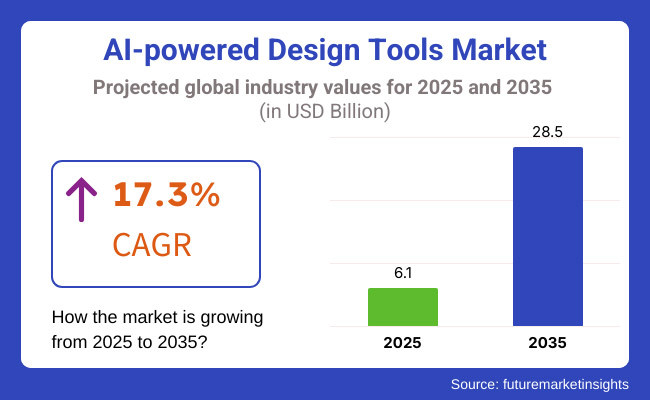

Emerging Trends in AI-powered Design Tools Market from 2023 to 2035. The AI-powered Design Tools Market is poised to witness a period of robust expansion from 2025 to 2035, with a growing number of industries embracing artificial intelligence to enhance their creative and digital design processes, including marketing, architecture, and fashion and product development. The market will approximate USD 6.1 billion in 2025 and is expanding at a CAGR of 17.3% over the forecast period. The market is expected to reach USD 28.5 billion by 2035.

Significant market growth is driven by the increasing need to automate graphic design, UI/UX, and content creation using AI. Thanks to advancements in ML (machine learning), generative AI, and real-time collaboration tools, AI-powered design platforms are redefining creative workflows, boosting efficiency, and minimizing manual efforts. The growth of the market is also supported by an increasing demand for personalized and data-driven design solutions on digital platforms.

Government-supported initiatives in addition to AI in creative industries and cloud-based AI design tools, SaaS investments are also on the rise and fuelling market growth. Moreover, partnerships among AI developers, design software providers, and businesses are further improving access to and usability of AI-enhanced design applications.

It will need strategic interventions as issues of intellectual property rights, ethical use of AI in design, and the role of human designers evolve. More organizations are prioritizing explainable AI (XAI), ethical design frameworks and AI-human collaboration models.

North America accounts for a considerable section in the AI-powered design tools market due to growing adoption of artificial intelligence in creative industries, digital marketing, and product development in the United States. The United States and Canada are the forerunners in the region, with growth of large enterprises, startups, and independent designers using AI-powered tools to increase efficiency, creativity, and automation.

Market dynamics are shaped by regulatory frameworks, like copyright laws and data privacy regulations, addressing issues related to ethical AI usage and intellectual property compliance. Nevertheless, issues around who owns AI-generated content, ensuring design uniqueness, and the cost of integration are barriers to broader use.

A focus on AI ethics and compliance with the European Union’s General Data Protection Regulation (GDPR) influences the deployment of AI-enabled creative solutions in the region.

Market growth is driven by rising use of AI-enabled design tools across branding, advertising, e-commerce, and content creation. Strict regulations on AI transparency, data protection, and automated content creation shape how AI tools are developed and used. With changing industry standards, European firms are working on improving their artificial intelligence-driven design capabilities in order to evolve with the industry and maintain growth across the market.

The fastest growing region in this new era of AI-powered design tools market is the Asia Pacific, owing to fast-paced digital transformation initiatives in the region, rising adoption of AI-enabled creativity tools, and government regulations backing AI research in developing countries such as China, Japan, South Korea, and India. Digital marketing, entertainment, and mobile app design are driven by AI system automation, and this creates a high demand for AI solutions due to continuous innovations in deep learning, real-time design generation, neural networks, etc.

A robust tech ecosystem and cost-effective AI development capabilities make large-scale adoption of AI-powered design tools across industries possible. Yet, the rules around AI ethics, content authenticity, and data sovereignty are still being established, and companies will have to adapt to these regulatory frameworks. The AI-driven innovation agenda, the emergence of cloud-based design platforms, and human-AI collaboration in the creative process are the future-oriented trends shaping the market and driving the investment in next-gen AI-powered design products.

