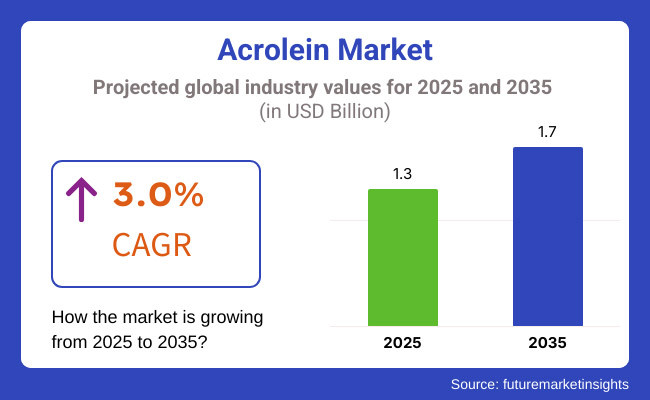

Acrolein is a fundamentally propellant and versatile aldehyde, which serves as an important intermediate for the production of countless chemicals ranging from derivatives of acrylic acid to specialty biocides. At the global level, the acrolein market in 2025 is expected to reach around USD 1.3 Billion and in 2035 it is projected to cross USD 1.7 Billion, growing at a stable CAGR of 3.0% during the forecast period. This continued growth is due to increased demand driven by agricultural applications, water treatment chemicals, and the production of methionine, which is a key amino acid in animal feed.

The market’s resilience is further strengthened by continuous piloting of safer and more efficient production processes and new applications in personal care and pharmaceutical sectors. As sustainability remains a fundamental consideration, businesses are looking for bio-based production approaches to decrease their environmental footprint, confirming the fact that acrolein will continue to play a fundamental role within the worldwide chemical industry.

Acrolein is supported by a wide range of applications, from manufacturing high-performance coatings to developing green agriculture chemicals. The growth of acrolein's downstream industries also proves to be a driving factor considering its role as a key intermediate for producing methionine which itself is witnessing surging demand owing to the growing livestock sector on a global scale. The growth in pharmaceuticals and personal care products is further expected to augment the market growth.

North America dominates the global acrolein market, owing to its advanced chemical manufacturing infrastructure and presence of key players across the market. The market is supported by established R&D activities and strong demand for specialty chemicals, such as biocides and corrosion inhibitors in the USA Agriculture is booming in Canada which also adds to the demand for acrolein in herbicide and fungicide formulations.

Moreover, these developments in safety and handling processes from this region are establishing global trends contributing to sustainable growth while increasing market penetration.

Within the global acrolein industry, Europe has a crucial role as an area with a strong regulatory framework and also a large chemical manufacturing base. Germany, France & UK are mentioned to be the significant markets with the need for acrolein being directly proportional to the manufacturing of methionine & environment-friendly biocides.

Investments in cleaner production technologies are driven by the European Union's commitment to sustainability and strict environmental regulations implementation. Consequently, European producers are turning to renewable feedstock’s for acrolein production along with sector expectations for industrial emission reductions across the entire region.

The Asia-Pacific region is expected to experience the strongest growth owing to its expanding manufacturing base and rapidly-growing agricultural production. China is leading the region, as a significant producer of chemicals capable of meeting both domestic and international needs for methionine and other acrolein derivatives.

Seized by new investments in agricultural infrastructure and water treatment facilities, India and Southeast Asian countries are also emerging as critical markets. Therefore, as governments in this region advocate for industrial modernization and harsher environmental regulations, the utilization of advanced acrolein production processes is expected to accelerate. Challenges and Opportunities

Challenge

Hazardous nature

Demanding rigorous safety controls and special handling. The toxicity and flammability of the compound are dangerous at each production, storage, and transport stage, calling for high compliance costs and advanced infrastructure. Such adversity is further exacerbated by raw material price volatility, particularly propylene, that influences the profitability of acrolein production and forces producers to remain profitable while still in compliance.

Opportunity

Development of bio-based production methods

Producing acrolein from renewable feedstock’s is a promising path to sustainable improvement as industries across the world shift toward greener and more sustainable practices. Not only does bio-based acrolein reduce dependency on fossil fuels, it also caters to increasing consumer and regulatory demands on chemical producers for green chemicals.

Manufacturers can capitalize on this unsustainability gap to diversify their product portfolio and achieve lower carbon footprints with competitive advantages by leveraging bio-refining technologies and joining hands with research institutions.

Acrolein Market is steadily growing from 2020 to 2024 owing to its diverse applications as chemical intermediates, in the treatment of water, manufacturing of biocide. Market growth was supported by higher demand from the agriculture, pharmaceutical and polymer sectors.

The demand from the industry was primarily propelled by the application of acrolein as an essential raw material in the production of methionine, which is used in animal feed, as well as in the synthesis of specialty chemicals. Challenges faced to market growth included strict environmental regulations, health hazards and fluctuation in raw material prices. On the manufacturer side, the emphasis was on optimizing production processes for unit emissions and sustainability.

The acrolein game will change in 2025 to 2035 owing to green chemistry innovations, bio-based production techniques, and stricter environmental compliance measures. As the awareness about the toxic effects of acrolein rises, sustainable alternatives and better waste disposal practices will be the key drivers for the growth of acrolein.

Technological progress in the bio-synthetic pathway, catalytic activity, and changing regulations favouring disruptive approaches will shift market structures. The industry`s trajectory will further be guided by the demand for high-purity acrolein in pharmaceutical, polymer additive and other specialty coatings.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent environmental regulations on acrolein handling due to toxicity concerns. Compliance with workplace safety and emission control standards. |

| Production Technologies | Conventional petrochemical-based acrolein production with moderate efficiency improvements. |

| Industry Adoption | High use of acrolein in herbicides, biocides, and methionine synthesis for animal feed. |

| Market Competition | Dominance of major chemical manufacturers with limited investment in alternative production methods. |

| Market Growth Drivers | Growth in agrochemicals, water treatment chemicals, and methionine production fuelled demand. |

| Sustainability and Environmental Impact | Initial efforts to reduce emissions and improve workplace safety. Limited focus on green alternatives. |

| Integration of AI and Process Optimization | Early-stage adoption of AI in monitoring production efficiency and emission control. |

| Advancements in Applications | Primary applications in herbicides, specialty chemicals, and water treatment. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulations on hazardous chemical emissions. Increased adoption of eco-friendly production processes and alternatives. |

| Production Technologies | Shift toward bio-based and green synthesis methods to reduce environmental impact and reliance on fossil fuels. |

| Industry Adoption | Expansion in high-purity applications, including pharmaceuticals, coatings, and specialty polymer additives. |

| Market Competition | Rise of biotech firms and green chemistry innovators offering sustainable and safer alternatives. |

| Market Growth Drivers | Demand shift toward high-value applications such as pharmaceutical intermediates and advanced polymer additives. |

| Sustainability and Environmental Impact | Large-scale implementation of green chemistry principles, bio-based acrolein synthesis, and closed-loop production systems. |

| Integration of AI and Process Optimization | Widespread AI-driven process automation to enhance production efficiency, reduce waste, and comply with environmental standards. |

| Advancements in Applications | Emerging applications in biodegradable polymer coatings, pharmaceutical synthesis, and renewable energy materials. |

Acrolein market in the USA is propelling with a significant margin due to its extensive use in manufacturing of specialty chemicals, biocides, and polymer intermediates. The country's mature chemical manufacturing industry and growing use of acrolein in agricultural applications, including herbicides and pesticides, are key factors propelling growth.

Moreover, modernization of sewage treatment methods is propelling the use of acrolein as a biocide to mitigate microbial growth in industrial water systems. Market expansion is also likely to be aided by the presence of leading chemical manufacturers in the region and ongoing research into sustainable acrolein production methods. Regulatory compliance with relevant environmental safety standards continues to be a major factor influencing the industry landscape in the USA

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

The UK acrolein market attained high volume, driven by the expanding application of acrolein derivatives in industrial applications and wastewater treatment methods. In this case, green or bio-based acrolein alternatives are gaining traction on the back of the country’s focus on sustainable and eco-friendly chemical production.

Moreover, an increase in high-performance specialty chemicals demand in pharmaceutical and polymer industries is contributing to market growth. The UK’s strict environmental standards regarding emission control and hazardous chemical handling are leading manufacturers towards cleaner production. The establishment of R&D in the field of acrolein synthesis from renewable feedstock will also be key in shaping the market trends, going forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.8% |

Acrolein market will show significant growth in Germany, France and Italy, owing to their predominant specialization in specialty chemicals and biocides during the forecast timeline. Investments in green chemistry are increasing in the region’s chemical industry, with research being carried out on sustainable pathways to produce acrolein.

Moreover, the rise of acrolein in polymer synthesis and agricultural chemicals has further propelled the market. Without the pharmaceutical industry, for example, the EU’s rigid chemical safety regulations are persuading manufacturers to move towards modern production methods to reduce impact on the environment. The increasing demand for acrolein-based water treatment solutions in industrial facilities is further boosting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.9% |

The key factors strengthening Japan acrolein market are the country's strong chemical manufacturing, technological advancement and robust regulatory framework. Increasing use of acrolein to manufacture chemical intermediates, largely in pharmaceutical and polymer sectors, is another factor boosting the market growth. Furthermore, the demand for acrolein-based biocides in Japan is growing due to the emphasis on wastewater treatment and industrial hygiene.

Aligned with the country’s commitment to sustainability and promoting the use of bio-based feedstocks will stimulate research efforts geared towards the development of bio-based acrolein, for instance, from renewable feedstocks. These factors are likely to support stable growth in the market, due to the presence of leading chemical manufacturers and investments in advanced production technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.7% |

Growth of acrolein market in South Korea can be attributed to its well-established chemical industry and growing demand for specialty chemicals. Increasingly, acrolein is being used in industrial and agricultural applications as an oxygen scavenger in deionized water treatment, in herbicides, and for polymer synthesis.

There are several initiatives being taken by the government that promote industrial sustainability and production of eco-friendly chemicals, which in turn is propelling the adoption of greener manufacturing practices. Moreover, R&D investments are also promoting high-purity acrolein production for specialty chemical applications. The continued growth of South Korea’s petrochemical sector is also likely to stimulate demand for acrolein and its derivatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

Segments such as Propylene Oxidation Method and Glycerol Dehydration Method dominate the Acrolein market, as industries are embracing innovative methods of production to increase efficiency, sustainability, and yield. Thus, these approaches become essential for maximizing acrolein production, minimizing its environmental footprint, as well as fulfilling the increasing universal requirement for this chemical building block.

The Propylene Oxidation Method is the most important industrial method for producing Acrolein, owing to its relatively high yield, low cost, and large-scale production capabilities. This technique enables a controlled oxidation reaction, producing acrolein with fewer impurities and higher yield, unlike the alternative methods.

The market is driven by the growing demand for acrolein in the synthesis of various chemicals such as its application in the manufacture of methionine and biocides. More than 70% of the commercial acrolein production adopts the propylene oxidation route owing to its scalability and reliability [7].

Catalytic process improvements, which include optimized reaction conditions, advanced catalyst formulations, and energy-efficient oxidation technologies, have fueled market demand and now provides a more sustainable and economics alternative.

The adoption has been further accelerated with the integration of AI-driven process monitoring that offer predictive analytics, automated reaction optimization, and real-time process adjustments to deliver better operational control and minimize production waste.

Market growth continues with the optimization of greater cross-industry collaboration opportunities, featuring joint research programs that include chemical manufacturers, catalyst developers and process engineers that grow on both a developmental and commercial basis.

The implementation of green production approaches with low-emission oxidation catalysts, renewable energy-driven processing plants, and accountable raw material sourcing has promoted market growth and compliance with global green chemistry programs.

Now, in spite of its benefits, which include high-yield production, cost-efficiency, and ease of large-scale industrial adoption, this propylene oxidation method still suffers from the constant and ever-changing prices due to sustainability concerns, ecological regulations, and also the energy required for the processing.

In contrast, newly discovered breakthroughs in catalysts, waste heat recovery systems, and AI-based emission control technologies are all enhancing sustainability and economics, and facilitating regulatory compliance, which ensures that market growth for the propylene oxidation method will continue in the upcoming years.

The Glycerol Dehydration Method has developed robust market traction owing to its environment-friendly approach and growing interest in sustainable chemical synthesis. Conventional propylene oxidation method is one of the routes, which pulls hydrocarbons from fossil fuels; whereas glycerol dehydration pulls renewable source (glycerol)/in turn reduced dependence on petrochemical-derived feedstock’s.

Growing demand for bio-based acrolein, particularly in pharmaceutical, agricultural, and water treatment applications, has driven adoption of glycerol dehydration to serve as a production pathway alternative. The bio-based chemical market is on the rise and glycerol dehydrogenation has become crucial in the efforts to ensure the sustainability of the acrolein market.

Market demand has been strengthened for bio-acrolein production as bio refinery integration continues to expand, with glycerol valorisation, closed-loop production cycles, and synergistic biomass processing all contributing to the economic feasibility of such production.

Greener chemistry concepts, including solvent-free processing, low energy dehydrating reactors and waste valorisation strategies, have accelerated uptake that overcomes environmental hurdles and improves process sustainability.

Market growth has been optimized through collaborative sustainability programs, with joint adventures between renewable chemical producers, waste glycerol recyclers and regulatory bodies, which ensure continuous innovation in glycerol-based acrolein synthesis.

The implementation of circular economy approaches such as glycerol waste upcycling, CO2 emission reduction projects, and renewable feedstock diversification has strengthened the market growth to remain in line with global carbon footprint reduction strategies.

Although it's advantageous in terms of sustainability and renewable feedstock use, lower petrochemical dependency and reduced environmental susceptibility, glycerol dehydration production methods face disadvantages in production yields, process costs, and production scalability in high-volume manufacturing.

Nonetheless, recent advancements in catalytic dehydration optimization, process intensification strategies, and AI-driven reaction engineering are enhancing yield efficiency, affordability, and industrial scalability, paving the way for glycerol-based acrolein production to grow globally.

The Methionine and Biocide segments hold a significant market share as industries increasingly utilize acrolein for advanced chemical synthesis, agricultural protection, and environmental management. These applications play a crucial role in global food security, industrial preservation, and ecosystem protection, ensuring sustained demand for acrolein-based products.

Methionine, an essential component amino acid utilized widely in animal nutrition, has emerged as a frontrunner segment in the Acrolein marketplace owing to its crucial involvement in the health and nutrition of livestock. Methionine that comes from acrolein guarantees the best protein synthesis and metabolic activity for poultry, swine, and aquaculture, which distinguishes it from synthetic alternatives.

Market adoption has been driven by the rising demand for methionine due to global population growth, increased meat consumption, and changing nutrients standards in animals. Methionine synthesis accounts for more than 60% of global acrolein production, emphasizing the importance of methionine in the agricultural market [4].

Growing adoption of precision animal nutrition strategies including personalized amino acid supplementation, minimum feed conversion ratios and AI-based diet formulations are likely strengthen market demand, ensuring improved efficiency in livestock production.

The inclusion of bio-based synthesis pathways, low-emission processing, and renewable feedstock utilization in sustainable methionine production has also contributed to its adoption, ultimately aligning with global environmental sustainability goals.

The advanced formulation methionine with high bioavailability, rapid absorption nature, and no adverse effect on the environment has increased the rise in the market due to improved livestock health and productivity of farm animals.

Although it offers benefits such as improved essential amino acids, enhanced feed conversion, and maintenance of livestock health, the production of methionine bears challenges including the fluctuation in raw materials prices, stringent regulatory scrutiny, and demand for constant innovation of feed formulations.

Nevertheless, continued growth in the methionine market across the globe goes on with novel solutions, including precision fermentation, AI-based feed optimization technologies, and sustainable methionine bio production, enabling the enhancement of efficiency, cost-effectiveness, and scalability.

Biocides are popular with the market thanks to their ability to eliminate pathogens and control microbial contamination for use in water treatment, agriculture and industrial preservation Acrolein-based biocides possess a broad-spectrum range with prolonged effectiveness compared to traditional antimicrobial reagents due to robust chemical stati and are environmentally friendly.

Benefits of industrial biocides, such as increased demand for water treatment methods, strict hygiene regulations, and rising concern for microbial resistance have increased adoption. The industrial biocide market is experiencing tremendous growth, responses to which, acrolein is an essential component of upscale antimicrobic formulations.

While the biocide segment holds benefits like microbial resistance control, industrial disinfection, and environmental conservation, it also faces limitations such as regulatory limitations on chemical use, toxicity issues, and changing safety standards.

On the other hand, Innovations in biocide formulations that employ biodegradable adjuvants, AI-based contamination monitoring, and sustainable antimicrobial technologies are enhancing efficacy, environmental safety, and regulatory compliance, thus facilitating growth in acrolein-based biocide applications globally.

Growing applications in agrochemicals, chemical intermediates, and water treatment will drive the Acrolein Market. Increasing adoption in industrial processes, especially in herbicides, biocides, and polymer production, is driving the market for these products significantly.

Some of the key trends observed across the industry include increasing eco-friendly production methods, growing focus on regulatory compliance in chemical manufacturing, and rising investments in R&D for sustainable acrolein derivatives.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Evonik Industries AG | 12-16% |

| Arkema S.A. | 10-14% |

| Dow Chemical Company | 8-12% |

| Hubei Jinghong Chemical | 6-10% |

| Wuhan Ruiji Chemical | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Evonik Industries AG | Develops high-purity acrolein for industrial applications, emphasizing sustainable production. |

| Arkema S.A. | Focuses on specialty chemicals, including acrolein derivatives for agriculture and coatings. |

| Dow Chemical Company | Provides acrolein-based intermediates for polymer and specialty chemical production. |

| Hubei Jinghong Chemical | Specializes in acrolein production for herbicides and industrial processing. |

| Wuhan Ruiji Chemical | Supplies acrolein for chemical synthesis and water treatment applications. |

Key Company Insights

Evonik Industries AG (12-16%)

Evonik leads in high-purity acrolein production, leveraging advanced chemical synthesis methods to meet industrial demands.

Arkema S.A. (10-14%)

Arkema enhances its presence in the market by developing specialty acrolein derivatives tailored for industrial and agricultural applications.

Dow Chemical Company (8-12%)

Dow focuses on acrolein as a key chemical intermediate, supporting polymer and specialty chemical manufacturing.

Hubei Jinghong Chemical (6-10%)

Hubei Jinghong Chemical specializes in acrolein for herbicide formulations and various industrial uses, expanding its footprint in agricultural chemicals.

Wuhan Ruiji Chemical (4-8%)

Wuhan Ruiji Chemical supplies acrolein for chemical synthesis and water treatment solutions, catering to industrial clients.

Other Key Players (45-55% Combined)

Several chemical manufacturers, specialty chemical producers, and industrial solution providers contribute to the expanding acrolein market. These include:

The overall market size for Acrolein Market was USD 1.3 Billion in 2025.

The Acrolein Market expected to reach USD 1.7Billion in 2035.

The Acrolein Market demand is driven by its rising use in methionine production for animal feed, increasing applications in water treatment and agrochemicals, and its role as a chemical precursor in industrial processes. Technological advancements in production and stringent environmental regulations further support market growth across multiple industries.

The top 5 countries which drives the development of Acrolein Market are USA, UK, Europe Union, Japan and South Korea.

Propylene Oxidation Method drives to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA