The factors such as high-level adoption of respiratory health and nose humidification technology, increased prevalence of chronic respiratory illnesses in the people and technological advancements in the humidifier devices are expected to be the major contributors towards the growth of global humidifier devices market during the years 2025 to 2035.

Such devices are important for medical use cases in critical care situations like in-patient, neonatal, and home-care environments, where humidity levels need to be maintained in patients on respiratory-support.

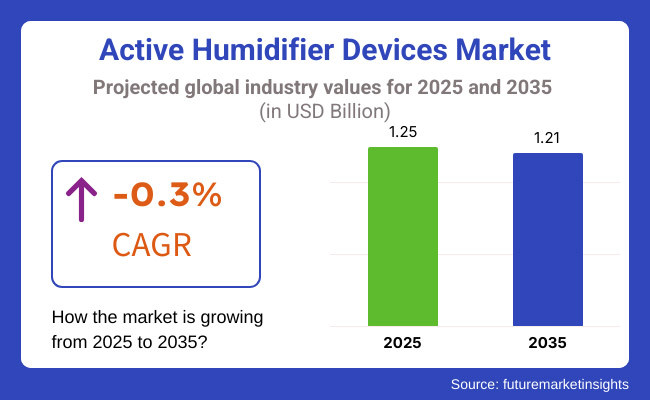

Market Data is expected to register a CAGR of approximately -0.3% from 2023 to 2035 and reach nearly USD 1.21 Billion in 2035. In recent years, various devices have been introduced using advanced technology that reduces particulate matter which is anticipated to further boost the growth in the market as humification therapy is becoming increasingly common in both hospital & homecare settings.

Explore FMI!

Book a free demo

North America accounts for nearly one-third of the total active humidifier devices in use, as the region has the highest incidence of diseases, including asthma, COPD and sleep apnea. Key parameters such as developed healthcare systems, solid regulatory frameworks, and expanding home healthcare solution adoption are driving the market. Continuous investments in healthcare technology and patient-cantered care solutions make the United States and Canada the largest contributors.

Among countries, Germany, France, and the UK commands demand for active humidifier devices. The market growth is driven by the well-developed healthcare infrastructure, the geriatric population, and government initiatives promoting respiratory care in the region. Growing focus on patient safety and a surge in home-based healthcare services also provide a positive scope for humidifier devices market.

Active Humidifier Devices Market: Regional Insights The active humidifier devices market would be primarily driven by the Asia-Pacific region, which is expected to be the fastest growing market attributed to rising pollution levels, increasing cases of respiratory disorders and improving healthcare infrastructure in countries such as China, India and Japan.

The major contributing factors are government policies focused on increasing access to healthcare, and increased awareness of respiratory health. Moreover, the growing aging population and their need for homecare boost the demand for the portable and advanced humidification solutions.

The active humidifier devices market in Latin America will be steadily growing due to the increase in healthcare expenditures as well as rising respiratory care needs. Advanced humidification solutions are being adopted due to facilities in the emerging countries, such as Brazil and Mexico that are investing in upgrading their healthcare facilities.

Marking an estimated growth rate of X% over the forecast period, the rising prevalence of respiratory infections coupled with an expanding middle-class population with increased access to healthcare services can also be attributed to its avanço in the proposed time frame.

Active humidifier devices are gradually finding a place in the Middle East & Africa region as a potential market. One of the major drivers is the rise in the prevalence of respiratory diseases, both attributable to environmental factors such as dust storms and pollution.

The demand for active humidifiers is expected to witness an increase in nations such as South Africa, the UAE, and Saudi Arabia owing to the growing investment for the expansion of healthcare infrastructure in these countries.

Challenge

High Costs and Logistical Complexities

However, as a result of high cost, complicated logistics, and regulation differences in different regions, the Active Humidifier Devices industry cannot reach the economic scale. Self-explanatory for all, while the manufacturers and distributors may face challenges of compliance with the health and the safety standards, achieving certifications for the product, and negotiation of distribution network, hence affecting the market penetration.

Technological and Maintenance Challenges

And the active humidifier devices also have to keep improving for efficiency, energy consumption, and user-friendliness in technology up to date. Routine maintenance, filter changes, and the threat of microbial contamination present trials for manufacturers and consumers alike.

Opportunity

Growth in Smart and Energy-Efficient Humidifiers

The increasing need for smart, energy-efficient and connected humidifier devices autonomous presents great opportunities for the market. Modern humidifiers are also increasingly sophisticated, with features like remote control, automatic humidity control and integration into smart home ecosystems attracting consumers.

Increase in Healthcare and Industrial Applications

Rising awareness regarding air quality and humidity control in healthcare segment, manufacturing plants, and commercial spaces is likely to boost demand for active humidifier units. Sectors including pharmaceuticals, electronics and data centres need controlled humidity levels, opening new business opportunities for manufacturers.

Active humidifier devices value is expected to witness steady growth during 2020 to 2024 owing to increased demand for air quality solution across urban regions and health facilities. Supportive of market growth is the increasing adoption of humidifiers in both residential and industrial applications in developed markets such as North America, Europe, and Asia-Pacific.

However, high product costs, energy consumption and maintenance requirements hampered the market growth. Companies responded with low-cost models, green humidification technologies, and advanced filtration systems.

By 2025 to 2035, the market and technologies such as AI-powered humidity management, green humidification techniques, and antimicrobial technologies are forecasted to launch the growth of the market. Equipped with cutting-edge features such as IoT compatibility for ultimate comfort, and even maintenance reminders, these products are also shaping the industry.

Growing green designs displayed in the form of energy efficient humidifiers and merger of humidifiers with HVAC systems will continue to generate traction alongside new opportunities to penetrate the underdeveloped markets. Some companies are investing in digital solutions, sustainability initiatives, personalized air quality management through smart Active Humidifier Devices Market, and alternative energy sources for the evolution of the Active Humidifier Devices Market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adherence to air quality standards, safety certifications, and local rules |

| Humidification Technology Growth | Increasing demand for ultrasonic, evaporative and steam based humidifiers |

| Industry Adoption | Rise in demand of residential, healthcare and industrial sectors |

| Supply Chain and Sourcing | Reliance on conventional manufacturing techniques and material providers |

| Market Competition | Presence of established humidifier brands, HVAC companies and air quality solution providers |

| Market Growth Drivers | Pressing need for cleaner air, allergy relief and workplace wellness |

| Sustainability and Energy Efficiency | Initial focus on reducing water waste and improving energy consumption |

| Integration of Digital Planning | Only some devices are IoT enabled, controlled via a smartphone, and AI-based humidity monitoring |

| Advancements in Humidification Experiences | Common use of simple humidifier for comfort and health |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined product approvals, AI-based compliance monitoring, and enhanced safety standards |

| Humidification Technology Growth | Expansion into AI-driven, sensor-controlled, and energy-efficient humidification technologies |

| Industry Adoption | Rise of smart humidifiers, IoT-enabled devices, and integration with advanced air purification systems |

| Supply Chain and Sourcing | Shift toward sustainable materials, modular designs, and locally sourced components |

| Market Competition | Growth of startups, specialized humidifier manufacturers, and AI-powered air management solutions |

| Market Growth Drivers | Increased investment in eco-friendly humidifiers, smart home integration, and healthcare applications |

| Sustainability and Energy Efficiency | Large-scale implementation of eco-friendly humidifiers, renewable energy integration, and self-cleaning humidifier technology |

| Integration of Digital Planning | Expansion of AI-driven air quality management, smart humidifiers with predictive maintenance, and blockchain-based product tracking |

| Advancements in Humidification Experiences | Evolution of personalized air quality solutions, adaptive humidity control, and multi-functional humidification systems |

The sonographic market in USA for active humidifier devices is gradually diminishing owing to technological advancements, enhanced preference for other respiratory therapies and the gradually increasing trend of non-humidified ventilation in healthcare markets.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | -0.3% |

Regulatory changes, increased constraints on healthcare spending, a preference in the market for budget-friendly respiratory care alternatives, and a rising trend toward portable and non-humidified ventilation options used in hospital settings are having a negative impact on the UK market.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | -0.6% |

The market for active humidifier devices in the European Union is predicted to grow moderately but, the market growth will be hindered by the emergence of advanced non-humidified respiratory solutions, increasing demand for cost-effective ventilation systems, changing regulations supporting alternative therapies, and rising investments to foster research for better respiratory care solutions. Furthermore, hospital policies value infection control, thus minimizing backups of traditional humidification devices.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | -0.5% |

The South Korea market is observing a minor contraction as a result of rapidly evolving technological advances in respiratory assistance systems along with increased investment in alternative therapies and a strong focus on innovations in medicine to minimize hospital-acquired infections.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | -0.4% |

The active humidifier devices market is experiencing a slight decline due to advancements in alternative respiratory therapies and shifting consumer preferences.

These devices are integral part of hospital, HC and ICUs for air way dryness prevention and enhance patients comfort. Heated humidifiers are particularly important for patients whose inspiration is assisted by mechanical ventilation or oxygen therapy since these patients are at elevated risk of dry airway anesthesia and the deleterious effects on airway mucosa, infections and other mucosal injury effects.

Moreover, the rise in the prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD) and asthma, has also fueled the heated humidifier market. Just as COVID-19 became a decisive factor in the degree of health conditions, smart intelligent innovations and the likes of humidity sensors and automated controls will also breed an increased level of integration and engagement in modern medicine.

As humidification technologies continue to innovate and patient-centered care and management have become an even greater consideration in the now hospital environment, some other factors are drive the growth of market for heated/electric humidifier.

Bubble Humidifiers are inexpensive and easy to use in medical facilities, leading to continuous growth of this segment. In general these devices are used for oxygen therapy since they humidify the administered oxygen, improving patient comfort and reducing dryness of the airways. Bubble humidifiers are easy, inexpensive, low-maintenance and they are the most preferred in hospital and homecare instalments.

Oxygen therapy is the most commonly used therapy for the respiratory disorders, this increasing use of oxygen therapy could lead to further increase of bubble humidifier market. Moreover, manufacturers are also focusing on enhancing the efficiency and endurance of these devices making them more favorable for health care providers and patients.

Factors such as the increasing importance of humidification in oxygen therapy, increasing consumption of bubble humidifiers in long-term care & rehabilitation settings, and increasing preference for home healthcare services to treat patients are few of the factors driving the bubble humidifier market.

By segmenting of end-user segment, the Adult segment is accounting a major share in the active humidifier devices market. Increasing adults with respiratory disorders including CEPD, sleep apnea, and asthma have led to an increase in the usage of humidification devices in hospitals as well as homecare settings. Moreover, the rise in geriatric population in the worldwide is another factor responsible for promoting the demand for respiratory support devices such as active humidifiers.

Another factor contributing towards the growth of this segment is the rapid adoption of heated humidifiers & bubble humidifier among adult patients receiving oxygen therapy or mechanical ventilation. Especially the rising awareness on respiratory health and recent innovations in humidification technology will keep piling up the demand for active humidifier apparatus in case of adult patients.

Rising demand for the Pediatric segment and Neonates segment is also anticipated, as infants and children need specialized respiratory care. It has been routine for preterm infants and pediatric patients with respiratory illnesses to receive humidified oxygen to ensure that the airway remains humidified and to enhance lung function (Download literature for URGIs).

Designed specifically for advanced humidification systems for neonatal intensive care units (NICU) and pediatric hospitals, the system ensures ideal breathing conditions for patients with delicate respiratory systems.

For over a decade now, these active humidifier devices have been able to accurately control both temperature and humidity thus rendering them an integral part of neonatal and pediatric respiratory care.

For instance, elevated investment in pediatric healthcare infrastructure along with the increasing prevalence of neonatal respiratory distress syndrome (RDS) will further open up new bonanza for humidification devices used in this niche. The pediatric and neonatal active humidifier devices market is poised for robust growth as healthcare providers focus breathing systems specializing in respiratory management as innovative medical approaches.

The active humidifier devices market is experiencing substantial growth due to increasing awareness about respiratory health, rising adoption in medical settings, and growing demand for smart home humidification solutions. Key segments include healthcare humidifiers, industrial humidifiers, and residential smart humidifiers.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Fisher & Paykel Healthcare | 20-25% |

| Philips Respironics | 15-20% |

| ResMed | 12-16% |

| Vapotherm | 8-12% |

| Teleflex Incorporated | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Fisher & Paykel Healthcare | Medical-grade humidification systems, respiratory humidifiers, and hospital ventilator humidification. |

| Philips Respironics | Advanced CPAP humidifiers, sleep therapy humidification solutions, and home respiratory care products. |

| ResMed | Smart CPAP humidifiers, integrated humidification systems, and home-use respiratory humidifiers. |

| Vapotherm | High-velocity nasal insufflation humidifiers, hospital-grade active humidification solutions. |

| Teleflex Incorporated | Airway management humidification devices, heated humidifiers, and critical care respiratory solutions. |

Key Market Insights

Fisher & Paykel Healthcare (20-25%)

Fisher & Paykel - The broadest offering of active humidifier devices, with significant shares in hospital and clinical respiratory care, providing high-performance medical humidification systems.

Philips Respironics (15-20%)

Philips Respironics focuses on sleep and respiratory care humidification equipment, most notably CPAP and BiPAP machines for domestic and hospital usage.

ResMed (12-16%)

Focussed on home respiratory, ResMed specializes in products that integrate smart humidification technology into sleep apnea and ventilation devices..

Vapotherm (8-12%)

Vapotherm is a key player in high-flow humidification therapy, providing innovative solutions for respiratory support in critical care settings.

Teleflex Incorporated (5-9%)

Specialized humidification solutions for airway management and respiratory therapy, for hospital and home care markets.

Other Key Players (30-40% Combined)

The active humidifier devices market is evolving with AI-driven humidity control, smart connectivity, and personalized respiratory therapy solutions introduced by multiple manufacturers and healthcare providers, including:

The overall market size for Active Humidifier Devices Market was USD 1.25 Billion in 2025.

The Active Humidifier Devices Market is expected to reach USD 1.21 Billion in 2035.

The demand for active humidifier devices will be driven by rising respiratory disorders, increasing neonatal care needs, and growing awareness of indoor air quality. Technological advancements in heated/electronic and ultrasonic humidifiers enhance efficiency and user convenience. Additionally, expanding healthcare infrastructure and stringent regulations promoting optimal humidity levels will further boost market growth.

The top 5 countries which drives the development of Active Humidifier Devices Market are USA, European Union, Japan, South Korea and UK

Surge in Demand for Pediatric and Neonatal Segments in Customized Mechanism for Respiratory Carer to command significant share over the assessment period.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Leukocyte Adhesion Deficiency Management Market - Innovations & Treatment Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.