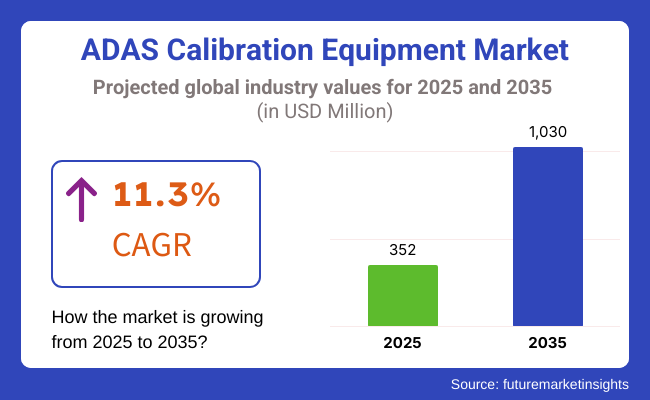

As per FMI analysis, the ADAS calibration equipment market will hit USD 352 million in 2025 and continue to grow further to USD 1,030 million by 2035, which has a CAGR of 11.3%. The key forces behind this trend are the increasing demand for fully autonomous and partially autonomous vehicles, the technological advancements in vehicle electrification, and smart city programs.

The integration of advanced driver-assistance systems (ADAS) in modern vehicles, the demand for precise calibration tools has surged. Car manufacturers and maintenance shops are heavily backing calibration technologies to guarantee the normal operation of vital safety equipment like collision avoidance systems, adaptive cruise control, and lane departure warning.

The industry is projected to present a significant expansion over the next decade, which is mainly caused by the robust growth of the automobile sector, new safety regulations, and the development of technology. Governments worldwide are imposing stricter safety regulations, making the need for accurate ADAS calibration tools more identifiable.

These regulations dictate the proper format and true pointing of sensors, cameras, and radar systems to improve car safety and help to avert accidents. Automotive service providers and manufacturers are rapidly responding to this demand by utilizing state-of-the-art calibration solutions which also help to increase efficiency and reliability.

On top of that, the ADAS penetrates cars to a higher degree, which leads to the growing annual requirements of regular upkeep and calibration that is needed for effective functioning of these systems. Furthermore, the growing popularity of electric vehicles has made it necessary to develop sophisticated diagnostic and calibration tools as electric and autonomous vehicles utilize sensor-based technologies to a greater extent to achieve safety.

The use of new technologies in AI-based diagnostics, off-site calibration, and cloud computing is bringing about a paradigm shift in the ADAS calibration sector. These technologies make way for more compact and accurate calibration processes, thereby down time is minimized, and accuracy is maximized. Automotive companies and calibration equipment manufacturers' investment in research and development is the driving force behind the progress of ADAS technology.

The shared role of original equipment manufacturers (OEMs) and calibration tool makers in this context gives birth to new on-the-market high technology as well as to more integrated and complicated calibration schemes.

As the adoption of ADAS expands, the requirement for top-notch calibration apparatus is assured to increase, therefore the vehicles with ADAS will be always safe and meet the new regulations. The ADAS calibration equipment industry, which will benefit from fast and stable growth, should keep a strong position driven by technological evolution, rules and the transfer towards intelligent mobility solutions.

Explore FMI!

Book a free demo

From 2020 to 2024, the industry grew smoothly because manufacturers and workshops focused on highly advanced driver support systems. Safer laws, along with accelerating consumer pressure on manufacturers for automatic features, caused adoption, requiring features such as adaptive cruise and lane-keep assist to have accurate calibration.

Tools that are highly accurate and based on optical, radar, and LiDAR sensing were offered by manufacturers. Also, cloud-based tools were used for remote testing. Equipment was costly, technicians were not easily available, and OEM calibration standards kept varying. This hindered the take-up, restricting access to smaller repair shops. Automated calibration offerings and training programs increased the hold in market.

From the years of 2025 to 2035, the market would go through a big transformation with respect to AI-powered automation, real-time sensor diagnostics, and cloud-enabled calibration panels. Self-adjusting sensors will minimize manual intervention using AI-powered calibration while quantum computing and LiDAR-based AR tools will be providing better accuracy. Robotic calibration stations will minimize labor expense, and blockchain would secure alignment data for sensors.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments controlled ADAS safety standards and created demand for certified calibration equipment. | AI-controlled calibration precision, blockchain-protected compliance records, and automated regulatory reporting will define regulation. |

| Calibration gear entailed optically, radially, and LiDAR sensor realignment to ensure proper ADAS functionality. | Quantum computing-driven calibration, self-healing AI-based sensor diagnostics, and AR-directed calibration grids will redefine the market. |

| Vehicle manufacturers and auto repair shops used ADAS calibration to reset sensors following repairs or replacement. | Autonomous cars will need real-time continuous calibration, creating a demand for automated, cloud-based calibration solutions. |

| Cloud solutions for calibration and operations for remote diagnostics have won the hearts of repair workshops with no fuss realigning such sensors. | The new normal will be robotic calibration stations, self-calibrating sensors attributable to AI, and 5G-enabled real-time tuning of ADAS. |

| Calibration devices were power-hungry and employed complex calibration methods unique to each manufacturer. | Wireless, energy-efficient calibration devices vector multi-brand calibration protocols with standardization and minimize electronic waste programs for greater sustainability. |

| The AI-based calibration software is ideal for conducting remote diagnostics and performance analysis of sensors. | Predictive AI-based calibration maintenance integrated with blockchain-secured calibration logs and real-time adaptive sensor tuning is the tonic for improved ADAS accuracy. |

| Cost of equipment and the requirement for specialized technicians created adoption barriers in small repair shops. | AI-based automated calibration processes, decentralized manufacturing of equipment, and OEM-free calibration solutions will make it more accessible. |

| Growing ADAS-equipped vehicle sales, enhanced safety regulations, and demand for precise sensor alignment fueled market growth. | Expansion will be faster with autonomous car adoption, AI-based self-calibrating ADAS systems, and legislations on periodic sensor recalibrations. |

Demand for the calibration equipment and services for ADAS is driven by the globally varying ADAS calibration regulations. The NHTSA has imposed stricter rates in North America, and automatic emergency braking (AEB) will be mandatory in all new vehicles in the region in 2027, placing greater demands on the accuracy of ADAS calibration.

The same goes for the European Union, where vehicles must meet Euro NCAP and General Safety Regulation (GSR) that enforce the likes of lane-keeping assist, adaptive cruise control, and blind-spot detection, thus making vehicle calibration to ensure compliance an absolute must.

China’s GB/T standards set rigid ADAS testing protocols that vehicles must meet to demonstrate that their systems achieve performance levels, while Japan’s MLIT maintains strict ADAS safety regulations as part of the country’s leap forward in autonomous driving technologies.

In contrast, India, South America and the Middle East have less-stringent restrictions. India’s AIS 140 standard does establish rules covering vehicle tracking and emergency response systems, but regulations around advanced driver assistance systems remain limited, impeding widespread adoption of calibration. In developed economies, fortunes may be reversed, as road safety initiatives will be more stringent, and ADAS compliance more rigorous in emerging economies.

Increased global ADAS regulations and the need for accurate calibration tools have helped improve demand in repair and service centers. AI-powered diagnostics and automated testing are changing that paradigm, ensuring ADAS sensors are calibrated properly. Because government regulations are increasingly requiring calibration following the repair of these devices, it is more important for companies to expand their range of technology to ensure they are in compliance with these changing regulations.

| Region | Regulation Stringency |

|---|---|

| North America (USA & Canada) | High - Mandatory ADAS compliance, strict safety norms, and regular calibration requirements. |

| European Union (EU) | High - Euro NCAP and GSR enforce stringent ADAS regulations and frequent calibration mandates. |

| China | High - GB/T standards require comprehensive ADAS compliance and testing protocols. |

| Japan | High - MLIT enforces ADAS safety regulations with stringent calibration procedures. |

| India | Low - Early-stage ADAS regulations, voluntary adoption, and minimal enforcement. |

| South America (Brazil, Argentina) | Low - Limited ADAS regulations, voluntary implementation, and evolving safety norms. |

| Middle East (UAE, Saudi Arabia) | Low - ADAS adoption driven by market demand, few formal regulations in place. |

| Africa (South Africa, Nigeria) | Low - ADAS regulations are minimal, with no widespread calibration requirements yet. |

Growing use of ADAS calibration tools in passenger vehicles is driven by increasing uptake of safety features in newer models. Safety features like adaptive cruise control, lane departure warning, automatic emergency brake, and blind-spot monitoring make extensive use of extremely sensitive cameras, radar, and LiDAR sensors.

Proper operation of these features requires proper calibration, especially after repairs, windshield replacement, or wheel alignment. With ever-tighter vehicle safety standards worldwide, suppliers and repair shops are turning attention to ADAS calibration to achieve system reliability and passenger safety.

Another major contributor to demand for ADAS calibration tools is increasing adoption of electric and autonomous cars. These cars come with advanced sensor suites that must be periodically recalibrated in order to match evolving road environments and software versions. The evolution of connected vehicles has also fueled demand for frequent recalibration in order to allow ADAS functionality to coexist with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications.

Automotive original equipment manufacturers (OEMs) are progressively applying ADAS calibration equipment in response to the escalating embedding of advanced safety and driver-assistance technologies in contemporary vehicles. With features such as lane-keeping assist, adaptive cruise control, and collision avoidance systems becoming increasingly commonplace, proper calibration ensures their best performance and complies with regulations.

Malfunctioning or less accurate ADAS sensors due to improper calibration result in decreased safety for vehicles. OEMs are thus investing in cutting-edge calibration tools to increase reliability and comply with strict government safety standards across the globe.

Another key driver of OEM adoption of ADAS calibration hardware is the increase in electric and autonomous vehicles, which are much more dependent upon LiDAR, radar, and camera-type sensors. Both of these systems need to be recalibrated routinely and accurately as they are assembled and after body repairs or even software updates.

In order for sensor integration to be smooth and trouble-free, OEMs are installing automated systems in their lines and service departments, enhancing the efficiency of manufacturing and minimizing faults.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.7% |

| European Union | 5.8% |

| Japan | 5.6% |

| South Korea | 6% |

The USA is experiencing remarkable growth in the ADAS calibration equipment market as a result of the increasing integration of advanced driver assistance systems (ADAS) in contemporary vehicles. The main factors stimulating the growth are; the rise in demand for vehicle safety features, strict regulatory standards, and autonomous vehicle development.

To guarantee the proper working and accuracy of ADAS sensors such as cameras, LiDAR, and radar systems, automotive service centres and OEMs are implementing advanced calibration tools. The companies in the market which provide total calibration of various car brands like Bosch, Autel, and Hunter Engineering are in the lead with their high-precision calibration systems. FMI is of the opinion that the USA ADAS calibration equipment market is slated to experience 6.1% CAGR during the study period.

Growth Factors in USA

| Key Factors | Details |

|---|---|

| High Adoption of ADAS Technologies | The USA car market is fast embracing ADAS technologies like lane drift warning and adaptive cruise control, which require accuracy calibration equipment. |

| Regulatory Support | Government regulations requiring the fitting of certain ADAS features on cars are driving demand for calibration tools. |

| Technological Advancements | Improvements in calibration and sensor technology are increasing the accuracy and efficiency of ADAS systems and contributing to market growth. |

The UK industry is growing with the increase of vehicle safety regulations, electric vehicles, and the investments being made toward autonomous driving technologies. The UK government's road safety and emission reduction campaign is the driving factor for the adoption of advanced calibration equipment. The demand for precise ADAS calibration rises as more vehicles come with lane departure warning, adaptive cruise control, and collision avoidance systems.

Companies are coming up with portable and AI-driven calibration tools which are not only reducing the time spent fixing the cars but also improving the efficiency of the service centres. FMI is of the opinion that the UK industry is set to expand at 5.7% CAGR during the study period.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| Stringent Safety Regulations | The British government enforces strict safety standards on automobiles, which encourages the adoption of ADAS technologies and the related calibration software. |

| Growing Automotive Industry | The automotive sector growth focusing on advanced security features is increasing the demand for calibration tools. |

| Consumer Awareness | Increased public awareness of car safety technology results in higher take-up of vehicles with ADAS, thus enhancing the demand for calibration. |

In European Union, the ADAS calibration equipment market has been experiencing rapid development, primarily due to the stringent automotive safety regulations and the increasing implementation of ADAS in the new car models. Germany, France, and Italy are the top three nations which have embraced these notations due to high automotive production and innovations in the vehicle safety sector. FMI is of the opinion that the European Union industry is set to expand at 5.8% CAGR during the study period.

The Euro NCAP is helping car manufacturers to implement precise ADAS functionality which means the demand for advanced calibration systems will increase. Meanwhile, it is noticed that workshops and service centres are heavily investing in multifunctional calibration devices to meet the demands and perform a better work.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| Unified Safety Standards | The EU harmonized requirements of safety for harmonization seek to include the use of ADAS in automobiles, which demands the calibration hardware. |

| Automotive Manufacturing Hub | Europe's strong car production sector identifies advanced safety characteristics, increasing demand for calibration machines. |

| Research and Development Investments | Heavy investments in research and development on auto safety technology are a factor in developing and utilizing ADAS calibration tools. |

Japan has registered increased growth in the ADAS calibration equipment market showcasing its commitment to smart mobility solutions, autonomous driving R&D, & strict regulations. The high incidence of ADAS in cars from renowned producers like Toyota, Nissan, and Honda propels the needs for accuracy calibration systems.

The Japanese automobile and service industry are following the innovations route which speaks about the use of AI-powered and automated calibration tools to achieve better performance and efficiency. FMI is of the opinion that the Japanese ADAS calibration equipment market is set to observe 5.6% CAGR during the study period.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Technological Prowess | Japanese leadership in automotive technology enables the development and deployment of sophisticated ADAS, which requires the utilization of premium calibration tools. |

| Aging Population | Expansion in an elderly population generates the need for ADAS equipped vehicles for added safety, thereby making the calibration market expand. |

| Government Initiatives | Regulations promoting road safety and the employment of advanced automotive technologies support the growth of the ADAS calibration equipment market. |

The ADAS calibration equipment market in South Korea is obtaining a significant leap due to new vehicle model ADAS accession and autonomous car driving technology development. Government programs to spur digital transformation in automobile industry are the drivers for this growth.

South Korean manufacturers manufacture high-tech calibration devices including AI and machine learning so that they achieve even higher calibration precision. The expansion of EV production and the connected car phenomenon boosts the market as these systems require very refined ADAS calibration for proper functioning. FMI is of the opinion that the South Korean market is set to observe 6% CAGR during the study period.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Emerging Automotive Market | South Korea's expanding automotive sector is increasingly integrating ADAS features, which has created an increase in calibration equipment demand. |

| Focus on Export | Being a key vehicle exporter, South Korea sees to it that its cars adhere to global standards of safety, requiring accurate ADAS calibration. |

| Innovation in Vehicle Technology | Ongoing developments in automotive safety technologies create demand for the latest calibration devices. |

The ADAS calibration equipment industry is poised to experience significant growth from 2025 to 2035 as the use of advanced driver assistance systems (ADAS) increases in new cars. The greater inclusion of safety features, legal requirements for the safety of vehicles, and the need for high-precision calibration equipment drive growth in the market.

Firms are advancing efforts on AI calibration systems, autonomous and handheld measuring devices, and laser/ radar imager precise technology, which is the mainstay of the automobile industry and the different organizations collaborating with diagnostic companies in driving the transformation toward convenience, precision, and productivity of automotive ADAS calibration.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Automotive Service Solutions | 15-20% |

| Texa S.p.A | 10-14% |

| Autel Intelligent Technology | 9-13% |

| Snap-on Incorporated | 7-11% |

| Launch Tech Co., Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Automotive Service Solutions | Creating auto repair tools for ADAS calibration that cover all brands, as well as camera, radar, and lidar alignment systems with multi-brand compatibility. |

| Texa S.p.A | ADAS calibration tools for enhanced accuracy with AI-based diagnostics and remote cloud technical support. |

| Autel Intelligent Technology | Presenting portable ADAS calibration tools with automated alignment workflows and intuitive interfaces for car workshops and garages. |

| Snap-on Incorporated | Produces professional-grade ADAS calibration devices that concentrate modularity, expandability, and software integration. |

| Launch Tech Co., Ltd. | Accessibly priced and user-friendly ADAS calibration systems are initially for new markets and independent automotive service centres. |

Key Company Insights

Bosch Automotive Service Solutions (15-20%)

Bosch is the leader in the ADAS calibration equipment industry with its innovative multi-system calibration tools for OEMs, dealerships, and aftermarket service operators. Bosch specializes in high-precision radar and camera alignment technology combined with AI-based diagnostic platforms.

Texa S.p.A (10-14%)

Texa concentrates on smart ADAS calibration systems with cloud connection, remote diagnosis, and AI-powered automation for quick and accurate vehicle sensor alignment.

Autel Intelligent Technology (9-13%)

Autel focuses on workshop-friendly and portable ADAS calibration solutions, including automated alignment processes to maximize service efficiency and accuracy.

Snap-on Incorporated (7-11%)

Snap-on offers scalable and modular ADAS calibration solutions for professional automotive workshops with easy-to-use software and high-precision equipment.

Launch Tech Co., Ltd. (5-9%)

Launch Tech addresses cost-sensitive markets with budget-friendly ADAS calibration systems to make them accessible to independent garages and smaller service centers.

Other Key Players (40-50% Combined)

Several emerging and incumbent players drive the development of ADAS calibration technologies, providing different levels of automation and accuracy improvement. These are:

The market is set to reach USD 352 million in 2025.

The global industry is estimated to be USD 1,030 million in 2025.

The USA, set to expand at 6.1% CAGR from 2025 to 2035, is slated to witness fastest growth.

Automotive OEM is a major end user.

The major players include Mahle GmbH, Robert Bosch GmbH, The Burke Porter Group, HELLA GmbH & Co., Autel Intelligent Technology Corp., Ltd., TEXA S.p.A, COJALI S.L., Launch Tech Co., Ltd., Hofmann Megaplan GmbH, and BorgWarner Inc.

Based on vehicle type the market is divided into commercial vehicles and passenger vehicles.

By end user, the market is divided into automotive OEMs, tier 1 suppliers, and service stations.

By region the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.