Challenges

Balancing Creativity with Automation

AI reference on GPT Take and Learn Text-Based with ease. While AI can save time and effort by producing design elements, some worry that it will further deaden originality and creativity. Moreover, users who are accustomed to AI-driven workflows may find it challenging to adapt, particularly in sectors that heavily use conventional design techniques. Highly customizable AI solutions are meant to work in concert with human creativity, offer low-friction user interfaces, and are designed to augment, not eliminate, human-led design must rise to the challenge.

Opportunities

Growth of AI-driven Personalization and Generative Design

the increasing need for tailored and data-driven design solutions offers lucrative opportunities in the AI-based design tools industry. Generative design with the help of AIs will allow for prototyping, data-informed design decisions, and tailored user experiences for particular audiences.

These new technologies have not only become more accessible but have also undergone systematic improvements - for example, NLP and AI-assisted creativity tools, which enable designers to create a whole bunch of unique visuals, optimize layouts, automate repeated tasks, etc., while remaining in creative control. The continuous advancement of AI-based branding, UI/UX design, and real-time design collaboration tools would also contribute to the growth of the market.

From 2020 to 2024, the trend toward digital transformation saw a rise in AI-powered design tools for faster and more scalable design solutions. Companies that wanted to automate repetitive tasks, optimize workflows, and embed AI-infused design recommendations. However, there was some concern over the authenticity of the designs and the reliance by users on the AI-generated outputs.

From 2025 to 2035, AI-enabled design tools will become increasingly sophisticated, integrating deep learning, real-time collaboration, and AI-based ideation. Integrating AR with AI-powered prototyping will allow us to design creatively faster than ever before without sacrificing artistry. To add more, responsible AI-generated content frameworks and the emergence of ethical AI in design will also contribute to the future of the industry.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emerging discussions on AI in creative industries |

| Technological Advancements | Growth in AI-assisted design automation |

| Industry Adoption | Early adoption in digital marketing and UI/UX sectors |

| Supply Chain and Sourcing | Dependence on cloud-based AI tools |

| Market Competition | Dominance of major AI-driven design software providers |

| Market Growth Drivers | Demand for efficient, scalable design solutions |

| Sustainability and Energy Efficiency | Focus on optimizing AI model efficiency |

| Integration of Smart Monitoring | Limited AI-driven performance tracking |

| Advancements in AI Innovation | Early-stage development of AI-driven design ideation |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized guidelines for ethical AI-generated design |

| Technological Advancements | Expansion of AI-driven generative design, AR integration, and real-time collaboration |

| Industry Adoption | Widespread use across architecture, fashion, branding, and industrial design |

| Supply Chain and Sourcing | Increased use of decentralized AI design platforms for enhanced security and control |

| Market Competition | Rise of niche, industry-specific AI design platforms, and open-source alternatives |

| Market Growth Drivers | AI-powered personalization, adaptive branding, and creative automation |

| Sustainability and Energy Efficiency | Adoption of eco-friendly AI training and sustainable design practices |

| Integration of Smart Monitoring | AI-powered design feedback loops and real-time optimization |

| Advancements in AI Innovation | Fully autonomous design assistants with deep learning-powered creativity |

Europe‘s AI-driven design products market is growing rapidly, and the region is likely to harness opportunities in their creative industry scenarios with the increasing exploration of generative AI and AI-generated content. Several tech companies and design agencies are shifting towards creating AI-based creativity tools for branding, web development, and content creation. The growing trend towards AI-enabled workflow automation and real-time design customization is driving its growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 17.1% |

The UK AI-powered design Tools market is steadily growing due to the increasing advent of AI-driven Creative platforms, automation in digital marketing, the advent of AI-assisted content generation tools, and the increasing use of AI-powered graphics software, which is driving the market in the region. The world’s leading design innovations include AI-powered visual design and instant brand presence from the likes of London, Manchester, and Birmingham. Demand is anticipated to grow as companies look for budget-friendly design solutions and AI-aided content personalization.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 16.5% |

The European Union AI-driven design tools market is booming, fueled by growth in digital transformation initiatives, AI-powered content creation, and investment in AI-based creative solutions. AI is transforming digital media, advertising, and web development in leading markets such as Germany, France, and Italy. The growth of AI-powered 3D modeling, video editing, and smart automation is also driving demand in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 16.7% |

Technological advancements, such as generative AI, AI-driven animation tools, and machine-learning-assisted creative applications, have propelled Japan's AI-powered design tools market to new heights. The growth of AI-powered branding solutions and automated design workflows is increasing market penetration.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 16.9% |

The South Korean market for AI-powered design tools is rapidly accelerating, driven by AI-enhanced digital content creation, enhanced design automation, and advances in the use of AI within K-content industries. Seoul and Busan are AI-driven creative hubs, with businesses embracing AI tools for web design, branding, and marketing automation. AI penetration into the market for motion graphics, video production, and AR/VR-based content creation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 17.2% |

Artificial intelligence is revolutionizing the design industry, and the AI-powered design tools market currently has explosive growth. They use AI, automation, machine learning, and deep learning to make design operations in a wide range of industries more effective and creative. With the rising demand for design solutions that are faster and smarter, AI-powered design tools are now widely being adopted in graphic design, UX/UI development, automated content creation, image and video processing, and 3D modeling.

From businesses and creative professionals to enterprise users, these solutions are being integrated to improve workflows, promote user experience, and optimize the design process. Current tools are being redefined, with AI offering advanced functionalities like predictive design, automated formatting, and personalized branding.

The two most prominent categories in the market expansion of AI design tools are graphic design tools and UX/ UI design. AI tools are revolutionizing creative processes with features like instant image refinement, smart layout recommendations, and even predictive design features.

Ai-driven graphic design tools allow users to generate high-quality graphics with minimal effort. They analyze design patterns, suggest updates, and automate repetitive tasks, such as resizing, background removal, or colorization. As the need for unique and impactful visual content increases on websites, social media networks, and digital marketing, we are witnessing a rapidly expanding embrace of AI graphic design tools.

From AI-powered templates to automated typography and intelligent color palette generation - these tools are becoming a blessing for designers and businesses alike. AI-generated logos, dynamic branding elements, and collaborative features are driving growth in the market.

Likewise, UX/UI design tools are disrupting the way digital interfaces are created. Their powerful combination of AI-driven analytics, anticipatory user behavior modeling, and automated usability test creation shapes seamless, intuitive experiences. AI-powered UX/UI programs provide real-time adjustments, creating wireframes, adaptive layouts, and responsive designs that are unprecedented for design software.

The growing importance of user experience in E-commerce websites, mobile applications, and digital platforms has led to an increased demand for AI-driven UX/UI tools to improve user engagement and retention. Such advanced capabilities for analysing heat maps, easy A/B testing guided by AI capabilities, and the design of voice-assisted UIs is making these tools a vital asset for every designer, developer, and product manager.

The accelerating use of graphic design and UX/UI tools is propelling innovation in the AI-driven design tools market. Businesses are pouring money into AI-driven design aid, configuration, and immediate input-based software tools to improve creative scrolls. Yet high upfront costs, integration complexities, and the necessity of audible creativity aside from AI-generated designs are still vital factors. However, limitations in a few of these factors, as well as discrepancies in the measurement of AI evaluation and implementation, are the key factors that may pose potential challenges to the growth of the market in the coming years.

Media & entertainment, as well as e-commerce & retail, are the leading adopters of AI-powered design tools - which is no surprise, given that companies are increasingly turning to intelligent automation for content production, personalization, and branding. AI-powered design solutions are transforming these industries with faster content creation, on-the-go editing, and auto promotional material generation that drives user interaction and customer engagement.

