It will help end users understand the complex market and various trends of the global Active Optical Cable (AOC) market. They outperform copper regarding performance and efficiency since they enable data transmission at much higher speeds, consume less power, and transmit over longer distances.

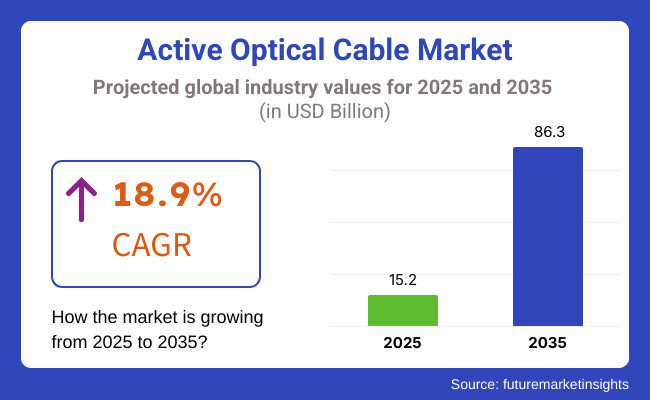

This is bound to grow with the market to reach nearly USD 86.3 Billion valuation by 2035 with an 18.9% CAGR during the forecast period. Other contemporary technologies, like fiber optics and growing 5G networks, also contribute to expanding the market.

In this market intelligence report, the Active Optical Cable market for data centers is registered for sale, which is capitalizing on the potential opportunities to accrue revenue for Active Optical Cables market players.

Explore FMI!

Book a free demo

North America is the leading region in the Active Optical Cable Market due to high investments in cloud-based services, data centers, and AI-powered apps. The presence of significant tech companies and cloud service providers in the region (USA and Canada) is supporting the growth of the regional market. The growth of 5G and IoT applications is further increasing the need for high-speed optical communication networks.

The AOC market in Europe is poised to grow at a substantial rate, driven by growing investments in hardware and software for high-performance computing and data center resources. Germany, the UK, and France, like other countries, have the highest cloud adoption, AI-driven applications, and telecommunication upgrades that are fueling the need for these cables, which would be employed to transmit data at high speeds with reliability.

In fact, the Asia Pacific region is expected to lead in this sector of Active Optical Cables, with China, Japan, and India being the most dominant regions. Some of the major factors driving the market include rapid digital transformation, government initiatives promoting smart city development, and rapid growth in data centers and 5G networks. The growing penetration of high-speed Internet and increasing demand for consumer electronics are other market growth drivers.

The AOCs phenomenon is slowly being adopted in Latin America, primarily due to a significant investment in data centers, cloud computing, and enhanced broadband connectivity. Additionally, Brazil and Mexico are showcasing as mentionable potential markets as they are reinvesting widely in their telecommunication infrastructure, thus, bringing in demand opportunities for high-speed data transmission solutions.

With the growth of smart city projects, digital transformation initiatives, and increasing 5G infrastructure across the region, the Middle East & Africa region is gradually being perturbed with interest in Active Optical Cables. UAE spends on upgrading telecommunication networks & South Africa focuses on high-volume data transmission.

Challenge

High Costs and Logistical Complexities

High costs and complex logistics & rules in different regions are hindering the Active Optical Cable Market. The manufacturers and distributors face challenges like compliance to international standards, data transmission in real-time, and managing a complex distribution network, which can hinder market expansion.

Technological and Compatibility Challenges

As a chip-based link, this form of active optical cable will continue to evolve in terms of speed, bandwidth, and power. Moreover, manufacturers and end-users face challenges in the form of making them compatible with different communication protocols and devices.

Opportunity

Growth in High-Speed Data Transmission and Cloud Computing

The increasing demand for high-speed data transfer, cloud computing, and data center connectivity creates notable opportunities for the market. With the need for low latency, higher bandwidth, and energy-efficient designs, both enterprises and consumers are looking for more advanced solutions, further driving the demand for active optical cables.

Increase in 5G, AI, and IoT Applications

The huge demand for extreme optical connectivity is backed by the increasing usage of 5G networks, AI (artificial intelligence), and IoT (internet of things). Enterprises need to focus on driving innovations around these applications to gain a competitive edge in the marketplace.

From 2020 to 2024, the Active Optical Cable (AOC) Market has witnessed sustained growth attributed to the surging need for high-velocity data transmission, rapid expansion of data centers, and continuous evolution of fiber optic technology.

The adoption of cloud computing, 5G networks, and streaming services also fed into the market. Major regions such as North America, Europe, and Asia-Pacific logged considerable adoption of optical cables in telecommunications, enterprise networking, and consumer electronics.

However, the industry also faced some challenges. The high production cost of fiber optic cables and challenges in integrating AOCs with legacy systems acted as a challenge for both manufacturers and end-users. This also led to more red tape area by area, making it difficult for the companies to comply with changing legislation and rules.

However, to tackle these challenges, enterprises worked on creating more economical products, enhancing fiber optic technologies, and simplifying production methods to improve effectiveness and affordability.

The future of the AOC market from 2025 to 2035 will witness transformative advancements in the technologies surrounding artificial intelligence-based network optimization, next-gen optical fiber materials, and high-performance, energy-efficient optical fabrics.

Ultra-high-speed data transmission, AI-integrated networking, and quantum communication technologies will change the industry and deliver unparalleled performance and security in data transmission.

Moreover, sustainability will take center stage, leading companies to form recyclable optical cable materials and energy-efficient designs to decrease environmental rupture. The continued growth of edge computing, smart city infrastructure and next-generation data centers will drive even greater demand for high-performance optical connectivity.

With businesses continuing to prioritize digital transformation, sustainability initiatives, and high-speed networking solutions that offer a seamless experience, the Active Optical Cable Market will play an integral role in shaping the future of global connectivity, enabling greater possibilities in data transmission, communication, and emerging technologies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with global data transmission standards and safety regulations |

| Optical Connectivity Growth | Growth in data centers, high-speed internet, and enterprise networking |

| Industry Adoption | Increased demand in telecommunications, consumer electronics, and cloud computing |

| Supply Chain and Sourcing | Dependence on traditional fiber optic manufacturers and material suppliers |

| Market Competition | Presence of established fiber optic brands, networking companies, and cloud service providers |

| Market Growth Drivers | Demand for high-speed internet, cloud storage, and video streaming |

| Sustainability and Energy Efficiency | Initial focus on reducing power consumption in optical networks |

| Integration of Digital Planning | Limited use of AI-driven network monitoring and predictive maintenance |

| Advancements in Optical Technology | Use of traditional fiber optic cables for data transmission |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined regulatory frameworks, AI-based compliance monitoring, and enhanced cybersecurity measures |

| Optical Connectivity Growth | Expansion into 5G backhaul, AI-driven networking, and quantum communication |

| Industry Adoption | Rise of AI-integrated networking solutions, ultra-high-speed optical connectivity, and IoT applications |

| Supply Chain and Sourcing | Shift toward sustainable materials, advanced optical fiber coatings, and localized production. |

| Market Competition | Growth of startups, specialized optical connectivity providers, and AI-powered network optimization solutions |

| Market Growth Drivers | Increased investment in AI-driven networking, smart infrastructure, and edge computing |

| Sustainability and Energy Efficiency | Large-scale implementation of energy-efficient optical cables, sustainable materials, and eco-friendly manufacturing |

| Integration of Digital Planning | Expansion of AI-based network automation, real-time performance analytics, and blockchain-secured data transmission |

| Advancements in Optical Technology | Evolution of high-capacity optical fiber, flexible optical cabling, and self-healing fiber optic networks |

Some of the key factors driving the growth of the active optical cable market in North America were the growing demand for high-speed internet, the immense growth rate of 5G technology, and the increasing investments in data centers in the region.

The prevalence of prominent tech giants and cloud service providers like Amazon, Google, and Microsoft promotes market expansion. Government initiatives to improve digital infrastructure, as well as the increasing adoption of AI and IoT applications, also added to the strength of the sector.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 19.5% |

The United Kingdom is witnessing positive growth in the active optical cable market mainly due to its digital economy and deployment of fiber-optic across the country. The government is investing in initiatives like Project Gigabit to help improve broadband connectivity, which benefits both consumers and businesses.

The demand for high-speed data transmission is increasing with the growth of cloud computing, remote work, and streaming services, which is likely to ensure further investments in optical networking infrastructure throughout the country.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 18.6% |

Heavy investments are being made by the European Union to provide next-generation networking and high-speed broadband infrastructure in its efforts to bolster the economy from a digital perspective. Leading countries, including Germany, France, and the Netherlands, spearhead the market with extensive data center expansion and fiber-optic deployments.

Additionally, the smart cities, AI integration, and cloud computing policy by the EU significantly promote the growth of active optical cables, giving opportunities for telecommunications in Europe.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 18.9% |

Also, South Korea is among the leaders in global digital transformation with extended use of 5G networks, AI-based connectivity, and advanced-generation telecommunications technologies. By investing in optimizing the speed of their networks on the government and private sector ends, there came the advent of optical fiber networks offering ultra-fast speed support innovations such as smart cities, IoTs, and Data Centers.

As innovative companies such as Samsung and SK Telecom continue to lead the way in networking solutions, South Korea's active optical cable market is expected to grow exponentially.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 19.7% |

The active optical cable market is experiencing rapid expansion due to increasing demand for high-speed internet, data center connectivity, and next-generation networking solutions. With strong investments across various regions, the market is poised for significant growth.

The Quad Small Form-factor Pluggable (QSFP)segment is one of the major contributors in terms of demand in the active optical cable (AOC) market, as it provides a data transfer rate of 100 Gbps and is used widely in data centers and high-performance computing (HPC) environments.

The QSFP connectors offer higher-density connectivity for networking applications, providing higher bandwidth, better energy efficiency, and scalability compared with copper cables. You have these features that make QSFP solutions to be ideal for organizations when it comes to high-speed data transfers with low latency.

The outstanding competitiveness of QSFP in the AOC market, thanks to the ability to support InfiniBand and Ethernet technologies, enables data centers to provide a high bandwidth and high-speed connection to create a valuable solution for enterprises that have always tried to take any move to improve the network performance and scalability.

With the growing demand for cloud computing services, artificial intelligence (AI) and big data analytics, enterprises must deploy robust and high-speed interconnect solutions to transfer massive amounts of data efficiently. The ultra-low latency and high bandwidth offered in 400G InfiniBand QSFP continue to offer reliable transmission rates from the chip to the fabric.

In addition, constant technical innovations in optical transceiver technology also maintain the future trend of QSFP-based active optical cables. This is an evolution that continues today, with the introduction of standards such as QSFP-DD (Quad Small Form-factor Pluggable Double Density) and QSFP56 that offer even faster data rates and greater power efficiency that keeps QSFP at the cutting edge of the market. These transformative technologies help enterprises to future-proof their network infrastructure and reduce energy consumption and operational costs.

InfiniBand is expected to dominate the active optical cable segment across various technology segments due to its low latency, high bandwidth, and scalable nature. InfiniBand technology, for example, is being adopted in several high-performance computing (HPC) environments, as well as AI-centric workloads and data centers that require real-time data transfer and ultra-fast networking.

Additionally, rising AI-based workloads and deep-learning applications in sectors including healthcare, fintech, and scientific research have contributed to an explosion in InfiniBand-based AOC demand in these past years.

One of the primary benefits of InfiniBand technology is its low-latency architecture, allowing real-time data transmission with minimal latency, making it suitable for high-performance computing environments. InfiniBand also enables RDMA, which allows nodes to communicate while making little use of the CPU, letting the processor do more actual work.

Such capability is important in AI workloads but also in high-frequency trading applications, where microsecond latency can tip performance one way or another.

Continuous improvement of InfiniBand standards, for instance HDR (High Data Rate) and NDR (Next Data Rate) will yield even higher throughput and efficiency; HDR InfiniBand (which is available now) gives you data rates up to 200Gbps per connection, and NDR InfiniBand will be your test of what lies above 400Gbps. As a result, InfiniBand has emerged as an ideal interconnect solution for next-gen AI supercomputers, cloud-scale data center, as well as, mission-critical workloads demanding extreme performance.

This creates a hot demand environment for InfiniBand-based AOCs as global businesses work to create high-speed, low-latency networks; these products will be a driving force behind the next generation of high-performance networking systems.

Due to its small size, cost-effectiveness, and versatile application, the SFP segment comprises a major chunk of the AOC market. Due to the flexibility it offers to enable scalable solutions for network expansion, SFP connectors are widely used in enterprise networking, telecommunications, and fiber optic fields. They are versatile on both directions of transmission, whether fiber or copper, providing a cost-efficient yet impactful enterprise solution.

One of the other benefits of SFP connectors is that they are modular, which allows enterprises to change and upgrade network configurations without having to replace entire hardware systems. Such agility is particularly important for growing enterprises and telecom operators that want to grow their networks cost-effectively. Also, SFP transceivers are compatible with Ethernet, Fiber Channels, and USB, which makes them very applicable in various industries.

As enterprises increasingly invest in digital transformation, cloud services, and IoT deployments, they are upgrading their network infrastructure to deliver faster data speeds and improved connectivity. Enterprise enterprises call for modern generation SFP transceivers such as SFP28 (25Gbps) and SFP56 (50Gbps) to fulfill the quickest assists of modern calls.

Governments are designing standards & emerging new power-efficient SFP transceiver architects for a strong and more powerful standards application for the optical marketplace members, which cut down energy consumption during bootstrap. So, such innovations eventually make SFP solutions one of the greener options and a commercial choice for enterprises looking at enhancing network performance and lowering operational expenses.

Ethernet is the dominant active optical cable technology due to its large-scale deployment in data centers and enterprise and telecom networks. Ethernet-based active optical cables combine the benefits of Ethernet and fiber optics, enabling high-speed data transfer over long distances with minimal latency and reduced power consumption. Ethernet's ongoing evolution in standards has played a major part in its continued dominance in the market.

Versatility is one of the main reasons behind Ethernet’s proliferation. Ethernet is a global standard, in contrast to proprietary networking technologies that cannot guarantee that any devices or applications will work together. Its widespread acceptance has been reflected in its acceptance by 5G networks, cloud computing environments, IoT ecosystems, and high-speed broadband infrastructure.

The expansion of high-speed Ethernet standards (e.g., 100G, 200G, 400G, and others) is also contributing to market growth. Ultra-Fast Ethernet Solutions for Scaling Bandwidth Demand As global internet traffic continues to rise exponentially, enterprises and data centers are deploying ultra-fast Ethernet solutions to fulfill the ever-expanding bandwidth requirements. First, the rise of 800G Ethernet is transforming the networking landscape through the delivery of ultra-low latency and high-speed data transfer, ideal for next-gen applications.

Moreover, with optical networking solutions continuing to improve, Ethernet is up for the challenge of managing growing data traffic requirements with efficiency. CPO and silicon photonics are examples of technologies that will see Ethernet delivering higher bandwidth at lower power while allowing better scaling and sustainable networking for the future.

Ethernet-based Active Optical Cables will continue to play a pivotal role in the backbone of modern digital infrastructure, as organizations keep investing in next-gen cloud services, AI-driven networks, and high-performance computing, ensuring smooth and high-speed connectivity in various sectors..

The active optical cable (AOC) market is witnessing substantial growth as the demand for high-speed data transmission, data center expansion, and advancements in fiber optic technology continues to rise. Important application sectors are telecommunications, data centers, consumer electronics, and industrial automation.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Finisar Corporation | 18-22% |

| Sumitomo Electric Industries | 12-16% |

| Broadcom Inc. | 10-14% |

| Molex LLC | 8-12% |

| 3M Company | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Finisar Corporation | High-speed AOCs for data centers, enterprise networks, and telecommunications applications. |

| Sumitomo Electric Industries | Advanced fiber optic technology, AOCs for high-performance computing, and cloud applications. |

| Broadcom Inc. | Optical interconnect solutions, high-bandwidth AOCs for hyperscale data centers. |

| Molex LLC | Customized AOC solutions, data center and high-performance computing connectivity products. |

| 3M Company | High-quality optical cabling solutions for industrial automation and consumer electronics. |

Key Market Insights

Finisar Corporation (18-22%)

Finisar leads the active optical cable market, offering innovative solutions for high-speed data transmission in data centers and enterprise networking.

Sumitomo Electric Industries (12-16%)

Sumitomo Electric provides high-performance optical networking solutions with advanced transmission technology in the timeframe corresponding with the establishment of data centers and cloud services.

Broadcom Inc. (10-14%)

Broadcom focuses on high-bandwidth AOCs for data-intensive applications such as AI-driven computing and hyperscale data centers.

Molex LLC (8-12%)

Meanwhile, Molex focuses on heavy-duty custom AOC products with high-reliability optical interconnects in the telecom, industrial automation, and multi-gig Ethernet segments of the target markets.

3M Company (5-9%)

3M provides optical cabling solutions designed for industrial and consumer applications, ensuring high performance and durability.

Other Key Players (30-40% Combined)

The AOC market is witnessing rapid advancements in speed, energy efficiency, and data transmission capabilities, with contributions from multiple manufacturers and technology providers, including:

The overall market size for Active Optical Cable Market was USD 15.2 Billion in 2025.

The Active Optical Cable Market is expected to reach USD 86.3 Billion in 2035.

The demand for the Active Optical Cable market will be driven by the dominance of the QSFP segment, which offers high-speed data transmission and energy efficiency. Additionally, Ethernet technology’s versatility and widespread adoption across data centers, telecommunications, and consumer electronics will fuel market growth. Increasing demand for high-bandwidth, low-latency connectivity further accelerates adoption across industries.

The top 5 countries which drives the development of Active Optical Cable Market are USA, European Union, Japan, South Korea and UK

Ethernet Technology Continues to Dominate Due to Its Versatility and Wide Adoption commands significant share over the assessment period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.