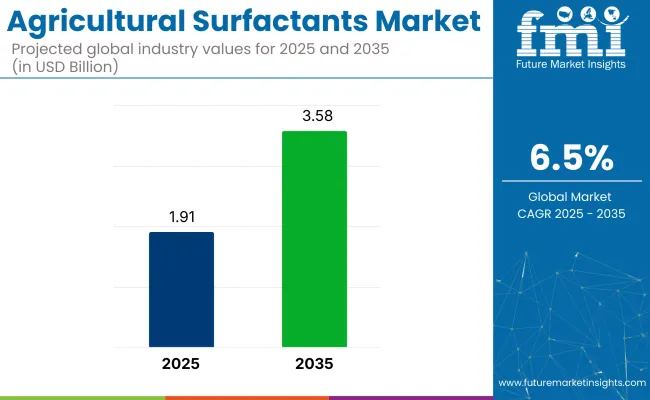

The global agricultural surfactants market is set to grow from USD 1.91 billion in 2025 to USD 3.58 billion by 2035, registering a CAGR of 6.5% during the forecast period.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 1.91 billion |

| Projected Industry Value (2035F) | USD 3.58 billion |

| Value-based CAGR (2025 to 2035) | 6.5% |

Growth in the industry is primarily driven by the increasing demand for efficient and eco-friendly solutions in crop protection and the rising need for improved agrochemical performance. Farming Surfactants are used to enhance the effectiveness of pesticides, herbicides, and fungicides by improving the spreadability and absorption of these chemicals on plant surfaces, which has become crucial in modern farming practices.

The agricultural surfactants industry holds a small but important share within its parent industry. In the broader agricultural inputs industry, surfactants account for around 2-4%, as they are a specialized component within fertilizers, pesticides, and other chemical inputs. Within the crop protection industry, surfactants make up approximately 5-7%, as they enhance the efficacy of pesticides, herbicides, and fungicides.

In the agrochemical adjuvants industry, farming surfactants comprise a significant portion, representing around 25-30% due to their role in improving the performance of agrochemicals. Within the biotechnology & specialty chemicals industry, surfactants hold around 3-5% as they are part of the broader category of bio-based and specialty chemicals. In the sustainable agriculture inputs industry, farming surfactants account for approximately 6-8%, driven by the demand for eco-friendly farming practices.

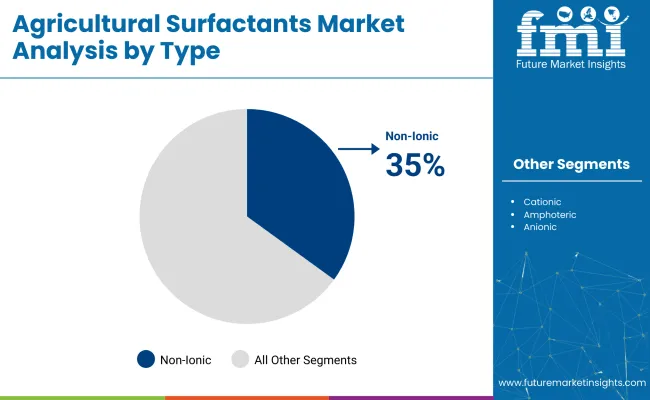

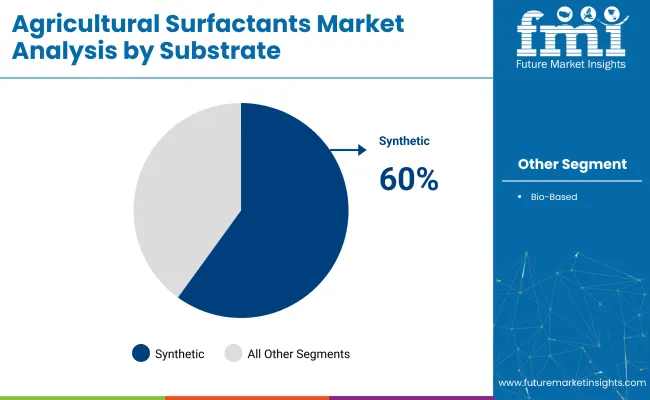

The market is segmented by type, application, substrate, and crop type. It is segmented by type into non-ionic, anionic, cationic, and amphoteric; by application into herbicides, insecticides, fungicides, and others; by substrate into synthetic and bio-based substrates; and by crop type into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. Industry analysis has been carried out in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic countries, and the Middle East & Africa.

Non-ionic surfactants are expected to capture 35% share by 2025. Their versatile properties, including the ability to mix with both oil and water, make them ideal for improving the performance of agricultural formulations, particularly herbicides.

Leading companies like BASF, Croda International, and DowDuPont are investing in eco-friendly, non-ionic surfactants to cater to the growing demand for efficient and environmentally sustainable agricultural products. Their ability to enhance spreadability and penetration is driving increased adoption in crop protection and pest control applications.

Herbicides are expected to capture 40% share by 2025. The use of surfactants in herbicides enhances the dispersion, absorption, and wetting properties, ensuring improved effectiveness in controlling weeds.

Companies like Syngenta, Bayer, and FMC Corporation are increasingly investing in surfactant-enhanced herbicides to meet the growing demand for more efficient and eco-friendly crop protection solutions. The trend toward eco-friendly agricultural practices and increasing demand for effective weed control solutions are further driving the adoption of surfactant-based herbicides.

Synthetic substrates are expected to dominate the industry, holding 60% of the industry share by 2025. These substrates are preferred for their cost-effectiveness, consistent quality, and excellent performance in various agricultural formulations, particularly in herbicides and pesticides.

Companies like BASF and Huntsman are at the forefront of developing synthetic substrates that meet the needs of modern agriculture. The increasing demand for higher crop yields and better protection against pests and diseases is expected to fuel the growth of synthetic surfactants in agriculture.

Cereals and grains are expected to account for 30% of the industry by 2025. Surfactants are used in crop protection products to improve the spreadability and effectiveness of pesticides, herbicides, and fungicides on cereals and grains.

Companies like Dow Chemical and Monsanto are focusing on developing surfactants to improve crop quality and yield. As demand for high-quality and high-yield grains continues to rise, the need for effective crop protection solutions, including surfactants, will contribute to the industry's growth.

The market is experiencing substantial growth, driven by the increasing demand for effective crop protection solutions and the adoption of eco-friendly farming practices. Surfactants enhance the efficiency of agrochemicals by improving their spreading, wetting, and penetration properties, leading to better absorption and effectiveness.

Market Growth Factors for Agricultural Surfactants

The agricultural surfactants industry is being driven by the increasing demand for effective crop protection solutions, the adoption of precision farming techniques, and the rise in global food demand. The need for eco-friendly products is also fueling the industry, as bio-based surfactants offer aneco-friendly alternative to traditional chemicals. The rise in government support for environmentally friendly agricultural practices is further pushing the growth of this industry.

Challenges in the Agricultural Surfactants Market

The costs associated with developing and manufacturing bio-based surfactants can be prohibitive, limiting their widespread adoption. Additionally, regulatory requirements for surfactant formulations in different regions increase operational complexity and cost. This, combined with competition from conventional synthetic alternatives, can limit the industry potential.

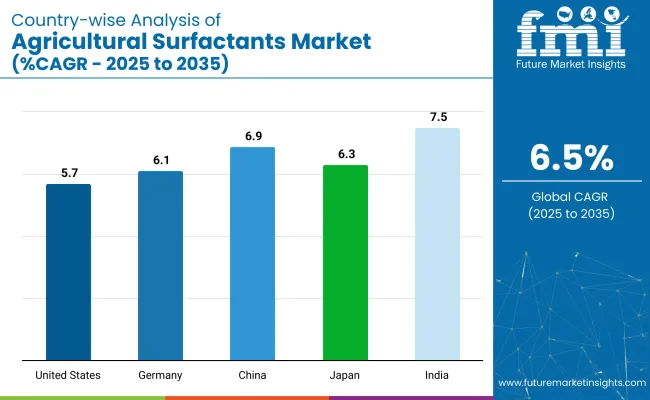

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

| Germany | 6.1% |

| China | 6.9% |

| Japan | 6.3% |

| India | 7.5% |

The agricultural surfactants industryis showing steady growth across OECD and BRICS countries. Among the OECD countries, the United States and Germany are experiencing moderate growth, with CAGRs of 5.7% and 6.1%, respectively. This growth is supported by increasing demand for eco-friendly agricultural practices and the rising adoption of surfactants in crop protection products.

Germany leads within the OECD due to its strong commitment to eco-friendly farming practices and regulatory frameworks that support eco-friendly products. In contrast, Japan shows 6.3% growth, driven by innovation in crop protection and environmental sustainability.

In the BRICS group, India stands out with a strong 7.5% CAGR, primarily driven by a rapidly expanding agricultural sector and growing demand for chemical-free crop management solutions. China, with a 6.9% CAGR, is showing moderate growth, influenced by increasing awareness of eco-friendly farming methods and the country’s large agricultural base. India’s growth highlights the shift in global demand towards emerging industrys, where there is increasing adoption of farming surfactants for eco-friendly farming.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

India is expected to grow at a CAGR of 7.5% from 2025 to 2035. The country’s rapidly expanding agricultural sector and increasing demand for eco-friendly farming practices are key drivers of this growth. With government initiatives promoting organic farming, the use of bio-based and chemical-free products is on the rise.

The farming surfactants industry is supported by the growing consumer awareness of eco-friendly farming practices, as well as innovations in product formulations. As the middle class grows, India is projected to become a leading industry for farming surfactants, contributing significantly to global demand.

The USA market is projected to grow at a CAGR of 5.7% from 2025 to 2035. Growth is fueled by increasing demand for eco-friendly farming practices and the use of surfactants in crop protection products. The USA is home to major agricultural companies focused on developing eco-friendly farming solutions.

Technological advancements in surfactant formulations enhance product efficiency in pesticide and herbicide delivery. The industry also benefits from consumer demand for natural ingredients in food production. The regulatory push toward eco-friendly agricultural solutions further supports the growth of the farming surfactants industry in the USA

German agricultural surfactants industry is expected to grow at a CAGR of 6.1% through 2035. The growth is driven by Germany’s focus on organic farming, sustainability, and the increasing demand for natural ingredients in crop management. The industry benefits from strong government regulations promoting eco-friendly farming solutions and clean-label products.

Local companies are increasingly adopting farming surfactants in crop protection, with a focus on reducing chemical usage. As the country maintains its leadership in European agriculture, the demand for farming surfactants continues to grow, contributing significantly to both local and international industrys.

The agricultural surfactants industry in China is projected to grow at a CAGR of 6.9% from 2025 to 2035. The industry is driven by a shift towards eco-friendly farming practices and increased demand for organic products. With government policies supporting green agriculture, China’s large agricultural base is adopting more eco-friendly solutions.

The growth is further fueled by rising awareness of environmental sustainability and the increasing demand for effective crop protection solutions. Innovations in agricultural technologies, such as the use of surfactants in precision farming, contribute to the expanding demand in the country.

Demand for agricultural surfactants in Japan is expected to grow at a CAGR of 6.3% from 2025 to 2035. Japan’s adoption of high-tech agriculture, coupled with the aging population and increasing focus on sustainability, drives demand for surfactants. These are used to improve crop protection products and efficiency.

The industry benefits from advancements in agricultural technology, such as precision farming, which optimizes the use of surfactants. The country’s focus on reducing chemical inputs and promoting eco-friendly solutions aligns with global trends, contributing to steady industry growth in Japan.

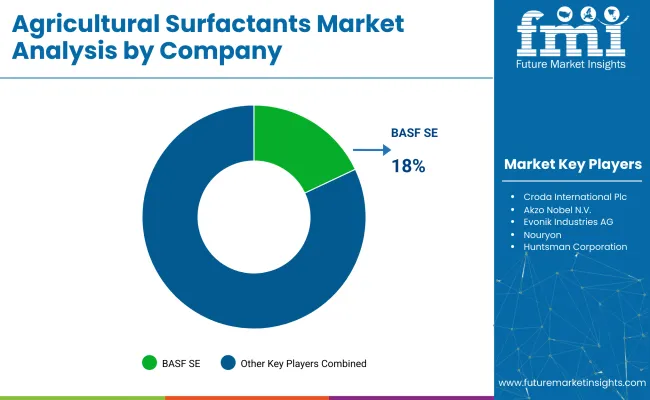

The agricultural surfactants industry is highly competitive, featuring dominant players, key contributors, and emerging firms. Leading companies such as BASF SE, Evonik Industries AG, Solvay S.A., and Clariant International Ltd hold significant industry shares, providing a wide range of surfactants for various applications in herbicides, fungicides, and insecticides.

Their position is supported by continuous product innovation, sustainability practices, and expanding distribution networks. Emerging players like Nufarm Ltd., Croda International Plc, Stepan Company, Helena Agri-Enterprises LLC, and Wilbur-Ellis Holdings, Inc. contribute to the industry's growth by offering specialized, bio-based surfactants, catering to the increasing demand for eco-friendly agricultural solutions.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.91 billion |

| Projected Industry Size (2035) | USD 3.58 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million liters for volume |

| Types Analyzed (Segment 1) | Non-ionic, Anionic, Cationic, Amphoteric |

| Applications Analyzed (Segment 2) | Herbicides, Insecticides, Fungicides, Others |

| Substrates Analyzed (Segment 3) | Synthetic, Bio-based |

| Crop Types Analyzed (Segment 4) | Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific (APAC), Middle East & Africa (MEA), Japan |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, South Africa, Saudi Arabia, UAE |

| Key Players | BASF SE, Dow Inc., Croda International Plc, Akzo Nobel N.V., Evonik Industries AG, Nouryon , Huntsman Corporation, Clariant AG, Solvay S.A., Helena Agri -Enterprises, LLC, Stepan Company, Wilbur-Ellis Company, Lamberti S.p.A. |

| Additional Attributes | Dollar sales, share by type and application, increasing demand for bio-based surfactants, rising use in organic farming, regional growth in herbicide applications, product innovations in surfactants for crop protection |

The industry is segmented into non-ionic, anionic, cationic, and amphoteric types.

Applications in the industry include herbicides, insecticides, fungicides, and others.

The industry is divided into synthetic and bio-based substrates.

The industry covers crop types such as cereals & grains, oilseeds & pulses, fruits & vegetables, and others.

The industry is geographically segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic countries, and the Middle East & Africa.

The industry is expected to reach USD 3.58 billion by 2035.

The industry is projected to grow at a CAGR of 6.5% from 2025 to 2035.

The synthetic substrate segment is expected to lead with a 60% share in 2025.

South Asia, particularly India, is expected to grow at a CAGR of 7.5%.

BASF SE leads the industry with an 18% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Lighting Market Forecast and Outlook 2025 to 2035

Agricultural Sprayers Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Fumigant Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Coatings Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Chelates Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tractors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Pheromones Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Adjuvant Market - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Microbials Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Gloves Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Activator Adjuvant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agricultural Testing Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Mapping Services Market Growth - Trends & Forecast 2025 to 2035

Agricultural Grade Zinc Chemicals Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Agricultural Food Grade Rubber Conveyor Belt Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA