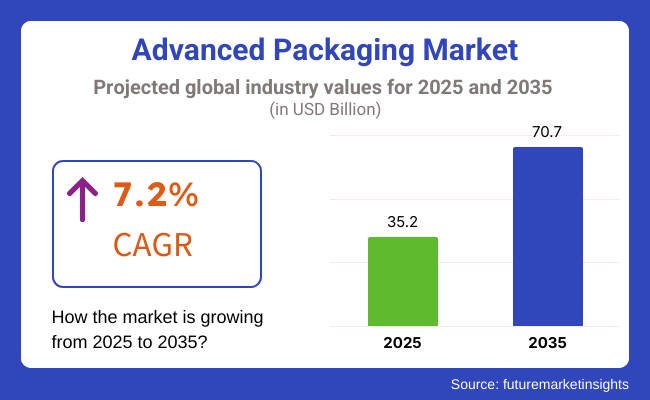

The worldwide advanced packaging market is anticipated to see strong growth, with a compound annual growth rate (CAGR) of 7.2% during the period from 2025 to 2035. The market is anticipated to be worth USD 35.2 billion in 2025 and is expected to grow to USD 70.7 billion by 2035.

This growth is driven by the increasing need for advanced semiconductor packaging solutions, propelled by advancements in artificial intelligence (AI), 5G technology, the Internet of Things (IoT), and autonomous driving applications. This further strengthens the market growth due to the increasing heterogeneous integration, fan-out wafer-level packaging (FOWLP), system-in-package (SiP), and 3D IC packaging.

The Asia-Pacific region is still the market leader thanks to strong semiconductor manufacturing infrastructure, with China, Taiwan, and South Korea leading the scores. North America and Europe, on the other hand, are focused on research and development to build up their semiconductor ecosystems.

The growing demand for power-saving electronic products with small footprints, along with exerting pressure on automotive, healthcare, and telecom industries, is expected to continue boosting market growth. High capital expenses are amongst the problems it faces, but even so, the advanced packaging sector is on a growth path.

The advanced packaging is predicted to grow nearly 1.6 times by 2035 and present an incremental opportunity of USD 70.7 billion, which indicates that it will continue to expand with lucrative opportunities.

Explore FMI!

Book a free demo

Rising Demand for Sustainable and Smart Packaging Solutions is Driving Market Growth

Resorting to advanced packaging technologies in the wake of sustainability demands and rising environmental concerns In fact, packaging solutions that can offer recyclability, biodegradability, and a low carbon footprint are quickly gaining favor.

Another technology helping drive the sector is smart packaging, such as that with sensors and RFID tags. Functional and eco-friendly packaging is becoming increasingly appealing to consumers. Moreover, regulations and incentives for sustainability are also pushing manufacturers to adopt advanced packaging to meet increasingly stringent environmental standards.

Technological Advancements and Customization Promote Market Growth

The packaging sector is seeing new trends in the development of advanced packaging, with packaging materials and methods enhancing technology. Nanotechnology, active and intelligent packaging, and flexible materials are some developing areas that are considerably upgrading the efficiency and reliability of packaging. The ability to customize these packaging, for branding or functional reasons, or both is also boosting the growth of the packaging sector.

Unfortunately, they are a separate concern, a need to innovate, as manufacturers aim to compete with each other based on needs such as food, electronics, and medicine, industries where packaging and protection are not only a means of protection but also additional functionality.

High Costs of Production and Raw Materials Remain Challenges

Widespread penetration highly depends on the accessibility and cost of advanced materials and the complexity of processing. High-end packaging materials include smart packaging, biodegradable plastics, and nanocomposites, which are expensive compared to conventional packaging and prevent widespread adoption, especially in developing areas.

Moreover, integrating advanced technologies such as sensors and smart features contributes to the costs involved in manufacturing. While it is true that these solutions represent much higher production costs today, as they become more mainstream, economies of scale and new technological solutions will bring down the production costs/downstream use, making them more accessible across large parts of every industry.

A few of the major areas that packaging manufacturers plan to invest in between 2025 and 2035 are changing demands and cutting-edge technology. Reusable, recyclable, biodegradable, and sustainable packaging materials are some of the main areas of focus for businesses.

New low-carbon materials that retain performance and durability are being invested in due to regulatory pressures and consumer demand for sustainable products. Further, they are honing their capabilities in flexible packaging, a lightweight, high-performing e-commerce, food, and pharmaceutical solution.

The other key investment sector is intelligent and interactive packaging technologies that combine QR codes, NFC chips, and RFID tracking to drive consumer interaction and supply chain optimization. These technologies facilitate real-time tracking, authentication, and customized experiences, enabling packaging to be more than a protective wrapper.

Automation and AI-based manufacturing are also transforming manufacturing strategies, enhancing efficiency, accuracy, and scalability while lessening operational expenses. As the demand for sophisticated packaging increases, companies are investing heavily in cutting-edge plants, eco-friendly manufacturing practices, and digitalization to remain competitive in a more dynamic global trade.

The global industry for advanced packaging recorded a CAGR of 5.2% during the historical period between 2020 and 2024. The growth increased as businesses in industries like electronics, food & beverage, and pharmaceuticals sought innovative, high-performance, and sustainable packaging solutions.

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Rapid expansion (~6.5% CAGR) fueled by innovations in technology and stricter regulations. |

| Sustainability Push | Fully sustainable packaging solutions become industry standard. |

| Raw Materials | Exploration of biodegradable, lightweight, and high-performance polymers, as well as innovative materials like algae-based plastics. |

| Technology & Automation | AI, robotics, and smart technologies enable mass customization, real-time tracking, and increased automation in packaging. |

| Product Innovation | Proliferation of smart packaging solutions, including active, intelligent, and sensory packaging. |

| Cost & Pricing | Automation and new manufacturing processes bring down costs, making advanced packaging more cost-competitive. |

| Industry Adoption | Widespread adoption across consumer goods, healthcare, luxury, and e-commerce industries. |

| Customization | High demand for personalized, hyper-customized packaging across multiple industries. |

| Regulatory Influence | Stricter packaging regulations and sustainability standards across major markets. |

| E-commerce Influence | Fully optimized packaging solutions for e-commerce, with a focus on durability, recyclability, and minimal environmental impact. |

| Circular Economy | Closed-loop systems and reusable packaging become commonplace across industries. |

| Factor | Manufacturer Priorities |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Durability, Moisture Resistance, Strength) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Food Safety & Hygiene |

|

| Reusability & Circular Economy |

|

The USA advanced packaging is projected to reach USD 5.7 billion by 2025, driven by rapid innovation in flexible packaging and rising consumer demand for sustainable and high-performance solutions. The 6.6% CAGR from 2023 to 2033 highlights the country’s leadership in advanced packaging technology.

Firms are expanding past R&D fabrication to benefit in areas such as electronics, automotive, and food packaging. The growth of e-commerce will further drive the expansion along with the need for tamper-evident and moisture-resistant packaging. The American systems will remain established, technology will help advancement.

The Canadian advanced packaging will be reaching USD 1.1 billion by 2025, growing with moderate momentum. The 5.8% CAGR from the Jeeps over the forecast for the Jeeps packaging also reflects the steady complement of Jeeps packaging innovation and adoption.

The demand for better, lighter, and more secure packaging is rising as a result of growing e-commerce and travel. Furthermore, Canada's regulatory framework supports green packaging initiatives, opening doors for expansion, particularly in the consumer goods, electronics, and food and beverage industries.

The UK advanced packaging is anticipated to reach USD 2.8 billion by 2025, with a steady 5.4% CAGR. One major factor is the UK's growing focus on environmentally friendly packaging options, as companies embrace new ideas to cut waste and increase recyclability.

Given the continued success of online retail, there will likely be a greater need for packaging solutions in consumer goods and e-commerce. The expansion is aided by government regulations that promote sustainability and eco-friendly packaging materials. Additionally, developments in barrier technologies and tamper-evident packaging meet the demands of the food and pharmaceutical sectors.

France’s advanced packaging is projected to reach USD 2.1 billion by 2025, with a 5.6% CAGR. The country’s focus on eco-conscious packaging technologies plays a crucial role in the growth, with consumer demand for environmentally friendly and recyclable materials rising.

France's food and beverage sector is a major contributor to the demand for high-performance packaging solutions, including moisture barriers and tamper-evident features. E-commerce’s expansion also drives the need for efficient packaging that ensures product safety and convenience. As the government enforces sustainability measures, France is well-positioned for significant advancements in advanced packaging.

At a 5.9% compound annual growth rate (CAGR), the advanced packaging in Germany is projected to reach USD 3.4 billion by 2025. Thanks to strong industrial demand in the consumer goods, electronics, and automotive industries, Germany continues to be one of Europe's leading manufacturing hubs. Make advancements in packaging technology to increase the product's shelf life, ensure product security, and make package materials recyclable and up cyclable.

The advanced packaging in South Korea is 1.4 billion dollars (USD 2.4 billion for the region) from 2025 with a 6.1% CAGR. Japan’s strong emphasis on technological progress with its electronics and semiconductor sectors translates into high demand for advanced packaging.

In the race of global packaging technology, companies are investing notably in research and development. High-performance packaging materials that provide safety and durability of products are primarily influenced by the consumer electronics, particularly mobile devices.

The nation's demand for advanced packaging is primarily driven by the food, automotive, and electronics industries, all of which require high-performing and environmentally friendly packaging solutions. Japan's industry for flexible, tamper-evident, and moisture-resistant packaging is driven by the country's strong emphasis on innovation and technological advancements.

The demand for packaging solutions that improve the sustainability, safety, and convenience of product deliveries is rising as e-commerce and online retail continue to grow. The opportunities are further enhanced by regulatory pressure to adopt eco-friendly materials.

The advanced packaging in China is projected to grow to USD 12.6 billion by the year 2025, boasting a strong +7.2% CAGR. Two important factors propelling this trend are the push for eco-friendly packaging and the Chinese government's endorsement of eco-friendly regulations.

Increased focus on safety and protection of products being shipped is pushing the demand for safe packaging solutions, coupled with growth in the e-commerce industry. With its large-scale production capacity and expanding consumer base, China has become the leading player on the global advanced packaging stage.

India’s advanced packaging is projected to grow to USD 4.3 billion by 2025 (at a CAGR of 6.4%). Growing sectors like food, pharmaceuticals, and e-commerce in India are fueling demand for niche packaging solutions. With consumers increasingly looking for sustainable packaging solutions that meet their need for convenience, flexible, recyclable, and tamper-evident packaging is seeing more interest. Demand for packaged goods is further fueled by the country’s growing middle class and rising disposable income.

Key players in the advanced packaging industry are focusing on technological advancements, sustainable materials, and product diversification to strengthen their positions in the industry. Companies are forming partnerships and collaborating with other firms to accelerate product innovation and extend their geographical reach.

The year 2024 brought about a concentration of the major companies within the advanced packaging industry on both sustainability and technology innovations. For example, ASE Technology Holding Co. predicted that 2025 revenue from advanced packaging and testing would more than double, i.e., to USD 1.6 Billion, because of a growing global appetite for AI chips. This strategic decision emphasizes ASE's focus on enhancing its advanced packaging solution ability.

Further, Amazon changed its packaging to remove all single-use plastics, replacing them with recyclable paper and cardboard. This program not only helps other companies achieve their net-zero goals but also showcases Amazon's commitment to sustainable operations.

Breakthrough startups in the packaging industry use very different tactics to grab the gaze of consumers. The "chaos packaging" idea, where instead of the usual forms of products, they are shown in unusual ways-for instance, tampons stored in an ice cream tub or sunscreen packaged in a whipped cream container-has been popularized.

Brands can rise above the flood of ads, draw in customers, and generate social media buzz using this new method. Both established brands and startups are working to meet evolving customer demands and comply with environmental rules. This shift highlights a wider industry trend of merging sustainable practices with creative packaging solutions.

Key Developments in Advanced Packaging Market

Product Launch

UFP Technologies, Inc. launched a newly designed line of eco-friendly advanced packaging solutions aimed at offering increased protection for electronic devices, providing safer transportation with reduced carbon footprint compared to traditional plastic packaging. This innovation caters to the rising demand for sustainable packaging in electronics.

Partnership

Dart Container partnered with PulPac to introduce the first dry molded fiber production line in North America, Dart Container has teamed with PulPac to launch the first dry molded fiber production line, the PulPac Scala. It seeks to improve the production of sustainable packaging and make advanced, green packaging more widely available in the region.

Acquisition

Mondi acquired the Western European operations of Germany's Schumacher Packaging for USD 634 million. This acquisition, which adds state-of-the-art box production plants in Germany and a packaging plant in the UK to the already attractive portfolio, further strengthens Mondi's position in the attractive European advanced packaging.

Acquisition

International Paper announced a USD 7.20 billion all-share takeover of DS Smith, aimed at consolidating its position in the packaging industry. This acquisition, expected to close in early 2025, will create a stronger presence in the advanced packaging.

Certification

Pactiv Evergreen received the FSC®-Recycled certification in recognition of our high-performance packaging solutions and the company's dedication to sustainability. This certification was presented at the International Production & Processing Expo in Atlanta, Georgia, emphasizing the brand’s dedication to eco-friendly practices.

Acquisition

Amcor agreed to acquire Berry Global Group in an approximately USD 8.4 billion stock exchange deal, which will form a consumer and healthcare packaging company with combined annual revenues of around USD 24 billion. This merger is expected to close by mid-2025, positioning the companies for greater innovation in advanced packaging solutions.

Increased demand for miniaturized devices, Heterogeneous integration, Growth in emerging markets, and sustainability and innovation are the advanced packaging industry.

The global advanced packaging industry stood at USD 35.05 billion in 2025.

The global advanced packaging industry is anticipated to reach USD 70.25 billion by the end of 2035.

South Asia & Pacific is set to record a CAGR of 7.5% during the forecast period.

Key players include Intel Corporation, ASE Technology Holding Co., Ltd, STMicroelectronics, and Nordic Semiconductor.

Increasing the flip chip scale package segment owing to their capability to improve electrical performance, reduce power consumption, and miniaturize semiconductor devices will further strengthen the industry. Flipping chips forward With the growing demand for high-speed computing, artificial intelligence-powered applications, and miniaturized electronic devices, manufacturers are expected to work on advanced flip chip technology refinement.

Investments in this packaging type will only continue to grow as 5G, IoT, edge, and other next-generation electronics need extreme levels of integration. The Flip Chip Ball Grid Array segment is expected to register steady growth, especially for sectors demanding high-reliability semiconductor technology. Excellent electrical interconnectivity, thermal management, and mechanical robustness are provided by this molded packaging, which makes it appropriate for use in data centers, industrial settings, and automotive electronics.

Manufacturers will continue to improve this packaging technology to meet shifting industry demands as EVs, cloud computing, and AI applications become more widespread. Its performance efficiency and durability will make it popular across a range of industries.

The consumer electronics will continue to be the biggest consumer of advanced packaging by end lift drive by the rapid pace of innovation in smartphones, tablets, wearables, and gaming consoles. With the advent of augmented-reality, virtual-reality, and artificial-intelligence-driven personal devices, semiconductor packaging must evolve to enable the more efficient transfer of data, longer battery life and improved heat dissipation.

The all-time high will be further enhanced by 5G and IoT expansion in embedded consumer devices that demand more sophisticated packaging. The healthcare industry will also increasingly look to advanced packaging for medical devices, diagnostic equipment, and implantable technologies. With the increasing use of telemedicine, remote patient monitoring, and wearable health trackers-semiconductor packaging must emphasize miniaturization, reliability, and biocompatibility.

Waterproof and rugged packs will be required for implantable medical devices and biosensors. The advent of precision medicine and AI-based diagnostics will be followed by the implementation of high-performance semiconductor solutions, which will enable quicker data processing and enabling real-time monitoring of patients.

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Takeaway Containers Market Report - Key Trends & Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Polystyrene Packaging Market Analysis - Size & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.