Aerial Imaging Market Share Analysis Outlook (2025 to 2035)

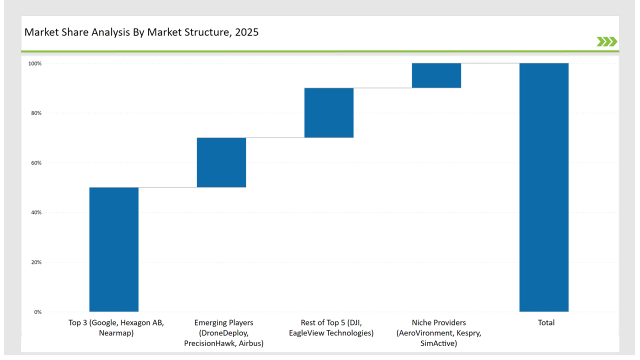

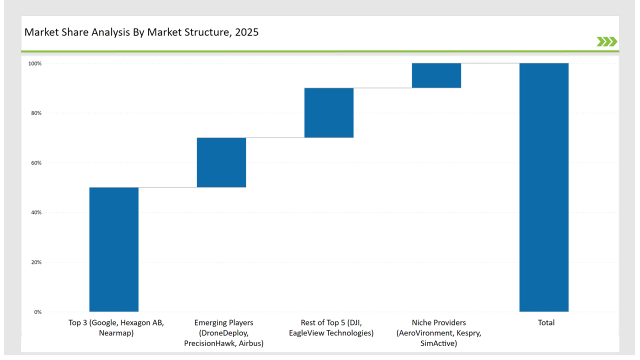

The Aerial Imaging market is expanding rapidly as industries adopt drone and satellite-based imaging for defense, urban planning, disaster response, and resource management. Google, Hexagon AB, and Nearmap lead the market, controlling 50%. They provide AI-powered image analytics, real-time mapping, and high-resolution aerial imagery solutions.

DJI and EagleView Technologies, holding 20%, focus on drone-based imaging solutions and cloud-based geospatial analytics. Emerging players like DroneDeploy, PrecisionHawk, and Airbus capture 20%, excelling in AI-driven aerial surveying and geospatial intelligence. Niche providers such as AeroVironment, Kespry, and SimActive account for 10%, catering to specialized imaging applications in agriculture, energy, and disaster management.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category |

Industry Share (%) |

| Top 3 (Google, Hexagon AB, Nearmap) |

50% |

| Rest of Top 5 (DJI, EagleView Technologies) |

20% |

| Emerging Players (DroneDeploy, PrecisionHawk, Airbus) |

20% |

| Niche Providers (AeroVironment, Kespry, SimActive) |

10% |

Market Concentration (2025 Assessment)

| Market Concentration |

Assessment |

| High (> 60% by top 10 players) |

Medium |

| Medium (40-60%) |

High |

| Low (< 40%) |

Low |

Segment Analysis

By Component

- Hardware: The hardware segment, including drones, satellites, and aerial cameras, dominates with a 40% share. DJI and AeroVironment lead this segment with advanced UAV platforms integrating high-resolution imaging systems.

- Software: Comprising 35% of the market, software solutions such as AI-powered image processing and geospatial mapping analytics drive adoption. Hexagon AB and Nearmap lead with cutting-edge AI-driven geospatial analytics.

- Services: Holding a 25% share, aerial imaging service providers like EagleView Technologies and DroneDeploy offer end-to-end aerial surveying, mapping, and analytics solutions for industries like urban planning, defense, and disaster management.

By Application

- Defense & Security Intelligence: The 30% market share of this segment is due to the defense and security sector employing aerial imaging for surveillance, reconnaissance and border security. Data from Google Earth and Airbus: High-resolution satellite imagery for Defense

- Geospatial Mapping: Geospatial mapping is another main assistant of aerial imaging adoption, constituting 25% of the market. Other companies such as Hexagon AB and DroneDeploy offer AIdriven mapping solutions for land surveying and urban planning as well.

- Urban Planning & Development: This segment constitutes 15%, as aerial imaging aids in infrastructure development, traffic planning, and city expansion. They are dominated by Nearmap and EagleView Technologies.

- Disaster & Response Management: Aerial imaging holds the highest share (10%) in disaster monitoring, emergency response, and damage assessment. DroneDeploy and Kespry focus on aerial assessments in real-time for post-disaster recovery.

- Energy & Natural Resource Management: This area contains 15% as aerial imaging aids surveillance of energy infrastructure, forest management and oil exploration. High-precision imaging for environment monitoring services are provided by companies such as PrecisionHawk and SimActive.

- Others : The remaining 5% is an assortment of applications encompassing agriculture, archaeology, and wildlife conservation - where aerial imaging allows for greater efficiency and sustainability.

Who Shaped the Year (2024)

- Google Earth focused on expansion AI-powered geospatial analytics, enhancing high-resolution satellite imagery capabilities.

- Hexagon AB help to advance AI-driven photogrammetry software, improving automated mapping and land surveying.

- Nearmap help for enhancing real-time aerial image streaming for smart city applications.

- DJI help to strengthens drone-based aerial imaging solutions with advanced LiDAR and multispectral sensors.

- EagleView Technologies innovates cloud-based aerial imaging solutions for property assessment and insurance claims.

Key Highlights from the Forecast

- AI-Driven Image Processing: Artificial intelligence will empower image processing from drones to conduct real-time object detection, pattern analysis, and predictive analytics. Through data analysis, AI will further optimize decision-making processes in sectors ranging from defense to agriculture to urban development.

- Vertical Imaging Solutions: Suppliers will create vertical imaging solutions to serve markets such as defense, smart cities and energy management. Technological advancements in industry-high-end imaging will be forced due to the high demand for precision mapping and environmental monitoring.

- Cloud-based geospatial platforms: They will enable the migration of geospatial data storage and analytics to the cloud, allowing images to be accessed and processed in real-time. Organizations will invest in scalable platforms enabling different stakeholders across the globe to work together seamlessly via secure cloud access environments.

- Regulatory Compliance & Data Privacy: Increased focus on regulatory compliance will be seen in the aerial imaging market in terms of adherence to GDPR, FAA guidelines, and cybersecurity protocols. Artificial intelligence will allow for better data encryption and privacy enhancement of geospatial information.

- GIS & IoT Networks Integration: Aerial imaging combined with GIS and IoT networks will allow for smarter urban planning, disaster management, and energy infrastructure monitoring. By combining aerial imaging with IoT, the integration will enable automation in different sectors with real-time insights and proactive risk mitigation.

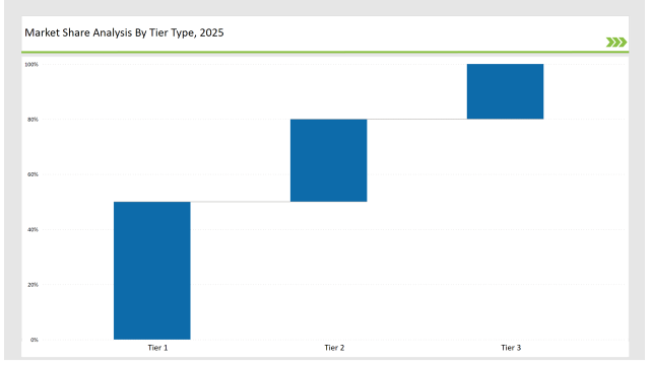

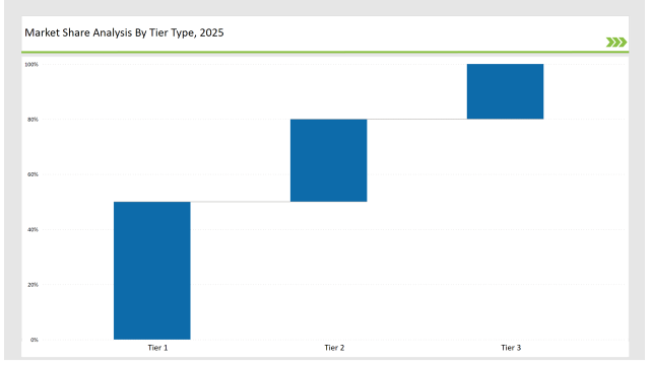

Tier-Wise Company Classification (2025)

| Tier |

Tier 1 |

| Vendors |

Google, Hexagon AB, Nearmap, DJI |

| Consolidated Market Share (%) |

50% |

| Tier |

Tier 2 |

| Vendors |

EagleView Technologies, DroneDeploy, PrecisionHawk, Airbus |

| Consolidated Market Share (%) |

30% |

| Tier |

Tier 3 |

| Vendors |

AeroVironment, Kespry, SimActive |

| Consolidated Market Share (%) |

20% |

Key Company Initiatives

| Vendor |

Key Focus |

| Google |

Expands AI-powered geospatial analytics and real-time mapping. |

| Hexagon AB |

Advances photogrammetry software and AI-driven land surveying tools. |

| Nearmap |

Enhances real-time aerial imaging and urban planning solutions. |

| DJI |

Develops next-gen UAV imaging technology with multispectral sensors. |

| EagleView Technologies |

Strengthens cloud-based aerial property assessment solutions. |

| DroneDeploy |

Innovates AI-driven drone surveying and mapping platforms. |

| PrecisionHawk |

Expands satellite and UAV-based energy infrastructure monitoring. |

| Airbus |

Strengthens high-resolution defense intelligence imaging. |

Recommendations for Vendors

- Enhance AI-Driven Analytics: Develop machine learning models for automated object recognition and geospatial insights.

- Strengthen Cloud Capabilities: Expand cloud-based aerial data processing to improve scalability and accessibility.

- Focus on Regulatory Compliance: Ensure compliance with GDPR, FAA, and defense regulations for secure aerial imaging.

- Expand into Emerging Markets: Leverage aerial imaging solutions for developing economies in infrastructure development.

- Collaborate with GIS & IoT Providers: Improve integration with smart city and industrial IoT networks for real-time data insights.

Future Roadmap

The aerial imaging industry is set for transformative growth with AI, cloud computing, and IoT integration. Vendors must refine AI models for automated aerial data analysis, enabling real-time decision-making. Predictive analytics and deep learning will enhance anomaly detection in defense, disaster response, and urban planning.

Blockchain-enabled aerial imaging will ensure transparency and data security. UAV-based aerial imaging will expand into commercial applications, requiring international regulatory compliance. Cloud-based platforms and strategic GIS/IoT collaborations will drive industry growth.

Frequently Asked Questions

Which companies hold the largest market share in the Aerial Imaging industry?

Leading vendors Google, Hexagon AB, Nearmap, and DJI hold 50% of the market.

What is the market share of emerging players in the aerial imaging sector?

Emerging players DroneDeploy, PrecisionHawk, and Airbus hold 20% of the market.

How much market share do niche providers hold?

Niche providers AeroVironment, Kespry, and SimActive hold 10% of the market.

What percentage of the market do the top 5 vendors control?

The top 5 vendors (Google, Hexagon AB, Nearmap, DJI, and EagleView Technologies) control 70% of the market.

How is market concentration assessed for 2025?

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 60-70% of the market.