Advanced composites industry have been steadily growing, and more companies producing advanced materials that are strong, tough, and light. Companies are investing in carbon fiber, glass fiber, and aramid fiber composites due to the growing demand for aerospace, automotive, and renewable energy applications. They employ automation, AI-based quality control, and green methods of production, targeting maximum performance and minimum price.

Market players are focused on meeting the regulatory requirements for thermoplastic composites, recycling, and AI-based manufacturing with environmental sustainability in mind. The markets are shifting toward high-strength, low-weight, multifunctional composites that aim to optimize efficiency and durability in mission-critical use cases.

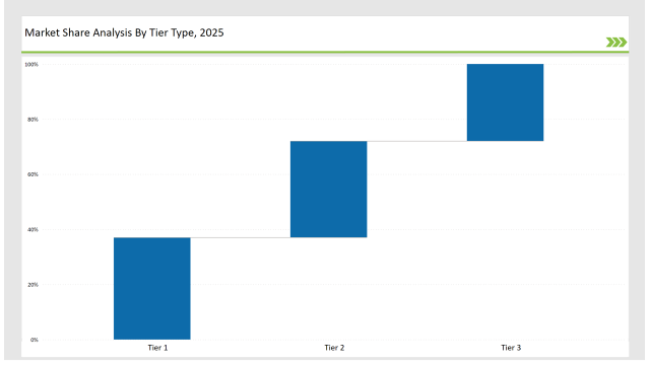

Dominated by Tier 1 players (Hexcel, Toray Industries, and Solvay), who command a 37% share thanks to cutting-edge research, large-scale production, and vast global distribution channels.

Tier 2 players, SGL Carbon, Mitsubishi Chemical, and Teijin, account for 35% of the market share while pushing innovations in aerospace-grade materials, high-temperature resistance, and smart composites.

Tier 3 essentially comprises regional and niche companies holding 28% of the market, whose focus lies in customized solutions, bio-based resins, and AI-accelerated material development.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Hexcel, Toray Industries, Solvay) | 19% |

| Rest of Top 5 (SGL Carbon, Mitsubishi Chemical) | 11% |

| Next 5 of Top 10 (Teijin, Owens Corning, Gurit, Axiom Materials, Victrex) | 7% |

The advanced composites industry supports multiple sectors that require strength, weight reduction, and durability. Companies enhance smart composite manufacturing and AI-driven predictive analytics to improve product efficiency and optimize material performance. Firms develop next-generation reinforcement materials to increase strength and reduce weight further.

Manufacturers advance composite material solutions with nano-reinforced resins, smart self-healing composites, and AI-enhanced production techniques. AI-driven structural analysis improves quality control and production efficiency. Companies integrate real-time defect detection to minimize waste and enhance product reliability. Firms optimize resin infusion techniques to improve mechanical properties and reduce processing time.

Companies accelerate advanced composite development by adopting automated fiber placement, resin infusion molding, and AI-powered defect detection. They refine high-temperature-resistant composites and bio-based alternatives to meet environmental standards. Industry leaders implement digital twin technology for real-time structural analysis and performance prediction. Manufacturers integrate machine learning algorithms to enhance material design and reduce production errors. Firms expand the use of graphene-enhanced composites to improve conductivity and mechanical properties. Companies develop ultra-lightweight composites to enhance fuel efficiency in aerospace and automotive sectors. Researchers explore self-healing composite materials for extended durability and reduced maintenance costs. Industry leaders invest in hybrid composite structures to optimize strength-to-weight ratios and structural performance.

Year-on-Year Leaders

Technology suppliers should prioritize automation, sustainability, and smart manufacturing to maintain competitiveness. Collaborating with industries such as aerospace, automotive, and renewable energy will drive demand and innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Hexcel, Toray Industries, Solvay |

| Tier 2 | SGL Carbon, Mitsubishi Chemical, Teijin |

| Tier 3 | Owens Corning, Gurit, Axiom Materials, Victrex |

Leading manufacturers enhance AI-driven composite production, digital twin analysis, and high-performance material customization. They integrate smart sensors for real-time structural monitoring and automated quality control systems. Companies optimize composite curing processes to improve material consistency and reduce defects. Firms leverage robotic automation to increase production efficiency and maintain precision in composite fabrication.

| Manufacturer | Latest Developments |

|---|---|

| Hexcel | Expanded aerospace-grade carbon fiber production (March 2024) |

| Toray Industries | Launched next-gen thermoplastic composites (April 2024) |

| Solvay | Introduced sustainable epoxy resin systems (May 2024) |

| SGL Carbon | Developed AI-enhanced composite manufacturing (June 2024) |

| Mitsubishi Chemical | Released bio-based fiber-reinforced materials (July 2024) |

| Teijin | Innovated high-temperature-resistant composites (August 2024) |

| Owens Corning | Strengthened glass fiber supply chain (September 2024) |

The market for advanced composites changes as businesses invest in smart materials, automation, and sustainable manufacturing. Businesses incorporate lightweight reinforcement material, nanotechnology, and AI-based quality control to enhance efficiency and product performance. Businesses innovate high-temperature-resistant composites to serve aerospace and industrial applications. Manufacturers use predictive maintenance equipment to maximize the lifespan and reliability of materials.

Manufacturers create AI-based material design, digital twin analysis, and ultra-lightweight composites. They advance high-performance composites for aerospace and automotive technology while growing smart, self-healing materials for long-term use. Firms incorporate automation in composite manufacturing to improve efficiency and accuracy. They adopt bio-based resins to improve sustainability and meet regulatory requirements. Firms optimize fiber placement techniques to maximize strength while minimizing material waste. Researchers explore nanotechnology applications to enhance composite performance. Industry leaders invest in predictive maintenance tools to extend product lifespan and reliability.

Hexcel, Toray Industries, Solvay, SGL Carbon, Mitsubishi Chemical, Teijin, Owens Corning, Gurit, Axiom Materials, Victrex.

The top 3 players collectively hold 19% of the global market.

The market shows medium concentration, with top players holding 37%.

The key growth drivers include increasing demand from aerospace and automotive industries, advancements in lightweight and high-strength materials, and the rise of sustainable and bio-based composites.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.