The intelligent, smart packaging business is changing at a fast pace as businesses embrace real-time monitoring, freshness indicators, and IoT-facilitated solutions. With the increasing demand for product security, longer shelf life, and sustainability, businesses are embedding RFID technology, temperature-sensitive materials, and biodegradable smart films. AI-driven analytics, blockchain validation, and cloud-based data monitoring enhance the efficiency, security, and consumer interaction of supply chains.

Firms spend money on active packaging, antimicrobial finishes, and self-healing coatings to meet stringent regulatory requirements. The industry is shifting toward active and intelligent solutions that encompass QR codes, near-field communication (NFC), and intelligent sensors for authentication and monitoring.

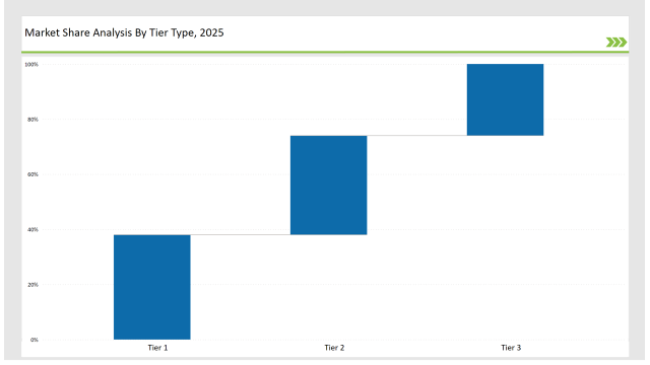

Tier 1 players such as Amcor, Sealed Air, and Tetra Pak have 38% market leadership via high-performance packages, green solutions, and smart tracking technologies.

Tier 2 players like Avery Dennison, Stora Enso, and Smurfit Kappa command 36% of the market share, focusing on active packaging technology, RFID-tracking, and temperature-sensitive smart packaging.

Tier 3 companies, made up of niche and regional companies, control 26% of the market. The firms have expertise in tailored smart labels, biodegradable packaging, and condition monitoring via artificial intelligence.

Explore FMI!

Book a free demo

Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Tetra Pak) | 19% |

| Rest of Top 5 (Avery Dennison, Stora Enso) | 11% |

| Next 5 of Top 10 (Smurfit Kappa, BASF, 3M, DS Smith, Crown Holdings) | 8% |

The intelligent, smart, and active packaging market addresses several industries where safety, tracking, and sustainability are paramount. Firms incorporate innovative packaging technologies to improve product protection, ensure compliance with regulations, and address changing consumer needs.

Producers develop advanced, intelligent, and smart packaging solutions with sensors, self-managing atmospheres, and AI-powered tracking systems. AI-powered pattern recognition enhances product authentication, while dynamic QR codes facilitate real-time customer interaction.

Automation and sustainability drive the active, smart, and intelligent packaging industry forward. Companies develop cloud-connected packaging, high-resolution tracking sensors, and AI-driven security solutions. AI-powered analytics improve efficiency, while biodegradable materials align with global sustainability regulations. Nanotechnology coatings enhance package durability, and blockchain-backed traceability ensures transparency. Companies accelerate the adoption of smart freshness indicators to prevent food waste. They integrate AI-driven automation to enhance packaging efficiency and accuracy. Firms deploy energy-efficient smart labels to minimize environmental impact. Businesses expand the use of augmented reality (AR) packaging to improve consumer engagement.

Year-on-Year Leaders

Technology suppliers should prioritize AI-powered automation, sustainable innovations, and advanced security solutions. Collaborations with food, healthcare, and logistics industries will drive adoption and market expansion.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Tetra Pak |

| Tier 2 | Avery Dennison, Stora Enso, Smurfit Kappa |

| Tier 3 | BASF, 3M, DS Smith, Crown Holdings |

Leading manufacturers advance AI-driven automation, interactive packaging, and sustainable materials. Companies integrate encrypted tracking codes and tamper-proof technologies to improve product security and traceability. High-resolution sensors enhance temperature and freshness monitoring, while AI optimizes supply chain operations and material efficiency.

Manufacturer & Latest Developments

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched biodegradable active packaging (March 2024) |

| Sealed Air | Developed antimicrobial food packaging (April 2024) |

| Tetra Pak | Introduced IoT-enabled smart cartons (May 2024) |

| Avery Dennison | Released AI-powered RFID tracking (June 2024) |

| Stora Enso | Strengthened blockchain-based authentication (July 2024) |

| Smurfit Kappa | Innovated temperature-sensitive smart films (August 2024) |

| 3M | Pioneered self-healing packaging materials (September 2024) |

The active, smart, and intelligent packaging market is evolving as companies invest in AI-powered automation, blockchain-secured packaging, and cloud-based solutions. Companies are incorporating tamper-evident, interactive packaging for brand protection and consumer interaction. Companies are creating temperature-sensitive packaging to provide product integrity in transit. They are also incorporating smart sensors in packaging for greater tracking ability.

Manufacturers will expand AI-driven personalization, blockchain security, and smart tracking technologies. Firms will integrate real-time monitoring and predictive analytics to optimize supply chain transparency and enhance consumer engagement. Businesses will refine high-speed smart packaging production and deploy augmented reality (AR)-enabled packaging for interactive experiences. Innovations in temperature-sensitive materials will further improve product integrity and safety. Companies will enhance active packaging with oxygen scavengers to extend shelf life. They will develop smart labels that change color based on product freshness. Firms will implement AI-powered logistics tracking for enhanced distribution efficiency. Manufacturers will integrate biodegradable nanocoatings to improve sustainability.

AI enhances smart packaging by enabling real-time tracking, predictive maintenance, and automated quality control. It optimizes supply chain efficiency and improves security through machine learning algorithms.

Amcor, Sealed Air, Tetra Pak, Avery Dennison, Stora Enso, Smurfit Kappa, BASF, 3M, DS Smith, Crown Holdings.

The top 3 players collectively hold 19% of the global market.

The market shows medium concentration, with top players holding 38%.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.