Adaptive Authentication Market is expected to witness a significant growth between 2025 and 2035 owing to the rising cybersecurity threats, and the growing adoption of digital transactions and AI-driven authentication solutions.

From ecommerce to banking organizations, adaptive authentication is a common feature adopted for enhanced security with an uninterrupted experience to users. With identity frauds, account takeovers, and credential stuffing attacks on the rise, the demand for risk-based, intelligent authentication mechanisms is only expected to increase.

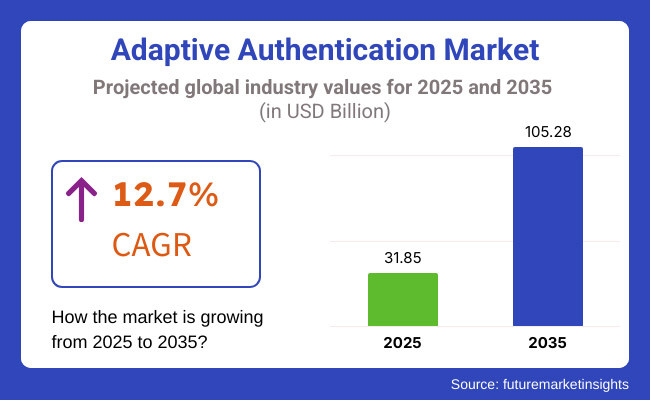

The market is expected to reach a size of USD 31.85 billion in 2025 and position itself at a value of USD 105.28 billion by 2035, for this period, the CAGR is 12.7%. The rising adoption of cloud computing, mobile-based authentication and multi-factor authentication (MFA), and other techniques also drive the growth of the market.

To combat cyber risks effectively, enterprises are evolving from traditional static password-based systems to context-aware, behaviour-based authentication models. Regulatory mandates like GDPR, CCPA, PSD2, and Zero Trust security models are forcing organizations to adopt solutions for adaptive authentication that address compliance and security.

The Adaptive Authentication Market in North America is expected to flourish owing to the greater adoption of the cloud-based security solutions coupled with the rising cyber threats as well as the strict regulatory frameworks. USA and Canadian companies are betting big on AI-driven authentication technologies, behavioral biometrics, and Zero Trust security frameworks to mitigate cybersecurity threats from hackers and other cybercriminals.

With an increasing number of data breaches, phishing attacks and identity theft incidents, businesses are being driven to move away from static, password-based login systems and towards intelligent, risk-based authentication mechanisms. Adaptive Authentication is being adopted by organizations to protect user identities and sensitive data due to government regulations like CCPA, HIPAA, and the National Institute of Standards and Technology (NIST) cybersecurity framework.

The region's robust cybersecurity ecosystem, concentration of global technology giants, and rising demand for password less authentication solutions will continue working towards market expansion.

The region shares one of the largest market sizes, driven by countries such as Germany, the UK, and France, which are leading the market in terms of adoption of multi-layered authentication systems. Regulatory compliance requirements, from the GDPR to PSD2’s Strong Customer Authentication (SCA), are driving financial institutions and enterprises towards adaptive authentication solutions.

By implementing AI-powered risk-based authentication to block malicious transactions and unauthorized access, businesses can enable safe transformative processes that crack down on and restrict fraudulent transactions as well as intrusions in the digital heart of Europe, where acceptance of digital banking, online transactions, and e-commerce continue to boom.

The market is also expected to grow rapidly due to the increasing adoption of biometric methodologies, behavioural analytics, and password less login solutions. Over the next few years, the expansion of digital identity verification platforms, remote workforce security protocols, and AI-powered fraud detection technologies will likely redefine the region’s adaptive authentication landscape.

The Adaptive Authentication Market in the Asia-Pacific region is anticipated to grow at the highest rate due to booming fintech, swift digital transformation, and escalating cyber threats. Market growth is being driven by countries such as China, India, Japan, and South Korea, where the penetration of mobile banking is high, the adoption of online payments is growing, and the demand for strong security solutions is rising.

In China, face recognition, AI-based fraud detection, and behavioural analytics are changing the authentication landscape. An increase in digital transactions for India due to initiatives like Digital India and UPI (Unified Payments Interface) is creating the need for real-time authentication solutions powered by AI so that cyber fraud can be avoided. Driven by data protection laws such as GDPR being enforced throughout the region, businesses are turning to AI enabled, compliance friendly authentication solutions.

Challenges

Complicated Implementation and Integration: Organizations often find it challenging to implement adaptive authentication solutions with legacy security infrastructure, resulting in some integration issues and implementation difficulties.

Privacy and Data Protection Concerns: The employment of behavioral biometrics, AI-driven tracking techniques, and contextual authentication approaches gives rise to some concerns regarding user privacy, data security, and adherence to legal compliance.

Barrier of Costly Security Solutions: While businesses are aware of the importance of adaptive authentication, the price of an AI-based security solutions and biometric authentication can prove difficult for small and medium enterprises (SMEs). Cybercriminals are finding new ways to bypass security measures

Opportunities

AI and Machine Learning will continue to Shape the Future of Authentication: AI algorithms will analyze user behavior to create granular profiles, allowing systems to quickly detect deviations or anomalies and prompt authentication measures accordingly.

Increasing Adoption of Passwordless Authentication: Organizations are moving towards passwordless authentication solutions such as biometrics, security keys, and device-based authentication methods to improve security and provide better user experience.

Rise of Zero Trust Security Frameworks - Enterprises are progressively moving towards Zero Trust architectures that allow adaptive authentication to validate user identity prior to access.

Rising Demand For Cloud-Based Authentication Solutions, Adaptable; As business are moving to the cloud, thus demand is for cloud-based adaptive authentication solutions that are cloud5based & thus MPO can be scalable,flexible & secure.

This is driving innovation in authentication as they galvanize compliance such as PSD2, GDPR, HIPAA, and CCPA.

2020 to 2024: Surge in Cybersecurity Threats and Demand for Intelligent Authentication

The Adaptive Authentication Market experienced rapid growth between 2020 and 2024, with organizations investing in advanced security solutions to combat a growing landscape of cyber threats, identity fraud, and data breaches. These trends, alongside the increase in remote work, cloud usage, and other digital transformation efforts, drove demand for dynamic authentication methods that could evaluate a risk in real time.

Conventional static authentication techniques (password-based login) fell short in combating sophisticated cyberattacks such as credential stuffing, phishing, and brute-force attack. When machine learning-driven risk assessment mixed with multi-factor authentication (MFA), it was employed by businesses to protect their identities without compromising user experience.

Financial institutions, healthcare providers, and e-commerce platforms pioneered the use of biometric authentication, behavioral analytics, and AI-powered fraud detection to protect sensitive customer data. Machine learning based risk-based authentication models assign risk scores for the user in real-time based on their behavior (such as typing speed or mouse movement), device reputation, geolocation, or network anomalies before granting access.

The emergence of zero-trust security models prodded organizations to adopt continuous authentication workflows, verifying user identity throughout the session rather than just upon login. Compliance regulations such as the GDPR, CCPA, and (in the case of financial transactions) PSD2 in Europe only increased the need for flexible security measures to ensure consumer privacy without breaching unauthorized access.

Challenges persisted despite the advances. The costs of implementation, users balked at further authentification stages, and integration complications all stifled widespread adoption. In contrast, companies that invested in enabling frictionless authentication experiences - logins without passwords and AI-based authentication workflows - found themselves with a distinct advantage.

2025 to 2035: AI-Powered Continuous Authentication and Quantum-Secure Identity Management

The Adaptive Authentication Market will witness a paradigm shift between 2025 and 2035 as enterprises adopt AI-driven continuous authentication, decentralized identity frameworks, and quantum-resistant security measures.

AI and machine learning will be integral to periodic wealth and document verification during authentication, allowing businesses to real-time process the micro-behaviours, keystroke dynamics, gait recognition and biometric traits. Traditional MFA will no longer be needed as behavioral biometrics and passive authentication methods will replace it providing seamless security at the point of access.

New Quantum Computing Threats Push The Adoption Of Quantum-Secure Cryptography In doing so, we will see enterprises adopt dids, allowing individuals to have SSI without reliance on a centralized database that can be hacked.

The approach of AI-driven anomaly detection and threat intelligence integration, delivering the ability to predict and protect accounts from takeovers before the fact. Dynamic Risk Assessment in Adaptive Authentication: Authentication mechanisms will become hyper-personalized based on the real-time risk assessments that will allow banking systems to dynamically shift authentication needs according to users’ contextual signals.

The regulatory landscape will bring even more innovation, as governments increasingly mandate identity protection through more stringent regulation. New systems for global digital identity verification will develop, where users can seamlessly authenticate across different platforms with the added security of biometric-backed digital passports and AI-verified credentials.

Brainwave authentication (EEG-based identification) and neural interface-based security channels will also be explored by enterprises as futuristic techniques in securing access. In turn, AI-driven identity governance will be key to automating the cybersecurity process so organizations can cut potential fraud consequences, whilst ensuring a user experience that is frictionless.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance-driven security upgrades (GDPR, PSD2, CCPA) |

| Technological Advancements | Adoption of AI-driven risk-based authentication |

| Industry Adoption | High adoption in finance, healthcare, and e-commerce |

| Threat Mitigation Strategies | AI-based fraud detection, geolocation tracking, and behavioral analytics |

| Authentication Models | MFA, biometric authentication, and zero-trust security |

| User Experience & Security Balance | Balancing security with user friction concerns |

| Market Growth Drivers | Rising cyber threats, regulatory compliance requirements, and remote workforce expansion |

| Fraud Prevention Techniques | AI-powered bot detection and biometric authentication |

| Data Privacy & User Control | Businesses manage authentication centrally |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global digital identity frameworks and quantum-secure authentication mandates |

| Technological Advancements | Quantum-proof encryption, blockchain-based identity management, and neural interface authentication |

| Industry Adoption | Integration across smart cities, IoT ecosystems, and autonomous systems |

| Threat Mitigation Strategies | Predictive cybersecurity automation, autonomous AI-driven threat intelligence, and post-quantum security measures |

| Authentication Models | Continuous, adaptive authentication with behavioral and biometric fusion |

| User Experience & Security Balance | Seamless, frictionless authentication with AI-driven passive security mechanisms |

| Market Growth Drivers | AI-powered security automation, blockchain-driven identity verification, and brainwave authentication |

| Fraud Prevention Techniques | Self-learning authentication models, federated identity verification, and real-time behavioral AI analytics |

| Data Privacy & User Control | Self-sovereign identity (SSI) models, user-controlled digital IDs, and decentralized authentication ecosystems |

North America, especially the United States, is important country for adoption of adaptive authentication owing to increasing focus on cybersecurity and regulatory compliance. Industries, from finance and healthcare to e-commerce, are pouring money and resources into more robust authentication solutions to curb fraud risk and secure data.

Additionally, the increasing occurrence of cyber-attacks and growing data protection regulations are driving organizations toward AI-based and biometric-based authentication solutions. Moreover, the growth of the cloud computing and remote work trend has demanded more secure identity verification systems, stoking market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 12.4% |

Increasing adoption of digital identification and cybersecurity solutions is driving the growth of the adaptive authentication market in the United Kingdom. The emergence of regulations like GDPR as well as strong authentication mandates has forced businesses to greatly deploy multi-factor authentication (MFA) and risk-based authentication systems.

Protecting identity fraud using machine learning powered security solutions is elementary for financial institutions, government agencies, and enterprises. Moreover, the combination of behavioural biometrics and AI-powered anomaly detection is expanding its way into the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 12.2% |

The European Union is experiencing consistent growth, with the primary economies of Germany, France, and the Netherlands paving the way for adaptive authentication solutions adoption. As identity fraud or data breach increases, companies make raising cyber security framework to combatėtų And now, we are training the data until October 2023. Besides, the growing digital banking and e-governance services is anticipated to boost the need for next-gen authentication technologies across the region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.3% |

Growing stance on cybersecurity in enterprises and digital transformation by organizations to secure online operations will exponentially boosts Japan Adaptive Authentication Market. As we get around to face the arise over identities, you are replacing.

Based on solutions, the AI-based fraud detection segment is forecasted to continue to account for a prominent market share, as the rising implementation of adaptive authentication in the banking and finance sector is projected to drive its growth. AI is also still being integrated into banks and fintech firms, tailoring models that use AI powered security frameworks to reduce fraud for online-based digital platforms and strengthen user verification.

Moreover, government-initiated regulations for secure digital identity and multi-factor authentication across multiple platforms are additional factors for the increasing demand for an efficient authentication infrastructure, conforming to the recently evolving regulatory standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.5% |

The adaptive authentication market in North America is expected to witness swift growth, due to growing digital banking, e-commerce and mobile payment solution in the continent. Due to the growing number of cyberattacks, companies are already adopting more complex authentication like biometric authentication and AI risk engines.

Moreover, with the growing demand for 5G technology and the rise in the number of Internet of Things (IoT) devices, the government's emphasis on digital security is also driving market growth. Enterprises use adaptive authentication to improve user experience without compromising on security.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

The increasing focus on cybersecurity, identity protection, and fraud prevention is expected to drive the growth of the adaptive authentication market. Businesses are adopting authentication via password, OTP token and biometrics to help enable user access control, generate anomalies and mitigate identity fraud. Also, the growing trend for cloud-based and on-premise deployments boosts the market growth even more.

Market Growth Driven by the Password Based and OTP Token Authentication as Organizations Are More Inclined to Layered Security

Password-Based Authentication: uuuIt Continues to be the foundational layer of security to gain access to your digital life Introduction Password-based authentication still is the most widely used security mechanism in organizations around the world. As the first line of defense in digital identity management, businesses implement passwords to authenticate users for access to sensitive data or systems. With many enterprises still relying on classic username-password combos - often in combination with extra security - despite the adoptation of multi-factor authentication (MFA) on the rise.

The frequent data breaches, credential stuffing attacks, phishing schemes, etc. have prompted organizations to improve password security with the help of AI-based risk assessment, real-time monitoring and behavioral analytics. To protect against such security vulnerabilities, companies are implementing adaptive authentication in concert with password management tools, encryption techniques and dynamic risk-based access controls.

The extensive use of username/password combinations can be risky since weak credentialing is still one of the leading causes of cyberattacks. To combat these threats, businesses are adopting password rotation policies, enhancing password complexity requirements, and using AI-based anomaly detection systems to block intrusive runs.

More Popular OTP Token Authentication As Companies Improve Identity Authentication

OTP (One-Time Password) token authentication is becoming a popular choice as a second-factor authentication for organizations wanting better security, fraud prevention, and better user experience. OTP tokens are leveraged by organizations to establish unique, transient authentication codes dispatched via SMS, email, or mobile applications, thereby guaranteeing that only authenticated users access sensitive systems.

OTPs-based adaptive authentication is widely used by financial institutions, e-commerce platforms, and cloud service providers to protect from identity fraud, unauthorized transactions, and theft of credentials. To further combat cyber threats, companies implement time-based one-time passwords (TOTP), push notifications, and biometrically-locked one-time passwords.

The increasing focus on zero-trust security models, data protection regulations, and AI-based fraud detection is driving the need for adaptive OTP authentication. However, threats like SIM swapping attacks, phishing scams, and OTP interception techniques persist. To combat these risks, organizations are growing increasingly reliant on measures such as encrypted OTP transmissions, artificial intelligence (AI)-driven authentication models and device fingerprinting techniques to bolster security.

Cloud-Based Adaptive Authentication Becomes Popular in 2023 with Skipped by Scalable and AI-Powered Security Features The growing adoption of cloud-based deployment for adaptive authentication is primarily attributed to its cost-effectiveness, scalability, and ability to leverage AI-driven risk assessment and real-time security analytics. Cloud authentication solutions have their greater adoption among businesses and companies due to the seamless integration, automated security updates, and the centralization of access to management spanning over several locations it offers.

This is where stateless adaptive authentication solutions that are cloud-based come into play, using machine learning algorithms, behavioral biometrics, contextual access policies to automatically analyze user activity, and flagging suspicious login attempts. Multilayer security controls, API based integrations, AI based fraud prevention mechanism, are helping and benefiting companies to secure digital identities.

With the rise of hybrid work environments, remote access requirements and cloud-first security models, organizations are moving to the cloud for authentication more quickly than ever. To bolster security across web, mobile, and enterprise networks, enterprises embrace identity-as-a-service (IDaaS), unfold AI-driven authentication engines and deploy cloud-centered MFA solutions.

While there are many advantages to using the cloud, there are key challenges around data sovereignty, risks associated with third-party access, and regulatory compliance. These risks are countered at the enterprise level through encrypted authentication frameworks, private cloud deployments, and AI-powered security monitoring that improve data protection and compliance adherence.

Enterprises Continue to Favor On-Premises Deployment for Full Control Over Authentication Security

Due to the desire for customized security configurations along with data sovereignty and in-house control over authentication infrastructure, many organizations are still adopting on-premises adaptive authentication. Enterprises in regulated industries like finance, healthcare, and government embrace on-premises solutions to adhere to rigorous data protection laws and retain operational autonomy.

Enterprise on-premises authentication has used existing IT infrastructure for applying security controls, and custom authentication policies, and enhance security with AI-driven behavioral analytics. Such solutions offer organizations more control over authentication, data storage, and adherence to industry-specific security requirements.

On-premises deployments, on the other hand, represent a higher upfront investment and require dedicated IT management and ongoing maintenance. So to combat these challenges, organizations are implementing hybrid authentication models, merging on-premises authentication with cloud-based AI analytics, as well as the automation of security updates.

The Adaptive Authentication Market expands with enterprises increasingly focusing on AI-based fraud detection, zero-trust security models, and real-time risk-based authentication to boost cybersecurity.

Biometric verification, machine learning-based anomaly detection, and multi-factor authentication (MFA) approaches are adopted by companies to implement cybersecurity threats mitigation. Competitive differentiation in a crowded space due to passwordless authentication, behavioural analytics and identity intelligence.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| RSA Security LLC | 15-19% |

| IBM | 12-16% |

| Okta | 10-14% |

| Cisco | 8-12% |

| Ping Identity | 7-11% |

| OneSpan | 6-10% |

| Broadcom | 5-9% |

| ForgeRock | 4-8% |

| OneLogin | 3-7% |

| SecureAuth | 3-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| RSA Security LLC | Provides RSA Adaptive Authentication, integrating AI-powered fraud detection, risk-based authentication, and biometric verification. |

| IBM | Offers IBM Security Verify, leveraging AI-driven identity analytics, adaptive access controls, and zero-trust security frameworks. |

| Okta | Develops Okta Adaptive MFA, enabling risk-aware authentication, biometric login, and contextual security for cloud applications. |

| Cisco | Provides Cisco Duo Security, featuring zero-trust authentication, real-time device trust verification, and behavioral risk analysis. |

| Ping Identity | Delivers Ping Intelligent MFA, incorporating adaptive authentication, AI-driven fraud prevention, and passwordless login capabilities. |

| OneSpan | Specializes in OneSpan Intelligent Adaptive Authentication, offering risk-based security, transaction monitoring, and mobile biometrics. |

| Broadcom | Develops Symantec Adaptive Authentication, integrating risk scoring, AI-powered fraud detection, and contextual authentication. |

| ForgeRock | Provides ForgeRock Identity Platform, offering AI-driven identity governance, adaptive access control, and continuous authentication. |

| OneLogin | Features OneLogin SmartFactor Authentication, combining machine learning-based risk analysis, user behavior tracking, and MFA. |

| SecureAuth | Offers SecureAuth IdP, incorporating biometric authentication, risk-based access management, and passwordless security. |

Key Company Insights

RSA Security LLC (15-19%)

RSA dominates the Adaptive Authentication Market with RSA Adaptive Authentication, delivering AI-powered risk scoring, real-time fraud detection, and biometric verification to strengthen enterprise security.

IBM (12-16%)

IBM enhances security with IBM Security Verify, leveraging identity analytics, AI-based authentication, and behavioral risk assessments for enterprise applications.

Okta (10-14%)

Okta strengthens cloud security with Okta Adaptive MFA, integrating contextual authentication, biometric verification, and AI-driven risk detection.

Cisco (8-12%)

Cisco secures enterprise access with Cisco Duo Security, offering zero-trust authentication, behavioral analytics, and device risk assessments.

Ping Identity (7-11%)

Ping Identity provides Ping Intelligent MFA, enabling passwordless authentication, machine learning-driven fraud prevention, and adaptive identity security.

OneSpan (6-10%)

OneSpan safeguards digital transactions with OneSpan Intelligent Adaptive Authentication, using mobile biometrics, AI-based fraud detection, and risk-aware authentication.

Broadcom (5-9%)

Broadcom strengthens enterprise identity security with Symantec Adaptive Authentication, offering real-time risk scoring, anomaly detection, and secure access management.

ForgeRock (4-8%)

ForgeRock enhances digital identity security with ForgeRock Identity Platform, integrating AI-driven governance, behavioral authentication, and continuous identity verification.

OneLogin (3-7%)

OneLogin delivers SmartFactor Authentication, combining ML-based risk analysis, dynamic user behavior tracking, and adaptive MFA.

SecureAuth (3-7%)

SecureAuth advances cybersecurity with SecureAuth IdP, incorporating biometric authentication, risk-based access control, and AI-driven fraud prevention.

Other Key Players (30-40% Combined)

Several cybersecurity firms contribute to zero-trust authentication, AI-powered fraud detection, and behavioral risk-based security solutions. Notable contributors include:

The overall market size for the Adaptive Authentication Market was USD 31.85 Billion in 2025.

The Adaptive Authentication Market is expected to reach USD 105.28 Billion in 2035.

The demand is driven by increasing cybersecurity threats, rising adoption of multi-factor authentication, regulatory compliance requirements, and the growing need for AI-driven risk-based authentication solutions.

The top 5 countries driving market growth are the USA, UK, Europe, South Korea, and Japan.

Password-Based and OTP Token Authentication is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Analysis (2018 to 2022) By Authentication

Table 2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Authentication

Table 3: Global Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 4: Global Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 5: Global Market Value (US$ Million) Analysis (2018 to 2022) By End User

Table 6: Global Market Value (US$ Million) Forecast (2023 to 2033) By End User

Table 7: Global Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 8: Global Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 9: Global Market Value (US$ Million) Analysis (2018 to 2022) By Region

Table 10: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table 11: North America Market Value (US$ Million) Analysis (2018 to 2022) By Authentication

Table 12: North America Market Value (US$ Million) Forecast (2023 to 2033) By Authentication

Table 13: North America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 14: North America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 15: North America Market Value (US$ Million) Analysis (2018 to 2022) By End User

Table 16: North America Market Value (US$ Million) Forecast (2023 to 2033) By End User

Table 17: North America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 18: North America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 19: North America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 20: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 21: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Authentication

Table 22: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Authentication

Table 23: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 24: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 25: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By End User

Table 26: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By End User

Table 27: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 28: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 29: Latin America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 30: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 31: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Authentication

Table 32: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Authentication

Table 33: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 34: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 35: Europe Market Value (US$ Million) Analysis (2018 to 2022) By End User

Table 36: Europe Market Value (US$ Million) Forecast (2023 to 2033) By End User

Table 37: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 38: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 39: Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 40: Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 41: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Authentication

Table 42: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Authentication

Table 43: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 44: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 45: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By End User

Table 46: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By End User

Table 47: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 48: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 49: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 50: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 51: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Authentication

Table 52: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Authentication

Table 53: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 54: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 55: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By End User

Table 56: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By End User

Table 57: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 58: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 59: East Asia Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 60: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 61: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Authentication

Table 62: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Authentication

Table 63: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table 64: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table 65: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By End User

Table 66: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By End User

Table 67: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 68: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 69: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 70: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2018 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Authentication

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Authentication

Figure 7: Global Market Attractiveness By Authentication

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 10: Global Market Attractiveness By Deployment Mode

Figure 11: Global Market Value Share Analysis (2023 to 2033) By End User

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 13: Global Market Attractiveness By End User

Figure 14: Global Market Value Share Analysis (2023 to 2033) By Industry

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 16: Global Market Attractiveness By Industry

Figure 17: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 18: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Region

Figure 19: Global Market Attractiveness By Region

Figure 20: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ Million), 2018- 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 25: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 26: North America Market Value (US$ Million), 2018 to 2022

Figure 27: North America Market Value (US$ Million), 2023 to 2033

Figure 28: North America Market Value Share Analysis (2023 to 2033) By Authentication

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Authentication

Figure 30: North America Market Attractiveness By Authentication

Figure 31: North America Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 32: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 33: North America Market Attractiveness By Deployment Mode

Figure 34: North America Market Value Share Analysis (2023 to 2033) By End User

Figure 35: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 36: North America Market Attractiveness By End User

Figure 37: North America Market Value Share Analysis (2023 to 2033) By Industry

Figure 38: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 39: North America Market Attractiveness By Industry

Figure 40: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 41: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 42: North America Market Attractiveness by Country

Figure 43: U.S. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 44: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 45: Latin America Market Value (US$ Million), 2018 to 2022

Figure 46: Latin America Market Value (US$ Million), 2023 to 2033

Figure 47: Latin America Market Value Share Analysis (2023 to 2033) By Authentication

Figure 48: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Authentication

Figure 49: Latin America Market Attractiveness By Authentication

Figure 50: Latin America Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 51: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 52: Latin America Market Attractiveness By Deployment Mode

Figure 53: Latin America Market Value Share Analysis (2023 to 2033) By End User

Figure 54: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 55: Latin America Market Attractiveness By End User

Figure 56: Latin America Market Value Share Analysis (2023 to 2033) By Industry

Figure 57: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 58: Latin America Market Attractiveness By Industry

Figure 59: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 60: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 61: Latin America Market Attractiveness by Country

Figure 62: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 63: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: Europe Market Value (US$ Million), 2018 to 2022

Figure 66: Europe Market Value (US$ Million), 2023 to 2033

Figure 67: Europe Market Value Share Analysis (2023 to 2033) By Authentication

Figure 68: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Authentication

Figure 69: Europe Market Attractiveness By Authentication

Figure 70: Europe Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 71: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 72: Europe Market Attractiveness By Deployment Mode

Figure 73: Europe Market Value Share Analysis (2023 to 2033) By End User

Figure 74: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 75: Europe Market Attractiveness By End User

Figure 76: Europe Market Value Share Analysis (2023 to 2033) By Industry

Figure 77: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 78: Europe Market Attractiveness By Industry

Figure 79: Europe Market Value Share Analysis (2023 to 2033) by Country

Figure 80: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 81: Europe Market Attractiveness by Country

Figure 82: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 83: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 84: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 85: U.K. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 86: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 87: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 88: Russia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 89: Rest of Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 90: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 91: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 92: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Authentication

Figure 93: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Authentication

Figure 94: South Asia & Pacific Market Attractiveness By Authentication

Figure 95: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 96: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 97: South Asia & Pacific Market Attractiveness By Deployment Mode

Figure 98: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By End User

Figure 99: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 100: South Asia & Pacific Market Attractiveness By End User

Figure 101: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Industry

Figure 102: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 103: South Asia & Pacific Market Attractiveness By Industry

Figure 104: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 105: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 106: South Asia & Pacific Market Attractiveness by Country

Figure 107: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 108: Indonesia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 109: Malaysia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 110: Singapore Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 111: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 112: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 113: East Asia Market Value (US$ Million), 2018 to 2022

Figure 114: East Asia Market Value (US$ Million), 2023 to 2033

Figure 115: East Asia Market Value Share Analysis (2023 to 2033) By Authentication

Figure 116: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Authentication

Figure 117: East Asia Market Attractiveness By Authentication

Figure 118: East Asia Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 119: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 120: East Asia Market Attractiveness By Deployment Mode

Figure 121: East Asia Market Value Share Analysis (2023 to 2033) By End User

Figure 122: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 123: East Asia Market Attractiveness By End User

Figure 124: East Asia Market Value Share Analysis (2023 to 2033) By Industry

Figure 125: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 126: East Asia Market Attractiveness By Industry

Figure 127: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 128: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 129: East Asia Market Attractiveness by Country

Figure 130: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 131: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 132: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 133: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 134: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 135: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Authentication

Figure 136: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Authentication

Figure 137: Middle East and Africa Market Attractiveness By Authentication

Figure 138: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 139: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 140: Middle East and Africa Market Attractiveness By Deployment Mode

Figure 141: Middle East and Africa Market Value Share Analysis (2023 to 2033) By End User

Figure 142: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 143: Middle East and Africa Market Attractiveness By End User

Figure 144: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Industry

Figure 145: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 146: Middle East and Africa Market Attractiveness By Industry

Figure 147: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 148: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 149: Middle East and Africa Market Attractiveness by Country

Figure 150: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 151: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adaptive Optics Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Microemulsions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Camouflage Materials Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Front Lighting Market Growth - Trends & Forecast 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Automotive Adaptive Lighting Market

Authentication Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Authentication Solutions Manufacturers

Authentication & Brand Protection Market Growth – Trends & Forecast 2024-2034

FIDO Authentication Market Analysis - Size, Share, and Forecast 2025 to 2035

Cloud Authentication Market Size and Share Forecast Outlook 2025 to 2035

Crypto Authentication ICs Market Growth – Trends & Forecast through 2034

Risk-based Authentication (RBA) Market

Out of Band Authentication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA