The agricultural packaging industry is a fast-growing field where companies are developing robust, eco-friendly, and cost-effective products. Also, the increase in demand for packaging materials across the different sectors-such as food, seed, fertilizer, and pesticide-drives manufacturers towards smart biodegradable material, tamper-evident structures, and Nobile early. In addition to the above, these companies introduce automated machines, AI-driven quality inspection, and green materials used for production optimization, thus meeting regulatory standards.

The light and water-proof, fully recyclable packaging is something the industries will also adopt as a means of improving product protection and sustainability. It is shifting toward biodegradable films, RFID tracking, and high-barrier protective coatings to maximize efficiency and regulation.

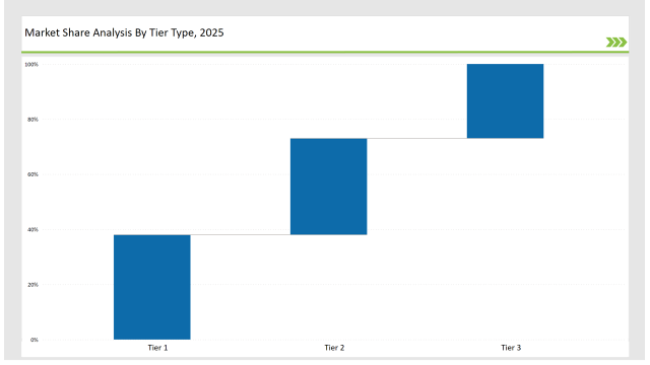

Amcor, Berry Global, and Mondi Group dominate Tier 1 players, capturing 38% market share through state-of-the-art manufacturing technology, worldwide supply networks, and innovative materials.

35% of market share is owned by Tier 2 players like Sonoco Products, Sealed Air Corporation, and ProAmpac, which focus more on individual custom packaging, extended shelf-life solutions, and sustainability.

Tier 3 accounts for 27% of the market and is composed of both regional and niche players, focusing on localized production, compostable packaging, and smart tracking solutions.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Berry Global, Mondi Group) | 17% |

| Rest of Top 5 (Sonoco Products, Sealed Air Corporation) | 12% |

| Next 5 of Top 10 (ProAmpac, Greif, DS Smith, Smurfit Kappa, Flex-Pack) | 9% |

The agriculture packaging industry supports multiple sectors that require product protection, sustainability, and regulatory compliance. Companies integrate smart tracking, AI-based defect detection, and bio-based materials to improve packaging performance and efficiency. Manufacturers enhance packaging designs to maximize durability and reduce environmental impact.

Manufacturers refine agriculture packaging solutions with smart labels, high-strength polymers, and UV-resistant coatings. AI-driven defect detection improves quality control and reduces waste. Companies develop tamper-proof sealing to enhance product safety. Firms integrate antimicrobial coatings to prevent contamination and extend shelf life. Manufacturers optimize lightweight packaging designs to reduce transportation costs.

Companies accelerate agriculture packaging innovations by adopting automated filling systems, AI-powered quality control, and recyclable materials. They refine lightweight yet durable designs to enhance sustainability and product integrity. Industry leaders implement smart packaging technology to improve traceability and reduce waste. Manufacturers develop advanced multilayer films to extend product shelf life. Companies integrate biodegradable coatings to enhance packaging sustainability. Firms implement laser-cutting techniques to increase precision in packaging design. Businesses explore smart sensors to monitor environmental conditions in transit. Industry leaders invest in predictive analytics to optimize logistics and reduce packaging costs.

Technology providers ought to focus on sustainability, automation, and security capabilities to enhance market growth. Working with food, seed, and agrochemical industries will encourage innovation and uptake. Organizations ought to invest in AI-based supply chain analytics to streamline logistics. Producers have to create intelligent sensors to track packaging conditions and maintain quality control.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Berry Global, Mondi Group |

| Tier 2 | Sonoco Products, Sealed Air Corporation, ProAmpac |

| Tier 3 | Greif, DS Smith, Smurfit Kappa, Flex-Pack |

Leading manufacturers enhance AI-driven production, sustainable materials, and smart tracking technology. They integrate lightweight, tamper-proof features to improve safety and durability. Companies develop cloud-based defect detection systems to optimize manufacturing efficiency. Firms implement blockchain technology to enhance supply chain transparency and prevent counterfeiting. Manufacturers adopt predictive maintenance systems to minimize downtime and improve operational efficiency.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Expanded biodegradable packaging production (March 2024) |

| Berry Global | Developed moisture-resistant smart labels (April 2024) |

| Mondi Group | Introduced high-barrier compostable packaging (May 2024) |

| Sonoco Products | Released AI-powered defect detection (June 2024) |

| Sealed Air Corporation | Innovated ultra-lightweight, durable films (July 2024) |

| ProAmpac | Strengthened tamper-evident pesticide packaging (August 2024) |

| Smurfit Kappa | Enhanced bulk packaging for agricultural feeds (September 2024) |

The market for agriculture packaging changes as businesses invest in automation, intelligent materials, and eco-friendly packaging. Businesses implement AI-based defect detection, lightweight materials, and tamper-evident functionalities to enhance product safety and productivity. Businesses embrace predictive analytics to maximize inventory management and minimize material loss. Companies create UV-resistant coatings to maximize durability and protect against degradation caused by long exposure to sunlight.

Manufacturers develop AI-driven customization, ultra-lightweight materials, and tamper-proof packaging. They refine recyclable and biodegradable films while integrating IoT-enabled smart tracking solutions to enhance functionality and reduce waste. Companies optimize barrier coatings to improve moisture resistance and product longevity. They enhance printing technologies to enable high-resolution branding and regulatory labeling. Manufacturers integrate automated filling and sealing solutions to improve production efficiency. Firms develop bio-based resins to replace petroleum-based materials in agricultural packaging. Businesses incorporate nanotechnology to reinforce packaging strength while maintaining lightweight properties. Companies implement machine learning algorithms to predict demand and optimize material usage.

Amcor, Berry Global, Mondi Group, Sonoco Products, Sealed Air Corporation, ProAmpac, Greif, DS Smith, Smurfit Kappa, Flex-Pack.

The top 3 players collectively hold 17% of the global market.

The market shows medium concentration, with top players holding 38%.

The industry faces challenges such as fluctuating raw material costs, increasing regulatory requirements for sustainability, and the need for continuous innovation in packaging materials and designs.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Ventilated FIBC Market Growth - Demand & Forecast 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.