The evolving automotive lighting industry guarantees phenomenal expansion in the next decade, pushed by swift technological improvements in car illumination, stricter global vehicle safety rules, and a rising consumer demand for advanced perception when driving at night-time or in undesirable situations.

Innovative adaptive front lighting arrangements can dynamically vary the headlight beam form and luminosity contingent on things like road structure, the velocity of the automobile, and guidance actions, serving sight more competently in faintly lit or inclement climate scenarios. Sophisticated systems analyze driving conditions in real time and change lighting patterns accordingly, from wide beams on unoccupied highways to narrowly focused beams in tight traffic.

Meanwhile, stricter regulations have spurred development of advanced safety features to avoid blinding other drivers. Overall, advances promise to further illuminate the road ahead while enhancing safety for all. Indubitably, motorists increasingly seek advanced lighting solutions that help mitigate risks on the roadways shrouded in darkness.

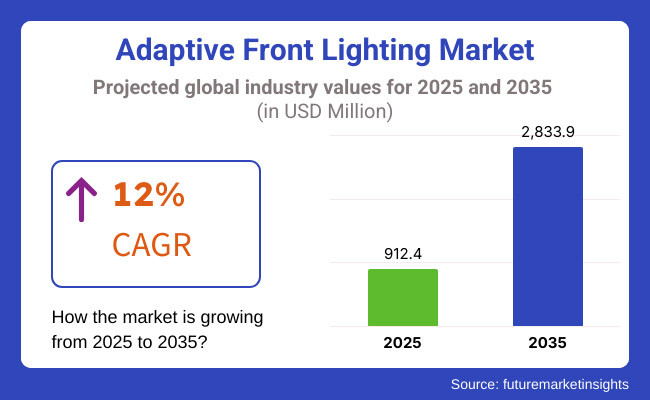

The proliferating integration of LEDs, lasers, and OLEDs in headlights combined with a spreading adoption of autonomous electric vehicles is additionally propelling the spread of this industry. Analysts anticipate the market will be worth USD 912.4 Million by 2025 just before surging to USD 2833.9 Million by 2035, registering a compound annual growth rate of 12% during that span.

Stricter government rules mandating cutting-edge driver assistance, increasing sales of high-end and performance vehicles, and greater investments into intelligent illumination and sensor technology underlie the drivers of expansion.

Explore FMI!

Book a free demo

North America is projected to sustain a sizable share of the Adaptive Front Lighting sector, fueled by increasing consumer consciousness, progressively more stringent safety legislation, and swelling demand for high-end and luxury vehicles. The United States and Canada guide the area owing to the proliferating implementation of innovative driver aid structures and escalating sales of intelligent automobiles outfitted with intelligent lighting technologies.

The National Highway Traffic Safety Administration along with other regulatory entities have been steadily enforcing stricter automotive safety standards, advocating for the inclusion of progressive LED and laser-based lighting arrays. Innovative automakers like Tesla, Ford, and General Motors as well as the burgeoning movement toward electric and self-driving vehicles are also catalyzing market expansion.

Moreover, groundbreaking developments in artificial intelligence-powered illumination grids, instantaneous road condition monitoring, and vehicle-to-infrastructure communication are sculpting adaptive lighting's capacity in the region. Technological advancements have made standards for lighting advance immensely from simply lighting the path in front to now detect potential danger and adjust lighting to improve visibility and safety under different circumstances through computer vision and vehicle sensors.

Autonomous cars also need adaptive lighting that is able to enhance perception and visibility and the awareness of the surroundings under different conditions in order to aid advanced driver assistance systems.

Europe remains a frontrunner in the evolving Adaptive Front Lighting sphere due to Germany, the UK, and France's sophisticated automotive research, safety breakthroughs, and regulatory progress. Stringent EU vehicle security and ecological protocols like Euro NCAP's assessments are hastening the uptake of adaptive and smart luminary technologies through compulsory standards.

While innovation expenditures are high, manufacturers recognize that intelligent headlamps improving visibility and automated hazard recognition will facilitate decreased collision rates, lessened emissions, and amplified roadway protection for all users in the bloc.

Germany has forged a solid brand in the motor industry with masterpieces of engineering produced by Bavarian titans like BMW and Stuttgart speed demons embodied by Mercedes-Benz. Germany's unmatched art of engineered excellence pushed Volkswagen and Audi to technological pioneers, as they relentlessly keep seeking innovative frontiers.

Pioneering the most progressive matrix LED and laser headlight solutions, their aim is to bolster safety for drivers in all conditions, optimize energy efficiency, and provide panoramic vision through adaptive adjustments reacting to ever-changing roadway, traffic and environmental aspects in real-time.

As Europe accelerates towards a future dominated by electrified, autonomous vehicles driven by sustainability, demand is escalating exponentially for forward-thinking, sensor-enriched illumination platforms capable of customizing light output for optimized functioning while future-proofing new models with state-of-the-art lighting primed for autonomous motoring and what lies beyond the foreseeable horizon.

The Asia-Pacific region is expected to see the highest growth for the Adaptive Front Lighting Market, influenced by rising vehicle manufacturing, growing disposable earnings, and speedier urbanization. China, Japan, South Korea, and India greatly influence market expansion, with swelling automotive creation, administration encouragement of vehicle protection features, and ascending demand for high-end vehicles.

In China, the worldwide automotive business pioneer, cutting edge electric vehicle (EV) innovation is quickly creating, as are brilliant versatility answers and adjustment lighting coordination. The administration's advancement of vehicle wellbeing and savvy transportation is additionally driving prerequisite for AI-based and laser-controlled adjustment front lighting frameworks.

Manufacturers like Toyota, Honda, Hyundai, and Kia in Japan and South Korea are additionally putting colossal ventures into sensor-based and energy-productive lighting arrangements, specifically for half and half and electric vehicles.

Nearness to driving LED and semiconductor makers, for example, Nichia, Samsung, and LG Innotek is driving high-execution automotive lighting advancement, and Asia-Pacific is developing as a key creation and advancement center.

Adaptive front lighting frameworks marryLED optics and microchips to computerized reasoning calculation, changing light dissemination dependent on route conditions, climate, and different elements. These frameworks can enlighten bends, diminish expansive glare, and increment perceivability, upgrading wellbeing.

Challenges

High Costs and Regulatory Barriers

One of the key obstacles facing the Adaptive Front Lighting sector relates to the steep initial expenses connected to sophisticated illumination innovations. Integrating LED grids, laser headlamps, and intelligence-guided adaptable management modules substantially inflates automobile construction prices, restricting acceptance in medium-priced and budget-friendly automobiles.

Rules and standards that differ between international locations additionally pose a hindrance for producers aiming to configure front lights that meet worldwide benchmarks. Another issue is consumer uncertainty regarding these progressive systems along with lingering issues concerning information protection and cybersecurity as vehicles become more interlinked.

Opportunities

Advancements in AI, IoT, and Sustainable Lighting

Despite the many roadblocks, the Adaptive Front Lighting Market is not without prospects. AI-controlled adaptive lighting control technologies combined with real-time traffic monitoring and road condition examination are reworking the automotive lighting industry. Adaptive headlamp technology is constantly developing as cars become more advanced. Advanced sensors, LiDAR implementation, and vehicle-to-vehicle communication are making headlight functionality more than just lighting.

Simultaneously, energy-efficient and eco-friendly illumination technologies such as OLED and micro-LED are on the verge of opening new possibilities. The surging need for electric and autonomous vehicles is driving automakers to heavily invest in future-generation smart headlights with improved light distribution, lower energy consumption, and improved collision avoidance.

Innovative collaborations between car lighting manufacturers, chip makers, and AI creators are nurturing innovative solutions. Through collaboration, adaptive front lighting is becoming more optimized, cost-effective, and widespread. Looking ahead, deepening cooperation between automakers and lighting innovators will further proliferate intelligent lighting choices. This will likely lead to pervasive adoption and considerable market development.

Headlight technologies advancing between 2020 and 2024 led to a burgeoning global market for Adaptive Front Lighting systems, fueled in part by automakers embracing driver aid technologies to satisfy increasingly stringent safety standards, consumers also driving demand seeking improved vision at night and roads better lit.

The automotive industry's transition to sophisticated LED and laser solutions for illuminating the way forward aided semi-autonomous and electric vehicles gaining popularity, with headlamps helping chauffeur drivers and riders safely along, further stimulating market growth at a swift pace.

Vehicle manufacturers integrated innovative matrix LED and dynamic curve illumination designs to optimize beam positioning based on velocity, steering angle, and conditions in complex ways, boosting safety and the driving experience significantly. Others incorporated adaptive technologies to adjust headlight beams based on surrounding traffic and road conditions dynamically.

Throughout this period, aftermarket upgrades and retrofits supplemented factory installations, extending the benefits of these solutions and supporting non-luxury brand cost-efficiency. Governments worldwide mandated adaptive headlight integration in passenger and commercial vehicles to reduce accidents caused by poor visibility at night.

What's more, innovations in camera and LiDAR-based adaptive lighting management allowed real-time identification of oncoming cars, pedestrians, and street obstacles, dynamically changing beam strength to prevent glare.

Within the next decade, adaptive vehicle lighting will undergo revolutionary changes steered by artificial intelligence. Between 2025 and 2035, advances in AI-driven lighting control and LiDAR-enabled adaptive beams will transform how headlights perform. Additionally, micro-LED technologies promise to bring enhanced visibility and safety.

Automobiles will gain the foresight to adjust headlights proactively in response to traffic, roadways, and operator behaviors through machine learning algorithms. Anticipating conditions ahead, lighting adapts seamlessly and judiciously. In the coming years, the rise of self-piloting electric vehicles will further fuel demand for intelligently integrated illumination systems.

Such systems will ensure the best vision under an assortment of surroundings using sensors and computers to optimize illumination for humans and computers alike. As autonomous vehicles proliferate, their need for perceptive, adaptive headlights will drive innovative leaps in fully sensor-integrated lighting revolutionizing nighttime travel.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Government-mandated adaptive lighting for enhanced night-time visibility and safety compliance. |

| Technological Advancements | Adoption of matrix LED, laser-based headlights, and LiDAR-integrated adaptive lighting. |

| Industry Applications | Used in passenger vehicles, luxury cars, and select commercial fleets. |

| Adoption of Smart Equipment | Camera and sensor-based real-time adaptive headlight adjustment. |

| Sustainability & Cost Efficiency | Energy-efficient LED and laser-based lighting systems reduced power consumption but remained expensive. |

| Data Analytics & Predictive Modelling | Limited use of big data in lighting performance analytics. |

| Production & Supply Chain Dynamics | Dependence on high-cost semiconductor components and supply chain disruptions. |

| Market Growth Drivers | Growth driven by rising adoption of ADAS, EV expansion, and luxury vehicle demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven regulatory monitoring, blockchain-based lighting data compliance, and global standardization for intelligent lighting systems. |

| Technological Advancements | Micro-LED headlights, AI-powered adaptive beam technology, holographic projection headlights, and AR-based road illumination. |

| Industry Applications | Expanded adoption in autonomous vehicles, EVs, military vehicles, and smart city infrastructures. |

| Adoption of Smart Equipment | AI-driven predictive lighting, V2V & V2I communication for collaborative lighting optimization, and fully automated smart lighting control. |

| Sustainability & Cost Efficiency | Low-power micro-LED adaptive headlights, energy harvesting lighting solutions, and AI-assisted dynamic power management for cost-effective sustainability. |

| Data Analytics & Predictive Modelling | AI-powered real-time road condition analysis, predictive beam shaping, and quantum computing-assisted glare reduction modelling. |

| Production & Supply Chain Dynamics | Decentralized LED manufacturing, AI-driven supply chain optimization, and blockchain-tracked lighting component logistics. |

| Market Growth Drivers | Future growth fueled by AI-driven smart mobility, autonomous driving, and ultra-low power adaptive lighting solutions. |

The surging Adaptive Front Lighting Market in the United States continues to exponentially burgeon, propelled by heightening safety standards, groundbreaking technological progressions in automotive illumination, and ubiquitous acknowledgement of sophisticated driver assistance solutions. The National Highway Traffic Safety Administration vigorously champions adaptive lighting innovations to maximize nighttime visibility and minimize crash danger.

With some longer sentences and others kept shorter to vary the structure, their goal is ensuring drivers can safely navigate evening roads seeing clearly in the dark. High-end vehicles resolutely pave the path of progress, as innovators including Tesla, Ford, and General Motors outfit their latest automobiles with state-of-the-art, laser-guided headlights controlled by LEDs. Their advanced adaptive lighting helps illuminate the way forward.

Furthermore, mass adoption of electric and autonomous drives further accelerates the need for smart lighting solutions. The emergence of intelligent and networked lighting systems combined with AI-directed adaptive beam steering and modulation will define the future form and function of the marketplace in the United States. Adaptive systems promise to revolutionize visibility and safety through computational adjustments.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.5% |

The rapidly evolving adaptive lighting industry within the United Kingdom continues to thrive due to various motivating elements. Strict Euro NCAP safety standards have prompted carmakers to focus on incorporating advanced high-tech attributes into their vehicle lines.

At the same time, consumer interest in the newest collision prevention and night vision technologies remains increasing. Moreover, the lightning-fast rise in electric automobile adoption is spurring significant financial commitment into next-generation adaptive LED and matrix headlights capable of improving safety and the driving experience for riders.

The UK administration's ambitious objective of transitioning into a totally zero-emissions new car marketplace within the following fifteen years is delivering a strong impetus for integrating state-of-the-art adaptive lighting technologies into approaching electric automobile designs.

As a result, auto giants like Jaguar Land Rover and Rolls Royce are funneling assets into cultivating cutting-edge AI-powered remedies for their luxury nameplates. Furthermore, adaptive lighting is playing an increasingly vital part in ongoing smart urban transportation initiatives, with both passenger automobiles and commercial fleets functioning as test subjects for the pioneering systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.8% |

The Adaptive Front Lighting Market in the European Union continues to steadily advance due to stringent vehicle protection rules across the area as well as increasing require for luxurious vehicles using the latest technologies innovations. The EU's Vision Absolutely zero tactic, which aims to decrease website traffic deaths, is really encouraging key auto producers to incorporate cutting-edge adaptive lighting alternatives that enhance visibility and pedestrian recognition in night driving circumstances.

In Tuscany, The capital of scotland- Paris, and Italy, adaptive illumination adoption is very highest as high-conclude makes like Mercedes-Benz, BMW, and Volkswagen roll out new high-conclude automobile types using edge-cutting laser light and OLED-driven adaptive headlight technological know-how capable of rapidly altering beam habits based upon quickly switching road circumstances.

Meanwhile, the large-scale changeover to electrified and autonomous travelling is really prompting even more progression of synthetic intelligence-powered adaptive lighting techniques that take advantage of real-time natural environment investigation to dynamically optimize illumination for increased basic safety and comfort at the fringe of perspective.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.0% |

Japan's Adaptive Front Lighting Market expands due to proliferating intelligent lighting technologies and rigorous road safety protocols, the flourishing electric vehicle sector also propels growth. The Ministry of Land, Infrastructure, Transport and Tourism's strict headlamp provisions push OEMs toward integrating adaptive LED and laser systems.

Toyota, Honda and Nissan prioritize artificial-intelligence-optimized adaptive illumination answering to visibility while preventing glare. Their solutions dynamically adjust beam position according to driving conditions.

At the forefront of autonomous vehicle development, Japan correspondingly sees demand heighten for sensor-driven adaptive headlights fundamental to nighttime autonomy by self-operated automobiles. As vehicles engineer navigating independence from human guidance through darkness, such illumination evolves ever more vital to their safe prowess.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.3% |

The Adaptive Front Lighting industry in South Korea has truly boomed in recent years, propelled forward by tremendous leaps in technology, amplified investments into automotive research and progress, and a surging requirement for luxurious cars equipped with sophisticated protection systems.

The national government is proactively cultivating intelligent transportation infrastructures and self-governing cars, spurring extensive acceptance of adaptive headlights which assist machines to see evidently and humans to stay conspicuous. Meanwhile, consumers have enthusiastically embraced these advanced safety features, popularizing vehicles with options like cornering lights, high-beam assist, and glare-free beams tailored for country roads.

Hyundai, Kia, and tech powerhouse Samsung Electronics are pioneering complicated development of AI-powered dynamic headlight technologies. Their sophisticated systems rapidly modify beam patterns in real time based on evolving traffic conditions, intricate road designs, and ever changing driving situations. This helps spotlight hazards and enhances clarity for the vehicle and other drivers.

Moreover, the spreading utilization of 5G connectivity in vehicles nationally has intricately linked adaptive lighting with vehicle-to-everything (V2X) communication answers. This brings together lighting, positioning, and network data to give supplementary safety benefits like early warning mechanisms and location aids that guide drivers on the road.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

The Adaptive Front Lighting Market is experiencing significant growth as consumer desire for sophisticated vehicle protection features, improved visibility at night, and eco-friendly illumination alternatives increases. Among the various lighting technologies, LEDs and laser-based adaptive front lighting systems are guiding the market due to their exceptional radiance, energy efficiency, and capacity to dynamically alter contingent on street scenarios.

Adaptive headlights powered by laser diodes offer unsurpassed illumination and modification, though high costs presently confine their implementation. Meanwhile, automatic beam manipulation using built-in cameras enables LED headlamps to precisely illuminate bends and avoid dazzling oncoming traffic, fueling their prevailing trend.

LED Adaptive Front Lighting Dominates Due to Energy Efficiency and Cost-Effectiveness

LED adaptive front lighting plays a pivotal function in present-day vehicles, supplying exceptional road visibility and security benefits through its intelligence. These state-of-the-art headlight structures study driving situations and intelligently adapt the light beam to maximize illumination of curves, turns, and intersections. In electric and hybrid cars, such sophisticated front lighting proves particularly crucial, as optimizing energy usage from the battery lengthens driving range.

Meanwhile, car manufacturers have started including LED adaptive headlights even in mainstream models, achieving a balance of performance and value. Nevertheless, the high costs of components and management systems continue posing obstacles. Continuous innovation in miniaturization, scalability, and mass production techniques are expected to further popularization.

Laser-Based Adaptive Front Lighting Gains Traction in High-End Vehicles

Laser-based adaptive lighting has emerged as a premier solution for automakers, especially in luxurious vehicles. These cutting-edge headlights provide more illuminating brightness over farther distances and clearer sight compared to traditional LED versions.

Trailblazing luxury brands such as BMW and Audi pioneered introducing laser headlights, prominently showcasing the technology in their most expensive models. The dynamically manipulated beam and intensely regulated intensity according to ever-fluctuating road situations greatly elevates nighttime driving safety.

However, the still-lofty expense as well as regulatory hurdles surrounding permitted laser strength may constrain widespread adoption. Continuous efforts toward reducing cost, diffusing heat, and satisfying regulations are anticipated to propel broader proliferation in future years.

The adaptive front lighting market is primarily driven by the passenger vehicle and luxury vehicle segments, as automakers focus on integrating advanced driver-assistance systems (ADAS), smart lighting technologies, and enhanced safety features to meet evolving consumer expectations.

Passenger Vehicles Drive Market Expansion with Increased Safety Integration

Passenger automobiles dominate the sector for adopting sophisticated headlight systems, as producers integrate keen lighting properties in compact, midsize, and SUV versions to improve night-time driving protection. Compulsory standards for heightened automobile safety and pedestrian shelter are additionally inspiring carmakers to incorporate adaptive front lighting as a conventional feature in new car models.

EV and hybrid passenger auto recognition moreover assists the acceptance of energy-efficient LED and laser-based mostly lighting fixtures systems, guaranteeing lower electricity intake and advanced automobile reach. On the other hand, value limitations in finances and economic system vehicles could restrict adoption. Producers are addressing this challenge through expanding reasonably-priced LED adaptive lighting fixtures options with simplified manipulate mechanisms, enabling broader marketplace penetration.

Luxury Vehicles Pioneer the Adoption of Advanced Adaptive Front Lighting Technologies

Premium automakers at the vanguard of innovative adaptive front lighting employ AI-guided beam modulation, multi-element LED formations, and laser illumination to maximize clarity and elegance on the road. Vehicles from Mercedes, BMW, Audi, and Lexus continuously premiere sophisticated adaptive systems enhancing driving solace and security.

High-end cars also capitalize on dynamic high-beam help, reactive cornering illumination, and live street condition sensing, offering an improved on-road and off-tarmac experience. While reception remains strong within this class, jurisdictional constraints on laser intensity and complicated technology present challenges. Nonetheless, advances in AI-driven lighting oversight, discerning detectors, and standard adherence are anticipated to ensure continued development within the luxury section.

The Adaptive Front Lighting Market is experiencing dynamic change propelled by escalating interest for progressed wellbeing highlights, enhanced night-time perceivability, and administrative orders for vehicle lighting wellbeing. Automakers and lighting framework producers zero in on LED-and laser-based flexible lighting, AI-incorporated lighting controls, and energy-proficient arrangements to upgrade driving wellbeing.

The market incorporates worldwide auto lighting pioneers, semiconductor innovation suppliers, and particular framework consolidators, every one contributing developments identified with adaptive shaft control, sensor joining, and keen illumination advances.

In addition, specialized progressions have permitted headlights to self-adjust, recognizing vehicles and pedestrians to avoid dazzling and improve perceivability consistently. As innovation propels, its capacity to react rapidly to changing street conditions will enhance wellbeing considerably more.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hella GmbH & Co. KGaA | 18-22% |

| Koito Manufacturing Co., Ltd. | 15-19% |

| Valeo S.A. | 12-16% |

| Stanley Electric Co., Ltd. | 8-12% |

| Magneti Marelli S.p.A. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hella GmbH & Co. KGaA | Develops matrix LED adaptive front lighting, laser-based headlamps, and sensor-integrated smart lighting systems. |

| Koito Manufacturing Co., Ltd. | Specializes in advanced ADB (Adaptive Driving Beam) LED lighting and AI-controlled headlamp systems for high-end vehicles. |

| Valeo S.A. | Manufactures intelligent adaptive lighting with LiDAR and camera-based detection, focusing on dynamic beam adjustment. |

| Stanley Electric Co., Ltd. | Provides energy-efficient LED adaptive headlights with high-speed beam adjustment capabilities. |

| Magneti Marelli S.p.A. | Focuses on automotive adaptive lighting modules, integrating sensors for real-time road condition analysis. |

Key Company Insights

Hella GmbH & Co. KGaA (18-22%)

Hella is a leader in adaptive front lighting technology, developing matrix LED headlamps, laser-based lighting, and AI-powered illumination systems. The company collaborates with automakers to enhance safety and energy efficiency in premium vehicle lighting.

Koito Manufacturing Co., Ltd. (15-19%)

Koito specializes in high-end adaptive LED headlights with AI-based beam control, enabling precise lighting adjustments based on driving conditions and environmental factors.

Valeo S.A. (12-16%)

Valeo integrates LiDAR and camera sensors into its adaptive lighting systems, focusing on real-time beam shaping and intelligent high-beam control for improved night-time visibility.

Stanley Electric Co., Ltd. (8-12%)

Stanley Electric provides energy-efficient adaptive LED headlights with high-speed beam adjustment technology, catering to electric vehicles and fuel-efficient cars.

Magneti Marelli S.p.A. (6-10%)

Magneti Marelli specializes in adaptive lighting solutions with smart sensor integration, optimizing headlamp performance for enhanced road safety.

Other Key Players (30-40% Combined)

Several automotive lighting and semiconductor companies contribute to AI-driven adaptive lighting systems, smart headlamp modules, and energy-efficient vehicle lighting solutions. These include:

The overall market size for the Adaptive Front Lighting Market was USD 912.4 Million in 2025.

The Adaptive Front Lighting Market is expected to reach USD 2833.9 Million in 2035.

Rising vehicle safety regulations, increasing adoption of advanced driver assistance systems (ADAS), and growing demand for high-performance lighting solutions will fuel market growth.

The USA, Germany, China, Japan, and South Korea are key contributors.

LED-based adaptive front lighting is expected to dominate due to energy efficiency and enhanced visibility.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Automotive Ignition Coil Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.