In the media and entertainment industry, AI-based design tools expedite processes like video editing, image processing, and automated content creation. These tools help build professional-grade video effects, make AI-powered animations, and even automate the process of turning a script into a story. These AI-powered content creation tools allow for synthesis of a video in real time, enhancements based on facial recognition, and motion graphics based on deep learning algorithms.

This sector has witnessed a surge in demand for digital media, streaming services, and social media content, which has further propelled the adoption of AI-powered design tools. Tools like AI-based voice synchronization, automatic video summarization, and intelligent editing recommendations allow contributors to create powerful visual experiences effectively.

From e-commerce and retail to fashion designing, businesses are using AI-powered design tools to provide personalized shopping experiences, improve product visualization, and boost marketing strategies. Through AI-driven product image editing, a new form of advertisement generation, and integrated designs for dynamic product catalogs, online retailers are diversifying how they showcase products. Personalized branding solutions with the help of AI can help brands generate logos with graphics to promote their products and personalized ads in real time.

AI-powered e-commerce trends Exploring consumer behaviour, visualizing product placement, and analysing sentiment are common under the hood for AI-generated design recommendations for web pages, helping e-commerce platforms realize higher conversion rates and customer engagement. These trends, combined with the use of AR (augmented reality) and AI (artificial intelligence) driven 3D modeling tools, have also changed how customers shop and make purchase decisions online.

The demand for the market is still being driven by the media & entertainment, and e-commerce sectors as AI-powered design tools grow more advanced. Businesses are investing not just in AI-driven marketing automation but also in personalized design recommendations and deep learning-enhanced branding strategies to stay ahead of the curve. Yet, issues such as data privacy risks, authenticity of content, and ethical aspects of AI-based media continue to exist.

The market for AI-powered design tools is growing rapidly, with a demand for automation in graphic design, UX improvement, and personalized content production. Generative AI, machine learning-based design recommendations, and real-time collaboration tools are some of the key features being honed to improve usability and efficiency. Graphic design platforms, UX design tools, and content generation software powered by AI fill the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Adobe Sensei | 20-25% |

| Canva AI | 15-20% |

| Figma AI | 12-16% |

| Autodesk AI | 10-14% |

| CorelDRAW AI | 8-12% |

| Other AI Design Tools (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Adobe Sensei | AI-powered creative automation, intelligent image editing, and design optimization. |

| Canva AI | Provides AI-enhanced design templates, automated branding tools, and smart resizing features. |

| Figma AI | Specializes in AI-driven collaborative UX/UI design with real-time predictive design suggestions. |

| Autodesk AI | Offers AI-based generative design, 3D modeling, and architectural visualization. |

| CorelDRAW AI | Focuses on AI-powered vector illustration, photo editing, and layout automation. |

Key Company Insights

Adobe Sensei (20-25%)

Adobe Sensei leads the AI-powered design tools market by integrating AI into its creative suite, enhancing automation and intelligent design assistance.

Canva AI (15-20%)

Canva AI simplifies design with smart branding tools, AI-driven content creation, and automated design adjustments.

Figma AI (12-16%)

Figma AI provides advanced AI-driven UX/UI design capabilities, offering smart recommendations for seamless prototyping.

Autodesk AI (10-14%)

Autodesk AI specializes in AI-driven generative design, helping engineers and architects create optimized structures.

CorelDRAW AI (8-12%)

CorelDRAW AI enhances vector illustration and graphic design through machine learning-powered automation tools.

Other Key Players (25-35% Combined)

Emerging AI-powered design tools are focusing on generative AI, automated content creation, and real-time design enhancements. These include:

The overall market size for the AI-powered design tools market was USD 6.1 billion in 2025.

The AI-powered design tools market is expected to reach USD 28.5 billion in 2035.

The AI-powered design tools market is expected to grow at a CAGR of 17.3% during the forecast period.

The demand for the AI-powered design tools market will be driven by increasing adoption of AI in creative workflows, growing need for automation in design processes, advancements in generative AI, rising integration with cloud-based platforms, and expanding applications across industries such as marketing, architecture, and product design.

The top five countries driving the development of the AI-powered design tools market are the USA, China, Germany, the UK, and Japan.

Table 01: Global Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 02: Global Market Shipments (‘000 Units) Analysis, by Type, 2018H to 2033F

Table 03: Global Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 04: Global Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Region

Table 05: Global Market Shipments (‘000 Units) Analysis, by Region, 2018H to 2033F

Table 06: North America Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 07: North America Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 08: North America Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Country

Table 09: Latin America Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 10: Latin America Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 11: Latin America Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Country

Table 12: East Asia Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 13: East Asia Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 14: East Asia Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Country

Table 15: South Asia & Pacific Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 16: South Asia & Pacific Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 17: South Asia & Pacific Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Country

Table 18: Western Europe Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 19: Western Europe Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 20: Western Europe Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Country

Table 21: Eastern Europe Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 22: Eastern Europe Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 23: Eastern Europe Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Country

Table 24: Central Asia Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 25: Central Asia Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 26: Russia & Belarus Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 27: Russia & Belarus Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 28: Balkan & Baltics Countries Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 29: Balkan & Baltics Countries Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 30: Middle East & Africa Market Value (US$ billion) Forecast (2023 to 2033) by Type

Table 31: Middle East & Africa Market Value (US$ billion) Forecast (2023 to 2033) by Application

Table 32: Middle East & Africa Market Value (US$ billion) Analysis and Forecast (2018 to 2033) by Country

Figure 01: Global Market Value (US$ billion), 2018 to 2022

Figure 02: Global Market Value (US$ billion), 2023 to 2033

Figure 03: Global Market Size (US$ billion) and Y-o-Y Growth Rate from 2023 to 2033

Figure 04: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 05: Global Market Shipments (billion Units) and Y-o-Y Growth Rate from 2022-2033

Figure 06: Global Market: Market Share Analysis, by Type – 2023 & 2033

Figure 07: Global Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 08: Global Market: Market Attractiveness, by Type

Figure 09: Global Market: Market Share Analysis, by Application – 2023 & 2033

Figure 10: Global Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 11: Global Market: Market Attractiveness, by Application

Figure 12: Global Market: Market Share Analysis, by Region – 2023 & 2033

Figure 13: Global Market: Y-o-Y Growth Comparison, by Region, 2023 to 2033

Figure 14: Global Market: Market Attractiveness, by Region

Figure 15: North America Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 16: Latin America Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 17: East Asia Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 18: South Asia & Pacific Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 19: Western Europe Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 20: Eastern Europe Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 21: Central Asia Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 22: Russia & Belarus Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 23: Balkan & Baltics Countries Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 24: Middle East & Africa Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 25: North America Market Value (US$ billion), 2018 to 2022

Figure 26: North America Market Value (US$ billion), 2023 to 2033

Figure 27: North America Market: Market Share Analysis, by Type – 2023 & 2033

Figure 28: North America Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 29: North America Market: Market Attractiveness, by Type

Figure 30: North America Market: Market Share Analysis, by Application – 2023 & 2033

Figure 31: North America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 32: North America Market: Market Attractiveness, by Application

Figure 33: North America Market: Market Share Analysis, by Country – 2023 & 2033

Figure 34: North America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 35: North America Market: Market Attractiveness, by Country

Figure 36: United States Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 37: Canada Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 38: Latin America Market Value (US$ billion), 2018 to 2022

Figure 39: Latin America Market Value (US$ billion), 2023 to 2033

Figure 40: Latin America Market: Market Share Analysis, by Type – 2023 & 2033

Figure 41: Latin America Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 42: Latin America Market: Market Attractiveness, by Type

Figure 43: Latin America Market: Market Share Analysis, by Application – 2023 & 2033

Figure 44: Latin America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 45: Latin America Market: Market Attractiveness, by Application

Figure 46: Latin America Market: Market Share Analysis, by Country – 2023 & 2033

Figure 47: Latin America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 48: Latin America Market: Market Attractiveness, by Country

Figure 49: Brazil Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 50: Mexico Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 51: Rest of LATAM Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 52: East Asia Market Value (US$ billion), 2018 to 2022

Figure 53: East Asia Market Value (US$ billion), 2023 to 2033

Figure 54: East Asia Market: Market Share Analysis, by Type – 2023 & 2033

Figure 55: East Asia Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 56: East Asia Market: Market Attractiveness, by Type

Figure 57: East Asia Market: Market Share Analysis, by Application – 2023 & 2033

Figure 58: East Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 59: East Asia Market: Market Attractiveness, by Application

Figure 60: East Asia Market: Market Share Analysis, by Country – 2023 & 2033

Figure 61: East Asia Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 62: East Asia Market: Market Attractiveness, by Country

Figure 63: China Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 64: Japan Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 65: South Korea Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 66: South Asia & Pacific Market Value (US$ billion), 2018 to 2022

Figure 67: South Asia & Pacific Market Value (US$ billion), 2023 to 2033

Figure 68: South Asia & Pacific Market: Market Share Analysis, by Type – 2023 & 2033

Figure 69: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 70: South Asia & Pacific Market: Market Attractiveness, by Type

Figure 71: South Asia & Pacific Market: Market Share Analysis, by Application – 2023 & 2033

Figure 72: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 73: South Asia & Pacific Market: Market Attractiveness, by Application

Figure 74: South Asia & Pacific Market: Market Share Analysis, by Country – 2023 & 2033

Figure 75: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 76: South Asia & Pacific Market: Market Attractiveness, by Country

Figure 77: India Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 78: Association of Southeast Asian Nations Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 79: Oceania Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 80: Rest of SAP Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 81: Western Europe Market Value (US$ billion), 2018 to 2022

Figure 82: Western Europe Market Value (US$ billion), 2023 to 2033

Figure 83: Western Europe Market: Market Share Analysis, by Type – 2023 & 2033

Figure 84: Western Europe Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 85: Western Europe Market: Market Attractiveness, by Type

Figure 86: Western Europe Market: Market Share Analysis, by Application – 2023 & 2033

Figure 87: Western Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 88: Western Europe Market: Market Attractiveness, by Application

Figure 89: Western Europe Market: Market Share Analysis, by Country – 2023 & 2033

Figure 90: Western Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 91: Western Europe Market: Market Attractiveness, by Country

Figure 92: Germany Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 93: Italy Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 94: France Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 95: United Kingdom Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 96: Spain Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 97: BENELUX Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 98: Nordics Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 99: Rest of Western Europe Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 100: Eastern Europe Market Value (US$ billion), 2018 to 2022

Figure 101: Eastern Europe Market Value (US$ billion), 2023 to 2033

Figure 102: Eastern Europe Market: Market Share Analysis, by Type – 2023 & 2033

Figure 103: Eastern Europe Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 104: Eastern Europe Market: Market Attractiveness, by Type

Figure 105: Eastern Europe Market: Market Share Analysis, by Application – 2023 & 2033

Figure 106: Eastern Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 107: Eastern Europe Market: Market Attractiveness, by Application

Figure 108: Eastern Europe Market: Market Share Analysis, by Country – 2023 & 2033

Figure 109: Eastern Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 110: Eastern Europe Market: Market Attractiveness, by Country

Figure 111: Poland Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 112: Hungary Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 113: Romania Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 114: Czech Republic Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 115: Rest of Eastern Europe Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 116: Central Asia Market Value (US$ billion), 2018 to 2022

Figure 117: Central Asia Market Value (US$ billion), 2023 to 2033

Figure 118: Central Asia Market: Market Share Analysis, by Type – 2023 & 2033

Figure 119: Central Asia Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 120: Central Asia Market: Market Attractiveness, by Type

Figure 121: Central Asia Market: Market Share Analysis, by Application – 2023 & 2033

Figure 122: Central Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 123: Central Asia Market: Market Attractiveness, by Application

Figure 124: Russia & Belarus Market Value (US$ billion), 2018 to 2022

Figure 125: Russia & Belarus Market Value (US$ billion), 2023 to 2033

Figure 126: Russia & Belarus Market: Market Share Analysis, by Type – 2023 & 2033

Figure 127: Russia & Belarus Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 128: Russia & Belarus Market: Market Attractiveness, by Type

Figure 129: Russia & Belarus Market: Market Share Analysis, by Application – 2023 & 2033

Figure 130: Russia & Belarus Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 131: Russia & Belarus Market: Market Attractiveness, by Application

Figure 132: Balkan & Baltics Countries Market Value (US$ billion), 2018 to 2022

Figure 133: Balkan & Baltics Countries Market Value (US$ billion), 2023 to 2033

Figure 134: Balkan & Baltics Countries Market: Market Share Analysis, by Type – 2023 & 2033

Figure 135: Balkan & Baltics Countries Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 136: Balkan & Baltics Countries Market: Market Attractiveness, by Type

Figure 137: Balkan & Baltics Countries Market: Market Share Analysis, by Application – 2023 & 2033

Figure 138: Balkan & Baltics Countries Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 139: Balkan & Baltics Countries Market: Market Attractiveness, by Application

Figure 140: Middle East & Africa Market Value (US$ billion), 2018 to 2022

Figure 141: Middle East & Africa Market Value (US$ billion), 2023 to 2033

Figure 142: Middle East & Africa Market: Market Share Analysis, by Type – 2023 & 2033

Figure 143: Middle East & Africa Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 144: Middle East & Africa Market: Market Attractiveness, by Type

Figure 145: Middle East & Africa Market: Market Share Analysis, by Application – 2023 & 2033

Figure 146: Middle East & Africa Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 147: Middle East & Africa Market: Market Attractiveness, by Application

Figure 148: Middle East & Africa Market: Market Share Analysis, by Country – 2023 & 2033

Figure 149: Middle East & Africa Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 150: Middle East & Africa Market: Market Attractiveness, by Country

Figure 151: GCC Countries Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 152: Türkiye Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 153: Northern Africa Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 154: South Africa Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 155: Rest of Middle East & Africa Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 141: Middle East & Africa Market Value (US$ billion), 2023 to 2033

Figure 142: Middle East & Africa Market: Market Share Analysis, by Type – 2023 & 2033

Figure 143: Middle East & Africa Market: Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 144: Middle East & Africa Market: Market Attractiveness, by Type

Figure 145: Middle East & Africa Market: Market Share Analysis, by Application – 2023 & 2033

Figure 146: Middle East & Africa Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 147: Middle East & Africa Market: Market Attractiveness, by Application

Figure 148: Middle East & Africa Market: Market Share Analysis, by Country – 2023 & 2033

Figure 149: Middle East & Africa Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 150: Middle East & Africa Market: Market Attractiveness, by Country

Figure 151: GCC Countries Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 152: Türkiye Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 153: Northern Africa Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 154: South Africa Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Figure 155: Rest of Middle East & Africa Market Absolute $ Opportunity (US$ billion), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Designer Sneaker Market Forecast Outlook 2025 to 2035

Design Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

PCB Design Software Market Analysis by Component, Deployment, Application, and Region Through 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Reference Designs Market Growth - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Packaging Design And Simulation Technology

Electronic Design Automation (EDA) Market

Second Hand Designer Shoes Market Trends – Growth & Forecast to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

SRAM and ROM Design IP Market Report - Growth & Industry Analysis 2025 to 2035

AI & AR-Powered Construction Design Apps for Seamless Planning

Computer-aided Design (CAD) Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AI In Packaging Design Market Size and Share Forecast Outlook 2025 to 2035

Cloud Electronic Design Automation (EDA) Market by Product Type by Vertical & Region Forecast till 2035

Civil Construction Design And Detailing Engineering Market Size and Share Forecast Outlook 2025 to 2035

Advanced Mobile UX Design Services Market Outlook 2025 to 2035

Intelligent Virtual Store Design Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA