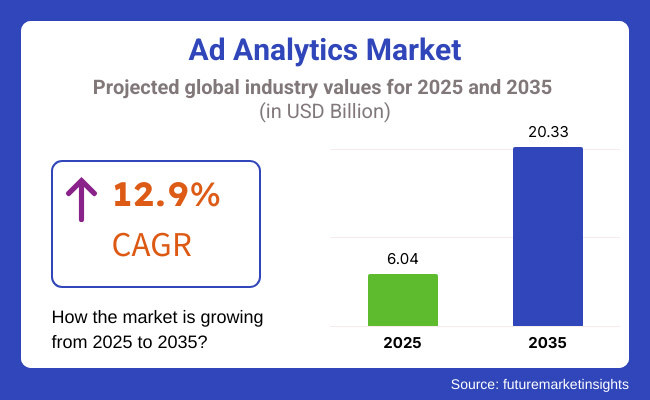

The Ad Analytics Market is expected to reach from USD 6.04 billion in 2025 to USD 20.33 billion by 2035, at a CAGR of 12.9% throughout the predicted period. The major growth factors of this market include increased spending on digital advertisement, growing demand for performance-based advertisement, and incorporation of a big data analytics in marketing strategy. Privacy regulations, consumer behaviour changes, and advances in AI-driven predictive analytics will also shape the evolution of the market.

Growing demand for data-driven advertising strategies, the emergence of AI-powered analytics and the dynamic growth of digital advertising channels are anticipated to expand the Ad Analytics Market considerably between 2025 and 2035. Businesses are ruthlessly using ad analytics platforms to analyse campaign performance, monitor consumer engagement, and optimise return on investment.

As programmatic advertising, cross-channel marketing, and real-time data tracking become increasingly dominant, advertisers can expect to see a continued shift in how brands split their advertising budgets. AI tools can analyse vast amounts of data and help companies identify which specific audience demographics to target, increase personalized marketing efforts and make informed decisions. As e-commerce, social media marketing, and connected TV (CTV) advertising continue to gain popularity, businesses are placing a premium on tools that help measure campaigns in real time to maintain competitiveness.

Explore FMI!

Book a free demo

The Ad Analytics Market will be held at the forefront by North America to increase their investment in AI-driven analytics solutions in order to maximize the returns on their digital advertisement strategies. Market growth in the region is further aided by having advanced digital infrastructure, a strong presence of tech giants, and consumer engagement across online channels.

The growth of connected TV (CTV) advertising, the expansion of influencer marketing, and additional investments in Omni channel advertising solutions are also solidifying market expansion. To optimize ads, companies are quickly implementing predictive analytics tools, real-time bid management platforms, and AI-based audience segmentation solutions into their advertising procedures. Reasons for this shift are due to the regulations like GDPR and CCPA forcing advertisers to turn to privacy-centric ad tracking solutions.

The Ad Analytics Market in Europe will dominate having a higher focus on ad performance measurement and AI-based marketing automation. The region’s strict data privacy laws in areas such as GDPR are compelling companies to formulate first-party data strategies and deploy privacy-compliant analytics tools.

The new European digital advertising landscape is swiftly emerging as brands ditch third-party cookies in favour of contextual targeting, artificial intelligence (AI)-powered personalization and predictive insights into consumer behaviours. Businesses are also spending on programmatic ad buying, real-time analytics, and customer sentiment tools to fine-tune their marketing campaigns. Continued market expansion will be driven by the growth of e-commerce, digital retail media networks, and AI-driven ad optimization solutions.

Ad Analytics Market in Asia-Pacific will harden the fact that it is the fastest growing region, propelled by increased digital ad spend. The region’s growing mobile-first consumer base, fast-end urbanization and booming social commerce industry have driven demand for real-time ad analytic platforms.

Companies are embracing AI-driven marketing platforms, automated bid optimization, and data-driven audience segmentation tools to enhance ad efficiency. Detailed tracking of consumer behaviour and measuring sales through advertisement are now leading to industry transformation with the fast-emerging Indian start up scene, adoption of digital payment and expanding smartphone usage driving businesses to enhance experience for the growing number of young and tech-savvy consumers

The regional governments are rolling out data privacy laws that establish rules comparable to the GDPR, which in turn is prompting advertisers to revaluate their tracking tactics and move to first-party data analytics solutions. In Asia-Pacific, the growing popularity of super apps, live commerce, and AI-powered influencer marketing analytics is augmenting ad analytics adoption.

Challenges

Opportunities

2020 to 2024: Growth Fuelled by Digital Advertising Boom and Data-Driven Marketing

A massive shift occurred from 2020 to 2024 when businesses realized they needed to move towards data-driven marketing strategies, which in turn translated into better customer engagement while allowing them to optimize ad spend. The growing presence of digital advertising on social media, search engines, streaming platforms, and e-commerce has spurred demand for tools that allow for tracking ad performance, audience segmentation, and return-on-investment (ROI) optimization, in real-time.

That’s when marketers adopted AI based ad analytics platforms in the marketplace that tracked KPIs like CTR, conversion rates, CLV, and attribution modelling. The increasing use of programmatic advertising and real-time bidding (RTB) systems allowed brands to automate ad placements and target finely defined audience segments.

Though, data privacy concerns, the erosion of third-party cookies and the changing landscape of regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) posed challenges for advertisers relying on behaviour tracking. In turn, businesses turned to first-party data strategies, contextual targeting, and adherence to consent-based collection models to ensure compliance despite maintaining ad effectiveness.

With growing Omni channel marketing strategies came the demand for unified ad analytics platforms capable of tracking ad performance across the web, mobile, connected TV (CTV), and in-app ecosystems. While big names such as Google, Facebook, and Amazon ruled the roost, new players in the privacy-focused space began developing AI-driven analytics solutions to gain a foothold in the market.

With all the automation, ad fraud, bot traffic, and problems with ad view ability were still ongoing problems. To combat fraudulent activities and improve ad spend efficiency, advertisers took advantage of block chain-based ad verification, AI-powered fraud detection algorithms, and transparency-enhancing initiatives.

2025 to 2035: AI-Driven Predictive Analytics and the Rise of Cookie less Advertising

The Ad Analytics Market will Transformation Between 2025 and 2035 As AI, machine learning and block chain are Reshaping Digital Advertising Strategies Predictive analytics, sentiment analysis, and real-time personalization will be key measures for businesses to adopt in order to maximize engagement and conversion rates.

With third-party cookies fully phased out, the world of advertising will rely on zero-party and first-party data strategies, including consumer preference tracking, AI-led contextual targeting, and consent-based data gathering models. Privacy-enhancing technologies (PETs) such as federated learning and differential privacy will help brands gain valuable insights, simultaneously adhering to strict data regulations.

The rise of the metaverse, Web3 and decentralized advertising networks will provide new avenues for immersive ad experiences. This can even lead to interactive and gamified ad campaigns, using virtual marketplaces, NFTs and decentralized applications (dApps) based on VR, AR and block chain-powered ad platforms to engage consumers.

As these trends continue, AI-powered advertising analytics platforms will become capable of predictive ad performance mapping, live sentiment tracking, and automated campaign optimisation. Emotion AI and biometric analytics will enable brands to understand consumer responses in real-time, through facial expressions, voice repertoires, and neural engagement levels.

Quantum computing will power ad analytics that can process this data in real time, enabling advertisers to analyse enormous datasets and deliver ads with unprecedented accuracy. Smart contracts on block chain will reduce both the need for and cost of intermediaries, ensuring transparent, fraud-proof advertising solutions while providing fair revenue allocation across digital advertising ecosystems.

Sustainability will also pressure them into green advertising practices, like energy-efficient ad delivery systems, carbon-neutral ad targeting, and eco-friendly digital ad formats. Powered by cutting-edge AI evacuation and sustainability analytics, advertising waste energy in direct relation to carbon footprints will remap brands with global sustainable goals.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing restrictions on third-party cookies and user tracking |

| Technological Advancements | AI-driven ad targeting, programmatic advertising, and real-time bidding (RTB) |

| Industry Adoption | High adoption in e-commerce, social media, and search engine advertising |

| Data Privacy & Compliance | GDPR, CCPA, and data localization laws shaping ad strategies |

| Supply Chain Transparency | Ad fraud and bot traffic detection through AI-based verification |

| Market Growth Drivers | Rising digital ad spend, AI-powered audience targeting, and Omni channel marketing |

| Sustainability & Energy Efficiency | Initial efforts toward sustainable ad formats and lower-energy ad servers |

| AI & Automation in Advertising | Real-time campaign performance tracking and AI-powered attribution modelling |

| Personalization & Engagement | Custom ad experiences based on behavioural data and preference history |

| Ad Fraud & Security | AI-powered fraud detection and third-party ad verification services |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Privacy-first advertising powered by AI, federated learning, and decentralized identity systems |

| Technological Advancements | Quantum-powered ad analytics, biometric response tracking, and block chain-based transparent ad verification |

| Industry Adoption | Expansion into metaverse advertising, NFT-integrated marketing, and decentralized ad networks |

| Data Privacy & Compliance | AI-powered privacy-preserving analytics, zero-party data collection, and real-time compliance automation |

| Supply Chain Transparency | Block chain-secured ad transactions and smart contract-enabled ad spend accountability |

| Market Growth Drivers | Expansion of immersive advertising (VR/AR), Web3-based ad monetization, and sustainable digital marketing |

| Sustainability & Energy Efficiency | Full-scale carbon-neutral ad targeting, AI-driven eco-ad optimization, and block chain-enabled green ad tracking |

| AI & Automation in Advertising | Autonomous AI ad campaign optimization, sentiment-driven dynamic ad creation, and neural engagement analytics |

| Personalization & Engagement | Hyper-personalized advertising through emotion AI, predictive modelling, and interactive metaverse-based campaigns |

| Ad Fraud & Security | Fully decentralized smart contract-based advertising, AI-driven fraud elimination, and bot-resistant ad verification mechanisms |

The Ad Analytics Market has been prominent in North America due to the need for digital marketing and programmatic advertising, with the advent of AI, the answer to effective and easy insights approach. Machine learning has emboldened the adoption of such technologies: the ability to anticipate and influence behaviour with greater granularity and pervasive actionable insight has led to more efficient ad spend and more data-driven targeting and engagement strategies.

Seamless integration with streaming offerings and CTV ad offerings also stoke demand for real-time ad analytics solutions. Moreover, data privacy requirements like the California Consumer Privacy Act (CCPA) are also forcing organisations to practice ethical data utilization and design a first-party data plan that is both compliant and beneficial for advertising. Ad performance has, therefore, become more measurable and efficient with the growth of predictive analytics and AI-powered automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 12.5% |

The rise of digital advertising, social media advertising and influencer marketing in the United Kingdom is fuelling the growth of ad analytics solutions. Organizations are relying more and more on AI-powered analytics tools to assess ad performance, measure consumer sentiment and improve content personalization. As the growth of online shopping and e-commerce advertising has sent conversion rates soaring, real-time insights have become more important than ever for brands.

Furthermore, companies have moved away from traditional methods due to the UK's Data Privacy Laws, which must comply with GDPR, driving a need for contextual advertising and cookie less tracking. Increasing focus on Omni channel, or multichannel, marketing approach, which involves data integration from various sources of platforms are further contributing to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 12.3% |

Ad Analytics market is growing in European countries, like Germany, France, and Italy. However, demand for advanced analytics solutions has been fuelled by the increased penetration of mobile advertising, along with a surge in video and display ads. EU regulations have pushed companies to implement more transparent and ethical ad-tracking methods. This evolution has resulted in an increased adoption of first party data strategies and privacy centred analytics tools.

Businesses, in turn, are also using predictive analytics and audience segmentation to improve their engagement all while still complying with new privacy standards. In addition to this, the region is witnessing a growth in programmatic advertising and the use of AI to track ad performance.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.4% |

Combined with increased digital transformation investment and AI-powered advertising strategies, the ad analytics market has quickly been growing across Japan. Data-driven marketing solution implementation by Japanese companies leads to insights related to consumer behaviour and advertising engagement. Demand for real-time analytics has been driven from the appetite for mobile advertising, particularly in the e-commerce and gaming verticals.

Therefore, Japan's advanced infrastructure aids the rapid implementation of AI-driven advertising solutions, allowing businesses to maximize ROI and optimize digital marketing campaigns. Automation within digital marketing is on the rise as well, making it possible to track campaign performance and target popular demographics with greater efficiency.

Optimizing price is crucial when the advertising field becomes an arms race while companies are investing in AI-based sentiment analysis and data-driven personalization to replace an unaggressive policy.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.6% |

South Korea Ad Analytics market is unearthing the potential due to the high penetration rate of social media marketing, mobile advertising, and video-centric content strategies. This includes improved connectivity, including high-speed internet and the rise of 5G technology, all of which has spurred further adoption around digital advertising platforms.

Corporate entities are leaning more towards the use of AI powered analytics tools to monitor the effectiveness of their advertisements, analyse user engagement, and manage ad placements across different digital channels. Furthermore, with a well-established gaming and entertainment sector in South Korea itself, digital ad spend is abundant, driving requirements for advanced analytics use cases. Moreover, brands are also enabling personalized ad experiences and predictive insights to improve customer targeting.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.7% |

As more organizations utilize AI-powered insights, automated tracking, and multi-channel ad performance analytics to optimize advertising efficiency, the ad analytics industry is flourishing. At present, the leading market segments are ad analytics software and cloud-based solutions, part of cloud applications that enable companies to spend wisely on ads, target the right audience, and ensure maximum return on the ad investment (ROI).

Real-Time Campaign Optimization and Performance Tracking With Ad Analytics Software

Ad analytics software for businesses helps to track ad engagement, click-through rates (CTR), conversion rates, and audience interactions across multiple digital platforms. The software also offers AI-driven insights, automated reporting and predictive analytics, enabling advertisers to optimize their campaigns, find top-performing content, and make adjustments to their bidding strategies in real-time.

The advent of programmatic advertising and personalized marketing has made ad analytics software a necessity for companies to track user journeys, analyse sentiment, and measure ad attribution. Machine Learning and Big Data are used to provide a granular insight into consumer preferences and ad effectiveness through these tools.

Ad analytics software is an analytics tool that helps e-commerce brands, media companies, and digital marketers track the effectiveness of ads run across search engines, social media, websites, and connected TV (CTV) platforms." Further adoption of these solutions has been pushed by the increased use of multi-channel attribution models, AI-driven customer segmentation, and campaign adjustments.

Although the scope for growth is huge, factors like implementation of data privacy regulations, fragmentation in the marketing landscape, and growing concerns regarding the rise of ad fraud act as roadblocks to the growth of the market. Companies are turning to block chain-based ad verification, AI-based fraud detection, and privacy-compliant ad tracking to protect data and comply with international laws.

Scalable, AI-Integrated Insights Make Cloud-Based Ad Analytics Solutions Popular Amid Growing Competition

This market of organizations comprises of companies with technology-based solutions that offer scalable cloud-based ad analytics platforms that can be easily integrated with other marketing tools, capable of processing data in real-time. Cloud platforms are also attractive to businesses, as they enable cross-platform tracking and optimization using artificial intelligence, machine learning, and automated audience segmentation - without the cost of extensive IT spur.

Cloud-based analytics tools allow businesses to view the performance of ads across social media, search engines, mobile apps and video streaming platforms in real time. Marketers are leveraging the cloud to anticipate consumer behaviour, adjust ad placements in real-time, and discover detailed insights about audience engagement metrics.

This shift towards cloud ad analytics is driven by the scale of adoption with Spectrum, 5G, edge computing, and big data analytics. Notably, they provide automated data visualization, interactive dashboards, and machine learning-powered recommendations, making it easier for advertisers to optimize their ROI.

Still, businesses must grapple with issues like data latency, dependence on the internet and fears of third-party data access. Companies are addressing these risks through hybrid cloud deployments, AI-powered data compression, and decentralized ad tracking models.

Online marketing and social media marketing are the top segments for ad analytics adoption among applications. Real-time audience insights, AI-driven campaign optimization, and automated ad performance tracking are now at the heart of the digital marketing strategies businesses implement.

AI-Powered Customer Insights and Multi-Channel Ad attribution Benefits Online Marketing

The data is used by online marketers to track user interactions, optimize ad placements and to measure the effectiveness of the campaign across different platforms. As e-commerce, digital advertising, and AI-powered content personalization grow, demand for advanced automated audience segmentation and real-time performance analytics is increasing.

Using AI-powered libraries of movie clips, customer reviews and your best hat images, companies are analysing that data on ad effectiveness and feeding it back directly into their CRM systems, AI-based content optimization, or automated bidding strategies to improve online ad performance. A/B testing, keyword performance tracking, and audience sentiment analysis are used by businesses to fine-tune their advertising campaigns.

Voice search advertising, programmatic ad buying, and personalized ad content are revolutionizing the online marketing industry. Analyses are performed to generate predictive analytics which machine learning utilizes for identifying high-converting ad creative, optimizing on ad delivery, and improving audience targeting.

Online marketers face challenges such as ad fatigue, rising customer acquisition costs, and shifting privacy regulations. To address these limitations, businesses are adapbit, utilizing privacy-first data collection methods, AI-powered contextual targeting, and block chain-based ad authenticity verification systems.

Social Media Marketing Leverages AI-Driven Engagement Insights and Influencer Campaign Analytics

Social media marketers rely on engagement rates, influencer performance analytics, and social media ad placements from ad analytics platforms. Real-time sentiment analysis, AI-divine audience insights, and of course dynamic creative content to make sure ads are more effective and audiences are retained.

This has led to an increased demand for social media ad analytics tools. By analysing user-generated content (UGC), influencers and ad engagement trends, companies are able to better target their ads and improve conversion rates.

As shoppable ads, social commerce, and augmented reality (AR) advertising become prevalent, businesses utilize AI-powered predictive analytics to provide personalized ad experiences and optimize the effectiveness of ad spend.

But rapid changes in search algorithms, intense competition for advertising space, and concerns about user data privacy make this a challenging landscape. Companies are addressing these matters through first-party data strategies, AI-driven ad targeting models, and ethical data collection practices.

Professional Services and Managed Services Fuel Growth of The Market With the Increase in Ad Analytics Capabilities

The market growth is primarily driven by high demand for software and cloud solutions, other major components include consulting services and managed services. As companies look to be optimized with their ad analytics solutions, they need not only consultative support, but also seamless integration of systems, as well as continuous technical support.

Ad Analytics Software and Services segment includes all activities ranging from consulting, integration, and installation services which are prove services from IT and software application analysis companies that are utilized to ensure a seamless deployment of analytical and cloud-based solutions for businesses. You require specialists to set up ad analytics to integrate seamlessly with the current marketing platforms, data management tools, and customer insight systems.

Through consulting services, the advertiser provides guidance to create data-driven ad strategies, optimize attribution models, and implement AI-powered analytics to enhance decision-making processes. The growing complexity of digital advertising and the ever-increasing demand for advanced analytics advice and strategic ad optimization consulting.

However, there are challenges like high costs of service and updating systems frequently. To overcome these challenges, businesses are increasingly turning to AI-powered automation, self-service analytics platforms, and streamlined on boarding processes.

Managed Services Also Offer Continuous Support and AI-Enhanced Tools for Ad Analytics Platforms

Real-time ad tracking, predictive campaign adjustments, and automated reporting fall under the purview of managed services, which is great for businesses without in-house expertise. To figure out what and how ad performance is detecting, traditional fraud detection, AI-based ad optimization, companies outsourcing directly to some managed service provider are managing at a lower cost and scalable to some extent.

As AI and predictive automation are getting more powerful due to analytics, direct ad tracking on the cloud, managed services now provide options for tailored ad intelligence frameworks, behaviour insights in the fragmented digital landscape and compliance-ready data security protocols.

Yet, organizations need to tackle data security issues, vendor dependency and system integration challenges. To put more simply, companies are cutting risk by using hybrid service, AI-powered security and multi-cloud ad analytics systems.

Ad Analytics Market is also developing as organizations are looking for data-driven insights, powered by AI marketing attribution and real-time advertisement performance tracking to enhance advertising strategies. Organizations aim at cross-platform analytics, predictive modelling, and segmentation to improve campaigns. Machine learning-based ad targeting, privacy-compliant data tracking, and Omni channel performance measurement innovations continue to make the market more competitive.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 18-22% | |

| Adobe | 14-18% |

| Oracle | 10-14% |

| Salesforce | 8-12% |

| 7-11% | |

| 5-9% | |

| Nielsen | 5-9% |

| IBM | 4-8% |

| Jungle Scout | 3-7% |

| HubSpot | 3-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Provides Google Ads Analytics, integrating AI-driven campaign tracking, audience insights, and predictive performance optimization. | |

| Adobe | Offers Adobe Analytics, utilizing AI-powered attribution modelling, cross-channel tracking, and real-time user engagement analysis. |

| Oracle | Delivers Oracle Moat and Oracle Data Cloud, focusing on ad verification, fraud prevention, and audience targeting solutions. |

| Salesforce | Features Salesforce Marketing Cloud, using AI-driven ad personalization, predictive analytics, and marketing automation. |

| Develops Meta Ads Manager, providing AI-based audience segmentation, campaign performance tracking, and conversion attribution. | |

| Provides Twitter Analytics, offering real-time campaign monitoring, audience engagement tracking, and sentiment analysis. | |

| Nielsen | Specializes in TV and digital ad measurement, providing cross-platform campaign effectiveness tracking and market intelligence. |

| IBM | Offers Watson Advertising, leveraging AI-driven ad targeting, predictive insights, and advanced media analytics. |

| Jungle Scout | Focuses on Amazon ad analytics, delivering competitive intelligence, PPC optimization, and e-commerce ad tracking. |

| HubSpot | Provides HubSpot Ads Analytics, integrating CRM-based ad tracking, lead attribution, and marketing automation insights. |

Key Company Insights

Google (18-22%)

Google dominates the Ad Analytics Market with Google Ads Analytics, using AI-driven insights, campaign optimization tools, and real-time performance tracking to enhance digital ad effectiveness.

Adobe (14-18%)

Adobe strengthens its position with Adobe Analytics, offering AI-powered attribution modelling, customer journey insights, and Omni channel marketing measurement.

Oracle (10-14%)

Oracle delivers Oracle Moat and Oracle Data Cloud, enabling ad verification, fraud detection, and audience intelligence solutions to improve advertiser transparency.

Salesforce (8-12%)

Salesforce leverages Salesforce Marketing Cloud, integrating AI-based ad personalization, customer journey mapping, and predictive analytics for marketing success.

Facebook (7-11%)

Facebook enhances its ad analytics through Meta Ads Manager, offering AI-driven audience segmentation, real-time engagement tracking, and performance forecasting.

Twitter (5-9%)

Twitter optimizes ad effectiveness with Twitter Analytics, delivering real-time sentiment tracking, engagement insights, and campaign impact measurement.

Nielsen (5-9%)

Nielsen leads in TV and digital ad measurement, offering cross-platform tracking, audience insights, and advanced attribution models.

IBM (4-8%)

IBM powers Watson Advertising, using AI-driven ad targeting, predictive consumer insights, and data-driven marketing analytics.

Jungle Scout (3-7%)

Jungle Scout specializes in Amazon ad analytics, providing e-commerce sellers with PPC optimization, competitive intelligence, and keyword performance tracking.

HubSpot (3-7%)

HubSpot integrates CRM-based ad tracking, marketing automation, and lead attribution tools, enhancing ROI-driven advertising strategies.

Other Key Players (30-40% Combined)

Several digital marketing and analytics firms contribute to ad performance optimization, AI-powered audience insights, and data-driven marketing intelligence. Notable contributors include:

The overall market size for the Ad Analytics Market was USD 6.04 Billion in 2025.

The Ad Analytics Market is expected to reach USD 20.33 Billion in 2035.

The demand is driven by increasing digital ad spending, the need for data-driven marketing strategies, AI-powered analytics, and the rising adoption of real-time ad performance measurement tools.

The top 5 countries driving market growth are the USA, UK, Japan, Europe, and South Korea.

Ad Analytics Software and Cloud Solutions is expected to command a significant share over the assessment period.

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

POS Receipt Printers Market Trends - Growth & Forecast 2025 to 2035

Multi-Axis Sensors Market Insights - Trends & Forecast 2025 to 2035

Personal CRM Market Report - Growth & Forecast 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.