Due to stress on air engines at high velocity, various aero engine coatings have increasingly gained traction. By shielding engines from oxidation, wear, and corrosion at extreme temperatures, aero engine coatings are crucial to enhancing the durability, efficiency, and environmental footprint of aircraft engines. That drive, and others, toward next-generation engines meant to curb their fuel consumption and carbon emissions has created such an explosion in demand for more sophisticated coating solutions.

As a result, companies are investing more and more in thermal barrier coatings (TBCs), corrosion-resistant coatings, and advanced materials to meet rigorous performance specifications while increasing engine lifetimes. Technological developments, rising deliveries of aircraft, and the expansion of the worldwide commercial aviation sector would be the key factors driving the growth of the aero engine coatings industry from 2025 to 2035. Aero Engine coatings market is growing nearly double in a decade.

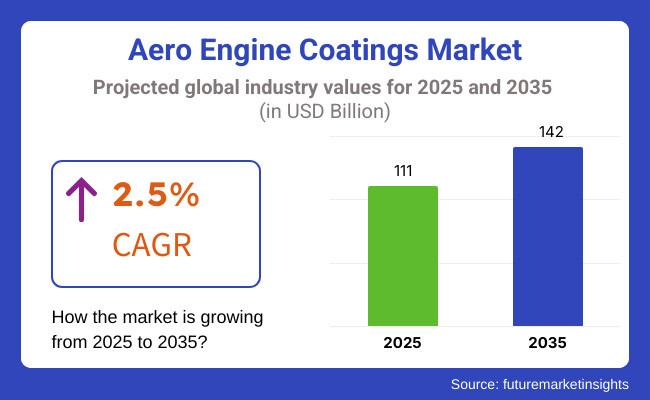

Aero Engine coatings Market is currently seated in USD 111.0 Billion by 2025 and which is expected to reach USD 142.0 Billion by 2035. This implies a compound annual growth rate (CAGR) of 2.5% and shows the dependence of the industry on high-performance coatings to guarantee operational efficiency, safety, and compliance with changing regulations.

North America is one of the largest regions of the aerospace manufacturing and most research and development in the aero engine coatings market. In particular, the presence of key engine OEMs and MRO (Maintenance, Repair, and Overhaul) providers in the United States significantly impacts the regional requirement for advanced coating solutions.

North American suppliers are also collaborating on advanced thermal barrier coatings and new materials to continue their edge as airlines modernize fleets and jump on the newest fuel-efficient engines. In addition, strict regulations for driving down emissions to boost operational efficiency is as a result fueling the market growth in the region.

A second key market is Europe, which has a significant concentration of global aircraft engine manufacturers and a large aerospace R&D footprint. Advanced technologies for aero engine coatings are being developed and implemented by countries including Germany, France, and the United Kingdom to conform to high environmental and performance standards.

European aviation regulators and industry stakeholders still call for cleaner and more efficient engines adding incentive to engine coating technologies. The region’s dedication to sustainable aviation and its embrace of advanced manufacturing practices guarantees a consistent demand for high-performance coatings in the commercial and defense sectors.

Asia-Pacific is one of the most fast-growing regions in terms of demand across the aero engine coatings market. The growing need for advanced coating solutions has been driven by increasing air travel demand, the growth of airline fleets and rising investments in domestic aerospace manufacturing range. Nations such as China, Japan and India are not just buying more and more aircraft they’re developing indigenous aerospace capabilities, including local manufacturing capabilities for engine components and coatings.

With the general strengthening of the region’s aviation sector, Asia-Pacific is positioned to be one of the growth drivers of the global market. The region’s focus on next generation technologies, from sustainable aviation fuels through more efficient propulsion systems, is also very much aligned with the adoption of advanced coating materials.

Challenge

Such a strict regulatory framework can be challenging for the Aero Engine Coatings Market. The demand for durable and efficient thermal barrier coatings (TBCs), corrosion-resistant coatings, and abradable coatings continues to increase due to the extreme temperatures, corrosion and oxidation under which aircraft engines operate.

But designing high-temperature coatings to help engines remain efficient without being heftier or less durable is another challenge. Moreover, the availability of raw material, complicated application procedures, and high price of advanced coatings act as hurdles for manufacturers harbored.

Opportunity

Next-generation airframe design for advanced gaseous and particulate emissions or brushing towards nano-tough composites could lead to more wide-reaching applications for manufacturers. Moreover, the growing expenditures on military and commercial aviation followed by growing maintenance, repair, and overhaul (MRO) activities boost the demand for high-performance coatings.

In the wake of the market evolution, those companies that capitalize on the development of 3D-printable coatings, artificial intelligence solutions for predictive maintenance, and sustainable coating formulations will further generate a competitive advantage.

Major market players emphasized on increasing the lifetime of coatings, better oxidation resistance and lower material deterioration. Market constraints were supply chain disruptions, higher raw material prices, and regulatory pressure on VOC emissions.

The future of coatings industry from 2025 to 2035 will be characterized by technological advancement towards AI-assisted coating applications, smart self-healing, and additive manufacturing based protective layers. The designs of market will evolve due to increasing adoption of sustainable coatings with low environmental impact and integration of nanotechnology for ultra-lightweight, high durability coatings. Furthermore, rising emphasis towards electric and hybrid aircraft engines will further boost demand of coatings that enhances efficiency, heat resistance, as well as energy optimization.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with aviation safety regulations, emissions standards, and material durability guidelines. |

| Material Innovation | Development of ceramic-based TBCs, oxidation-resistant coatings, and erosion-resistant layers. |

| Industry Adoption | Primarily used in commercial aviation, military aircraft, and engine overhaul services. |

| Supply Chain and Sourcing | Dependency on specialty materials like yttria-stabilized zirconia (YSZ) for high-temperature coatings. |

| Market Competition | Dominated by leading aerospace coating manufacturers and aviation OEM partnerships. |

| Market Growth Drivers | Growth fueled by rising aircraft production, increasing MRO activities, and demand for fuel-efficient engines. |

| Sustainability and Environmental Impact | Initial adoption of eco-friendly coatings, with limited focus on full lifecycle sustainability. |

| Integration of Smart Technologies | Early-stage use of automated spray-coating processes and performance analytics. |

| Advancements in Application Techniques | Development of thermal spray techniques, vapor deposition coatings, and high-velocity oxygen fuel (HVOF) coatings. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, focus on low-VOC coatings, bio-based alternatives, and carbon reduction. |

| Material Innovation | Adoption of self-healing coatings, nanomaterial-based solutions, and AI-optimized surface protection. |

| Industry Adoption | Widespread adoption in electric aircraft, next-generation supersonic jets, and advanced defense aircraft. |

| Supply Chain and Sourcing | Shift toward sustainable sourcing, AI-driven supply chain optimization, and advanced coating material R&D. |

| Market Competition | Entry of new players focusing on nanocoatings, plasma-sprayed coatings, and 3D-printed protective layers. |

| Market Growth Drivers | Accelerated by sustainable aviation initiatives, electric propulsion systems, and high-performance coating demand. |

| Sustainability and Environmental Impact | Large-scale implementation of bio-based coatings, recyclable materials, and carbon-neutral coating processes. |

| Integration of Smart Technologies | Expansion of AI-driven coating maintenance, predictive wear analysis, and smart surface technology. |

| Advancements in Application Techniques | Evolution of robotic coating applications, AI-driven precision layering, and energy-efficient coating solutions. |

The aero engine coatings market in USA is also on the rise and is expected to show these trends further with continuous innovations in the aerospace technologies and rising demand for heat-resistant and durable coatings. High-demand thermal barrier and oxidation resistant coatings innovations drive the market due to large investments made by worldwide commercial aircraft manufacturers and also military aviation programs. Furthermore, the increasing environmental regulations are driving the demand for sustainable coating solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.6% |

The Aero Engine Coatings market in the United Kingdom is developing as aerospace manufacturers and MRO (Maintenance, Repair, and Overhaul) service providers strive to increase fuel efficiency and extend engine life. Growing demand for lightweight coatings with high durability and sustainability-driven innovations are driving the growth of market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.4% |

Aero engine coatings market growth across EU countries in the aerospace industry, high-performance coatings are used extensively to improve engine efficiency and durability, driving the growth of the Aero Engine Coatings market across the European Union. The market has been gradually expanding due to robust regulation on sustainable aviation and climbing investments into R&D partnerships.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.5% |

Aero engine coatings are a new technology and Japan's Aero Engine Coatings market is mainly driven by improvement in materials science and breadth of application in defence. Next-gen coatings for improved heat resistance and wear protection are aiding the steady development of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.4% |

The South Korea aero engine coatings shipbuilding market is steadily growing, supported by the country's increasing participation in the worldwide aerospace supply chain. Expanding collaborations with global aerospace companies and the increasing use of high-temperature coatings for military aviation are propelling market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.6% |

The Aero Engine Coatings Market is expanding in tandem with the growing needs of the aviation sector for components that prioritise durability, fuel economy, and thermal resistance. High-performance engines fuel an increasing demand that has manufacturers investing in innovative coating solutions to enhance operational efficiency and lifespan. It covers market segmentation by Aircraft Type (Commercial, Regional, General, Military) and Engine Type (Turbofan, Turbojet, Turboprop, Turboshaft Engines).

Due to rising global air traffic and fleet expansion, the commercial aviation segment is the highest across the Aero Engine Coatings Market as a significant share. Airlines demand improved engine efficiency and longer useful lifetime, leading to the requirement of advanced thermal barrier coatings (TBCs), oxidation-resistant coatings, and corrosion-preventive layers.

They are researched and developed in close cooperation between engine manufacturers and coating technology providers to create next-gen coating methods with which components can work under extreme temperature & wear condition. The growing acceptance of ceramic matrix coatings and thermal spray coatings aids the commercial engines to maintain performance and productivity efficiency and to reduce maintenance costs. Military aircraft segment advances high-temperature and stealth coating technologies

This is the defense aircraft needs special coatings to improve the durability, stealth properties and thermal resistance thus also driving the growth of the aero engine coatings market from the military aviation sector. Military fighter jets, surveillance aircraft and strategic bombers all operate in high-stress environments that require advanced high-temperature coatings to protect engines from oxidation, erosion and thermal degradation.

In addition, increasing development activity of hypersonic aircraft and sixth-generation fighter jets has created a huge demand for plasma-sprayed thermal barrier coatings and protective ceramic coatings due to the need for extended engine service life in demanding environments. Additionally, low radar observability (stealth) is a requirement for military aircraft coatings, resulting in technologies such as radar-absorbing and infrared suppressing coatings for aero engine components

Because of their use in both commercial and military aviation, the largest share of the Aero Engine Coatings Market is contributed by turbofan engines. These engines, which power the vast majority of passenger aircraft, cargo jets and military fighter aircraft, are extremely reliant on state of the art coatings that improve their thermal protection, oxidation resistance and wear durability.

Ceramic coatings, aluminide coatings, and TBCs are applied to turbine blades, combustors, and afterburners by manufacturers to increase resistance of extreme temperatures and prevent premature engine failure. Additionally, the introduction of leading-edge ultra-high bypass ratio (UHBR) turbofan engines with their tighter design parameters has increased the need for coatings that enhance fuel efficiency and extend time between maintenance.

Turbojet engines typically operate in extreme environments (for example, in military fighter jets, reconnaissance aircraft, and supersonic transport systems) and so coatings for turbojet engines must resist high temperatures and extreme pressure and rapid acceleration conditions. The engines run under extreme thermal and mechanical stress and require protective coatings that improve oxidation resistance, erosion protection and thermal barrier performance.

For example, plasma-sprayed ceramic coatings and oxidation-resistant MCrAlY (Metal-Chromium-Aluminum-Yttrium) coatings are extensively used in turbojet engines to guarantee a prolonged component service life. Infrared emissions reduction coatings are also a key Military Stealth Tool, with defense contractors and engine manufacturers placing increased scrutiny on these coatings.

The growth of the aerospace and aviation industry, as well as the ongoing need for improved thermal protection, oxidation resistance, and enhanced fuel economics in next-generation aircraft engines, are factors driving the global aero engine coatings market.

The rise in demand for technologies that enhance the life, performance, and energy efficiency of aero-engines, coupled with information technology developments supporting AI-driven material innovations, developments in ceramic-based thermal barrier coatings (TBCs), and developments in coating deposition techniques, have combined to drive new technologies in this Emerging materials for aerospace coatings development space.

The players in the market include aerospace coating manufacturers, engine OEMs, MRO (Maintenance, Repair, and Overhaul) service providers, and aviation research institutions that drive technological advancements through high-temperature coatings, erosion-resistant materials, and AI-powered predictive maintenance solutions.

Market Share Analysis by Key Players & Coating Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Praxair Surface Technologies (Linde Group) | 18-22% |

| Oerlikon Metco (Oerlikon Group) | 12-16% |

| APS Materials Inc. | 10-14% |

| Zircotec Ltd. | 8-12% |

| Chromalloy Gas Turbine LLC | 5-9% |

| Other Coating Providers & Aerospace Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Praxair Surface Technologies (Linde Group) | Develops thermal barrier coatings (TBCs), erosion-resistant ceramic coatings, and AI-driven predictive coating performance analytics. |

| Oerlikon Metco (Oerlikon Group) | Specializes in plasma spray coatings, oxidation-resistant metallic coatings, and ceramic-based engine protection solutions. |

| APS Materials Inc. | Provides thermal spray coatings for high-performance jet engines, MRO coating solutions, and AI-assisted material analysis. |

| Zircotec Ltd. | Focuses on zirconia-based ceramic coatings, high-temperature resistant aerospace coatings, and advanced TBC solutions. |

| Chromalloy Gas Turbine LLC | Offers aircraft engine refurbishing, corrosion-resistant coatings, and AI-driven wear monitoring solutions. |

Key Market Insights

Praxair Surface Technologies (18%-22%)

Praxair is a market leader in aero engine coatings with an extensive portfolio ranging from plasma spray coatings, AI-level material analysis and next-gen thermal protection.

Oerlikon Metco (12-16%)

Oerlikon provides high-performance aerospace coatings that improve thermal resistance, oxidation and fuel efficiency strengthening.

APS Materials Inc. (10-14%)

APS: Enhanced coatings for engine longevity (MRO): AI-based wear diagnostics, cost-saving thermal barrier coatings.

Zircotec Ltd. (8-12%)

Zircotec specializes in zirconia-based coatings, combining high-temperature engine protection with an AI-powered application process.

Chromalloy Gas Turbine LLC (5-9%)

Chromalloy takes care of aero engine refurbishment solutions that include corrosion resistance, erosion prevention, and AI-based predictive maintenance.

Next-gen aero engine coating innovations, AI-driven predictive maintenance and sustainability-focused material advancements will evolve with contributions from aerospace materials suppliers, coating technology companies and engine OEMs. These include:

The overall market size for Aero Engine Coatings Market was USD 111.0 Billion in 2025.

The Aero Engine Coatings Market is expected to reach in USD 142.0 Billion 2035.

The demand for Aero Engine Coatings is expected to rise due to increasing air passenger traffic, growing demand for fuel-efficient aircraft, and stringent regulations on emissions and engine performance. Additionally, advancements in coating technologies to enhance thermal resistance, oxidation protection, and durability, along with rising defense sector investments in advanced aerospace coatings, are driving market growth.

The top 5 countries which drives the development of Aero Engine Coatings Market are USA, UK, Europe Union, Japan and South Korea.

Aircraft Type to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aero-Gel Pouch Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aerosol Cap Market Size and Share Forecast Outlook 2025 to 2035

Aerostructure Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Printing And Graphics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aeroderivative Sensor Market Size and Share Forecast Outlook 2025 to 2035

Aerographite Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerobridge Market Size and Share Forecast Outlook 2025 to 2035

Aerostat System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA