Executive Summary

Efficiency, power, and simplicity are more valuable to customers and businesses when selecting adhesive solutions. With its use in numerous industries, such as packaging, electronics, automotive, and medical, the market for adhesive transfer tapes is expanding. Adhesive transfer tapes, originally applied in industrial adhesion and sealing, now feature innovations such as heat-resistant polymers, enhanced bonding, and solvent-free adhesives.

Manufacturers are shifting towards high-performance, eco-friendly adhesives that satisfy industry demands. To address changing customer demands and regulatory needs, companies are launching recyclable content, bio-based adhesives, and low-VOC (volatile organic compounds) formulations.

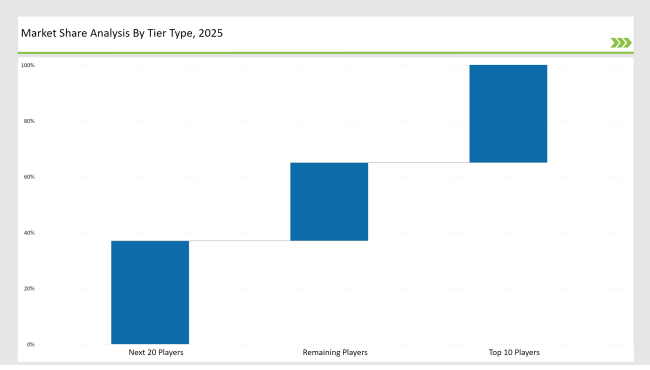

Tier 1 companies such as 3M, Avery Dennison, and Nitto Denko command a dominant 35% market share due to their strong adhesive technology, high-volume manufacturing, and well-established brands.

Tier 2 companies that provide specialized, affordable, private-label adhesive solutions for a range of industrial applications, including Tesa SE, Scapa Group, and Lintec, hold 37% of the market.

With 28% of the market, Tier 3 is made up of regional and specialty producers of high-performance, biodegradable, and sector-specific adhesive transfer tapes. These businesses prioritize locally produced goods, environmentally friendly adhesives, and personalized product lines.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Avery Dennison, Nitto Denko) | 16% |

| Rest of Top 5 (Tesa SE, Scapa Group) | 12% |

| Next 5 of Top 10 (Lintec, Intertape Polymer Group, Shurtape Technologies, Adhesive Applications, Sekisui Chemical) | 7% |

The adhesive transfer tape market supplies many industries with a demand for strong, flexible, and specialized adhesives to bond. As demand for high-performance, environmentally friendly adhesives increases, product capabilities continue to be developed by manufacturers.

Manufacturers are developing adhesive transfer tapes that balance strength, versatility, and sustainability.

The market for adhesive transfer tape is still being shaped by sustainability and innovation. To lessen their carbon impact, businesses are spending money on bio-based materials, solvent-free adhesives, and pressure-sensitive bonding technologies. In order to prevent counterfeiting, smart adhesive solutions now include incorporated security features and RFID tracking.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Technology suppliers will be required to focus on automation, material productivity, and sustainability when producing adhesive transfer tape. Partnerships with auto, healthcare, and electronics manufacturers will drive innovation and market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Avery Dennison, Nitto Denko |

| Tier 2 | Tesa SE, Scapa Group, Lintec |

| Tier 3 | Intertape Polymer Group, Shurtape Technologies, Adhesive Applications, Sekisui Chemical |

Leading manufacturers focus on improving adhesive durability, expanding transfer tape applications, and integrating sustainable adhesives to meet industry demands.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched solvent-free adhesive transfer tapes in March 2024. |

| Avery Dennison | Introduced biodegradable adhesive tapes in April 2024. |

| Nitto Denko | Developed high-temperature-resistant automotive adhesives in May 2024. |

| Tesa SE | Expanded specialty adhesive tape solutions in June 2024. |

| Scapa Group | Strengthened medical-grade adhesive portfolio in July 2024. |

| Lintec | Released ultra-thin, high-performance bonding tapes in August 2024. |

| Intertape Polymer Group | Focused on heavy-duty, industrial-grade adhesives in September 2024. |

| Shurtape Technologies | Innovated tamper-evident security adhesives in October 2024. |

The adhesive transfer tape industry is rapidly evolving as key players invest in sustainability, smart adhesives, and performance-driven solutions to maintain market leadership.

The market will shift towards AI-driven quality control to optimize the consistency and efficiency of adhesive bonding. Bio-based and green adhesives will become the standard as environmental protection regulations become more stringent.

RFID-tagged smart adhesives and tamper-evident security will drive market adoption. Production efficiency, cost savings, and precision will rise with automation. Growing demand in the automotive, electronics, and medical industries for lightweight, high-bonding adhesives will drive the market.

Leading players include 3M, Avery Dennison, Nitto Denko, Tesa SE, Scapa Group, and Lintec.

The top 3 players collectively control 16% of the global market.

The market shows medium concentration, with top players holding 35%.

Key drivers include sustainability, automation, adhesive material innovation, and regulatory compliance.

Explore Packaging Consumables and Supplies Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.