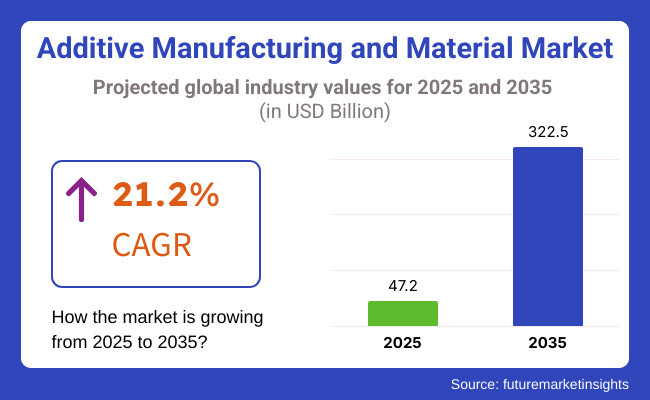

The Additive Manufacturing and Material Market is set for robust growth between 2025 and 2035, driven by increasing adoption across industries such as aerospace, healthcare, automotive, and industrial manufacturing. The market is expected to reach USD 47.2 billion in 2025 and expand to USD 322.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 21.2% over the forecast period.

The growing adoption of additive manufacturing technologies such as 3D printing and advanced material development are key drivers of market growth. As printing processes improve and material innovation continues, we anticipate the adoption of additive manufacturing to increase. And the rise in sustainability, demand for customization and low production methods are also driving widespread industry adoption.

The industrial growth in budding economies along with the high-performance material and software integration technologies stimulating market growth. Moreover, material developers are forming partnerships with manufacturers, making production processes more efficient and scalable.

But, high initial investment costs, regulatory compliance, and material standardization all pose challenges that need strategic interventions. Organizations are pouring investment into R&D in order to create economical and superior printing solutions in additive manufacturing, thus guaranteeing healthy growth of the market for additive in the long run.

Explore FMI!

Book a free demo

The additive manufacturing and material market in North America guide lights the largest share of this market driven by the advanced 3D printing technologies and high adoption in the aerospace, healthcare, and automotive industries. Region-wise, the USA and Canada are the leaders while major companies are widely investing in the R&D to improve the performance of the material, the efficiency of the process, and make them compatible with the Industry 4.0 solutions.

Additive manufacturing of prototypes, on-demand components, and lightweight parts continues to be a strong market, aided by developments in metals, polymers and composites. Perhaps even more important, regulatory frameworks such as those set by the Federal Aviation Administration (FAA) and the Food and Drug Administration (FDA) shape market environments by establishing mandatory compliance with safety and quality standards. There are still hurdles to widespread adoption, however, stemming from high material costs and issues with scalability of the process.

Additive manufacturing and materials market in Europe still remained a lucrative one in 2021 and continued to dominate during the duration, as largely horded by rich industrial nations such as Germany, France and United Kingdom with their high rates of industrial automation, precision engineering and manufacturing. This has also accelerated the implementation of 3D printing solutions to cater to the region’s sustainability and digital manufacturing focus.

Rising adoption of additive manufacturing in the production of automotive, medical implants & high-performance engineering will propel the market growth. But strict environmental regulations and shifting certification requirements do shape how things are made. European manufacturers are focusing on both material efficiency and recyclability - and on meeting evolving industry standards to maintain momentum in the marketplace.

Asia-Pacific region is the fastest growing market for additive manufacturing and materials owing to a high rate of industrialization and rising demand for advanced manufacturing solutions, especially in China, Japan, South Korea, and India. Strong demand for additive manufacturing in consumer electronics, industrial tooling and healthcare applications persists, with the aid of innovations in high-performance materials and scalable production technologies.

The region has a strong manufacturing ecosystem and competitive production costs, promoting the mass implementation of 3D printing solutions. The strong regulatory landscape such as intellectual property rights, material safety standards, and technological standardization are not static, and companies need to evolve with them. As a result, the initiatives based on smart factory, AI-based automation, and digital transformation are continuing to impact future market trends, and are thus driving investment in next-generation AM materials and processes.

Challenge

High Material Costs and Limited Scalability

The market for additive manufacturing and material is forecasted to grow exponentially, but high material costs and limited scalability currently pose significant problems. Development of innovative materials (high-performance polymers, metal powders, etc.) leads to higher production costs. Furthermore, issues related to scalability arise because companies find it hard to shift from prototyping to full-scale production, largely owing to the limitations on speed and consistency of manufacturing. Material innovations and process optimization are imperative for companies to improve cost-efficiency and scalability.

Opportunity

Expansion in Aerospace, Healthcare, and Automotive Industries

Additive manufacturing is seeing increased adoption in aerospace, healthcare, and automotive, which presents a sizeable market opportunity. Such innovations in new materials and 3D printing technologies are driven in demand for lightweight, high-strength components and customer-specific medical implants and devices. Additionally, AI-powered design optimization, multi-material printing, and sustainable materials continue to expand the capabilities and applications of additive manufacturing in multiple industries.

Additive manufacturing market grew in adoption for prototyping, tooling and limited production applications between 2020 and 2024. Nonetheless, issues like expensive materials, slow production speed, and variable quality limited wider industrial use. To overcome these limitations, companies dedicated themselves to refining printing techniques, developing specialized materials, and improving process automation.

In regards to 2025 to 2035, market growth will be fuelled by AI-powered design automation, hybrid manufacturing techniques, and advancements in bio-compatible and recyclable materials. These end2end solutions will be complemented through fully digital supply chains, on-demand production and sustainable 3D-Printing solutions all pushing the industry to the next revolution. Amp up investments by both governments and the private sector in components for additive manufacturing (AM) infrastructure will further drive adoption across industries.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with industry-specific material certifications |

| Technological Advancements | Improvements in metal and polymer 3D printing |

| Industry Adoption | Growth in prototyping and small-scale production |

| Supply Chain and Sourcing | Dependence on specialized material suppliers |

| Market Competition | Presence of niche additive manufacturing firms |

| Market Growth Drivers | Demand for lightweight components and rapid prototyping |

| Sustainability and Energy Efficiency | Initial exploration of eco-friendly materials |

| Integration of Smart Monitoring | Limited real-time process control |

| Advancements in Manufacturing Innovation | Use of conventional 3D printing techniques |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global standardization of additive manufacturing regulations and sustainability policies |

| Technological Advancements | AI-driven generative design, multi-material printing, and hybrid manufacturing |

| Industry Adoption | Expansion into mass production, aerospace, healthcare, and automotive sectors |

| Supply Chain and Sourcing | Integration of decentralized production and on-demand material manufacturing |

| Market Competition | Growth of large-scale industrial 3D printing providers and material innovators |

| Market Growth Drivers | Sustainable materials, AI-optimized design, and fully automated additive production |

| Sustainability and Energy Efficiency | Widespread use of bio-based, recyclable, and energy-efficient printing solutions |

| Integration of Smart Monitoring | AI-enhanced quality assurance, predictive maintenance, and real-time optimization |

| Advancements in Manufacturing Innovation | Adoption of multi-material, high-speed, and automated additive manufacturing systems |

The additive manufacturing and materials marketplace is experiencing explosive growth in the United States generating significant adoption in aerospace, healthcare, automotive, and industrial manufacturing. Demand is driven by the increasing use of 3D printing in medical implants, lightweight aerospace components, and customized automotive components.

Stirring the Scene: Recent years have seen cities such as Detroit, Chicago, and San Francisco rise as the epicentres of advanced material research and 3D printing innovation as governments build programs around sustainable material development and bio-based materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 21.2% |

The UK is experiencing a robust growth in the additive manufacturing sector with high demand for industrial-grade 3D printing in defence, healthcare, and automotive industries.

Government-backed research initiatives are driving London and Birmingham’s leadership in metal 3D printing, polymer-based additive manufacturing and bio printing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 20.4% |

Germany, France, and the Netherlands control the majority of the EU additive manufacturing market, where automotive, industrial, and consumer product applications are seeing considerable demand.

Germany, a stronghold of precision engineering and industrial additive manufacturing, is pouring money into generative design, performance-based materials and high-throughput AM. Sustainable materials and bio-based printing solutions are gaining attention in France and Italy, which is also boosting regional growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 20.6% |

Robotics, consumer electronics and automotive applications are making Japan's additive manufacturing market grow. Industry pioneers including Mitsubishi, Toyota, and Sony have incorporated 3D printing into smart manufacturing to bolster product personalization and variable material components development in recent years.

Further, the market is anticipated to be propelled nano textures and high-strength polymers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 20.9% |

South Korea has emerged as one of the fastest-growing markets for additive manufacturing technology, its applications being concentrated in electronics, health care, and industrial automation as well. The likes of Samsung and Hyundai are investing in 3D-printed electronic parts and high-performance materials for vehicles.

With the Republic of Korea joining the global trend as one of the most important centers for 3D printing R&D in addition to Seoul and Busan, the government is heavily investing in smart manufacturing and AI-driven design solutions and provides incentives for 3D printing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 21.0% |

The market is segmented by additive manufacturing and material technology, where the former dominate the landscape due to increasing adoption of advanced manufacturing methods, precision-driven production, and efficient material utilization.

These solutions provide design flexibility with waste reduction and product performance optimization for such industries as healthcare, aerospace and defence, automotive, and industrial manufacturing. The increasing demand for lightweight, complex and customized components is driving several additive manufacturing technologies to disrupt traditional production processes therefore significantly affecting market growth.

Additive manufacturing techniques like Stereo lithography (SLA) and Fused Deposition Modelling (FDM), enable industries to obtain highly accurate prototypes, finely detailed custom parts, and highly efficient structural designs. SLA and FDM offer superior design flexibility, fast prototyping, and economical production of complex geometries compared with traditional manufacturing techniques.

As one of the oldest and most mature forms/pointers of additive manufacturing the stereo lithography technology shows enormous opportunity for market growth because of its high precision, capability of producing fine features, and smooth surface finish.

SLA offers a level of precision unprecedented in traditional methods for applications in industries as diverse as aerospace, automotive and healthcare where it’s used for items such as functional prototypes, surgical models and fixtures and custom components. This technique allows to print complex patterns employing the nature of photo polymerization which also grants high-strength lightweight materials which makes it an interesting candidate for the future applications.

In contrast, FDM technology has risen to prominence due to its accessibility, material variety and cost-effectiveness. FDM is being used more and more in industries, delivering durable, thermoplastics parts for end-use, as well as industrial tooling and rapid prototypes (thermoplastics such as ABS, PLA, and nylon).

With their low-cost FDM printers and production scalability, small businesses and large manufacturers have a compelling solution. Moreover, the developments in multi-material printing and high-temperature filament availability have made FDM attractive to an even wider range of industries.

SLA and FDM fuelled the demand of customized, lightweight and high-performance materials. According to research, over 60% of manufacturers utilize SLA or FDM among additive manufacturing technologies because of its precision, rapidity, and flexibility. Innovations in the sector through AI-based design optimization and automated printing are on the upswing, and are well-positioned to propel notable market growth.

However, challenges persist including material limitations, surface finish optimization, and it requires high initial investment. Yet, the continuous developments in photopolymer chemistry, hybrid printing approaches, and AI-enabled print optimization solutions help resolve the barriers, offering greater adoption of SLA and FDM across sectors.

The other modifiers driving market growth, especially for applications using metal and ceramic parts, include binder jetting and Laser Sintering. With material efficiency, rapid production speeds, and economical batch manufacturing, these technologies are poised to become desirable solutions in industries that require precision-engineered components.

Companies are starting to lean towards binder jetting for the production of complex metal or ceramic parts in high throughput due to its powder-based additive manufacturing nature. Binder jetting is utilized by industries like aerospace and automotive to generate light yet tough structures that do not need exhaustive post-processing.

The technology's ability to print without support structures makes it more efficient, and allows manufacturers to scale production while maintaining design flexibility. Since then, its versatility with various materials such as stainless steel, ceramics, and composite powders have contributed to the widening of its applications.

Demand that cannot be met by traditional manufacturing technologies, including some large structures not printable with laser equipment, allowed the development of the laser sintering process, especially Selective Laser Sintering (SLS) and Direct Metal Laser Sintering (DMLS), which enable the direct printing of functional metal and polymer parts.

Aerospace and defence is heavily dependent on laser sintering to produce lightweight, complex geometries that cannot be accomplished with traditional machining methods. Alternatively, the healthcare sector utilizes DMLS for manufacturing patient-specific artificial limbs and implants with enhanced mechanical properties.

The increasing need for low-waste, energy-efficient and high-strength components has encouraged the adoption of binder jetting and laser sintering. Studies indicate that more than half of the metal produced using additive manufacturing is produced using them because of their excellence in terms of high strength-to-weight ratio and accuracy. With ongoing advancements in the material science research space, the coupling of AI-based print optimization, high-speed sintering techniques, and sustainable material formulations are expected to stimulate further expansion of the market.

Despite the advantages provided by binder jetting and laser sintering, challenges still exist due to powder handling complexities, energy-intensive processes and post-processing requirements. But recent progress in material recycling, AI-driven process control and hybrid printing technologies are addressing those challenges, leading to wider industry uptake.

The additive manufacturing market in the healthcare and aerospace & defence industries is experiencing significant growth due to the increasing demand for precision-engineered components, patient-specific solutions, and lightweight structural components enabled by advanced 3D printing technologies.

Additive Manufacturing has established itself as an essential technology in these industries due to its capability to manufacture custom high-performance parts with shorter lead times. Additive Manufacturing on Increase in the Healthcare Industry with Developments of Patient Specific Implant and Bio printing

Additive Manufacturing goes through a significant ramp-up period in the medical field, especially medical implants, prosthetics, and bio printing. Traditional manufacturing such as machining and casting depends on standardized parts, whereas additive manufacturing is used to produce patient-specific implants with high anatomical accuracy and better treatment outcomes.

Additive manufacturing technologies, including SLA, DMLS, and FDM, are increasingly used by medical device manufacturers to create personalized surgical guides, dental implants, and orthopedic prosthetics. The use of biocompatible materials (titanium, PEEK, bioresorbable polymers) also allowed to extend further the field of the application. Additive manufacturing has cemented its dominance in healthcare, with more than 70% of patient-specific medical implants produced using AM, according to research.

Within this realm, bioprinting is an innovative application of additive manufacturing that is advancing regenerative medicine through the creation of artificial tissues or organ scaffolds. Subsequently, the bioinks and cell-laden hydrogels have considerably improved tissue engineering research, leading to future perspectives in the fields of personalized medicine and organ transplantation.

Continued advancements in AI-powered cell placement, vascularisation approaches, and bio-compatible biomaterials are anticipated to be significant growth factors guiding the future market growth of bioprinting in healthcare.

Despite the immense potential offered by 3D printing, especially in terms of customization and precise healthcare applications, challenges such as regulatory approvals, biocompatibility of materials, and high production costs still persist. Nonetheless, the continuous advancements in AI-based medical imaging integration, affordable bioprinting materials, and real-time quality control are overcoming these challenges, propelling the market growth during the forecast period.

Aerospace and defence has continued to be one of the largest markets for additive manufacturing due to its unique ability to create lightweight, complex, high-strength solutions. Conventional end-to-end manufacturing schemes are material-wasteful with extensive machining times and design limitation; additive schemes eliminate these restraints by allowing for optimized structures without a strong material usage concern.

Technologies like binder jetting, laser sintering, and SLA in additive manufacturing are common practice in the aerospace industry for producing turbine blades, fuel nozzles, and other structural components. Being able to manufacture highly complex lattice structures with enhanced strength/weight ratios has made additive manufacturing key enabler for fuel efficiency and performance improvements for aircraft and spacecraft.

Additive manufacturing has also proved invaluable in the defence sector with rapid deployment of mission critical components. The technology facilitates on-demand manufacturing, allowing anything from lightweight armor structures to unmanned aerial vehicle (UAV) components to be produced, drastically decreasing supply chain dependencies and operational downtime. The additive manufacturing is used to improve performance and lower costs in more than 60% of next-generation aerospace and defence parts.

Additive manufacturing has numerous benefits in aerospace and defence, but there are challenges to overcome, such as material certification, process standardization, and scalability towards conventional mass production. Nonetheless, the above complications and others are posing challenges to the growth of the market, but innovations in AI-based structural analysis, real-time detection of failures, and rapid metal printing are addressing some of these challenges, creating opportunities for sustained growth in the market.

Key Market Drivers The growth of the market can be attributed to the rising adoption of additive manufacturing and advanced materials in environment drove industries like healthcare, aerospace & defence, automotive and industrial manufacturing. This growth can be attributed to improvements in 3D printing technologies, cost-effective manufacturing, and the development of high-performance materials.

These organizations are creating solutions for mineral development, mineral screening, and process-automation via AI for efficiency advancement, scalability, and item customization. This market consists of suppliers of additive manufacturing technology, material developers, and specialized service providers that provide precision-based solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Stratasys Ltd. | 20-25% |

| 3D Systems Corporation | 15-20% |

| EOS GmbH | 10-15% |

| GE Additive | 8-12% |

| HP Inc. | 5-10% |

| Other Manufacturers (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Stratasys Ltd. | Global leader of Fused Deposition Modelling (FDM) and PolyJet 3D printing technologies for the industrial and healthcare sectors. |

| 3D Systems Corporation | Expert in Stereo lithography (SLA) and Selective Laser Sintering (SLS) for high-precision 3D printing. |

| EOS GmbH | Develops advanced Laser Sintering technologies for aerospace, automotive, and medical applications. |

| GE Additive | Specializes in Binder Jetting and Direct Metal Laser Melting (DMLM) for industrial scale additive manufacturing. |

| HP Inc. | Develops low cost, fast production methods; Innovative Multi Jet Fusion (MJF) printing technology |

Key Company Insights

Stratasys Ltd. (20-25%)

Specializing in FDM and polyjet printing, Stratasys becomes the frontrunner in additive manufacturing markets that include aerospace, healthcare, and automotive.

3D Systems Corporation (15-20%)

Specializing in high-precision SLA and SLS technologies, 3D Systems provides end-to-end solutions for industrial and medical applications.

EOS GmbH (10-15%)

EOS, the world's leading supplier for laser sintering solutions, is a pioneer in metal and polymer additive manufacturing for industrial-scale production.

GE Additive (8-12%)

GE Additive for aerospace and automotive sectors GE Additive is a key player in the field of metal additive manufacturing, utilizing Binder Jetting and DMLM.

HP Inc. (5-10%)

Reshaping the industry with Multi Jet Fusion technology for scalable and cost-effective additive manufacturing.

Other Key Players (30-40% Combined)

Newcomers and independent producers are leading the charge of innovation including AI-aided design, sustainable materials, and high-throughput production methods. These companies include:

Desktop Metal (Specializes in affordable metal 3D printing solutions for industrial applications)

The overall market size for the additive manufacturing and material market was USD 47.2 billion in 2025.

The additive manufacturing and material market is expected to reach USD 322.5 billion in 2035.

The additive manufacturing and material market is expected to grow at a CAGR of 21.2% during the forecast period.

The demand for the additive manufacturing and material market will be driven by advancements in 3D printing technology, increasing adoption in aerospace and healthcare industries, demand for lightweight and customized products, sustainability initiatives, and growing applications in industrial manufacturing.

The top five countries driving the development of the additive manufacturing and material market are the USA, Germany, China, Japan, and France.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.