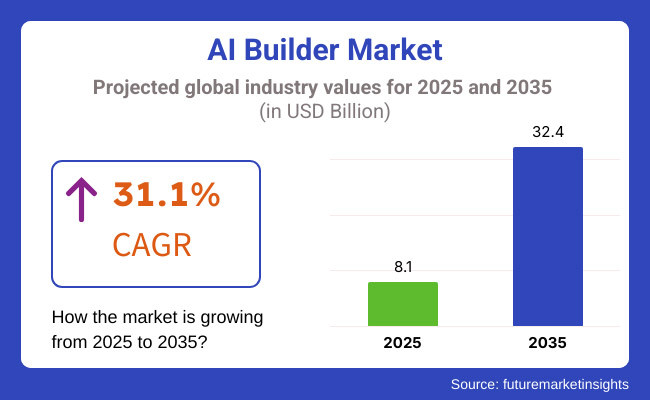

Market of AI Builder will grow at a headlong pace in 2025 to 2035 because AI-based products will keep on growing in emerging and emerging importance in finance, healthcare, retail, and manufacturing sectors. The market will grow from USD 8.1 billion in 2025 to USD 32.4 billion in 2035 with a compound annual growth rate (CAGR) of 31.1% in the forecast period.

Increasing demand for low-code/no-code AI platforms, business application of AI, and standalone AI development platforms is fuelling market growth to a large extent. Natural language processing (NLP), machine learning (ML), and computer vision are revolutionizing, but AI developers are also leading the democratization of AI adoption in business environments. Increased demand for economical AI solutions and uses of AI-driven automation across business functions is also driving market growth.

Government initiatives in digitizing and promoting AI, and investment in the development of AI-as-a-Service (AIaaS) is also accelerating the growth of the market. Other drivers that are also influencing AI builder platforms to develop and become economical are also partnerships between organizations, cloud providers, and AI software companies.

Strategic issues are data privacy, explainability of AI models, and computational cost. Explainable AI (XAI), ethics-constrained AI design, and power-constrained AI models dominated the market owing to such issues and ethics-constrained uses of AI.

Explore FMI!

Book a free demo

North America occupies the first rank in providing AI Builder market share as artificial intelligence is being heavily utilized to make businesses automated, process data, and develop apps. The United States of America and Canada rank as the primary nations in the continent where enterprises and start-ups have launched AI-related technology to gain maximum work productivity and digitalization.

Market among the adopters in the finance sector, health sector, retail trade sector, and manufacturing sector is slowly moving towards the machine learning innovation platform, natural language processing innovation platform, and cloud computing innovation platform. Regime of regulation by the FTC and law enforcement support can be bought as data privacy commitment, and ethically moral use of AI that requires market drivers. Challenges to large-scale adoptions include resistance to AI bias, data protectionism, and deployment cost.

Europe is a rapidly growing AI construction industry with strong growth in the United Kingdom, France, and Germany, with digitalization, regulation, and AI automation on the agenda. Ethical AI construction and General Data Protection Regulation (GDPR) compliance in the European Union is fuelling AI adoption.

Smart manufacturing, consumer service, fintech, and corporate software lead marketplace expansion with increased use of AI creators. AI influences policymaking through controlled information openness, accountability through algorithms, and enabling use of AI technology. Corporate innovation in Europe in AI with security, understand ability, and compliance guarantee in the face of changing regulations enable market development.

Asia-Pacific is the hotbed of activity for AI Builder business and where digital transformation is happening at neck break speed, government-sponsored AI research, and encouraged AI adoption of AI technology is happening in China, Japan, South Korea, and India. AI-powered automation of e-commerce, smart city, and manufacturing is seeing unprecedented scale with deep learning, robotics, and edge computing technology advancements.

The area has a growing tech sector and affordable AI development software in massive numbers to be utilized by numerous various industries. However, there are still pending cases of AI ethics, intellectual property rights conflicts, and data sovereignty conflicts and yet the necessity to become agile to render litanies agile. Cloud AI, AI innovation, and borderless AI collaborations are shaping the future market trends theme, fuelling next-generation AI builder technology investments.

Challenge

Difficulty of Integration and Adoption Constraints

AI builder market is faced with the challenge of embedding AI solution into business. Cost of deployment, AI skills gap, and legacy support are the biggest constraint to most organizations in most cases. Data privacy, legal, and ethics of employing AI are some of the other constraints associated with other matters. They can be addressed by offering AI development platforms, improved interoperability, and infrastructure support across to enable industries to deploy AI without disruption.

Opportunities

Rise of No-Code and Low-Code AI Platform

Increasing needs for easy-to-consume AI solutions accelerated the growth of no-code and low-code AI builder platforms at a greater rate. Small, medium, and enterprise companies now develop AI-powered applications with minimal technical expertise, breaking AI adoption barriers in all industries. This, thus, auto-machine learning (AutoML) and AI-fueled workflow optimization also continue to liberate business agility and decision-making, opening immense space for AI builder growth.

AI builder market developed at a quicker rate in 2020 to 2024 because increasing demands for digitalization and automation were there. The technical problems and problem of bias in AI were hindering massive growth in the market. The companies attempted to make AI products easier and offer more transparency in AI-decisions in an effort to keep these problems under control.

With forward to 2025 to 2035, AI developers will be even more intuitive with even greater presence of generative AI, NLP, and AI democratization. With the coming of AI working in terms of more mass-market business requirements with the emergence of AI copilots, regulation frameworks for making AI accountable, space will also continue to evolve. Decentralized model structure of AI and federated learning will also continue to influence data protection as well as data privacy in AI solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emerging AI governance and ethical concerns |

| Technological Advancements | Growth in AutoML and deep learning frameworks |

| Industry Adoption | Early adoption in tech-driven enterprises |

| Supply Chain and Sourcing | Dependence on cloud-based AI solutions |

| Market Competition | Dominance of major AI platform providers |

| Market Growth Drivers | Increasing demand for AI-driven automation |

| Sustainability and Energy Efficiency | Focus on optimizing AI training efficiency |

| Integration of Smart Monitoring | Limited AI model monitoring tools |

| Advancements in AI Innovation | Early-stage development of no-code AI tools |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global AI regulations and standardized ethical AI frameworks |

| Technological Advancements | Expansion of generative AI, NLP-driven AI builders, and real-time AI model training |

| Industry Adoption | Mainstream adoption across all industries with AI-powered decision-making |

| Supply Chain and Sourcing | Rise of edge AI and decentralized AI models for enhanced privacy |

| Market Competition | Growth of open-source AI builders and industry-specific AI solutions |

| Market Growth Drivers | Widespread adoption of AI copilots, workflow automation, and AI-driven business intelligence |

| Sustainability and Energy Efficiency | Adoption of green AI models and energy-efficient AI processing |

| Integration of Smart Monitoring | AI-powered self-learning and auto-improving models for real-time optimization |

| Advancements in AI Innovation | Fully autonomous |

The USA AI Builder marketplace is evolving on an unprecedented scale with pervasive AI-driven automation, cloud-based AI building platforms, and increased investment in AI infrastructure. Innovative hotbeds such as Silicon Valley, New York City, and Seattle are witnessing out-of-control expansion as companies and start-ups implement AI for business analytics, workflow automation, and predictive analytics. Expansion in low-code/no-code AI platforms is also generating demand, enabling businesses to create AI solutions without depending on huge programming capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 31.0% |

UK AI Builder market is growing steadily on the back of government push in AI research, business adoption in AI, and development in machine learning automation. London, Manchester, and Cambridge are at the forefront of the AI innovation wave, and large corporations and startups are tapping into AI builders in fintech, health, and smart automation. Using AI for business processes and digitalization fuels market growth at an extremely rapid rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 30.2% |

EU AI Builders market is growing well with robust regulatory backing, digitalization through AI, and a strong investor base for R&D in AI. Pioneering countries such as Germany, France, and the Netherlands are at the forefront of industrial applications of AI, robotics, and AI-driven automation in manufacturing, logistics, and banking sectors. EU emphasis on ethical AI and responsible AI is also influencing market forces.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 30.5% |

Japan's AI Builder market is growing with the development of industrial solutions, intelligent automation, and robotics. Large cities such as Tokyo and Osaka are seeing more adoption of AI-driven automation software, chatbots, and AI-driven decision-making platforms. Customer experience solutions driven by AI, voice-controlled AI, and machine learning-driven automation are also generating demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 30.8% |

The South Korean AI Builder market is picking up momentum with government AI initiatives, smart city development, and AI-driven business automation development. Seoul and Busan are becoming AI innovation centers, with firms employing AI builders to provide predictive analytics, NLP, and intelligent automation. Smart manufacturing, fintech, and digital transformation projects also drive AI adoption, further fueling growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 31.2% |

AI Builder market segments are growing enormously with organizations from all industries increasingly applying artificial intelligence to automate processes, streamline them, and engage with customers. AI builders offer platforms and tools by which organizations can build AI-powered applications with minimal programming knowledge. Growing demand for conversational AI, predictive analytics, and intelligent automation solutions is driving the growth of the AI Builder market.

As digital transformation accelerates, AI creators are increasingly becoming a part of business processes, customer experience, and operational efficiency. Conversational AI and Predictive AI Spur Market Expansion as AI Embraces Its Role as Businesses' Main Operations Ally

Software developers of conversational AI and predictive AI software are two of the most potent industries in AI Builder's market, addressing increased demand for more sophisticated automation and data-driven solutions. Increased implementation of AI-based chatbots, virtual assistants, and predictive analysis solutions across industries has driven growth in these AI solutions.

Conversational AI systems simplify conversation, with real-time feedback, self-service customer support, and user interaction personalization. In contrast to rule-based chatbots, conversational AI uses NLP and ML technologies to improve context sensitivity and response accuracy. Conversational AI developers are being hired by increasingly more e-commerce, health care, bank, and telecommunications companies to automate customer support, decrease response times, and improve user experience.

With increased speech recognition, multilingual support, and sentiment analysis, the market for conversational AI builders will keep growing. Predictive AI developers are revolutionizing decision-making with big data analysis and machine learning algorithms.

The predictive AI platforms review past records, detect trends, and generate forecasting insights to allow businesses to predict trends, reduce risks, and optimize strategies. Unlike traditional analytics platforms, predictive AI builders allow businesses to make real-time decisions, which help them respond to market trends. Predictive AI is being employed by the banking and finance sectors, healthcare, manufacturing sectors, and retail sectors on a massive scale to enhance fraud detection, supply chain management, targeted marketing, and disease diagnosis.

Growing usage of AI business intelligence suites and automated analytics platforms is fueling demand for predictive AI builders to become an integral part of business as usual. As there is ongoing innovation in AI technologies, conversational AI and predictive AI developers will experience massive uptake across industries. Research indicates that more than 70% of businesses are investing in AI-based automation technology to enhance productivity, reduce costs, and enhance customer experience.

With data privacy, appropriate use of AI, and bias in AI models being areas of concern, developers are mitigating these issues through emphasis on open AI algorithms, ethical standards of AI, and robust security measures to regulate proper use of AI and continuous market innovation. Cloud-Based AI Deployment Takes Off as Businesses Adopt Scalable AI Solutions

AI developers are being implemented through cloud-based and on-premises solutions, and cloud-based deployment of AI is witnessing heavy demand because it offers scalability, is cost-saving, and integrates seamlessly. Enterprises are adopting cloud-based AI developers more and more in order to harness the capabilities of state-of-the-art AI solutions without having to spend millions of dollars on infrastructure.

Unlike on-premises deployment, cloud deployment does not involve huge hardware deployments and maintenance, which allows companies to concentrate on AI-driven innovation. AWS, Microsoft Azure, and Google Cloud have come up with AI builder platforms that allow easy creation of AI models, deployment, and management with minimal technical knowledge. Growing adoption of cloud computing and growing demand for AI-powered automation are driving growth in cloud-based AI builders.

