locations.

As industries are embracing the Industry 4.0 and smart manufacturing era, the incorporation of AI and IoT in air audit equipment is vastly the go-to way people choose, leading to increased accuracy, full automation of the processes, and data-driven decision-making benefiting the environment.

Rising Focus on Sustainability and Carbon Footprint Reduction

The new air audit technology being invented due to the global struggle for ecological conservation and clean air cut is the contemporary scenario. National authorities and legislative bodies have been laying down new injunctive laws and promoting eco-friendliness as a result, the companies have been reducing energy waste and emissions. Ideally, compressed air systems are the ones that will use a lot of energy and become uneconomic if the systems are not functioning properly, and which in turn will cause greenhouse gases.

The organizations have been resorting to the air audit appliances to find the leakage, downsize the use of compressed air, and conserve energy. The investment in energy-efficient air management solutions will be accelerated by various initiatives like the European Green Deal, the programs of the USA Department of Energy concerning energy efficiency, and the Asia-Pacific region's industrial sustainability mandates, with the consequent rise in the demand for advanced air auditing technologies.

The air audit equipment market has managed to maintain healthy growth from 2020 to 2024 as a result of the increasing energy efficiency issues, the more frequent regulatory scrutiny, and also the greater focus on the environment in the industrial operation processes.

The air audit instruments of such kind as flow meters, leakage detectors, and pressure sensors are vital for the efficiency of clean air. The principal moving gear behind this period were stricter environmental regulations, rising energy costs, and advanced sensor technology.

As for the period in the horizon 2025 to 2035, the market is projected to further grow and the major drivers for this development would be the higher levels of automation, the upgrading of AI, and the use of the Industry 4.0 paradigm in manufacturing. The authorities are due to promulgate even more penalties on industrial energy efficiency, hence raising the need for air audit solutions.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Framework | Governments have made it obligatory to abide by the minimum energy efficiency standards, through which they aim at the reduction of carbon footprints in the industrial sector. |

| Innovation | Digitalization has set the pace for the growth of wireless sensors, digital monitoring, and handheld audit devices. |

| Sectoral Demand | Much of the implementation was done in the manufacturing, food & beverage, and pharmaceuticals fields. |

| Green & Circular Economy | The first steps were mentioning leak detection and energy-saving in industrial plants. |

| Market Growth Forces | The cry for cost savings and boost of energy efficiency in reed air systems. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Framework | More rigorous standards and carbon taxation measures will be the primary reason for the obligatory practice of air audit by the industries. |

| Innovation | The introduction of AI-based predictive maintenance, automated diagnostics, and real-time monitoring will be a part of improved efficiency. |

| Sectoral Demand | They will considerably grow into other categories like data centers, semiconductor manufacturing, and renewable energy. |

| Green & Circular Economy | The Energy management system on a holistic level, heat recovery of waste, and joining all these with sustainability projects. |

| Market Growth Forces | Broadening the concepts of smart factories, the rule of sustainability, and machine learning in industrial audits. |

The escalating requirements for energy efficiency have led to the mushrooming of the USA air audit equipment market along with the rise in green manufacturing practices. The Environmental Protection Agency (EPA) has mandated industrial energy audits as a part of its efforts to curtail emissions which in turn has resulted in companies investing in high-tech air monitoring equipment.

Sectors such as manufacturing, healthcare, and food processing are the primary users of air audit equipment that helps them in optimizing their compressed air systems and reducing their operational costs. The advent of Industry 4.0 has played a significant role in connecting the IoT-enabled sensors for the real-time monitoring of air quality and predictive maintenance.

At a time when energy costs are climbing and regulatory scrutiny is becoming more intense, many manufacturers are choosing to prioritize air efficiency audits for both meeting regulations and sustainability reasons.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

The United Kingdom's air audit equipment market is a direct outcome of the country's strong commitment to fulfilling the Net Zero 2050 target. The increasingly stringent energy efficiency regulations and the carbon reduction schemes are forcing the companies to use the air monitoring and auditing solutions. Among them, the pharmaceutical, food processing, and heavy manufacturing units are the top beneficiaries, as they aim at energy optimization and reducing costs of operations.

The UK government incentivizes the green companies for using energy-efficient technology, thus capturing the additional market growth. Air auditing has been affected by the inclusion of AI and digital monitoring instruments. As the industrial energy prices are on the rise, the air audits have become a popular choice for compliance and sustainability improvement.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

The air audit equipment market in the European Union is in the process of growing owing to the effect of the hard-hitting environmental policies, including the Energy Efficiency Directive (EED) and the European Green Deal. The imposition of these regulations on large-scale industrial facilities to carry out energy audits has consequently led to an increase in the need for air monitoring solutions.

Prominent industries such as the automotive, the chemical, and the electronics sectors have turned to the use of cutting-edge air audit technologies to attain their strict carbon reduction marks. The market is witnessing the introduction of diagnostic systems driven by AI and the integration of IoT functionalities in air monitoring tools, which help in the performance optimization of compressed air systems and lead to energy wastage reduction. With sustainability still being a dominant theme, companies have made it a priority to carry out air audits in order to adhere to the EU environmental regulations while improving efficiency in their operations.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.9% |

The air audit equipment market in Japan is on the rise due to the emphasis on energy savings and factory automation. The country is subject to the limitations of carbon emissions, which in turn, means that the automotive, electronics, and semiconductor companies need to introduce air monitoring devices. The air audit equipment is now being equipped with cutting-edge solutions, such as AI-based auto diagnostic and IoT equipped sensors, thus allowing the machinery to work more efficiently and making it easier to predict faults.

The state is also encouraging projects like that with cash bonuses to companies implementing green technologies. In the spirit of being smart and eco-friendly, Japanese manufacturing ventures are now increasingly focused on compressed air audits as a way to increase output, reduce costs, and comply with environmental requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The air audit equipment market in South Korea is on track for rapid growth due to the flourishing industrial automation and energy efficiency efforts. The country’s Smart Factory Initiative motivates the manufacturers to make use of air audit systems through which they optimize compressed air and thus reduce the operational costs. The electronics, semiconductor, and automotive sectors are the leading ones as they apply AI-powered air monitoring tools to external diagnostics and to boost efficiency.

The government is passing legislation that supports the development of green energy and the decrease of industrial carbon emissions, which in turn increases the demand for air audit equipment. As factory owners are trying to become more efficient and cheaper, the use of air monitoring and predictive maintenance solutions will increase greatly.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

Particle Counter Dominates Due to Increasing Air Quality Regulations

With the help of particle counters, the contamination in compressed air systems can be detected and therefore they ensure the compliance of these systems with the stringent air quality standards such as ISO 8573-1.Industries like pharmaceuticals, electronics, and food and beverage face stringent requirements for high-purity air, making this demand a top priority.

As a result, particle counting has gained significant prominence, driven by growing environmental concerns and the tightening of regulations across Europe and North America. Then again, manufacturers with the backing of the progressive industry are replacing air filters with real-time particulate monitoring systems. Plus, laser-based particle counting, among other technologies, plays the role of

Industrial particle counters are flourishing together with growing technological innovations like laser-based particle counting that delivers much more exact results. Besides, industrial automation is also a factor to the market development since monitoring compressed air purity is an integral part of longest lifetime and most efficient operation.

Leak Detector Gains Traction Amid Rising Energy Efficiency Demands

Air leak detection is a highly crucial component of compressed air management because the air leak off leads the energy loss and most of the time the increase of operational costs. The tendency that prevails among the automotive and chemical branches for ultrasonic leak detectors is striking, for an adequate air compression they are a must.

Energy efficiency objectives for the government and programs like the USA Department of Energy & Industrial Assessment Center (IAC) which corresponded to such needs are simply advocating for the uptake of leak detection technologies..

Besides, industries that are focused on lowering carbon and improving sustainability are the ones giving priority to the leak detection solutions. The recent integration of IoT utilities in the leak detectors has made them even better at real-time monitoring and predictive maintenance; thereby making them irreplaceable in the modern industrial world.

Oil & Gas Industry Leads Due to Stringent Safety and Efficiency Norms

Air audit equipment has become central to the oil & gas sector. Primarily, it helps with pipeline monitoring, process control, and emissions reduction; thus, the industry has to cut down on its environmental impact. Due to the severe regulatory environment in the industry, the compliance with the EPA and OSHA standards is paramount.

Particle counters, dew point meters, and pressure meters are some of the most critical tools for achieving the adequate quality of compressed air that is necessary in drilling, refining, and gas processing applications.

Gas companies are moving towards digital air audit solutions in both offshore and onshore facilities that will lead to much more effective operations. The global trend of switching to eco-friendly and sustainable prospecting techniques is driving the investment in highly sophisticated air monitoring methods which are the key to safety, compliance, and reduced costs in the oil & gas sector.

Food & Beverage Industry Sees Rising Demand for Air Quality Compliance

A scarce number of food & beverage companies can remain unaffected by the regulations out there. Food processing, packaging, and storage all rely on high-purity compressed air to avoid contaminating the products. Environmental agencies like the FDA and ISO 22000 impose a number of air quality regulations, thus, the industry must use oil vapor measurement, particle counters, and dew point meters predominantly. As the sector leans more and more towards automation and clean technologies, the trend of purchasing air audit equipment is becoming prevalent.

Non-polluted air is highly important in breweries, dairy, and meat processing industries thus, it calls for real-time monitoring. Besides, the trend for customizable, lower-carbon product ranges as well as energy-cutting air audit solutions is being promoted by the quest for sustainable production efficiency.

The Air Audit Equipment Market is expected to expand its coverage in manufacturing facilities by endorsing the green agenda of reducing energy waste, meeting regulatory standards, and cutting down costs. Companies are embracing modern technologies like IoT and AI to detect and repair energy leaks in compressed air systems. Global giants like Atlas Copco and Ingersoll Rand are leading the market by introducing the latest technologies in the predictive maintenance and air audit branches.

The mulching punishment environmentalists are giving to industries for corrupting the environment is turning them into air audit equipment buyers to eradicate energy stealing. The air audit equipment market is also undergoing the process of consolidation in the sense, that the older companies are taking over the small niche ones in order to boost their product portfolio. The Asia-Pacific region is a hotbed for the freshest opportunities owing to factory expansions driven by the manufacturers that are also looking to integrate energy-saving equipment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Atlas Copco AB | 15-20% |

| Ingersoll Rand Inc. | 12-16% |

| SUTO iTEC GmbH | 8-12% |

| FLIR Systems, Inc. | 6-10% |

| Pentair PLC | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Atlas Copco AB | Provides high-precision air audit solutions with advanced data analytics and IoT integration. Focuses on sustainability and energy efficiency. |

| Ingersoll Rand Inc. | Offers comprehensive air audit and leak detection solutions. Invests in predictive maintenance technologies. |

| SUTO iTEC GmbH | Specializes in compressed air monitoring solutions with real-time data tracking. Targets industrial automation. |

| FLIR Systems, Inc. | Develops thermal imaging and ultrasonic leak detection solutions for air audit applications. Focuses on high-precision diagnostics. |

| Pentair PLC | Supplies air quality testing and filtration solutions. Optimizes energy efficiency through advanced sensor technology. |

Key Company Insights

Atlas Copco AB

Atlas Copco is the primary compressor air solution manufacturer, and it also sells air audit equipment. The creative offer of Atlas Copco Internet of Things (IoT) devices which are used to monitor, control, and optimize energy consumption and the decrease of operational costs goes hand in hand with the company's key value of sustainability.

By investing in technologies like AI, Atlas Copco manages to meet energy regulations required for the operation of the machines in the industrial sector. Expansion through acquisitions of companies around the globe has played a key role in their leadership in the market. The cloud-based analytics and predictive maintenance tools are increasing the company portfolio which aims at shelving a commitment of long-term efficiency to the industrial clients.

Ingersoll Rand Inc.

Ingersoll Rand is an industry leader in the monitoring of air audit solutions. The service palette consists of leak detection, energy analysis, and system optimization. Ingersoll Rand has been at the forefront of utilizing smart sensor technology and AI-based monitoring to create an even more efficient compressed air system. The company has been concentrating on predictive maintenance as a strategy to ensure that their industrial clients have the least amount of downtime while saving costs.

Sustainability and adherence to the rules are the hallmarks of the company, making it the first choice of the energy-saving firms. The company is broadening its operational field by venturing into new markets, thereby securing its status as a global industry leader in the program of industrial energy efficiency measures.

SUTO iTEC GmbH

SUTO iTEC is a young Hungarian company that is specialized in air density measuring rather air diagnostics which is mostly used by large-scale users of compressed air. A complete system of SUTO iTEC consists of devices for monitoring and devices to interpret the results of the monitoring, namely the company offers flow meters, dew point sensors, and cloud-based analytics platforms.

It is worth mentioning that SUTO iTEC is known for its high quality and precision instruments that are capable of optimizing the compressed air usage in industries besides helping them meet their sustainability targets. Along with these advancements, the company has been actively expanding its business in the European and Asia Pacific (APAC) regions and its air system expertise has been significantly acknowledged. The major innovation element is the digital automation of the program which is typical for the company.

FLIR Systems, Inc.

FLIR Systems is a top company in infrared and ultrasonic detection technologies among which provide integrity air monitoring ability at a high level of accuracy. The thermal imaging tools by their innovative developers built in compressed air leak detectors that work with the thermal imaging method of detecting which is the most efficient one. Both in the commercial and military fields the company has high penetration; this makes them a versatile player in the air audit market.

FLIR which is committed to developing new tools for diagnosis that are unlike any other in the industry will ensure that companies use energy as efficiently as possible. Their focus on high technology and quality control has awarded them a good reputation, making them a trustworthy partner in air system audits.

Pentair PLC

Pentair deals with air quality testing and filtration products aiding industries to have cleaner and energy-efficient air systems. Advanced sensor Hawkeye technology for optimizing air monitoring helps to prevent the waste of resources and augment the performance of the whole system. Pentair is famous for its affordable and eco-friendly products which comply with local regulations.

The company initial of maintaining its lead in the energy optimization and industrial filtration market will be by expanding its product offerings thus meeting the additional needs of industries. Its economy and efficiency concern adds more weight to its wide acceptance in the market.

In terms of Equipment Type, the industry is divided into Particle Counter, Oil Vapor Measurement, Pressure Meter, Flow Meter, Differential Pressure Meter, Leak Detector, Energy Meter, Dew Point Meter

In terms of End User, the industry is divided into Automotive, Oil & Gas, Food & Beverage, Power Generation, Mining, Chemical & Petrochemical Plants.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Air Audit Equipment market is projected to reach USD 6.9 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 3.9% over the forecast period.

By 2035, the Air Audit Equipment market is expected to reach USD 10.1 billion.

The Particle Counter segment is expected to dominate the market, due to its critical role in air quality monitoring, regulatory compliance, high demand in pharmaceuticals and cleanrooms, and advanced technology for detecting airborne contaminants with high accuracy.

Key players in the Air Audit Equipment market include Atlas Copco AB, Ingersoll Rand Inc., SUTO iTEC GmbH, FLIR Systems, Inc., Pentair PLC

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Equipment Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Equipment Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Equipment Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Equipment Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Equipment Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Equipment Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Air Quality Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA