The Aerospace Lightweight Materials Market is segmented by material type, component type, application, and region from 2025 to 2035.

The global lightweight materials market for aerospace sector also would grow in a double-digit CAGR over 2025 to 2035, due to the push for improving fuel efficiency, reducing emissions and increasing engine performance. Aerospace market competition has focused on exclusively using the materials such as carbon fiber composites, titanium alloys, aluminium-lithium alloys, and high temperature thermoplastics to lightweight structures without sacrificing strength and safety.

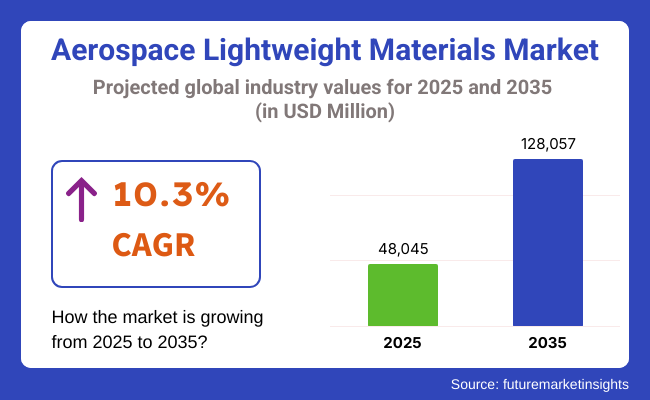

As defence space, commercial air transport and space exploration missions around the world increase, so does the demand for high-performance materials that help save weight. The market would be USD 48,045 million in 2025 and USD 128,057 million in 2035 with a CAGR of 10.3% during the forecast period.

Fuel efficiency regulations, growing backlogs in airplane production, and environmental programs are encouraging aerospace original equipment manufacturers and suppliers increasingly to use lightweight substitutes for conventional metals in fuselage structures, wings, interiors, and engine components. Greater utilization of electric and hybrid-electric aircraft platforms underscores the need to save airframe weight even more.

North America is the largest market, and the top aerospace producers like Boeing, Lockheed Martin, Raytheon, and a gigantic aerospace material supplier globally are focused there. The United States has heavy investment in next-generation fighter programs, commercial transport, and city air mobility technology, all demanding light structure materials. Metal matrix composites and additive manufacturing are also quickly coming of age.

Europe is at the forefront with heavy demand from Airbus, Safran, BAE Systems, and Rolls-Royce. UK, France, and Germany are eager to adopt eco-design and carbon-free airframe design, thus enabling high-strength and lightweight recyclable material. EU Flightpath 2050 visions are taking over the use of carbon fiber and titanium alloy in civilian and defence aviation designs.

Asia-Pacific is the driver of growth through high commercial aviation growth, defence spending growth, and development of indigenous competitors like COMAC (China) and HAL (India). China, India, and Japan are investing in light-weight airframe and engine materials to improve fuel efficiency and comply with emission rules as fleets and traffic expand.

Challenges: High Material Cost, Complex Manufacturing, and Certification Barriers

One of the major issues is the extremely high price of new light materials such as carbon fiber and titanium, which may render them unaffordable for small aero firms to adopt. Complexity in processing, growing cycle time, and recyclability problems of composites are production problems. Need for extreme aerospace safety approvals may be a barrier to production introduction of new materials.

Opportunities: Hybrid Composites, Additive Manufacturing, and Electric Aviation

There are prospects in hybrid composite design, nano-reinforced polymer, and light 3D-printed parts with less waste in reduced design. Increasing needs for electric aircraft and UAVs are generating the need for ultra-lightweight temperature-resistant materials. Adding to this, aerospace industries are also exploring alternative material sources like bio-based resins and closed-loop recycling composite waste.

Between 2020 and 2024, aerospace lightweight materials recorded post-pandemic rebound through aircraft delivery rebound and defence expenditure that were resilient. OEMs followed suit shortly in making use of carbon composites and titanium alloys in weight reduction for new aircraft like Boeing 777X and Airbus A321XLR. Global supply chain disruption imposed strains on local capabilities with local production of the material.

During the period 2025 to 2035, the sector will see a trend towards materials that are multi-functional in nature that is, materials offering weight saving and thermal, acoustic, and electromagnetic shielding performances. Autonomous aerial vehicles, space travel, and hypersonic travel will call for high strength-to-weight ratio materials and environment-resistant materials. Aerospace material innovation in the future will be characterized by collaboration between aerospace OEMs, material science start-ups, and advanced manufacturing firms.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance focused on FAA material safety standards and REACH directives on weight reduction. |

| Consumer Trends | Airline operators pushed OEMs to lower fuel burn via lighter airframes. |

| Industry Adoption | Use of aluminium -lithium alloys and carbon-fiber composites in commercial jets and defence aircraft. |

| Supply Chain and Sourcing | Heavy reliance on Tier-1 aerospace suppliers and centralized carbon fiber sources in the USA and Japan. |

| Market Competition | Dominated by Alcoa, Hexcel, Toray, and Arconic with established OEM contracts. |

| Market Growth Drivers | Fuelled by commercial aircraft backlog, fuel efficiency initiatives, and military modernization programs. |

| Sustainability and Environmental Impact | Emphasis on weight reduction to cut CO₂ emissions per flight. |

| Integration of Smart Technologies | Basic structural simulation for fatigue testing. |

| Advancements in Equipment Design | Manual layup and autoclave-based curing processes. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Implementation of next-gen sustainability regulations including carbon accounting for materials and global mandates on recyclability standards. |

| Consumer Trends | Growing demand for hybrid airframes and electric propulsion systems will favour ultra-light and heat-tolerant composites. |

| Industry Adoption | Expansion into hypersonic flight materials, additive-manufactured titanium parts, and multifunctional composites for UAVs and eVTOLs. |

| Supply Chain and Sourcing | Diversification into localized thermoplastic and metal matrix composite production hubs across MENA and Southeast Asia. |

| Market Competition | Rise of aerospace startups and material innovation labs developing graphene-based composites and nano-engineered alloys. |

| Market Growth Drivers | Driven by e-mobility in aviation, carbon-neutral flight initiatives, and lightweighting in space-bound platforms. |

| Sustainability and Environmental Impact | Focus on circular material systems, energy-efficient composite curing, and closed-loop recycling of aluminium -lithium scrap. |

| Integration of Smart Technologies | Widespread use of digital twins, AI-driven structural health monitoring, and automated ply placement robotics in composite fabrication. |

| Advancements in Equipment Design | Shift to out-of-autoclave (OOA) curing, thermoplastic fusion welding, and 3D weaving machines for complex aerospace part geometries. |

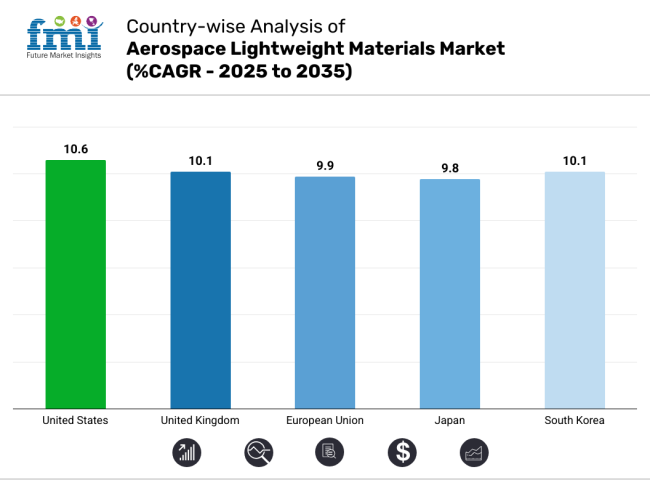

The USA still takes the lead with the utilization of high-performance lightweight materials in future-generation fighter aircraft, commercial fleets, and space launch vehicles. Boeing and Lockheed Martin are integrating thermoplastic composites and 3D-printed titanium alloys, supported by NASA and DoD investment in aerospace technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.6% |

The UK is investing in aerospace material R&D through initiatives such as ATI and Catapult. Firms are using recycled carbon fibers and high-performance polymers for regional aircraft and defence rotorcraft. Light weighting is also crucial for zero-emission aviation prototypes such as those in Project Fresson.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.1% |

The EU's Horizon Europe and Clean Aviation programs have pushed collective innovation toward light weighting. Safran and Airbus are incorporating more thermoset resins, magnesium alloys, and nanostructured coatings into their airframe structures with the goal of lower lifecycle emissions and higher fuel efficiency.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.9% |

Japan's aerospace industry supply chain is expanding capabilities for carbon fiber preparing and hybrid fiber manufacturing. Mitsubishi Heavy Industries is advancing integration of fiber-metal laminates in aircraft structures, while Toray is at the forefront globally in sustainable composite processing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.8% |

South Korea is emphasizing carbon composites and high-strength alloys in indigenous space vehicle development and military aviation. Government-sponsored innovation parks are developing nano-material infusion and powder metallurgy to aid future aerospace programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.1% |

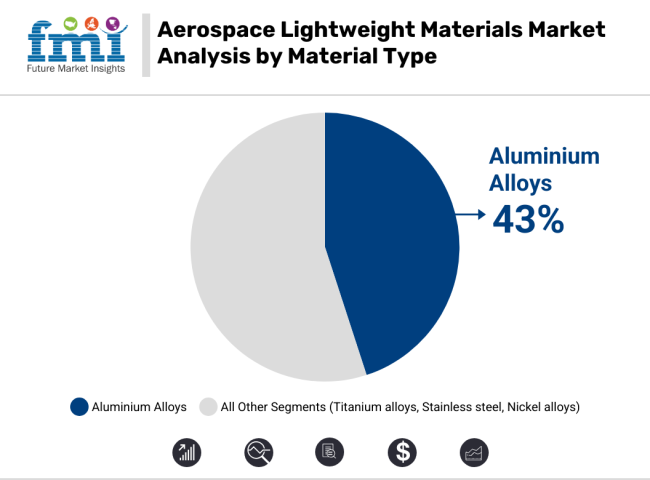

Aluminium alloys are expected to dominate the aerospace lightweight materials market in 2025, holding 43% of the total demand. This is due to their extensive usage in important aircraft structural components like airframes, wing structures, and fuselages. Boeing introduced aluminium-lithium alloys into the 737 series primarily to reduce fuel consumption while maintaining structural integrity.

Because of their desirable balance between high strength and low cost, this family of alloys are often used by aerospace manufacturers. Aluminium alloys aren't just lightweight, they're a lot less expensive than alternatives such as titanium or composites, without sacrificing performance.

Their resistance to the hostile environment of flight and low-weight penalty directly leads to fuel savings, a primary consideration for commercial and general aviation aircraft. Aluminium alloys play an essential role in fulfilling aerospace performance and economic targets.

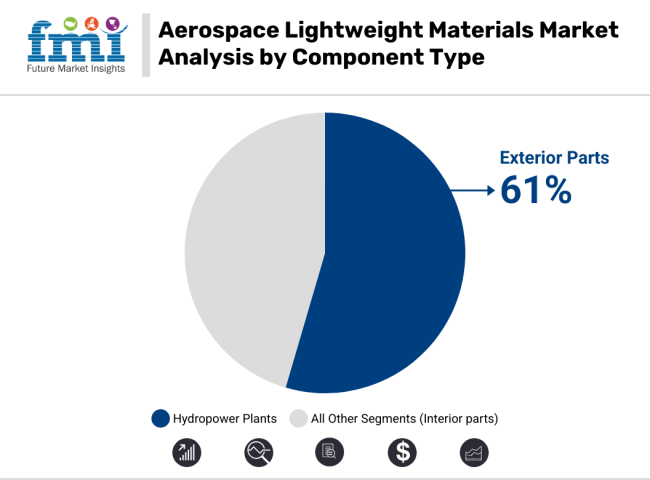

Exterior parts of aircraft parts are expected to hold 61% of the aerospace lightweight materials market in 2025, a report indicates, showing a strong trend for a weight saving and improved aerodynamics. Lightweight and high-strength materials such as composites and aluminium alloys have widespread uses in constructing major outsider parts such as wings, fuselage panels, and landing gear systems.

This is being reflected by the growing demand for more fuel-efficient fuel aircrafts since the lighter planes are more efficient and consume less amount of fuel with higher operational efficiency. The Airbus A350 employs lightweight outer panels to enhance aerodynamic performance and minimize emissions, especially on long flights.

The demand for lightweight material in the outer parts will increase as airlines continue to focus on cutting operating costs and achieving sustainability objectives. This change shows the sector's dedication to balancing aircraft efficiency with safety and structural integrity.

The aerospace lightweight materials market also has a high growth led by increasing demand for fuel-efficient aircrafts and stringent regulations regarding emissions. The new generation of companies focus on advanced materials, such as composites, aluminium alloys, and titanium, to optimize performance and lower operation costs.

There is intense competition among the players in the industry due to the product launch, research and development, collaborations, and broader product portfolio that meet changing requirements of the aerospace industry.

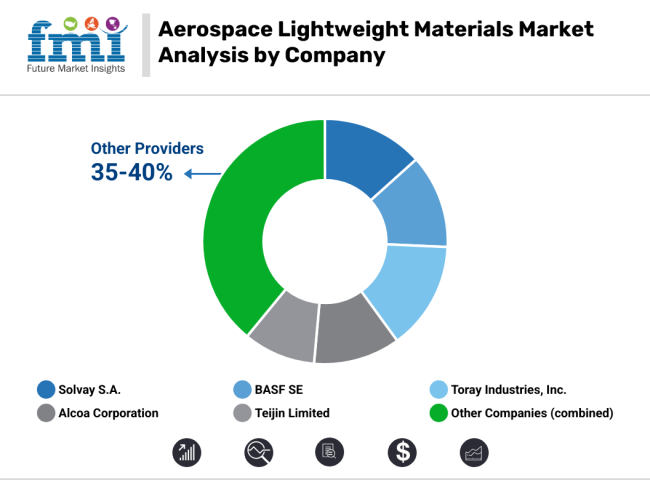

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Solvay S.A. | In 2024, launched a new class of advanced aerospace-grade thermoplastic composites. In 2025, this was expanded to meet growing European demand. |

| BASF SE | In 2024, also introduced a new lightweight polyurethane foam designed for aircraft interiors. 2025- Partnered with top aerospace manufacturers to provide sustainable material solutions. |

| Toray Industries, Inc. | Expanded its portfolio with higher strength-to-weight ratio carbon fiber composites in 2024. Collaborated with aerospace companies in 2025 to use these materials in future aircrafts. |

| Alcoa Corporation | In 2024, launched a novel series of aluminium -lithium alloys specifically designed for aerospace structure components. 2025: Invested in Recycling Technology for More Sustainable Materials |

| Teijin Limited | In 2024, launched high-performance aramid fibers for aerospace safety applications. 2 |

Key Company Insights

Solvay S.A. (14.5%)

This growing demand for lighter, tougher aerospace materials, is being satisfied by Solvay's wide range of thermoplastic composites.

BASF SE (13.5%)

BASF is a key player in that arena, supplying cutting-edge polyurethane foams and focusing on sound sustainable solutions via strategic partnerships with aerospace manufacturers.

Toray Industries, Inc. (12-15%)

Toray is known for its high-tech carbon fiber composite material, with a close working relationship with aerospace companies to get the material into next-generation aircraft designs.

Alcoa Corporation (10-12%)

Alcoa specializes in aluminium-lithium alloys, which are both high-strength and sustainable, and invests in recycling technologies.

Teijin Limited (8-10%)

Teijin is a leading supplier of high-performance aramid fibers and is strengthening its R&D capabilities to collaborate on the development of next-generation aerospace materials.

Other Important Players (35-40% Combined)

The overall market size for the aerospace lightweight materials market was approximately USD 48,045 million in 2025.

The aerospace lightweight materials market is projected to reach approximately USD 128,057 million by 2035.

The increasing demand for fuel-efficient and environmentally sustainable aircraft, along with advancements in materials science and manufacturing processes, fuels the aerospace lightweight materials market during the forecast period.

The top 5 countries driving the development of the aerospace lightweight materials market are the United States, China, Germany, France, and the United Kingdom.

On the basis of material type, composite materials are expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightning Strike Protection Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA