The active packaging industry is on the move as companies embrace smart, green, and long-shelf-life technology. In line with growing demand for food safety and less wastage, companies employ oxygen scavengers, humidity control technologies, and antimicrobial packaging materials.AI-driven quality control, high-barrier films, and biodegradable materials boost the integrity, sustainability, and alignment with food safety legislation of a product.

Industry captains spend on smart freshness indicators, sustainable packaging, and active barrier technology to keep up with regulatory requirements. The direction is towards longer shelf life, intelligent tracking, and eco-friendly packaging solutions with smart sensors, blockchain verification, and machine learning-driven optimization.

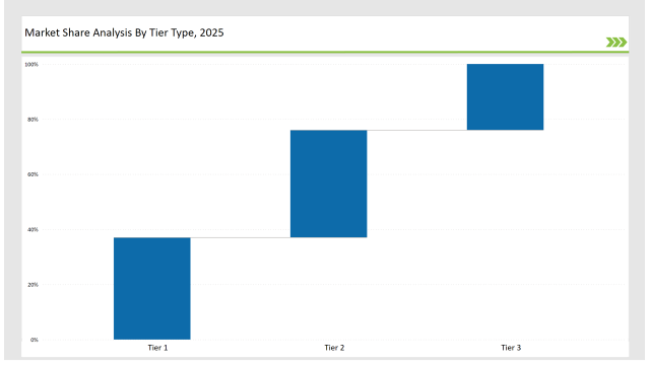

Tier 1 players like Amcor, Sealed Air, and Multivac dominate 37% of the market, with leadership in active oxygen absorbers, antimicrobial packaging, and supply chain efficiency worldwide.

Tier 2 players such as Berry Global, Winpak, and Coveris account for 39% market share, leading the charge with high-barrier films, bio-based solutions, and resealable packaging.

The last 24% of the market consists of Tier 3 players that involve regional and niche businesses catering to active packaging customized at their level, RFID tracking technology, and biodegradable tech.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Multivac) | 18% |

| Rest of Top 5 (Berry Global, Winpak) | 11% |

| Next 5 of Top 10 (Coveris, Linpac, Tetra Pak, Bemis, ULMA Packaging) | 8% |

The active packaging industry supports sectors requiring extended shelf life, safety compliance, and reduced food waste. Companies implement smart packaging technologies to meet consumer demands and regulatory standards.

Manufacturers improve active packaging solutions with intelligent freshness sensors, real-time oxygen control, and fully recyclable packaging materials. AI-driven monitoring ensures food quality and safety, while temperature-sensitive indicators track supply chain conditions.

Businesses keep redefining packaging norms with high-performance products and sustainable endeavors. They refine supply chains with AI-based predictive analytics to minimize inefficiencies. Business leaders launch next-generation antimicrobial packs for better food security. Companies add IoT-enabled smart labels for real-time tracking of product conditions. Leading companies invest in intelligent packaging technologies to achieve sustainability and food safety objectives. Companies create high-barrier recyclable films to improve product integrity.. They implement AI-powered quality assurance systems to detect defects in real-time. Businesses adopt blockchain-based tracking for greater transparency. Firms integrate nanotechnology coatings to improve packaging durability. Organizations enhance supply chain efficiency with machine learning-driven predictive maintenance. They develop temperature-sensitive labeling to ensure proper storage conditions across distribution networks.

Year-on-Year Leaders

Technology suppliers should focus on AI-driven automation, sustainable materials, and active packaging innovations to capture market growth. By partnering with industries such as food, healthcare, and logistics, they can accelerate adoption and market penetration.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Multivac |

| Tier 2 | Berry Global, Winpak, Coveris |

| Tier 3 | Linpac, Tetra Pak, Bemis, ULMA Packaging |

Innovative companies develop AI-driven design automation, green materials, and active food preservation technologies. Businesses use oxygen scavenging technology and moisture absorption to enhance product freshness. High-barrier films provide longer shelf life, and AI streamlines production efficiency and waste minimization. Firms integrate intelligent freshness monitoring to enhance food safety. Companies develop compostable materials to meet regulatory requirements. Businesses invest in advanced RFID technology for enhanced tracking. Organizations establish strategic partnerships to accelerate smart packaging development.

Manufacturer & Latest Developments

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Developed biodegradable, high-barrier packaging (March 2024) |

| Sealed Air | Launched intelligent freshness indicators (April 2024) |

| Multivac | Introduced AI-driven active packaging systems (May 2024) |

| Berry Global | Released 100% recyclable multilayer packaging (June 2024) |

| Winpak | Strengthened oxygen-absorbing packaging solutions (July 2024) |

| Coveris | Innovated fully compostable active packaging films (August 2024) |

| Linpac | Pioneered moisture-control active packaging (September 2024) |

The active packaging industry transforms as firms invest in AI-powered automation, blockchain-supported traceability, and cloud-based packaging solutions. Intelligent freshness tracking, tamper-resistant seals, and antimicrobial finishes are integrated into products by firms to enhance product safety and customer interaction. Companies create temperature-controlled packaging to provide product integrity while in transit. Firms utilize biodegradable films and smart sensors for greater food safety and sustainability.

Manufacturers will expand AI-driven smart packaging, blockchain-based traceability, and ultra-durable protective films. Companies will integrate machine learning for predictive analytics and develop intelligent packaging with embedded freshness sensors. Firms will refine biodegradable active packaging to reduce environmental impact. Advancements in temperature-sensitive labeling will ensure product safety in global supply chains. Businesses will enhance packaging recyclability with improved material innovation. Companies will leverage real-time tracking solutions to improve supply chain visibility and reduce spoilage. Industry leaders will establish strategic collaborations to accelerate sustainable packaging development.

Leading players Amcor, Sealed Air, Multivac, Berry Global, Winpak, Coveris, Linpac, Tetra Pak, Bemis, ULMA Packaging

The top 3 players collectively hold 18% of the global market.

The market shows medium concentration, with top players holding 37%.

Key trends include AI-driven quality control, blockchain-enabled traceability, biodegradable materials, and smart sensor integration.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.