Key factors propelling global advanced empty capsule sales during 2025 to 2035 include increasing demand from the pharmaceuticals, nutraceuticals, and research laboratory industries. They provide better bioavailability, stability, and the ability to control the drug delivery, and therefore are crucial in high-precision applications of drug delivery. The increasing focus on vegetarian and gelatin-free capsules has also contributed to the growing uptake of advanced capsule materials across industries.

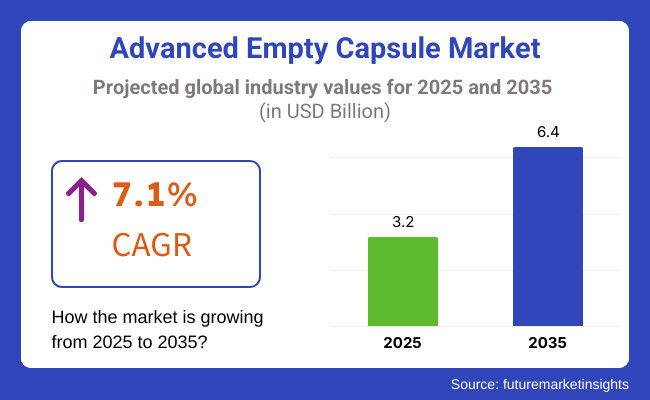

Furthermore, in 2025, the advanced empty capsule industry was valued at USD 3.2 Billion. It is expected to be USD 6.4 Billion by 2035, with a CAGR of 7.1%. The growing use of hydroxypropyl methylcellulose (HPMC) capsules and investments in pharmaceutical innovations, along with technological advancements in capsule formulation, are the major factors propelling market growth.

Explore FMI!

Book a free demo

North America continues to hold a major market share for advanced empty capsules, driven by a well-established pharmaceutical and nutraceutical industry, advanced adoption of innovative drug delivery systems, and large R&D investments. The leading advancement in the next generation of capsule materials going into development and commerciality is taking place in the United States and Canada.

Asia and North America market are characterized by higher demand for plant-based capsules, high regulatory standards, and innovation in encapsulation technologies. The investment in European markets is anticipated and developing countries like Germany, France, UK are mainly focused on sustainability and enhancing capsule formulations to increase drug bioavailability.

The advanced empty capsules market is booming across Asia-Pacific, due to rapid growth in the pharmaceutical and dietary supplement industries. To meet rising demand, China, India, and Japan are investing heavily in capsule manufacturing and infrastructure development.

This market continues to grow in Latin America, propelled by increasing pharmaceutical manufacturing and vital growth in nutraceutical demand. Particularly Brazil and Mexico are driving these efforts, building up in terms of capsule production and its applications to advanced drug formulations.

Advanced empty capsules market research report highly concentrates on key highlights such as advancements in technological trends and competition within the market with respect to regions. Efforts to improve capsule production capabilities in the region are driven by both the UAE and South Africa.

The progress in capsule materials and the increasing uptake across different industries bode well for the advanced empty capsule market that is projected to grow continuously between a decade, opening up avenues for capsule manufacturers, pharmaceutical companies, and research institutions.

Challenge

High Production Costs and Stringent Regulatory Compliance

High costs of raw materials and processes involved in manufacturing are hindering factors of the Advanced Empty Capsule Market. The process of manufacturing capsules without contents necessitates specialized machinery, pharmaceutical-grade gelatin, and high-grade hydroxypropyl methylcellulose (HPMC) materials-resulting in higher production costs.

Furthermore, manufacturing is complicated by regulatory compliance with agencies like the FDA, EMA, and WHO, which demand thorough quality control processes. (Designed and manufactured at the lowest cost + Regulatory compliant, with the fastest and cheapest strategy)

Supply Chain Disruptions and Raw Material Availability

One of the major restraints limiting the global Advanced Empty Capsule Market is raw material availability such as gelatin, plant-based alternatives, and other raw materials to manufacture capsules. Geopolitical instability, trade restrictions, or pandemics cause supply chain disruption that again hit production timelines and cost structures.

These challenges would be mitigated by manufacturers forming supplier networks diversified enough to minimize disruption, integrating different capsule materials into production, and developing logistic strategies that ensure a steady stream of supplies.

Opportunity

Rising Demand for Vegetarian and Vegan Capsules

Growing preference for plant-based and vegetarian diets has led to the demand for other than gelatin capsules. Owing to their compatibility with dietary and religious restrictions, consumers and pharmaceutical companies are leaning toward HPMC and pullulan capsules. This trend offers a lucrative opportunity for market players to diversify their product portfolios, invest in research and development activities, and launch innovative plant-based capsule solutions which address the changing consumer preferences.

Growth in Nutraceutical and Pharmaceutical Applications

The Advanced Empty Capsule Market offers significant growth opportunities to the expanding nutraceutical and pharmaceutical industries. Growing demand for specialized capsules with improved bioavailability, targeted delivery systems, due to the increasing use of dietary supplements, probiotics, and personalized medicine. Market Projections: According to estimates, this market is expected to reach nearly USD 72 Billion USD by 2024 from approximately USD 42 Billion USD in 2017.

The period between 2020 and 2024 witnessed a steady growth in the Advanced Empty Capsule Market, spurred by rising consumer health awareness, pharmaceutical innovations, and adoption of plant-based capsules. Yet, the company faced challenges like regulatory hurdles, supply chain disruptions and raw material price volatility. In response, industry players turned to investing in automation, sustainable materials and robust supply chain strategies to code for these market dynamics.

From 2025 to 2035 Paradigms are changing with an era of transformation, new bio-degraded equip would be seen for Capsule Market and AMS broke rigidity of Instrument and Machines, individual habit and dose would be in trend for capsule formulations. Key highlights of the report include:

The increasing trend of smart packaging, drug delivery systems based on nanotechnology, and sustainable manufacturing processes will help increase market growth. In addition, increasing regulatory support for clean-label and allergen-free capsules is likely to drive the adoption of innovative encapsulation solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with strict pharmaceutical regulations |

| Technological Advancements | Growth in automation and precision capsule manufacturing |

| Industry Adoption | Increased demand for nutraceutical and personalized medicine capsules |

| Supply Chain and Sourcing | Dependence on gelatin and HPMC suppliers |

| Market Competition | Dominance of established pharmaceutical capsule manufacturers |

| Market Growth Drivers | Rising consumer awareness of health and wellness |

| Sustainability and Energy Efficiency | Initial adoption of sustainable capsule production methods |

| Integration of Smart Monitoring | Limited adoption of quality control automation |

| Advancements in Encapsulation Innovation | Use of standard gelatin and HPMC capsules |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of AI-driven compliance monitoring and eco-friendly capsule standards |

| Technological Advancements | Expansion of biodegradable and smart capsules with nanotechnology integration |

| Industry Adoption | Widespread use of targeted drug delivery capsules and functional ingredient encapsulation |

| Supply Chain and Sourcing | Diversification into sustainable, plant-based, and bioengineered capsule materials |

| Market Competition | Rise of innovative startups focusing on personalized and biodegradable encapsulation solutions |

| Market Growth Drivers | Expansion of clean-label, allergen-free, and vegan-friendly capsule formulations |

| Sustainability and Energy Efficiency | Full-scale transition to carbon-neutral manufacturing and zero-waste encapsulation processes |

| Integration of Smart Monitoring | Full-scale deployment of AI-powered capsule inspection and predictive maintenance |

| Advancements in Encapsulation Innovation | Development of liquid-filled, delayed-release, and functional ingredient-infused capsules |

The advanced empty capsule market is dominated by United States owing to its well-established pharmaceutical market and growing need for inventive drug delivery systems. Market growth is fuelled by the presence of leading capsule manufacturers and high R&D investments.

The expansion of the market is further supported by regulatory initiatives from the FDA, increased consumer preference for vegetarian and gelatin-based capsules. Increasing consumption of nutraceutical and dietary supplements is also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

The empty capsules market in United Kingdom is expected to grow with the high end healthcare system and growing concerns over precision medicine. Demand for high-quality capsules is bolstered by their expanding use in pharmaceutical and nutraceutical contexts.

Market growth is encouraged by government policies that favour pharmaceutical innovation and investments in biodegradable and plant-based capsule technologies. The partnership of these academic providers with biotech companies allows for further advancement in these products' development.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.3% |

The European Union empty capsule market belongs to Germany, France and Italy. Strong pharmaceutical and nutraceutical industrial base, high regulatory standards assure quality products in the region.

Combination of sustainable manufacturing and accelerated research in cutting-edge drug encapsulation in EU also benefits market growth. HPMC and gelatin-based capsules are increasingly preferred for drug and supplement applications, which is a factor that supports expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.4% |

Japan's pharmaceutical industry is one of the leading factors contributing to the country's developed empty capsule market. The country’s concentration over high-precision drug delivery systems and innovation with respect to capsule technology as a result; will boost the market growth.

The growing aging population and the need for personalized medicine also fosters the adoption of novel empty capsules. Moreover, government sponsored research programs associated with health technology tends to boost the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.6% |

The South Korea advanced empty capsule market is expanding rapidly with the increasing pharmaceutical & nutraceutical industries in this region. State investment in biotechnology and innovative drug formulation also boosts market growth.

This is consistent with global patterns, including government policies that have been encouraging research on advanced encapsulation, and increasing demand for plant-based capsules. Moreover, the increase of health-aware consumers selecting supplements continues to maintain the market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.7% |

Oral capsules dominate the advanced empty capsules market segment, due to their greater usage in pharmaceutical and nutraceutical applications. Immediate release capsules and delayed release capsules share a substantial market segment among oral capsules that provide versatile drug delivery solutions for different therapeutic needs. Immediate tablets dissolve rapidly in your stomach, which makes them a quick way to get pain relief, antibiotics and over-the-counter medication into your system.

Delayed-release capsules, in contrast, are designed to protect sensitive drug from stomach acid, releasing them into the intestines, where they can work more effectively. The growth of this segment is primarily fueled by the rising prevalence of targeted drug delivery, and is expected to continue to grow due to advances in capsule technology.

Also, with the ability to encapsulate hydrophobic (lipophilic) drugs, there is an increasing adoption for liquid-filled oral capsules, as this ensures excellent bioavailability and stability. The growing market is due to this liquid formulation preference by pharmaceutical companies for complex drugs.

Combined with gelatin, capsules of hydroxypropyl methylcellulose (HPMC) provide a versatile platform for oral formulations and this segment has been further boosted by growing availability of vegetarian-friendly as well as dietary restricted alternatives in the following years.

Inhalation capsules represent a significant portion of the advanced empty capsule space, as they enable targeting of precious anti-asthma medicines for localized delivery in diseases like asthma, chronic obstructive pulmonary disease (COPD), and pulmonary hypertension where the majority of the drug is targeted at the lungs to reduce adverse effects in other organ systems.

Therapy with dry powder inhalers (DPIs) has become increasingly common, and these capsules are intended for use with DPI devices to provide accurate, targeted drug delivery to the lungs. The market's demand for inhalation capsules is driven by the increasing incidence of respiratory diseases and preference for inhalation therapy over traditional oral or injectable approaches.

Thus, the type of inhalation capsules with high performance, optimized moisture stability, and favorable flow property, and compatibility with inhalation devices have been emerged from positive swallowing number development pharmaceutical products.

Both gelatin and HPMC capsules are widely used in this market segment, although the plant-based HPMC capsules, along with their enhanced stability, are gaining in popularity. This is supported further with research in the inhalation drug delivery systems leading to regulatory approvals, which is expected to drive the inhalation capsules market, making it a critical part of the advanced empty capsule market.

Animal-based capsules especially Type-A (pork skin) Type-B (animal bones & calf skin) gelatin capsules have recently held a monopoly in the industry designed, as they are; the most inexpensive, the most durable, and the easiest to manufacture.

Gelatin (the most widely used polysaccharide polymer) based capsules provide outstanding elasticity, mechanical strength, & dissolution characteristics, thus enabling them to be the preferred polymeric excipients for the first generation of pharmaceuticals. Nonetheless, ethical issues and dietary restrictions cause alternative raw materials, so manufacturers have begun to expand their product offerings.

As the demand for plant-based and non-GMO formulations continues to swell in the market, vegetarian-based capsules, including those made with HydroxyPropyl Methyl Cellulose (HPMC) and Pullulan, have gained considerable momentum.

These capsules are well-received in the pharmaceuticals and nutraceuticals organizations because they are stable, moisture resistant and designed for use with liquid or dry formulations. Factors such as the rising popularity for clean-label products and preferences for plant-based solutions have led to considerable investments in the production of vegetarian capsules, which have helped in the growth of this market.

The global advanced empty capsules market is expected to grow remarkably owing to the growing demand for innovative and cost-effective drug delivery systems, increasing preference for vegetarian-based capsules and technological development for capsule manufacturing.

Sustainable materials, enhanced bioavailability, and precision-targeted drug release formulations: Companies are concentrating on these areas. Industry evolution is fueled by innovations in hydroxypropyl methylcellulose (HPMC) capsules, gelatin free alternatives, and enteric-coated solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Capsugel (Lonza Group) | 18-22% |

| ACG Group | 14-18% |

| Qualicaps | 10-14% |

| Suheung Co. Ltd. | 8-12% |

| Bright Pharma Caps Inc. | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Capsugel (Lonza Group) | Leading in HPMC and gelatin capsules with innovations in liquid-filled and delayed-release formulations. |

| ACG Group | Specializes in vegetarian-based capsules and customized drug delivery solutions for pharmaceutical and nutraceutical industries. |

| Qualicaps | Provides premium gelatin and HPMC capsules with a focus on controlled drug release and tamper-resistant technologies. |

| Suheung Co. Ltd. | Developing plant-based capsules with advanced coating technologies for enhanced stability and absorption. |

| Bright Pharma Caps Inc. | Innovating in specialized capsules for probiotic and sensitive drug formulations, offering superior moisture resistance. |

Key Company Insights

Capsugel (Lonza Group) (18-22%)

Capsugel is the industry leader in HPMC and gelatin capsule solutions for pharmaceutical and nutraceutical applications.

ACG Group (14-18%)

ACG Targets sustainable and high-performance capsule technologies, expands product portfolio with customized encapsulation solutions.

Qualicaps (10-14%)

Qualicaps provides precision-targeted methods for drug delivery, focusing on innovative tamper-proof technologies and delayed-release capsule mechanisms.

Suheung Co. Ltd. (8-12%)

Suheung developing plant-based capsules increasing bioavailability and functional coating tech.

Bright Pharma Caps Inc. (6-10%)

Bright Pharma Caps innovates capsule solutions for moisture-sensitive medicines, probiotics and hygroscopic formulas.

Other Key Players (40-50% Combined)

Key players of the advanced empty capsules market are driven by product innovation leading to the development of sustainable filling systems which mitigate various challenges pertaining to stability and bio availability. Key players include:

The overall market size for advanced empty capsule market 3.2 Billion was USD in 2025.

The advanced empty capsule market expected to reach USD 6.4 Billion in 2035.

The demand for the advanced empty capsule market will be driven by increasing pharmaceutical and nutraceutical applications, rising preference for vegetarian and gelatin-based capsules, advancements in capsule technology for controlled drug release, growing consumer demand for dietary supplements, and expanding pharmaceutical R&D activities.

The top 5 countries which drives the development of advanced empty capsule market are USA, UK, Europe Union, Japan and South Korea.

Animal-Sourced and Vegetarian-Based capsules growth to command significant share over the assessment period.

Hyperammonemia Treatment Market Trends – Growth & Therapeutic Advances 2025 to 2035

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Veterinary Auto-Immune Therapeutics Market Growth - Trends & Forecast 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Suture Anchor Devices Market Is Segmented by Product Type, Material Type, Tying and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.