The advanced packaging industry is rapidly becoming a paradise as companies look for innovative, smart, and sustainable solutions through digital transformations. There is increasing demand coming from electronics, pharmaceuticals, and food and beverage sectors, thus focusing on intelligent, secure, and eco-friendly packaging from the manufacturers' side. Automated production within companies is coupled with AI-driven quality control and recyclable materials to ensure compliance with regulations.

Industry leaders are focusing highly on smart sensors, tamper-proof designs, and high-precision manufacturing of those to enhance product protection and traceability. The market is increasingly heading for biodegradable, RFID-enabled, and active types of packaging, which improve the efficiency and sustainability of the supply chain.

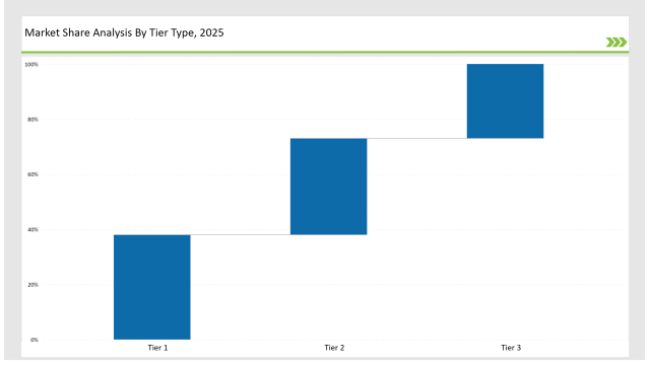

Tier 1 such as Amkor Technology, ASE Group, and TSMC accounts for 38% of the market as a result of high-end R&D, large-scale production, and an expansive global distribution network.

Tier 2 such as Intel, JCET Group, and Powertech Technology take 35% of the market share concerning miniaturization, high-performance integration, and AI-powered packaging.

Tier 3 players composed of regional and niche firms, which constitute 27% of the market and specialize in customized solutions, flexible packaging, and bio-based materials.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amkor Technology, ASE Group, TSMC) | 18% |

| Rest of Top 5 (Intel, JCET Group) | 12% |

| Next 5 of Top 10 (Powertech Technology, Samsung Electronics, Texas Instruments, UTAC, Chipbond Technology) | 8% |

The advanced packaging industry serves multiple sectors that demand miniaturization, high-speed performance, and sustainability. Companies integrate AI-powered defect detection and nanotechnology advancements to improve efficiency and quality. Firms develop next-generation flexible packaging to enhance adaptability and reduce material waste.

Manufacturers refine advanced packaging solutions with nano-coatings, tamper-proof technology, and AI-enhanced production techniques. AI-driven monitoring ensures defect-free manufacturing and high-quality output. Companies enhance automated inspection systems to improve efficiency and reduce waste. They develop self-healing materials that increase product longevity and durability.

Companies accelerate advanced packaging innovations by adopting high-precision molding, AI-powered quality control, and recyclable materials. They refine flexible, lightweight designs to enhance sustainability and performance. Industry leaders implement blockchain-enabled track-and-trace systems to improve supply chain transparency. Manufacturers integrate predictive analytics to reduce defects and enhance efficiency. They develop self-healing packaging materials to extend product life and reduce waste. Companies adopt multi-layered barrier technology to improve durability and product preservation. Firms enhance tamper-proof seals to ensure product integrity and compliance with safety regulations.

Year-on-Year Leaders

Technology suppliers should prioritize AI-driven automation, smart materials, and high-security packaging to drive market growth. Collaborating with electronics, healthcare, and food industries will accelerate adoption and innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amkor Technology, ASE Group, TSMC |

| Tier 2 | Intel, JCET Group, Powertech Technology |

| Tier 3 | Samsung Electronics, Texas Instruments, UTAC, Chipbond Technology |

Leading manufacturers enhance AI-driven defect detection, smart tracking, and ultra-high-density packaging. They integrate lightweight, tamper-proof features to improve durability and security. Companies develop cloud-based production analytics to optimize efficiency and reduce waste. Firms adopt advanced material science to enhance packaging resilience and performance.

| Manufacturer | Latest Developments |

|---|---|

| Amkor Technology | Expanded high-density fan-out packaging (March 2024) |

| ASE Group | Developed RFID-enabled smart packaging (April 2024) |

| TSMC | Introduced nano-coating technology (May 2024) |

| Intel | Released AI-driven defect detection systems (June 2024) |

| JCET Group | Innovated chip-on-wafer stacking (July 2024) |

| Powertech Technology | Strengthened flexible recyclable packaging (August 2024) |

| Samsung Electronics | Enhanced chip-scale package efficiency (September 2024) |

The advanced packaging market has begun to evolve as companies invest in AI-driven automation, smart materials, and blockchain-based authentication. Companies integrate tamper-proof technologies, lightweight designs, and sustainable solutions to further enhance efficiency and security. Fast robotics are being deployed in packaging production by manufacturers. Predictive analytics are being improved to better respond to supply chain management.

Manufacturers develop AI-powered defect detection, ultra-miniaturization, and smart RFID tracking. They refine biodegradable and nano-enhanced packaging while integrating blockchain-backed authentication systems to optimize security and sustainability. Companies adopt machine learning algorithms to predict and prevent defects in packaging production. They enhance high-speed automated manufacturing to improve efficiency and reduce costs. Firms develop advanced barrier coatings to extend shelf life and protect contents. Industry leaders integrate Internet of Things (IoT) solutions for real-time tracking and quality monitoring. Businesses invest in energy-efficient production methods to lower carbon footprints. Manufacturers improve tamper-evident features to ensure product authenticity and consumer trust.

Amkor Technology, ASE Group, TSMC, Intel, JCET Group, Powertech Technology, Samsung Electronics, Texas Instruments, UTAC, Chipbond Technology.

The top 3 players collectively hold 18% of the global market.

The market shows medium concentration, with top players holding 38%.

The industry is witnessing rapid adoption of AI-driven automation, blockchain-enabled tracking, and sustainable materials. Companies are also developing ultra-miniaturized packaging to enhance performance and efficiency.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.