Agricultural Sprayers Market Share Analysis Outlook From 2025 to 2035

The agricultural sprayers market in the world is expected to grow at 5.9% CAGR to reach USD 6,179.7 million in 2035. Rising precision farming, more mechanization of agriculture, and increasing adoption of advanced spraying technology are some key drivers of market growth.

Farmers around the world are shifting from manual spraying to automated and precision-controlled sprayers to increase efficiency, reduce pesticide use, and maximize crop protection. Integration of GPS-guided sprayers, drone-based aerial spraying, and AI-enabled smart sprayers is changing agricultural operations.

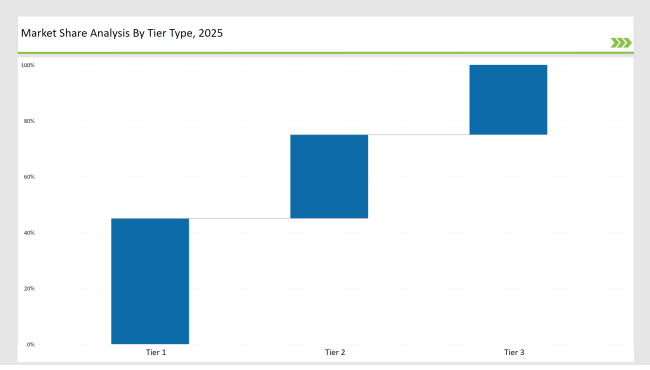

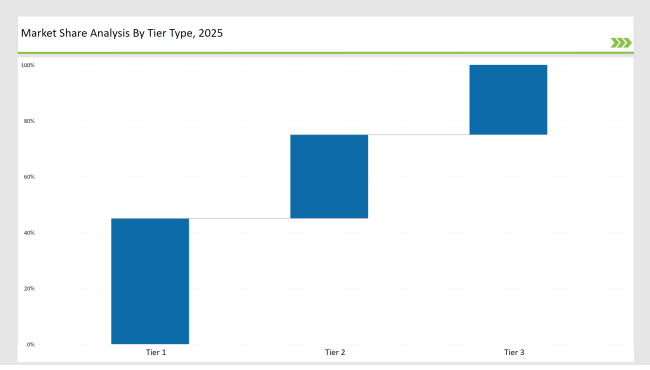

There have been moderate-level consolidations witnessed in the markets, with tier 1 operators such as John Deere and CNH Industrial, along with AGCO Corporation, holding onto 45 percent of the share. Among type, tractor sprayers hold market share of nearly 40% while by farms, large-farm size categories account for approximately 50%, as they more heavily rely upon mechanized solution for spraying requirement.

| Attribute |

Details |

| Projected Value by 2035 |

USD 6,179.7 million |

| CAGR (2025 to 2035) |

5.9% |

Explore FMI!

Book a free demo

Industry Landscape

| Category |

Industry Share (%) |

| Top 3 Players (John Deere, CNH Industrial, AGCO Corporation) |

32% |

| Next 2 of 5 Players (Kubota Corporation, Mahindra & Mahindra) |

38% |

| Rest of the Top 10 |

30% |

The market is fairly consolidated, with global players investing in automation, AI, and smart spraying technologies, while local players serve cost-conscious markets.

Segmental Analysis

By Type

- Tractor-Mounted Sprayers (40% Market Share): 40% of the market is dominated by the sprayers since they are the most efficient and versatile for broad-scale farming practices. The brands that dominate are John Deere and CNH Industrial with precision agriculture designed into GPS-integrated tractor-mounted sprayers.

- Self-Propelled Sprayers: Self-propelled sprayers, though low in capacity, are used widely for commercial farming and plantation agriculture. Such sprayers are apt for large farm applications due to their high coverage, automation, and advanced technology. AGCO Corporation and Kubota Corporation are known to develop self-propelled sprayers with AI-based crop health monitoring.

- Aerial Sprayers: High efficiency, precise targeting, and rugged terrain are some of the reasons why demand for drone-based aerial spraying is increasing rapidly. DJI and Yamaha Motor Corporation are leading the agricultural drone solution for aerial spraying.

- Trailed Sprayers: These are being used widely by mid-sized farms, which give a balance between cost and efficiency. Mahindra & Mahindra has trailed sprayers that are available at a price to suit the emerging markets.

- Handheld Sprayers: These are mostly required by small farmers for spot application. They continue to be in demand due to their low cost and simplicity. Regional companies maintain a market leadership position with low-cost products.

By Farm Size

- Large Farms (50% Market Share): Large farms produce high volumetric, technology-intensive sprays for efficiently and effectively expanding land under cultivation. Large farm buyers have GPS-guided, self-propelled sprayers as well as tractor-mounted ones from John Deere, CNH Industrial, and AGCO Corporation.

- Medium Farms: For middle-sized farms, the focus lies on medium-scale, mid-price sprayers where automation is paired with affordability. Kubota Corporation and Mahindra & Mahindra support this sector through mid-priced trailed and tractor mounted sprayers.

- Small Farms: Small-scale farmers prefer low price, handheld, and trailed sprayers, although entry-level drones are becoming more popular for focused spraying. Small-scale regional companies and agricultural cooperatives provide entry-level sprays at an economical price.

Who Shaped the Year?

Several key companies contributed to market advancements in 2024

- John Deere launched autonomous sprayers with AI-based crop analysis and real-time variable rate application.

- CNH Industrial launched smart self-propelled sprayers with cloud-based farm management integration.

- AGCO Corporation developed electrically powered sprayers with low fuel consumption and minimal environmental impact.

- DJI expanded its agricultural drone offerings, focusing on precision aerial spraying for small and mid-sized farms.

- Mahindra & Mahindra launched affordable trailed and handheld sprayers for emerging agricultural markets.

Key Highlights from the Forecast

- Tractor-Mounted Sprayers Lead Market Share: Tractor-mounted sprayers have 40% of demand due to big mechanization trends in agriculture

- Large Farms Drive Growth: A large farm occupies 50% of market demand because commercial farmhouses require an efficient spraying technology

- Smart Spraying Technologies Gain Traction: The trend of AI and GPS and in real-time sprayer monitoring can revolutionize the concept of precision agriculture.

- Rise of Aerial Sprayers: The increasing use of drones for targeted pesticide application is an emerging trend.

Tier-Wise Industry Classification

| Tier |

Examples |

| Tier 1 |

John Deere, CNH Industrial, AGCO Corporation |

| Tier 2 |

Kubota Corporation, Mahindra & Mahindra |

| Tier 3 |

Regional and niche players |

Market KPIs

- Precision Spraying & Automation: The demand for GPS, AI, and real-time monitoring systems is increasingly being adopted.

- Drone-Based Spraying Innovations: The agricultural drones are revolutionizing the efficiency of aerial spraying and crop management.

- Energy Efficiency & Sustainability: Manufacturers are now focusing on battery-powered and electric sprayers to reduce carbon footprints.

- Affordability for Small Farmers: Cost-effective solutions for small-scale agriculture have been a prime market driver.

Key Company Initiatives

| Company |

Initiative |

| John Deere |

Launched autonomous AI-driven sprayers for large-scale commercial farming. |

| CNH Industrial |

Established independent smart sprayers with remote cloud monitoring & automation.. |

| AGCO Corporation |

Launched electric-powered sprayers, sustainable and environment-friendly.. |

| DJI |

Added more products of agricultural drones for precise aerial spraying. |

| Mahindra & Mahindra |

Maintained low-cost trailed & handheld sprayers for entry-level agricultural economies. |

Recommendations for Suppliers

- Investment in Smart Spraying Technologies: Suppliers ought to focus on creating AI-driven smart spraying systems offering variable rate applications as well as real-time monitoring. The utilization of machine learning algorithms and high-tech sensors allows the sprayers to optimize pesticide and fertilizer usage, reducing waste while increasing crop protection. The use of precision spraying will improve efficiency, reduce environmental impact, and increase yields, making smart solutions an essential investment for future-proofed suppliers.

- Expansion in Agricultural Drone Products: The increasing popularity of Unmanned Aerial Vehicles as an efficient method of applying pesticides, replacing conventional ground-based methods, opens an opportunity for expansion in precision aerial spraying drones, which could rapidly cover a vast area with improved accuracy. The drones would save farmers chemicals that run off to the fields while reducing operation costs and maximizing effectiveness in applying the pesticide.

- Enhance Sustainable Sprayer Solutions: Sustainability is now center to the issue, with increased regulatory pressure on carbon footprints in agriculture. Suppliers will need to invest more into electric and hybrid-powered sprayers that reduce dependence on fossil fuels and emissions. It will not only meet environmental standards but be cost-effective and energy-efficient for farmers.

- Address Small and Medium Farmers: Small and medium-scale farmers of developing agricultural economies need affordable, easy-to-use sprayers. Suppliers should thus design economical solutions that are also user-friendly. Suppliers should keep in mind how to make solutions accessible and scalable in emerging markets.

Future Roadmap

The agricultural sprayers market is poised for a major overhaul, driven by automation, artificial intelligence, and sustainability. AI-integrated sprayers will utilize machine learning and sensor-based automation to make real-time decisions on pesticide application, minimizing waste.

Drones will revolutionize precision agriculture with targeted spraying, efficiency, and reduced chemical usage. This adoption will accelerate the transition toward sustainability with battery-powered and hybrid sprayers, which are environmentally motivated along with government incentives.

These green alternatives will reduce carbon footprint and overall operating costs but will optimize productivity. Moreover, IoT-enabled sprayers can be easily integrated with farm management systems to monitor them in real-time and adopt data-driven spraying techniques that optimize resource utilization.

By 2035, the agricultural sprayers market will be dominated by AI-driven, automated, and sustainable solutions, which will enable farmers to enhance efficiency, reduce costs, and maximize crop yields while promoting environmentally responsible farming practices.

Frequently Asked Questions

Which Companies hold significant share in the Agricultural Sprayers Market?

John Deere, CNH Industrial, AGCO Corporation holds significant share in the Agricultural Sprayers Market.

Which is the leading product segment in Agricultural Sprayers Market?

Tractor-Mounted Sprayers is the leading product which holds 40% of share in the segment.

How much share does regional and domestic companies hold in the market?

The regional and domestic companies hold 30% of the share in the market.

How is the market concentration assessed in the Agricultural Sprayers Market?

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

By farm size which type offers significant growth potential to market players?

Large Farm hold the biggest the biggest share of 50% offering significant growth potential to the market.