The activated carbon filter market growth includes the marketing system of top models or brands like Hayward and others in the sector. Examples are activated carbon filter in water treatment, air purification, food and beverage, pharmaceutical, and some industries. They are an essential component in filtration systems from all over the globe due to their ability to eliminate contaminants, odors, and harmful chemicals.

Increasing demand for water purification methods is one of the major factors that will drive the market growth. The surge in water pollution levels due to the growing urbanization and industrialization has led to the need for effective filtration technologies.

As a result, governments and regulators are imposing stringent regulations for wastewater treatment and drinking water safety, the two industries are witnessing greater expenditures on activated carbon filtration systems. Furthermore, increasing Knowledge regarding waterborne diseases and pollution from heavy metals, pesticides, and micro plastics have driven the demand for advanced filtration solutions.

Another significant area for activated carbon filter growth is in air purification. With growing pollution levels leading to poor air qualities, activated carbon-based air filtration systems have been widely adopted by industries, commercial places and even households to extract volatile organic compounds (VOCs), poisonous gases and odors. This is additional driving demand in this segment along with increasing industrial level activities and strict emission control regulations.

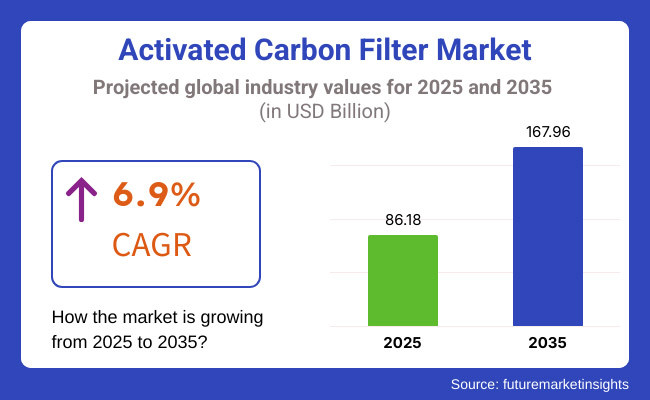

The activated carbon filter market accounted for USD 86.18 billion in the year 2025 and is expected to reach USD 167.96 billion by the year 2035, at a CAGR of 6.9% during the forecast period.

Technological advancements are also an important factor driving the activated carbon filter market. Additions such as carbon activation processes, nanotechnology-based filters, and bio-based activated carbon materials are improving both the efficiency and sustainability of filters. Market players are investing heavily to offer cost-effective and high performance filtration solutions which in turn leads to product diversification and thereby adoption.

Explore FMI!

Book a free demo

North America captured the largest market share for activated carbon filter, with the USA and Canada in the forefront owing to rigorous environmental laws and rising investments in water and air treatment technologies.

Activated carbon filter has a major market in Europe, with Germany, UK, and France being the top three adopters. EU requirements for strict regulations on industrial emissions and water treatment are increasingly enforcing the installation of advanced filtration technologies by industries. This increasing air pollution levels would also open up window of opportunity for air purifiers with activated carbon filters.

Asia-Pacific is leading the activated carbon filter market due to the growth in China, India, and Japan. Widespread industrialization, urbanization and rising water pollution concerns are driving demand for filtration solutions. Additionally, government measures to enhance air and water quality are fueling market expansion.

Latin America: Steady growth, with Brazil and Mexico among the key markets this is attributed to increasing industrial activities and government initiatives for advanced water treatment infrastructure. But these things do not come cheap, and all the accelerating economics may suppress widespread rollout.

Saudi Arabia, UAE, and South Africa are investing in projects related to water treatment and air purification, which is gradually contributing to the growth of the Middle East & Africa activated carbon filter market. Increasing pollution and the growing challenges of desertification, water availability, and industrial emissions are boosting demand for effective filtration techniques.

Challenges

High Production Costs and Raw Material Dependency

High prices of raw materials such as coal, coconut shells, and wood are some of the factors adversely affecting the Activated Carbon Filter Market. Production cost and market stability rely heavily on these materials which can experience frequent changes in availability and price.

Moreover, the manufacturing process involved in activated carbon filters is energy hungry driving up operational costs. Manufacturers also face compliance challenges from regulatory requirements for sustainable production and disposal.

Opportunities

Rising Demand for Water and Air Purification Solutions

Stringent government regulations on clean air and clean water and growing global environmental sustainability awareness are contributing to the activated carbon filter market growth. This widespread adoption in municipal, industrial and residential sector has been initiated by increasing concerns towards industrial pollution, increasing urbanization and the introduction of safe drinking water.

Moreover, along with this a rapid growth in pharma, food & beverage and chemical industries has also provided traction for filtration. Biomass-derived powdered activated carbon production methods and smart filtration systems provide market participants with an opportunity to grow in the USA

From 2020 to 2024, due to growing environmental regulations and demand for air and water purification. Activated carbon filters registered high demand in several industries including healthcare, food processing, and wastewater treatment.

Yet disruptions in supply-chains and higher costs for raw materials along with issues faced in filter disposal continued to be major challenges. Companies were working on new sustainable sources of activated carbon and to create the best pores for the best filtration efficiencies.

Looking ahead to 2025 to 2035 with Sustainable Activated Carbon Production; Nanotechnology-based Filtration; AI-driven Shape Purification Systems. More and more are investing in renewable raw materials, from bamboo to agricultural waste, making solutions more affordable and sustainable. Incorporation of IoT in filters to allow real-time monitoring and predictive maintenance will also propel innovations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter environmental policies on industrial emissions and water treatment |

| Market Growth | Increased adoption in water purification, air filtration, and industrial processes |

| Industry Adoption | Rising use in municipal water treatment and industrial air purification |

| Raw Material Sourcing | Dependence on coal-based activated carbon sources |

| Market Competition | Presence of traditional filtration manufacturers |

| Sustainability and Efficiency | Initial adoption of eco-friendly filtration solutions |

| Technology Integration | Use of standard activated carbon filter media |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of carbon-neutral filtration solutions, global water and air quality standards |

| Market Growth | Expansion into smart filtration systems, nanotechnology-based activated carbon filters |

| Industry Adoption | Growth in pharmaceuticals, electronics, and food & beverage industries for contamination control |

| Raw Material Sourcing | Shift towards renewable and bio-based activated carbon production |

| Market Competition | Entry of sustainable filtration start-ups, AI-integrated filtration companies |

| Sustainability and Efficiency | Large-scale implementation of recyclable activated carbon filters, energy-efficient manufacturing |

| Technology Integration | Adoption of AI-driven filtration monitoring, IoT-enabled purification systems |

The increasing demand for water purification, air treatment, and emissions control from blowing is also driving the growth of activated carbon filters in the United States. The activated carbon filter market is also expected to prosper with the adoption of stringent environmental regulations, such as those established by the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA). Therefore, varied industries such as pharmaceuticals and chemicals to food & beverages and manufacturing are adopting activated carbon filtration systems to meet air and water quality standards.

Rosetta to PFAS compounds in municipal water systems vigilant growing concern of contaminating municipal water systems with PFAS (per- and polyfluoroalkyl substances) has driven increased use of activated carbon filtration at municipal water treatment facilities.

Additionally, stringent emissions regulations for industrial facilities are propelling the adoption of air filtration systems that utilize activated carbon filters for volatile organic compound (VOC) and hazardous contaminants removal.

Moreover, because everyone has a better understanding of indoor air quality and personal health, the activated carbon use in home and commercial air purification has gradually increased. The increasing use of activated carbon in automotive end use industries such as EV battery systems and cabin air filters is also expected to contribute significantly to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The growing awareness of pollutants have led to the growth of the activated carbon filter market in both the USA and UK as competitive filtered technologies are at forefront of regulatory, environmental, and consumer interest creating pressure for sustained market growth. Stricter emissions controls from the UK Environment Agency (EA) and DEFRA (Department for Environment, Food & Rural Affairs), will also cause increased adoption of activated carbon filters in factories, power plants, and wastewater treatment facilities.

The growing pharmaceutical and food & beverage industries in the UK is also pushing the demand for high-quality water filtration solutions using activated carbon. In addition, rising awareness regarding air pollution in urban hotspots such as London, Manchester, and Birmingham are stimulating the demand for activated carbon-based air purification solutions in both residential and industrial sectors.

Also, the shift of the UK towards green energy and electric vehicles (EVs) is supporting the adoption of the activated carbon filtration in hydrogen fuel cells and the battery cooling systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

Demand for EU carbon filters has been increasing at a meteoric rate owing to stringent EU environmental protection policies, industrial safety regulations, and relatively high consumer demand for clean air and water. The market is led by countries like Germany, France and Italy with developed structure related to the industry and stringent rules governing air and water consideration.

Legislation such as the EU’s Industrial Emissions Directive (IED) and Water Framework Directive include requirements that industries adopt advanced filtration technologies to meet compliance. In industrial-scale municipal drinking water treatment plants across Europe, activated carbon filtration is being installed to remove pollutants, micro plastics and pharmaceutical residues.

Furthermore, the period to achieve sustainable production of activated carbon filtration products respectively is advancing through proactive changes to carbon-neutral and green filtration solutions. Automotive: Activated carbon filters are becoming increasingly popular in the automotive industry, especially in electric vehicles (EVs) and hydrogen fuel cells.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.9% |

The active filters of carbon has the most advanced regulation framework in the world for air and water purification, leading industries to adopt high-efficiency activated carbon filters.

With air pollution problems in Tokyo and Osaka, acceptance of activated carbon-based air purification systems has expanded in commercial buildings, residential areas, and terminals. Japan’s pharmaceutical and semiconductor industries also need ultra-pure water for manufacturing processes, helping to drive demand for industrial activated carbon filtration.

In Japan, activated carbon filters are integrated into electric and hydrogen fuel cell vehicles, paving the way for automotive innovation. Furthermore, the expansion of smart cities and sustainable infrastructure projects is propelling the investment in eco-friendly filtration technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

Driven by stringent air pollution regulations, rapid industrialization in South Korea, and investments in sustainable water treatment solutions, the demand for activated carbon filter is also growing significantly in the country. In South Korea, aggressive emission reduction policies have led to extensive deployment of air and gas filtration technologies throughout power plants, petrochemical industries, and manufacturing sites.

Developments by the country’s smart city creations, as well as increasing consumer demand for clean indoor air, are also boosting sales of home and commercial air purifiers featuring activated carbon filters. Moreover, the increasing dominance of South Korea in EV battery production is boosting the penetration of activated carbon in battery cooling and filtration systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

Stainless steel shell activated carbon filters continue to dominate the market, owing to their superior corrosion resistant property, durability, and compatibility across different applications. For long-lasting performance, these filters are being used in industries demanding hygiene standards like pharmaceuticals and food processing.

Stainless steel shell activated carbon filters are still the most popular types in food & beverages, pharmaceuticals and high-purity water treatment among other critical industries. Their resistance against rust, high pressure, and harsh chemicals guarantee users prolonged service life and dependable filtration performance.

Stainless steel filters with improved adsorption efficacy are being launched by manufacturers to meet stringent environmental and safety regulations. The demand for advanced filtration technologies such as membrane filtration in water purification and choose industry processes also augments the demand for stainless steel shell filters.

Although its initial cost is quite high, industries prefer stainless steel because of its cost-effectivity in the long run as it not only eliminates the need for replacements but also for regular maintenance. However, it has become the most widely used shell type in the activated carbon filter market, particularly due to its increasing application in municipal water treatment and high purity liquid filtration.

The carbon steel shell filter has a strong market share, especially for applications in industrial water treatment, chemical processing, and large-scale filtration systems. These filters provide a lower-cost option than stainless steel, while still ensuring high structural integrity and efficient removal of contaminants.

Carbon steel shell filters are still in use for industries where bulk water filtration and mild corrosion resistance are acceptable. While they need protective coatings to prevent rusting, the fact that they are affordable and cost-effective makes them suitable for large-scale applications such as power plants, wastewater treatment, and petroleum refineries.

Activated carbon filters are extensively used in a range of applications with the industrial water treatment and drinking water treatment segments holding a significant share of the overall market. These segments continue to witness growth as environmental concerns are increasing, regulatory compliance increases and industries need purified water.

Industrial Water Treatment Remains the Largest Application Segment Due to Stringent Environmental Regulations

The activated carbon filter finds a major end-use in the industrial water treatment sector, where industries are trying to purify the wastewater by removing impurities and complying with local regulations. The most important application of activated carbon filters in manufacturing plants, chemical processing, and power generation plants, is to remove organic contaminants, heavy metals, and volatile organic compounds (VOCs) from wastewater streams.

In strict governments' environmental laws in the world country, the use of high-efficiency filtration system in the industry is one of the important factors of the enriching environmental protection industry. As a result, the industrialized regions have taken up its usage significantly place in developing economies where the industrialization is still taking shape hence activating the demand for activated carbon filtration solutions.

The industrial water treatment segment is strengthening its position further, as industries are deploying advanced filtration technologies with growing concerns over water scarcity and pollution.

Activated carbon filter has become the most widely used water purification technology for removing chlorine, pesticides, pharmaceuticals and organic pollutants from drinking water due to its high effective absorption with low cost lead to growing demand for activated carbon filters among consumers and municipal authorities.

Activated carbon technology is used to improve water at municipal water treatment plants, residential filtration systems, and establishments. This segment continues to increase due to the gallon water of health concerns linked to polluted water, along with increasing population in urban areas.

The growing use of activated carbon filters in homes, hotels, and public water supply systems is a result of improved point-of-use (POU) and point-of-entry (POE) filtration systems. This segment is anticipated to continue gaining traction in the coming years because of increasing global attention toward clean drinking water initiatives.

The activated carbon filter market is relatively steady, owing to the growing demand for water and air purification solutions, stringent environmental regulations, and industrial filtration needs. The demand from sectors like water treatment, food & beverage, pharmaceuticals, & chemicals, all of which are major industries using activated carbon filters, are driving sales across the globe.

As the tech revolution continues, companies invest into R&D of high-efficiency filtration systems, advanced adsorption technologies and AI-powered monitoring solutions. Market trends are also shifting toward sustainable efforts, such as activated carbon regeneration and bio-based carbon filters.

Market Share Analysis by Key Players & Filtration Technology Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Calgon Carbon Corporation | 16-20% |

| Cabot Corporation | 11-15% |

| Donau Carbon GmbH | 9-13% |

| Kuraray Co., Ltd. | 7-11% |

| Haycarb PLC | 5-9% |

| Others | 35-45% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Calgon Carbon Corporation | Leading supplier of granular and powdered activated carbon filters for air and water treatment, industrial applications, and wastewater management. |

| Cabot Corporation | Specializes in high-purity activated carbon materials for air purification, automotive emission control, and industrial gas filtration. |

| Donau Carbon GmbH | Provides tailor-made activated carbon solutions for food & beverage processing, water filtration, and pharmaceutical applications. |

| Kuraray Co., Ltd. | Offers coconut shell-based activated carbon filters, focusing on sustainable filtration technologies and high-efficiency adsorption systems. |

| Haycarb PLC | A key player in renewable activated carbon production, with expertise in gold recovery, air filtration, and specialty carbon products. |

Key Market Insights

Calgon Carbon Corporation (16-20%)

Calgon Carbon is a global leader in activated carbon filtration and a leading supplier of high-quality carbon filters used in the treatment of municipal water, industrial gas and in wastewater treatment. The company invests in carbon regeneration technologies that are sustainable.

Cabot Corporation (11-15%)

Cabot Corporation specializes in high-performance activated carbon for air filtration, emission control systems, and water treatment. The company is also expanding its solutions in electric vehicle battery applications and energy storage.

Donau Carbon GmbH (9-13%)

Specialized in filtration solutions according to individual needs, Donau Carbon offers activated carbon for industrial water treatment, food processing and specialty chemical applications. The firm has also been strengthening its footprint across the Asian and European regions.

Kuraray Co., Ltd. (7-11%)

Features coconut shell raw materials to produce sustainable activated carbon that is helpful for water cleaning, air purification, and chemical processing.

Haycarb PLC (5-9%)

Haycarb is a key manufacturer of eco-friendly activated carbon filters, focusing on air and water purification, gold recovery, and specialty activated carbon products for high-end industrial applications.

Other Key Players (35-45% Combined)

The activated carbon filter market also includes several other manufacturers, specialty filtration companies, and industrial players. These include:

The overall market size for activated carbon filter market was USD 86.18 billion in 2025.

The activated carbon filter market is expected to reach USD 167.96 billion in 2035.

The activated carbon filter market will rise due to increasing concerns over water and air pollution, driven by the growing emphasis on environmental sustainability, rising regulatory standards for industrial emissions, and the expanding adoption of filtration systems across various industries. Additionally, the shift toward advanced purification technologies, the integration of activated carbon filters in residential and commercial water treatment, and the rising demand from the pharmaceutical and food & beverage sectors for high-quality filtration solutions will further propel market growth during the forecast period.

The top 5 countries which drives the development of activated carbon filter market are USA, European Union, Japan, South Korea and UK

Industrial and drinking water demand supplier to command significant share over the assessment period.

Aluminum Phosphide Market Growth - Trends & Forecast 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.