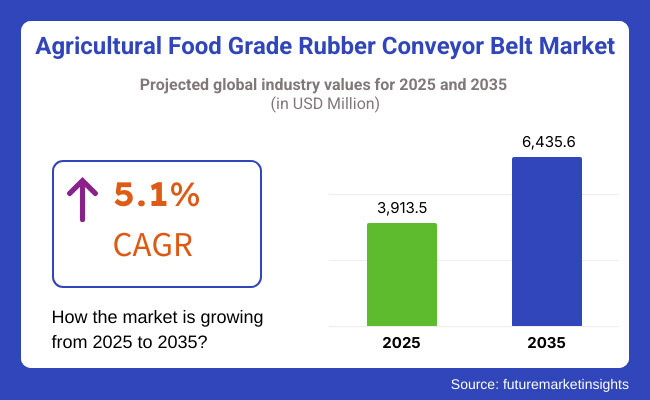

The agricultural food grade rubber conveyor belt market is projected to witness steady growth over the forecast period, with an estimated market size of USD 3,913.5 million in 2025, reaching USD 6,435.6 million by 2035 at a CAGR of 5.1%.

This growth is driven by the increasing demand for efficient material handling solutions in the agricultural sector, particularly in food processing, grain transportation, and packaging. The rising focus on food safety regulations and the need for contamination-free conveyor systems further fuel the adoption of food-grade rubber conveyor belts.

The agricultural food grade rubber conveyor belt market is on a significant upward trend with the modern farming and food processing industries adopting automation, efficiency, and food safety as their primary concerns. Conveyor belts are primarily used in agriculture to increase efficiency, from harvesting and sorting to packing and shipping.

Population growth and urbanization drive the trade-off between food and resource allocation, which induces more investments in agricultural equipment thereby boosting the market. Concerning contamination and food handling laws which are set by the government have motivated the installation of FDA and EU-compliant food-grade rubber conveyor belts, thus ensuring the market's continuity, and long-standing prosperity.

The market is influenced by various factors, such as technological breakthrough, improvement in the level of automation in agricultural food-processing, and the introduction of stringent food safety regulations. Food-grade rubber conveyor belts are primarily instrumental in maintaining hygiene in agricultural applications, which includes stopping contamination and enhancing productivity.

The agricultural food-grade rubber conveyor belt market has a very quick development with farming and food processing moving towards the automated trend. This type of belt is used for the hygienic, efficient, and rapid transportation of grains, fruits, vegetables, and dairy goods thereby minimizing the risks of contamination.

The application of the Precautionary Hazard Analysis Critical Control Point (HACCP), the Food and Drug Administration (FDA), and the European Union (EU) norms has made food producers go for non-toxic wear-resistant rubber conveyor belt. The introduction of new technologies such as antimicrobial and oil-resistant rubber materials is also enhancing product life.

Moreover, the transformation to sustainable, biodegradable rubber conveyor belts is a new opportunity for people. The increasing trend of food supply globalization and agricultural trade is creating a strong demand for quality long-lasting conveyor solutions which will in turn promote the market for the next ten years.

Explore FMI!

Book a free demo

Technology and strict food safety policies steer the North American agricultural food-grade rubber conveyor belt market forward. The USA and Canada processing industries that are mainly engaged in the agricultural sector are the biggest players operating complex mechanisms in a need of reliable and cost-effective conveyor systems for handling and processing of various goods like grains, fruits, and dairy products.

The FDA and USDA policies suggest the use of non-toxic, wear-resistant, and easily cleaned conveyor belts in food production plants. There has also been a spurt in the food processing sector, which is further pushing the demand for durable and food-safe rubber conveyor solutions.

Besides, the shift towards the adoption of sustainable agricultural practices and organic food production has led to the use of biodegradable rubber conveyor belts. With continued investments in smart and precision agriculture, North America is still a principal market for conveyor belt manufacturers.

The European agricultural food-grade rubber conveyor belt market is experiencing growth due to the influence of the EU's strict food safety regulations and increased money put in green food processing technologies. Nations such as Germany, France, and the Netherlands have a competitive edge because of their active roles in establishing solid agriculture and food export industries.

The EU Regulation 1935/2004 regarding food-contact materials has mandated the manufacturers of conveyor belts to manufacture non-toxic, resistant to chemicals conveyor belts that are in line with the HACCP (Hazard Analysis and Critical Control Point) standards.

On top of that, the European Association of Food Producers is putting emphasis on energy efficiency and the use of biodegradable rubber materials as a way of looking after the environment. The increase in demand for more advanced and automated conveyor belts in the according to the latest trend of bakery, dairy, and meat processing in the sector, is what makes Europe a key market for food-grade conveyor belts.

In the Asia-Pacific region, agricultural food-grade rubber conveyor belts are registering high growth, as a result of the agricultural sector rapidly industrializing and the demand for food on the rise. These countries are China, India, and Indonesia, who are modernizing the food-processing facility in their battle with food supply both at home and abroad. Initiatives from the government focused on food security are driving the sector toward the food-safe conveyor belt adoption.

The agriculture mechanization trend is snowballing with the technologically driven operations in grain handling, fruit sorting, and dairy processing further boosting the market growth. The Industrial Cooperation program between countries on the "Belt and Road" is translating into heightened demand for high-quality conveyor systems. With the increasing number of smart farming technologies, the region is on its course towards becoming the fastest regional market for growth.

The market is gradually growing for the Rest of the World (RoW), such as Latin America, the Middle East, and Africa in terms of the adoption of agricultural food-grade rubber conveyor belts. Latin America led by Brazil and Argentina is a geographically advantageous location with a well-developed agribusiness sector which will drive the demand for conveyor systems, especially for grain handling and meat processing.

The activities in food import and export in the Middle East are booming which has increased the opportunities for the usage of food-safe conveyor belts in logistics and packaging. The market in Africa is at an early stage with the establishment of modern farming practices and food processing units that will enhance the cheap and quality belts demand. Though the financial burdens, and lack of infrastructure investments remain unfixed, the governments are creating food security through the implementation of new projects.

High Initial Investment Costs

One of the major predicaments that the agricultural food-grade rubber conveyor belt market is facing is the very high initial costs which are related to advanced technology. Small and medium-sized food processing plants, predominantly those which are situated in developing areas, often experience difficulties in the procurement of high-grade FDA-compliant conveyor belts because of financial constraints.

The costs that are related to the installation, repair, and change of food-grade rubber belts are massive and this is also another factor that hampers their buying. The customized conveyor systems are necessary for the functional and productivity needs of specific agricultural applications (dairy, grain handling, and meat processing) that add to the overall cost.

Even if the long-term paybacks of automation and efficiency are clear, a lot of agricultural sectors are reluctant to adopt the conveyor belt solution for various reasons, which in return delays the market entry; especially in countries with a bad financial situation like India, Africa, and Latin America.

Regulatory Compliance Complexity

Manufacturers and food processors face an alarming problem arising from the complexity of the regulatory compliance. Different areas have regional food safety and hygiene standards, which include the FDA and USDA regulations in North America, EU Regulation 1935/2004 in Europe, and the particular national safety guidelines in Asia-Pacific and Latin America.

Producers have to ensure that their food-grade rubber belts are non-toxic, chemical resistant, and meet the very strict migration limits which can be both time- and cost-consuming. Also, the frequent changes in food safety laws lead to compliance problems that require continuous product testing and reformulation.

For the global players, handling the various regional rules brings about operational difficulties, increasing R&D spending and slowing down the expansion of the market particularly in areas where food safety laws are changing quickly.

Rising Adoption of Automation in Agriculture and Food Processing

The increased trend towards automation in agriculture and food processing is a primary opportunity for the agricultural food-grade rubber conveyor belt market. The main focus of food production is scaling up and mechanization, therefore, manufacturers are opting for smart conveyor systems in order to achieve better efficiency, hygiene, and productivity.

Probable paths in terms of profits are provided by smart conveyor belts designed for the internet of things helping producers keep quality under control and reduce food wastage. In developed economies like North America and Europe, the capital that's being injected into Industry 4.0 and intelligent agricultural solutions is contributing to the demand for technology belt upgrades.

On the other hand, the rising economies like India and China are availing themselves of government support in the purchase of new machines to accelerate the modernization of the processing facilities with scrolling up the automation trend.

Development of Antimicrobial and Biodegradable Rubber Conveyor Belts

Sustainability and food security are key drivers behind the development of antimicrobial and biodegradable rubber conveyor belts which can be great opportunities for the market. The manufacturers are looking for innovative technological breakthroughs in the fight against food processes being contaminated by the bacteria.

The gents for the eco-green, biodegradable rubber belts, which are on the rise as environmental laws are tightening down on Europe and North America, obliterate the image of companies investing in natural rubber-based non-toxic conveyor belts as winners in markets with greener production.

The growth of organic farming and the increased production of organic foods will ensure that the belts which are environmental and food safety standards compliant will be more in demand, hence, they will provide significant growth opportunities.

The evolution of the agricultural food grade rubber conveyor belt market is very visible in the years of 2020 and 2024. The fear concerning food safety, the regulatory framework that is becoming stricter, and the technical progress in material science determine the availability of conveyor belts that are of high quality for the handling and processing of food. During that time, the sector was primarily made up of synthetic rubber belts, which were introduced as those having a longer lifetime and an outstanding record of hygiene.

Automating agriculture will power the market's growth in manufacturing due to the emphasis on environmental sustainability regulations and the need for food to be transported without the risk of contamination. For sure, we will see the usage of new materials like biodegradable and sustainable ones again and STEAM conveyor systems mixed with IoT-enabled devices will handle the tasks efficiently.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of food safety standards such as FDA and EU 1935/2004 for rubber conveyor belts. |

| Technological Advancements | Introduction of synthetic rubber belts with antimicrobial properties and high durability. |

| Industry-Specific Demand | Demand driven by large-scale farming and food processing industries. |

| Sustainability & Circular Economy | Initial efforts to reduce environmental impact by limiting the use of hazardous substances. |

| Market Growth Drivers | Growth fueled by expanding food processing industries, rising food safety concerns, and global agricultural mechanization. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter global regulations on material composition and sustainability requirements for eco-friendly belts. |

| Technological Advancements | Development of biodegradable, recyclable belts and IoT-integrated monitoring for real-time efficiency tracking. |

| Industry-Specific Demand | Increased adoption in precision agriculture and automated food handling systems. |

| Sustainability & Circular Economy | Shift towards bio-based rubber belts, enhanced recycling, and closed-loop manufacturing processes. |

| Market Growth Drivers | Market expansion driven by automation, sustainability initiatives, and the demand for cost-effective, long-lasting conveyor solutions. |

The United States or USA, is a region and market that is continuing to grow (about 4.8% CAGR through 2025 to 2035 period), is uplifted by different factors/documents namely rising automation in food processing, business-related FDA regulations, and also the sustainability trends i.e. mechanization in granary handling, dairy, and fresh produce logistics. The main driver of demand for high-quality conveyor belts is mechanization in grain handling, dairy, and fresh produce logistics.

The trend of opting for bio-based, low-VOC rubber materials, is in sync with sustainability goals. Manufacturers are being persuaded to come up with inventions such as nylon belts that are both strong and harmless to the environment, by the rules of food safety compliance. Despite the maturity of the market, the inventive antimicrobial coatings and temperature-resistant belts are ensuring the constant demand.

Also, the high labor costs are the root cause of the problem, where automation in food supply chains is being accelerated which in turn helps in the adoption of automation. The USA market is expected to grow at a compound annual growth rate (CAGR) of 4.8% between 2025 and 2035, which is slightly lower than the global average of 5.5% because of regulatory costs but is also driven by technological progress.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The UK conveyor belt market is showing a strong potential for growth after the recovery of the supply chain in the post-Brexit period with increasing demand for high-quality materials and solutions from the food industry where automation is becoming the norm. The rate of introduction of clean, disinfectant-resistant conveyor belts is increasing, particularly in the meat, dairy, and bakery sectors.

Manufactures are driven by the need for sustainable materials which is being upheld by concerns about the environment. Ongoing issues of labor shortages in warehouses are giving rise to more automation in food logistics, packaging along the lines of conveyor belts which in turn is the most preferred choice.

However, post-Brexit, the minor challenges present such as economic uncertainties and unpredictable import/export policies. The UK market is likely to achieve a CAGR of 5.0% (2025 to 2035) backed by food safety, production efficiency, and sustainable material investments despite regulatory and economic changes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

The high demand for the EU market is a consequence of the EFSA food safety regulations and sustainability initiatives that necessitate compliance with tough requirements. The conveyor belt producers are facing high demand for durable and sturdy conveyor belts as Germany, France, and the Netherlands are progressing in food processing automation the fastest. The trend of using bio-based and antimicrobial materials not only goes along with the green policies but also supports the objectives of the circular economy.

The increase in food logistics and warehousing automation also contributes to the further demand for these items. Along with the increased food exports, the need for efficient processing and packaging comes into the picture, hence the market expansion is consolidated.

The EU market is expected to develop at a CAGR of 5.3% (2025 to 2035), which is slightly higher than the global average, and the things which will help are sustainability regulations, more automation, and the increase in food exports.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

Japan's market is technologically advanced, exhibiting automation in food processing, strictly follows hygiene standards, as well as embraces technological innovations in conveyor belts. The antibacterial-coated and precision-engineered belts are in very high demand as they help to minimize the contamination risks. The decrease in personnel due to the aging workforce in the food supply chains is further convincing companies to adopt conveyor belts, the main focus of Japan's on food quality with proper packaging.

The only and very small concerns about the expansion of the market are the very high costs of state-of-the-art conveyor systems and the limited labor force available in the agricultural sector despite the benefits of automating.

The Japanese market is likely to grow at a CAGR rate of 4.7% during 2025 to 2035, just a little less than the global standard, and stay stable due to automation, food safety concerns, and technological improvements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The market in South Korea is on the rise as a result of adhering to rigorous food safety rules, targeting the global market for food production, and the growing trend of automation in agriculture. Investments in the internet of things (IoT) in smart farming and automated food processing plants are two of the major growth drivers. The seafood, grain, and meat sectors look for high-grade, hygienic conveyor belts that can resist wear and tear.

What is more, the increase in demand for food processing that uses high efficiency is a government initiative that is also contributing to the solution. At the same time, the continuous rise in labor costs encourages manufacturers to add integrated conveyor belt systems to their production lines making it easier to increase both productivity and hygiene.

In South Korea, the most likely market is with a CAGR of 5.5% (2025 to 2035) which is expected to grow beyond the global average due to the government's strong backing of smart agriculture and food processing automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

White Food Grade Rubber Conveyor & Elevator Belt Dominates Due to Hygiene Compliance

The white color of food-grade rubber conveyor belts, especially those made from rubber, is largely associated with hygiene compliance and is thus the most dominant among them. White food-grade rubber conveyor belts are now considered the premium choice in agricultural operations because of their impressive hygiene rating and their adaptation to food safety regulations such as FDA and EU guidelines.

The belts are non-toxic & odorless, moisture-resistant, and the growth of bacteria is also a problem with them. They are used in the handling of fresh products, grains, and dairy products. Non-marking types of conveyor belts ensure there is no contamination, and the food safety issue till the supply route is not there.

Request for white food-grade rubber conveyor belts is reporters in the machinery sector where cleanliness and the materials have the utmost importance. In view of the increase in organic and clean-labeled foods that consumers are looking for, it is expected that the implementation of these belts will become even more widespread. The belts are particularly used in North America and Europe which have stringent food safety regulations.

Green Food Grade Rubber Conveyor & Elevator Belt Gains Popularity for Durability and Versatility

The green food-grade rubber conveyor belts are one of the belts that are made of recycled materials showing the green of the color that they are environmentally friendly. The use of green food-grade rubber conveyor belts is significantly increased mainly due to their extremely high reliability and stage to reduced waste.

Green food-grade rubber conveyor belts are the hottest right now because they are quite practical and long-lasting. Farmers use this kind of machinery where they need more human power on planting, harvesting crops, and moving materials. It can be seen from the fruit, vegetable, and food processing industry belt, which has an excellent oil, and grease technicality. They are oil and grease-resistant therefore they are suitable for handling fruits, vegetables, and processed food items.

The green color helps to separate different belt applications in the facilities, which enhances safety and operation efficiency. The countries that are situated in the Asia-Pacific region and Latin America are experiencing a rapid growth in the demand for green food-grade conveyor belts as a result of the mechanization of agriculture and food processing industries. Besides reducing start-up time, the emphasis on making agricultural processes more efficient is expected to give rise to a gradual increase in the demand for these belts.

Harvesting Equipment Drives Demand for Durable Conveyor Belts

The agricultural sector is one of the main areas of application where food-grade rubber conveyor belts are used, and harvesting machinery is one of the most significant applications. These belts are used in farmers' vehicles such as combines and harvesters and they simplify the work of collecting, sorting, and transporting crops like wheat, corn, and fruits to storage facilities.

As these belts are used in tough working environments, they must have high tensile strength, elasticity, and resistance to environmental factors such as moisture and UV rays. The propulsion of mechanized techniques in farming, especially within regions as North America and Europe, keeps on leading to the increased demand for the durable food-grade rubber conveyor belts.

New inventions in belt materials, for example, reinforced synthetic fibers and antimicrobial coatings are also responsible for this fact. This helps in making longer-lasting conveyor belts and therefore, there is a reduction in the frequency of replacements that in turn lead to lower maintenance costs.

Processing Equipment Segment Dominates with a Focus on Food Safety

Food-grade rubber conveyor belts are mainly applied in processing equipment that has the largest area of applications and it is through this application that the belt directly interacts with food quality and hygiene compliance. In food processing plants, these belts manage the raw materials, the sorting of produce required, and the transportation of semi-processed and wrapped food products. White food-grade rubber conveyor belts are preferred based on their good properties which are non-contaminating, easy cleaning, and resistance to microbial growth.

The demand for conveyor belts in processing equipment is going up due to the increasing obligation of the regulatory authorities related to food safety, particularly in developed markets. The need for conveyor belts with better temperature resistance and anti-static properties has expanded, promoting the selling of high-performance conveyor belts as well as the climatic conditioning in the production field due to the automation of food processing facilities.

The Agricultural Food Grade Rubber Conveyor Belt Market plays a significant role in food processing, grain handling, and agricultural logistics. The market is going through positive progress thanks to the increased demands for food safety compliance, the adoption of automation in food production, and the need for hygienic material handling solutions.

Regulations, such as those from the FDA, EU, and the FSMA, are driving the need for high-quality and non-toxic rubber belts. Also, companies are concentrated on developing sustainable and antimicrobial rubber formulations that enhance the wear-and-tear resistance, temperature tolerance, and productivity. Moreover, the concerns about cross-contamination, hygiene standards, and efficiency in production are directing the industry to innovate new technologies hence conveyor belt designs are growing smarter and IoT monitoring systems are introduced.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 12-16% |

| Fenner Group | 10-14% |

| Ammeraal Beltech | 8-12% |

| Intralox | 7-10% |

| Habasit | 6-9% |

| Other Companies | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Produces high-durability rubber belts with FDA-approved coatings for food processing. Focuses on sustainable rubber solutions. |

| Fenner Group | Specializes in agriculture and grain handling conveyor belts with anti-microbial properties and moisture resistance. |

| Ammeraal Beltech | Develops heat-resistant and non-stick belts for food production lines, ensuring high efficiency and hygiene standards. |

| Intralox | Known for modular conveyor belts for the agri-food industry, providing customized automation solutions. |

| Habasit | Offers flexible, food-safe conveyor belts with energy-efficient designs to enhance processing efficiency. |

Key Company Insights

Continental AG

Continental AG is the world's leading manufacturer of conveyor belts, especially for applications in the food industry. The company is committed to producing abrasion-resistant, sustainable, and very efficient rubber belts to be utilized under extreme conditions in the food processing and agricultural sector. Continental's belts are FDA-approved and come with an antimicrobial coating, thereby ensuring safety in the transport of materials.

The company is working on bio-based rubber production as part of its green initiative. Networking with smart monitoring systems for belts that increase efficiency and decrease the time required for maintenance are other features.

The company achieved the announced targets not only by the production of temperature-resistant rubber belts but also through inventing and making custom solutions for grain handling and dairy processing, thus standing as a main competitive player in providing high-performance conveyor solutions.

Fenner Group

Fenner Group is a leader in the agriculture and food processing sector with a concentration on hygienic and durable belts. The brand is notable for its moisture-resistant, and anti-microbial rubber belts that guarantee food safety adherence. The introduction of woven belt technology at Fenner has improved the load capacity and efficiency, which subsequently lowered the energy use in grain and food transport.

Besides, Fenner teamed up with agricultural cooperatives and food processing plants to improve the flow of materials. The company has set a solid foundation in research and development to produce longer-lasting, high-performance belts fitting appropriate food safety controls. Hence the company is a reliable player in the agricultural belt conveyor industry.

Ammeraal Beltech

Ammeraal Beltech is the most prominent conveyor belt supplier to the food industry, with its know-how in heat-resistant and non-stick solutions dedicated to food processing and agricultural uses. The company comes up with solutions that respect hygiene standards while increasing productivity. Its closed-belt design jettisons the risks of cross-contamination for it to be certified as suitable for the prescripts demanding norms in the food industry.

Ammeraal is continuously working on the development of environmentally-friendly and energy-efficient belts, dealing with the ongoing pressure for sustainability. The most up-to-date innovations include temperature-resistant rubber compounds and lightweight belt materials for less energy consumption. Standing firmly on customization and industry-specific solutions, Ammeraal Beltech has become the number one option for food-safe conveyor systems.

Intralox

Intralox is the very first modular conveyor solutions’ provider that comes with the fit-and-food-grade belts to enhance the level of automation and efficiency at the same time. The company is clearly the forerunner in agri-food handling, focusing on sanitary belt designs which are in agreement with FSMA and HACCP standards.

The smart tracking technology of Intralox allows for real-time monitoring of the conveyors and the predictive maintenance regulation which help in cutting downtime and increasing processing accuracy. By channeling funds into AI-driven automation solutions, the company is consolidating its competitive footing.

New products on the market are the innovative easy-to-clean conveyor designs which will decrease the food contamination risk significantly. Using new styles and innovative methods, Intralox continues to both improve food processing and act as an industry leader in conveyor technology.

Habasit

Habasit is a key player and a worldwide leader in the provision of food-grade belting solutions with highly energy-efficient and top-quality conveyor belts made specifically for agriculture and the food processing industry. The company believes in durability, hygiene, and pertinence to the regulations, with the belts designed to function with various temperature and food textures.

And yet, Habasit is making investments in rubber formulations that are FDA- and EU-approved and are long-lasting. The innovations presented by the company include the release of lightweight, ultra-flexible belts which will ease handling and at the same time cut operational costs.

Alongside its customer-centric solutions, Habasit is also a strong partner who teams up with food processors all around the world to deliver conveyor systems that are tailor Engineered, thus ensuring relied power and performance for years down the road.

The global Agricultural Food Grade Rubber Conveyor Belt market is projected to reach USD 3,913.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Agricultural Food Grade Rubber Conveyor Belt market is expected to reach USD 6,435.6 million.

The White food grade rubber conveyor & elevator belt segment is expected to dominate the market, due to its higher bandwidth, longer transmission distances, lower attenuation, and superior signal integrity, essential for aerospace applications.

Key players in the Agricultural Food Grade Rubber Conveyor Belt market include Amphenol Corporation, TE Connectivity, Corning Inc., Radiall, OFS Fitel, LLC.

In terms of Product Type, the industry is divided into White food grade rubber conveyor & elevator belt, Green food grade rubber conveyor & elevator belt, Standard black rubber conveyor & elevator belt

In terms of Application, the industry is divided into Harvesting equipment, Processing equipment, Material handling & packaging equipment, Bottling equipment

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Power Tool Gears Market - Growth & Demand 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

External Combustion Engine Market Growth & Demand 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.