Banking, retail, healthcare, and education industries are using cloud-based AI platforms to improve customer experience, automate, and enable digital transformation. On-premises AI builders, providing more control and security on data, are gaining traction mainly among organizations with stringent data privacy compliance mandates and industry-specific regulatory mandates.

Unlike cloud deployment, on-premises deployment of AI demands high infrastructure investment, regular maintenance, and in-house technical expertise. In spite of all these hindrances, government, defence, and healthcare sectors still value on-premises AI developers so that they can maintain data confidentiality and regulation compliance. Hybrid AI deployment options, compromising the advantage of both on-premises and cloud AI solutions, are also emerging popular so that business houses can avail the optimum advantage of AI with no compromise over data security as well as business flexibility.

Cloud AI deployment will become trendy as businesses need scalable, cost-effective, and AI-powered digital solutions. Studies have revealed more than 80% of organizations are implementing cloud AI solutions in order to provide agility, automation, and decision-making. Notwithstanding this, data protection issues, AI governance, and reliability in the cloud are on the top list of priorities. Cloud AI solution providers are thus implementing next-gen encryption techniques, AI governance frameworks, and regulatory certifications to institute safe and moral AI.

Rising demand for AI Builder offerings across various industries such as automation, predictive analysis, and workflow improvement is fuelling quick growth in the market.

Growth in the market is being spurred by digital transformation, greater dependency on AI-driven decision-making, and demand for scalable AI-driven automation solutions. AI-driven process automation, low-code/no-code AI platforms to develop, and machine learning-based insights are most heavily invested upon by businesses to drive business efficiency and innovation. Market players consist of AI platform providers, automation software providers, and cloud-based AI service providers with industry-specific AI solutions for different industry applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft AI Builder | 20-25% |

| Google AI Platform | 15-20% |

| Amazon Web Services (AWS) AI | 12-16% |

| IBM Watson AI | 10-14% |

| Salesforce Einstein AI | 8-12% |

| Other AI Platforms (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft AI Builder | Provides a low-code AI platform for businesses to integrate AI-driven automation and predictive analytics. |

| Google AI Platform | Specializes in cloud-based AI and machine learning services for developers and enterprises. |

| Amazon Web Services (AWS) AI | Offers AI-driven cloud solutions, including deep learning, speech recognition, and automation tools. |

| IBM Watson AI | Develops enterprise-grade AI solutions with advanced analytics and cognitive computing capabilities. |

| Salesforce Einstein AI | Focuses on AI-powered CRM and business intelligence solutions to optimize customer interactions. |

Key Company Insights

Microsoft AI Builder (20-25%)

Microsoft leads the AI Builder segment with a low-code platform built-in to build AI within its Power Platform to enable firms to automate and make better decisions.

Google AI Platform (15-20%)

Google AI is a robust portfolio of cloud-based AI offerings based on machine learning, deep learning, and data analysis to introduce greater business intelligence.

Amazon Web Services (AWS) AI (12-16%)

AWS AI is cloud computing driven by AI, offering scalable automation and predictive analytics platforms to global companies.

IBM Watson AI (10-14%)

IBM Watson AI is enterprise-focused AI use cases with advanced machine learning and cognitive computing capabilities.

Salesforce Einstein AI (8-12%)

Salesforce Einstein AI brings CRM and business intelligence to allow organizations to leverage AI to improve customer interaction.

Other Key Players (25-35% Combined)

Future AI platform providers are introducing next-generation AI offerings, such as industry-specific AI applications, autonomous decision-making, and personalized AI experiences. They are:

The overall market size for the AI builder market was USD 8.1 billion in 2025.

The AI builder market is expected to reach USD 32.4 billion in 2035.

The AI builder market is expected to grow at a CAGR of 31.1% during the forecast period.

The demand for the AI builder market will be driven by increasing adoption of AI-driven automation, growing demand for low-code and no-code development platforms, advancements in machine learning algorithms, expansion of AI applications across industries, and rising investment in AI infrastructure.

The top five countries driving the development of the AI builder market are the USA, China, Germany, India, and Japan.

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Mobile Wallet Market Insights – Demand & Growth Forecast 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Push-to-Talk Market Trends - Demand & Growth Forecast 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.