The worldwide advanced composite industry will see miraculous growth in the duration of 2025 to 2035, backed by growing requires across areas such as aerospace, automotive, and building. There is an unparalleled performance capability of advanced composites in terms of their lightweight to strength ratios relative to standard metals, impact resistance, and protection from corrosion. The intensification of environmental responsibility and cost sensitivity has served further to propel adoption of the new composite material throughout industries.

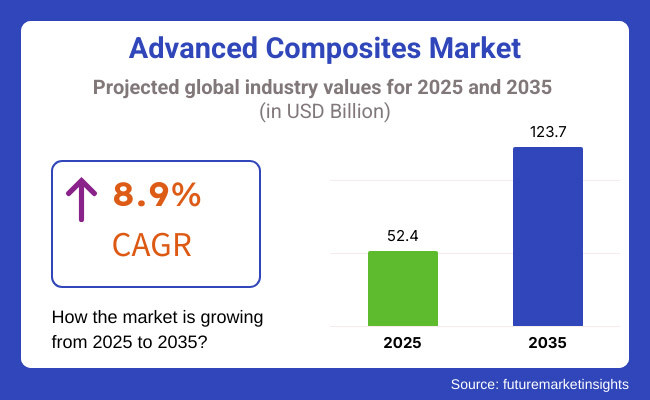

The advanced composites market share by 2025 was approximately USD 52.4 Billion and it is projected to reach USD 123.7 Billion by 2035, growing at a CAGR of 8.9% from 2025 to 2035. Market growth is anticipated to benefit from the development of material science technology, increasing adoption of carbon fiber composites, and rising investment toward automation of manufacturing processes.

Explore FMI!

Book a free demo

North America is a leading market for advanced composites, backed by a robust aerospace and defense industry, extensive use of lightweight materials in automotive production, and heavy investments in R&D. The United States and Canada are at the forefront of next-generation composite material development and commercialization.

In contrast, Europe is characterized by increasing demand from renewable energy sources, particularly from wind energy applications. Germany, France, and the UK are all getting more focused on sustainability, and on minimizing carbon footprint via advanced composites use in transportation and industrial applications.

The highest growth in advanced composites market has been witnessed in Asia-Pacific owing to accelerated industrialization, increasing automotive production and growing aerospace manufacturing. Composite technology and infrastructure development are also receiving major investments from China, India and Japan in response to growing demand.

Latin America is witnessing steady growth in this market with rising industrial uses and expanding investments in lightweight materials. Brazil and Mexico are major drivers, with a concentration on developing composite production capabilities and integrating them in high-performance applications.

Middle East & Africa region is slowly growing its presence in the advanced composites market with rising investments across construction, infrastructure, and defense. Composite manufacturing is becoming popular due to the efforts in the region by the UAE and South Africa to expand composite manufacturing.

The advanced composites market has been set to grow consistently over the next decade, creating opportunities for material developers, aerospace engineers, and vehicle designers, as composite materials continue to evolve and are adopted in an expanding range of industries.

Challenge

High Production Costs and Complex Manufacturing Processes

The Advanced Composites Market is limited by expensive raw materials and premium manufacturing processes. Advanced composites like carbon fiber and aramid composites require premium production processes, which drive costs up and limit mass-market entry.

Expensive tooling and labor-intensive production drive up total cost of production. The industry stakeholders need to invest in automation, new manufacturing technology, and low-cost raw material acquisition to drive affordability and scalability against this.

Recycling and Environmental Concerns

The recycling of advanced composite materials is one of the greatest challenges because traditional composites are non-biodegradable and have to be broken down through energy-intensive means. Aerospace and automotive industries are being pushed more and more to be more sustainable, but the lack of cheaply available recycling technologies is holding the industry back.

The development of new recycling processes, such as bio-based composite materials, and policy rewards for sustainable production can reverse these environmental concerns and move market take-up forward.

Opportunity

Growing Demand in Aerospace and Automotive Industries

The Advanced Composites Market is being propelled due to the ever-increasing demand for lightweight and high-performance material in aerospace and automotive industries. With the requirements of fuel efficiency, durability enhancement, and emissions reduction, manufacturers are compelled to include advanced composites in aircraft bodies, electric cars, and performance sports cars.

Organizations targeting increasing composite use, enhancing the manufacturing process efficiency, and developing alliances with OEMs will get an upper hand in the marketplace.

Expansion of Advanced Composites in Renewable Energy and Infrastructure

Application of next-generation composites in wind energy, construction, and infrastructure development offers new possibilities for growth. Application of carbon fiber composites by wind energy turbine manufacturers is increasingly being employed to make blades lighter yet more efficient, thereby increasing the potential for energy generation.

Composites are increasingly being applied to bridges, ship construction, and high-speed rail because they are more durable and corrosion-resistant. Companies which invest in composite technology for the infrastructure and energy from renewable resources are likely to be rewarded with this new business segment.

During 2020 to 2024, the Advanced Composites Market witnessed consistent growth fueled by enhanced usage in aerospace, automotive, and wind energy applications. Nonetheless, high price, supply chain issues, and environmental issues presented challenges. Market participants reacted by emphasizing automation, sustainability efforts, and increasing research into future composite materials.

Forward to 2025 to 2035, the industry will experience revolutionary changes in the form of the creation of bio-based composites, AI-based composite production, and innovation in recycling technology. The entry of smart composites with in-built sensors, advanced thermoplastic composites, and higher regulatory support for green materials will fuel further growth. The escalating need for high-performance composites in urban mobility solutions and space exploration will also define the future of the industry.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing environmental regulations on composite waste |

| Technological Advancements | Growth in automated composite manufacturing and material R&D |

| Industry Adoption | Increased usage in aerospace, automotive, and wind energy |

| Supply Chain and Sourcing | Dependence on limited raw material sources |

| Market Competition | Dominance of established players in aerospace and automotive sectors |

| Market Growth Drivers | Demand for lightweight materials and fuel efficiency |

| Sustainability and Energy Efficiency | Initial exploration of composite recycling technologies |

| Integration of Smart Monitoring | Limited adoption of sensor-integrated composites |

| Advancements in Composite Innovation | Development of high-strength and lightweight composites |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of sustainable composite policies and incentives for eco-friendly production |

| Technological Advancements | Widespread adoption of AI-driven composite fabrication and smart self-repairing composites |

| Industry Adoption | Expansion into infrastructure, urban mobility, and space applications |

| Supply Chain and Sourcing | Diversification of supply chains with bio-based and recycled composite materials |

| Market Competition | Rise of new entrants focusing on sustainable and cost-effective composite solutions |

| Market Growth Drivers | Surge in eco-friendly composites, high-performance thermoplastics, and advanced recycling solutions |

| Sustainability and Energy Efficiency | Full-scale adoption of circular economy models, bio-composites, and low-energy composite production |

| Integration of Smart Monitoring | Widespread use of smart composites with real-time performance monitoring and predictive maintenance capabilities |

| Advancements in Composite Innovation | Introduction of multi-functional composites with enhanced durability, conductivity, and adaptability |

North America is expected to dominate the advanced composites market from 2018 to 2023, owing to the growth of the aerospace, automotive, and defense sectors in the United States. Major composite manufacturers in the country invest in research and development, helping to develop new lightweight and high-strength materials.

Market growth is also driven by government initiatives to promote the use of advanced composites in energy-efficient applications. Moreover, an increasing demand from the wind energy sector and the rising use of composites in various applications is propelling the market growth in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.3% |

Aerospace and automotive industries in the UK serve as prominent markets for advanced composites. There is an upsurge in investments in carbon fibre and glass fibre composites due to the growing production of electric vehicles and next-generation turbine blades and aircraft.

The rising sustainability projects supported by the government, which promotes sustainable materials, further aids the market expansion through green energy application. Additionally, collaborative research-development efforts between research institutions and manufacturers facilitate innovation in advanced composites technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.1% |

The European Union’s advanced composites market is currently led by Germany, France and Italy. Known for a strong automotive manufacturing, wind energy and aerospace bases, there's high demand for composite materials.

The European Commission’s sustainable materials and carbon-neutral manufacturing focus is growing investments in recyclable and bio-based composites. Market Growth is fueled by the increase in the funding for R&D of lightweight structures)

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.2% |

Japan is also a major market, with expertise in high-performance materials and robotics contributing to the advanced composites sector. Demand for both lightweight and durable composites is fueled by the country’s advanced manufacturing sector, especially in automotive and electronics.

Furthermore, investments in carbon fiber technology and government-supported research programs propel market growth. Japan's interest in sustainable composites also aligns with international environmental programmes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.4% |

South Korea is one of the fastest-growing advanced composites markets, backed by robust automotive and electronics industries. The country’s top companies are harnessing high-performance composites for electric vehicles and applications in renewable energy.

The national policies fostering innovation in materials science and the expanded partnerships with international manufacturers strengthen the country’s market position. Industry growth is further driven by South Korea's specialisation in nanocomposites and smart materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.5% |

It is these properties that give carbon composites control over the advanced composites market. These composites have been widely used in industries demanding lightweight, high-performance materials like aerospace, automotive, and wind energy.

Lightweight and strong carbon fiber-reinforced composites ensure better fuel economy in both cars and aircraft. Furthermore, new technologies in the carbon fiber production process have lowered composites costs, leading to a wider adoption across a number of industries.

The market is also impacted by aramid composites, especially in applications requiring both impact resistance and thermal stability. Aramid fibers, which provide low weight and high tensile strength aramid fibers, are most widely used for aerospace, defense, and protective apparel.

Such composites often withstand extreme situations whilst remaining lightweight, making them perfect for ballistic protection, structural reinforcement, and high-performance sports equipment. Surging utilization of aramid-based composites in military and protective applications, are presumed to be the most prominent market growth driver in future.

The aerospace and defense industry is still a leading market, and advanced composites have been used to reduce airframe weight and improve fuel efficiency. Carbon and aramid composites are widely utilized in the fuselage, wings, and interior components of aircraft to reduce overall weight and increase durability.

The growth of air travel, combined with the increasing demand for fuel-efficient and next-gen planes, has driven adoption of advanced composites in aerospace manufacturing. Composite materials remain the choice in defense applications like armor, vehicles and even gear for added safety and performance.

This is expected to witness significant penetration in key application segments such as automotive, due to a growing need for lightweight materials that further enhance fuel economy and lower emissions. As automakers look for ways to increase strength while decreasing weight, carbon fiber-reinforced composites are finding their way in structures, body panels and interiors.

The greatest focus on composites comes from the high-performance and electric vehicle manufacturers, because they seek to maximize efficiency and driving range. The demand for composite materials in automotive applications will likely increase significantly due to the emergence of sustainability programs and the need for strong emission regulations.

The enhanced composites market is propelled by the rising need and application of lightweight in aircraft, automotive, and sustainable energy industries. The companies are targeting the technological advancements in composite manufacturing, sustainable material solutions, and artificial intelligence (AI) driven quality control processes. Advancements in thermoset composites, carbon fiber reinforcement, and automation of the manufacturing process are revolutionizing the field.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Toray Industries | 18-22% |

| Hexcel Corporation | 14-18% |

| Solvay S.A. | 10-14% |

| Teijin Limited | 8-12% |

| Mitsubishi Chemical Corporation | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Toray Industries | Leading in carbon fiber composites for aerospace and automotive applications, investing in sustainable composite technologies. |

| Hexcel Corporation | Specializes in high-performance composites for aviation, defense, and wind energy industries. |

| Solvay S.A. | Pioneering thermoplastic composites and resin systems for lightweight and high-durability applications. |

| Teijin Limited | Developing advanced aramid and carbon fiber composites for industrial and structural applications. |

| Mitsubishi Chemical Corporation | Innovating in eco-friendly composite solutions and automation-driven production techniques. |

Key Company Insights

Toray Industries (18-22%)

Toray occupies a near-monopoly position in the carbon fiber market, with proprietary resin and fiber technology that can improve performance in aerospace and automotive markets.

Hexcel Corporation (14-18%)

Hexcel is a crucial player in high-performance aerospace composites with a focus on lighter, strong materials, for commercial and defense planes.

Solvay S.A. (10-14%)

Solvay is known to be a leader in thermoplastics composites and provides advanced material solutions to help customers create lighter components, improve fuel efficiency and increase structural integrity.

Teijin Limited (8-12%)

Teijin's core business is in aramid and carbon fiber composites for industrial applications, including next-generation mobility.

Mitsubishi Chemical Corporation (6-10%)

Mitsubishi Chemical is making an investment in eco-friendly composite solutions that focus on bio-based, renewable and recyclable materials as part of sustainable manufacturing, as per the company.

Other Key Players (40-50% Combined)

Dozens of companies are pushing innovations in advanced composites, particularly around next-gen materials and automation-based production methods. Key players include:

The overall market size for advanced composites market 52.4 Billion was USD in 2025.

The advanced composites market expected to reach USD 123.7 Billion in 2035.

The demand for the advanced composites market will be driven by increasing applications in aerospace and defense, rising adoption in automotive light weighting, growing demand in renewable energy sectors like wind energy, advancements in manufacturing technologies, and the need for high-strength, durable, and corrosion-resistant materials.

The top 5 countries which drives the development of advanced composites market are USA, UK, Europe Union, Japan and South Korea.

Aerospace & Defense and Automotive sectors growth to command significant share over the assessment period.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.