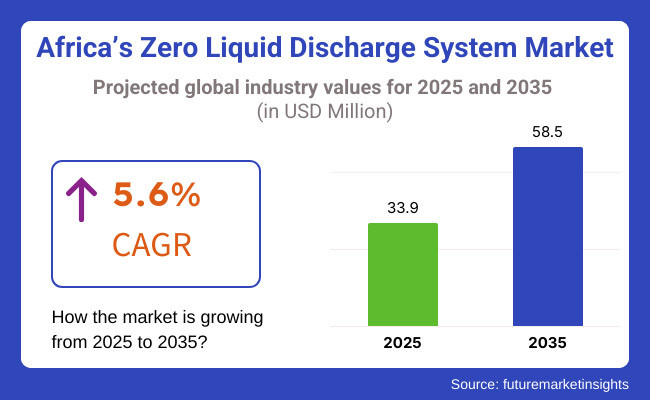

Africa’s Zero Liquid Discharge (ZLD) System Market will expand in a steady trend in 2025 to 2035 driven by water-saving technology, environmental protection, and treatment of industrial effluent. The market will expand from USD 33.9 million in 2025 to USD 58.5 million in 2035 at a compound annual growth rate (CAGR) of 5.6% during 2025 to 2035.

Growing need for green technology in water treatment, circular economy, and industrial level compliance is driving the market. Membrane filtration technologies, evaporation-crystallallization technologies, and energy-saving water plants are driving growth in the new role of ZLD systems as municipal and industrial wastewater treatment. Growing use of desalination processes, regulation guidelines, and water reuse programs are also driving growth.

Government policies of encouraging wastewater recycling and reuse, and investments in high-tech water treatment technology are also fuelling the market. Apart from that, joint efforts of environmental engineering companies, industries, and research organizations are also improving ZLD systems both economically and efficiently.

But something has to be done in a manner that satisfies high operating and capital costs, energy-consuming processes, and complex regulatory systems. Hybrid ZLD technologies, automated water treatment, and integration with renewable energy are where companies will be able to capitalize on the efficiency of systems and sustainability to the maximum extent possible.

Explore FMI!

Book a free demo

The North African market is a promising one for Zero Liquid Discharge (ZLD) technology with growing water scarcity, industrialization, and government policy to reduce the discharge of wastewater into the environment. Egypt, Algeria, and Morocco are adopting ZLD technology in a bid to increase the sustainability of water use in their oil & gas, textile, and electric power sectors.

Global partnership and public-private collaborations are driving demand for high-technology crystallization evaporative technology, reverse osmosis, and high-technology filtration across the world. High energy consumption and expensive operation of ZLD plants are restraining global adoption, though. Water-conserving techniques and green legislations will drive domestic development.

Sub-Saharan Africa is providing one-of-a-kind development opportunities to the ZLD industry, and this is further fueled in South Africa, Nigeria, and Kenya on the industrialization and urbanization platform that spur demands for effective wastewater water treatment. Mining, chemical, and beverages are among the biggest consumers of ZLD technology in sub-Saharan Africa.

Governments and ecologists are imposing strict water discharge regulations on industries that force them to look for sustainable water use. Greater industry use through desalination and reuse also makes it economically feasible. Lack of infrastructural constraint, being extremely expensive to run, and technical know-how necessitate the stranglehold of mammoth application. International funding, technology transfer, and local capacity development programs will decide the fate of ZLD systems in the region.

East Africa presents a promising market for ZLD systems of water-intensive industries, food processing, and environmental protection requirements. Ethiopia, Tanzania, and Uganda are rising to wastewater reuse and ZLD technology for managing the water scarcity and conserving freshwater resources.

Growing demand for low-energy and low-cost solar-powered ZLD technology, i.e., solar-powered ZLD technology for food and beverage and textile industry is on the trend. Aggressive market penetration is repressed with regulatory risk, cost, and technology constraint. Use of renewable power sources by ZLD plants and industry trends shall be the most probable to become the driver for future market growth.

Challenges

High Capital Outlay and Operating Cost

Zero Liquid Discharge (ZLD) technologies are not adopted by African nations to a large extent yet since primarily capital cost and operating cost are the issues. Technically efficient operation of waste water treatment plant, and maintenance cost, is earning an unacceptable amount of money for industries.

Lack of technocrat human resources as well as technology is also the issue for the widespread application of ZLD. Government subsidies, innovation that saves costs, and access to finances in an effort to facilitate support mechanisms must be improved so that the Zero Liquid Discharge technology can be implemented by local industries.

Opportunities

Increasing demand for Environment-Friendly Water Management Solution

Terrible water scarcity and strict environmental regulations in Africa are providing Gargantuan opportunity to the industry for Zero Liquid Discharge system. Industrialization and urbanization growth are turning the green water management system into a sharply urgent requirement. Power, chemical, and textile industries are introducing ZLD systems to avoid wastage of water and to meet environmental standards. Rising applications of energy-saving treatment technology and renewable energy fuel are boosting utilization of ZLD solutions in the nation.

Africa's ZLD market progressed at regular levels during the period of 2020 to 2024 with growing concern for water conservation and sustainability. It was hindered by high cost and lack of infrastructure. Business and the government started investing in pilot plants as well as domestic solutions to pilot scale so there is assured viability.

Policymaker efforts and technological progress in the period 2025 to 2035 will drive growth in utilization of ZLD system. Synergistic blending of low-cost desalination, membrane separation-based filtration, and AI-ensured process monitoring will increase efficiency further. Synergies of public-private partnerships alone will further create infrastructure for supply of ZLD solutions to industry and even to cities.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emerging water conservation policies |

| Technological Advancements | Limited adoption of energy-efficient treatment |

| Industry Adoption | Early-stage implementation in select industries |

| Supply Chain and Sourcing | Dependence on imported ZLD components |

| Market Competition | Presence of a few global players |

| Market Growth Drivers | Awareness about water scarcity and conservation |

| Sustainability and Energy Efficiency | High energy consumption in ZLD operations |

| Integration of Smart Monitoring | Limited data-driven efficiency tracking |

| Advancements in Water Recycling | Basic water recovery methods |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Strict enforcement of wastewater discharge regulations |

| Technological Advancements | AI-driven ZLD optimization and membrane advancements |

| Industry Adoption | Widespread use across power, textile, and chemical industries |

| Supply Chain and Sourcing | Development of local manufacturing and supply chains |

| Market Competition | Rise of regional players and technology partnerships |

| Market Growth Drivers | Large-scale industrial adoption and policy-driven investments |

| Sustainability and Energy Efficiency | Integration of renewable energy and energy-efficient processes |

| Integration of Smart Monitoring | AI-powered monitoring and predictive maintenance |

| Advancements in Water Recycling | Full-scale water reuse and closed-loop industrial systems |

South Africa has the largest African market for Zero Liquid Discharge (ZLD) technologies because of water scarcity, industrial wastewater treatment policy, and growing demand for sustainable water management. Pharmaceutical companies, power generation, and mines are implementing new ZLD technologies for going green and minimizing water loss. Growing government interest in circular water economy programs is also fueling the use of ZLD systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Africa | 5.3% |

Egypt ZLD system market is increasing with increasing industrialization, desalination, and wastewater discharge rules. ZLD water reuse and recovery technology is being adopted by chemical, textile, and food industries in Egypt since it is confronted with Nile River water sustainability. Egypt is developing investment growth for industrial wastewater treatment facilities since Egypt is becoming a competitive market in adopting ZLD.

| Country | CAGR (2025 to 2035) |

|---|---|

| Egypt | 5.0% |

Nigeria ZLD market is gaining pace through speedy urbanization, industrial necessity for wastewater management, and increased water pollution adoption. Industry sub-segments of oil & gas, food & beverage, and chemical are making capital investments towards ZLD for reaching water savings objectives and implementing green regulations. Market growth for the long-term would be promoted through increasing industrial capacity additions along with government initiatives towards sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Nigeria | 5.2% |

Kenya's ZLD market is growing due to water scarcity constraints, eco-friendly wastewater treatment technologies, and government spending on industrial water recycling increasing. Textile, agricultural, and manufacturing industries are witnessing growing uptake of membrane-based ZLD technologies. With Kenya prioritizing green water management policies, it will definitely see steady market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Kenya | 5.1% |

Morocco's ZLD system market is growing as companies need efficient wastewater treatment technology to meet environmental regulations. Government policies regarding water desalination and water recovery in industry are pushing the adoption of ZLD systems in power, mining, and chemical industries. Growing use of thermal and membrane ZLD technologies will propel the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Morocco | 5.1% |

Africa's ZLD system market is gaining pace with business entities looking for environment-friendly processes to treat wastewater. As a result of stringent environmental regulations and water scarcity, various industries in various industry segments are putting up ZLD facilities to prevent discharge of liquid wastes. ZLD facilities treat the wastewater as a whole and transform it into reusable form and thus conserve water in the long run.

Market is observing very high demand from various industries like power generation, oil & gas, chemicals & petrochemicals, mining & metallurgy, pharmaceutical, food, textile, leather, and paper industry. Environmental sustainable business objectives, regulation, and emerging technologies are propelling growth in implementing ZLD in Africa.

African zero liquid discharge systems market bifurcates into traditional and hybrid ZLD systems and remains in huge demand on the basis of treatment function offered by the two with its capacity to treat complicated requirements in wastewater treatments.

Traditional ZLD Systems are known internationally to function across mammoth sections of the heavy industries where wastewater solutions for handling solids are urgently needed. Multi-stage technologies employed in equipment applications include ultrafiltration, RO, and crystallization of the brine solution.

Conventional systems have highly diversified applications in oil & gas, mining, and heavy power-generating industries where zero discharge as well as water recovery becomes the major criterion for plant suitability. Although efficient, conventional systems are operation and capital-intensive, thus unsuitable for small industries. With automation, energy-saving evaporators, and inexpensive filter systems, the systems are less expensive and cost-effective now.

Hybrid ZLD systems are highly in demand as well because industries nowadays need more energy-saving and efficient wastewater treatment plants. Hybrid systems integrate membrane-based technology and advanced thermal evaporation technology and provide higher efficiency with lower energy usage.

Hybrid systems are most suited to be designed for industrial wastewater streams like variable composition wastewater of chemical, textile, and pharmaceuticals. Hybrid ZLD systems have higher water recovery at low operating costs compared to traditional systems. Greater emphasis on sustainable industrial operation and increasing pressure to minimize costs is driving the adoption of hybrid ZLD systems on the African continent.

Conventional and hybrid ZLD plants are the dominant contributor to the industrial wastewater solution in Africa. Increased demand for effective water management technology, and government assistance in the form of regulation and technology, is leading to investment in such plants. Except for capital-constrained expenditure and process sophistication, new trends in membrane filtration, AI-driven process optimization, and energy-efficient evaporation will continue to propel the market growth opportunity.

The two most prevailing industries of ZLD system application in Africa are the power generation industry and the oil & gas industry. Both of these industries produce massive quantities of wastewater that is highly concentrated in contaminants, which is the reason why application of ZLD as an important choice in pursuing environmental standards as well as the conservation of resources comes into play.

Power Generation Industry is highly water-dependent for cooling, steam generation, and other processes. As Africa still suffers from water shortage because of the lack of water, water-scarcity water shortage power plants are implementing ZLD plants as a gesture of goodwill in water conservation and resource conservation.

Thermal power plants, especially coal and gas power plants, can be supported by ZLD by recycling water so that they utilize it, thus minimizing the use of fresh water. CSP-based renewable power plants are also moving towards ZLD in a bid to conserve water. Utilization of advanced filtration, AI monitoring, and modular ZLD designs is also improving these systems to be utilized in power plants.

Oil & Gas Industry necessitates strong wastewater treatment systems due to produced water and refinery effluent containing large volumes of impurities. ZLD plants enable oil & gas operators to comply with the environment by not discharging liquid and enabling water to be reused for refining and drilling. Growth demand for lowering environmental impact, alongside business sustainability initiatives, is powering demand in oil & gas downstream and upstream markets. Upgrades in crystallizer systems, low-energy membranes, and dense brines are spurring the efficiency improvements of ZLD systems for oil & gas operations.

Growing application of ZLD systems in power stations and oil & gas is redrawing the industry water management picture in Africa. While the systems are economically oriented, they deliver long-term advantages of regulatory certification, reduced operation cost, and eco-friendly use of resources. As business organizations have started planning on environmental sustainability along with production and conservation needs of water, the African market for ZLD can be predicted to witness massive growth.

The African Zero Liquid Discharge (ZLD) System Market is growing at a rapid pace driven by industrialization growth, environmental regulations, and demands for sustainable water management. Power generation, chemicals, textiles, and pharma sectors, in a pursuit to invest in improved wastewater treatment technology, are driving demand for ZLD systems at an accelerating rate.

Government policies and legislations regarding recycling wastewater along with the conservation of freshwater resources are also supporting market development. Companies are making investments in new treatment technologies such as membrane filtration, evaporators, and crystallizers to stay green and optimize water recovery.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Veolia Water Technologies | 22-27% |

| SUEZ Water Technologies & Solutions | 18-22% |

| Aquatech International | 12-16% |

| Thermax Limited | 10-14% |

| GEA Group | 8-12% |

| Other ZLD System Providers (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Veolia Water Technologies | Specializes in complete ZLD systems, integrating membrane filtration, evaporators, and crystallizers. |

| SUEZ Water Technologies & Solutions | Offers advanced brine concentration and high-efficiency wastewater recovery solutions. |

| Aquatech International | Focuses on modular ZLD solutions tailored for industrial and municipal wastewater treatment. |

| Thermax Limited | Develops cost-effective, energy-efficient ZLD systems using proprietary evaporation and crystallization technology. |

| GEA Group | Provides innovative water recovery solutions with sustainable thermal separation technology. |

Key Company Insights

Veolia Water Technologies (22-27%)

Veolia dominates the ZLD market in Africa with end-to-end water treatment solutions that integrate cutting-edge membrane filtration and thermal treatment technologies.

SUEZ Water Technologies & Solutions (18-22%)

SUEZ specializes in high-efficiency brine concentration systems, providing customized solutions for industrial wastewater reuse.

Aquatech International (12-16%)

Aquatech is a leader in modular ZLD systems, catering to industries such as power, chemicals, and textiles, focusing on sustainable water management.

Thermax Limited (10-14%)

Thermax offers cost-efficient, energy-optimized ZLD solutions for industrial wastewater treatment, emphasizing evaporative and crystallization technologies.

GEA Group (8-12%)

GEA Group provides innovative thermal separation solutions for water recovery, reducing liquid waste discharge in industrial processes.

Other Key Players (25-35% Combined)

Emerging companies and technology providers are driving market growth with advanced, energy-efficient ZLD solutions. Notable players include:

The overall market size for Africa’s zero liquid discharge system market was USD 33.9 million in 2025.

Africa’s zero liquid discharge system market is expected to reach USD 58.5 million in 2035.

Africa’s zero liquid discharge system market is expected to grow at a CAGR of 5.6% during the forecast period.

The demand for Africa’s zero liquid discharge system market will be driven by increasing industrial wastewater regulations, rising water scarcity concerns, advancements in membrane and thermal technologies, government initiatives for sustainable water management, and growing industrialization in key regions.

The top five countries driving the development of Africa’s zero liquid discharge system market are South Africa, Egypt, Nigeria, Kenya, and Morocco.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.