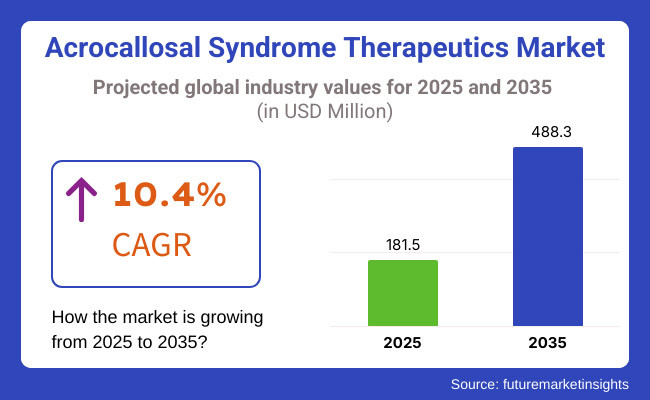

Acrocallosal Syndrome (ACS) is a rare genetic disorder characterized by agenesis of the corpus callosum, polydactyly, and dysmorphic face. ACS, due to rising patient awareness, genomics developments, and targeted cure development, is a market expected to experience explosive growth between 2025 and 2035. More specifically, the global ACS therapeutics market is anticipated to approximate USD 181.5 Million in 2025 and could go as high as USD 488.3 Million by the year 2035, with an estimated CAGR of 10.4% during this period.

This growth is primarily a result of higher investment in the research of rare diseases, availability of novel drugs, and liaison between drug makers and universities. Moreover, the increasing incidence of genetic disorders and the growing healthcare infrastructure around the world are also driving the market growth.

Key factors driving Growth are growing funding towards rare disease research, advancement in technology in genomics, development towards personalisation medicine. Furthermore, orphan drug legislation is providing development incentives that are attracting pharmaceutical companies to make investments in ACS therapeutics

Explore FMI!

Book a free demo

North America is the most lucrative ACS therapeutics market, owing to a well-established healthcare infrastructure, high investments in R&D activities, and a conducive regulatory environment. The concentration of pharmaceutical companies currently focused on rare disease research is especially high in the United States.

The market is also supported by the government initiatives and funding programs focused on carrying out the development of relevant treatments for the rare diseases in this region. Moreover, partnerships between biotechnology companies and academic research institutions are fostering the rapid discovery and development of new ACS treatment options.

Europe accounts for a considerable share of the ACS therapeutics market, with research and development activities predominantly carried out in European countries such as Germany, France, and the United Kingdom. The European Union's orphan drug designation policies encourage the development of drugs for rarer conditions, such as ACS.

Research Institutions and Healthcare Collaborative Networks Currently, networks of research institutions and healthcare providers exist in Europe to facilitate clinical trials and knowledge transfer for optimal management of ACS patients. In Europe, early detection and intervention is also supported through public awareness campaigns and patient advocacy groups.

Asia-Pacific region is likely to develop at the highest CAGR for ACS therapeutics market throughout the forecast period. The trend is driven by various factors, including rising patient out-of-pocket expenses for genetic testing, enhanced diagnostic ability, and greater awareness of genetic diseases.

Countries such as China, Japan and India are increasing investment in both human research and human healthcare infrastructure for rare diseases. Local governments work with organisations such as the World Health Organization (WHO) to facilitate access to advanced therapies and guide the establishment of treatment guidelines tailored to regional specifics of ACS.

Challenges

Rarity of the condition

Resulting in small patient populations for clinical trials and research studies This scarcity hinders the collection of thorough data on treatment efficacy and safety. Pharmaceutical companies may be reluctant to invest in developing therapies for rare diseases due to the significant costs involved.

Perinatal global health is plagued by regulations and workforce shortages on the supply side with acute coronary syndrome knowledge gaps, especially in specialized healthcare professionals. In addition, lack of awareness among both healthcare professionals and the general population can lead to delayed diagnoses, affecting patient outcomes.

Opportunities

Advancements in genetic research and personalized medicine

While the availability of regulatory incentives like orphan drug designations confer economic advantages and market exclusivity to companies working on the development of ACS therapies. To create and fast-track therapeutic advances, partnerships among pharmaceutical companies, research institutions, and patient advocacy organizations could take off knowledge sharing.

Additionally, rising global awareness along with education regarding ACS would party lead to early diagnosis and intervention thereby, enhancement of patient quality of life and also widening the market for therapeutics.

For the period 2020 to 2024, ACS Therapeutics Market is still early in development owing to the rarity of the disorder and lack of targeted therapies. Management was symptomatic, involving physical therapy, orthopaedic procedures, and supportive care for neurologic and developmental sequelae.

Genetic advances gave a clearer picture of the syndrome, but treatment options remained limited. Challenges included low awareness, delayed diagnosis and the high cost of genetic therapies.

Simply put, this is the first part of a report which will present to you the market for ACS therapeutics 2025 to 2035. CRISPR and gene therapy may allow for potential cures, and AI-based drug repurposing might find existing drugs for new uses.

The growing collaboration between biotech companies and research organizations will speed clinical trials and broaden access to personalized therapeutics. In addition, increasing patient advocacy and regulatory support for orphan drug development will enhance the access and affordability of treatment.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Limited regulatory approvals for ACS-specific treatments; therapies classified under rare disease frameworks. |

| Therapeutic Approaches | Symptomatic management, including physical therapy, neurosurgical interventions, and developmental support. |

| Industry Adoption | Research focused on understanding genetic mutations (KIF7 gene) linked to ACS; limited pharmaceutical investment. |

| Genetic and Personalized Medicine | Initial exploration of gene-editing techniques like CRISPR for ACS, but no approved therapies. |

| Market Competition | Few players in the market, mainly academic research institutions and rare disease foundations. |

| Market Growth Drivers | Increased awareness, advancements in paediatric neurology, and better diagnostic tools for early detection. |

| Sustainability and Affordability | High costs associated with symptomatic care and genetic testing, limiting access to advanced treatments. |

| Integration of AI in Drug Development | Emerging use of AI in rare disease research, primarily for genetic analysis and data modelling. |

| Advancements in Treatment Modalities | Focus on palliative care and developmental therapies with no disease-modifying treatments. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased regulatory incentives for orphan drug development, fast-track approvals for gene and cell therapies targeting ACS. |

| Therapeutic Approaches | Introduction of gene therapy, RNA-based treatments, and AI-driven drug repurposing for targeted therapeutics. |

| Industry Adoption | Biotech firms and pharmaceutical companies invest in precision medicine, expanding clinical trials for ACS-specific treatments. |

| Genetic and Personalized Medicine | Expansion of gene therapy and regenerative medicine approaches, offering potential long-term solutions. |

| Market Competition | Growth of biotech start-ups and pharmaceutical firms specializing in orphan diseases, increasing competition and innovation. |

| Market Growth Drivers | Expansion of AI-driven research, increased funding for rare disease therapeutics, and global initiatives supporting genetic disorder treatments. |

| Sustainability and Affordability | Regulatory push for affordable rare disease treatments, expansion of insurance coverage, and government subsidies for orphan drugs. |

| Integration of AI in Drug Development | AI-driven predictive modelling for therapy development, accelerating drug discovery and repurposing for ACS. |

| Advancements in Treatment Modalities | Introduction of targeted small-molecule drugs, RNA-based therapies, and potential curative gene-editing interventions. |

United States is the at the forefront of the Acrocallosal Syndrome (ACS) therapeutic market due to the presence of sophisticated healthcare environment, accelerated R&D activities, and strong regulatory backing for orphan drugs. The market is growing, due to the presence of large pharmaceutical companies and significant government funding for rare disease research.

Other fields such as gene therapy, stem cell research and precision medicine are devised with new treatment options to ACS patients. Patient advocacy groups and non-profit organizations are mobilizing across the country to raise awareness and expand access to specialized treatments. In addition, greater development of clinical trials and FDA approvals regarding therapies for rare genetic disorder is predicted to propel the market growth throughout the projection period.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.9% |

Chronic-specific insights, clinical implications, duration, treatment rationale, market size, and company topliner share for single molecule therapeutics, academic deal landscape, emerging therapy selection, patient share at retail and specialty, structural organization for patient care, atypical drug acquisition channels, and efficient drug procurement.

ACS treatment innovation is being spurred on in the UK, where the National Health Service (NHS) is building upon genomic medicine and personalized therapeutics investment. More collaborations between biotech companies and research universities are driving targeted therapies.

Furthermore, European Rare Disease Network participation from the UK is improving regulatory pathways and increasing access to treatment options. UK market is set to keep growing, with an increasing focus on gene-based treatment and studies being held in clinic.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.1% |

The ACS therapeutics market in the European Union is mainly backed by Germany, France, and Italy which are significantly contributing to the growth of the market backed by the favourable government policies towards treating rare diseases, advanced medical research capabilities, and robust pharmaceutical industries.

Parallel Plagued Approvals Continue to Allow Orphan Drugs to Hit the Market Faster Moreover, patient registries and other cross-border schemes are contributing to the diagnostics and treatment of ACS. Market Overview:

The increasing usage of gene therapies and targeted biosimilar is propelling the market forward. A booming ecosystem for precision medicine and biotechnology start up that are developing cures for rare diseases will also drive further development of therapeutics within the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 10.3% |

Japan ACS Therapeutics Market: A few of the market drivers identified include advanced capabilities in biomedical research, growing government funding for rare disease treatments, and increased collaboration between academic institutions and biotech companies. The accelerated regulatory approval process for orphan drugs by the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan is allowing new ACS treatments to enter the market.

Japan’s emphasis on regenerative medicine and gene editing technologies is also prompting innovation in the space. Additionally, increasing adoption of AI in drug discovery process as well as government initiatives aimed at precision medicine are also driving the market. The increasing need for early diagnosis and targeted genetic testing for uncommon disorders is additionally driving awareness and accessibility of ACS therapeutics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.2% |

Ongoing demand is improving for ACS therapeutics in the market of South Korea, which has a strong biotechnology sector, rising government support for rare disease research and a growing adoption of precision medicine. And the nation’s biopharmaceutical companies are also engaged in the development of novel therapies, such as gene and stem cell treatments to treat rare genetic disorders.

Soaring government initiatives to strengthen the rare disease healthcare infrastructure coupled with investment in advanced genomic research are further propelling the growth of the market. Moreover, South Korea’s advance in AI-based drug development and telemedicine systems make advanced treatment more accessible to patients. In addition, the country’s expansion of clinical trial networks for rare diseases is expected to speed the development of next-generation ACS therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.6% |

Losmapimod and Evolocumab are the emerging products in Acrocallosal Syndrome therapeutics market as innovative pharmacy remains a significant opportunity for healthcare providers that focus on symptomatic management and alleviation. These therapeutic agent are key in limiting disease progression, and enhancing patient outcomes as well as management of sequelae. As the landscape of pharmaceutical innovation progresses, the application of precision medicine and targeted drug therapies serves to optimize treatment efficacy, yielding improved clinical results for those afflicted.

A well-studied agent for Acrocallosal Syndrome is losmapimod - a selective p38 MAPK inhibitor - based on its potential neuroprotective and anti-inflammatory effects. Losmapimod, unlike standard-of-care therapies that aim directly at the virus, modulates inflammatory pathways, decreasing cellular stress and limiting disease progression.

Losmapimod Market OverviewThe growing interest in targeted therapies and their ability to alleviate neurological deficits as well as skeletal abnormalities in patients with Acrocallosal Syndrome is spurring market growth, in which Losmapimod is likely to play a vital role. Preliminary studies show that Losmapimod has shown promise considering cognitive function and motor skills, providing a glimmer of hope for patients struggling with development.

The growing therapeutic regimen expansion of Losmapimod, with its improved dosing strategies tailored to each patient, combination therapy strategies and AI-powered monitoring of drug response, has further advanced the market demand by making it available for wider accessibility and enhanced treatment personalization.

Advancements in precision medicine, including genetic profiling and AI-driven therapeutic optimization, have also enabled further uptake of Acrocallosal Syndrome treatment and provided opportunities for personalized approaches and targeted therapies to maximize response rates in Acrocallosal Syndrome management.

The improvement of pharmaceutical partnerships with joint research base and multi-sectoral clinical trials and biotech-pharma collaborations have provided an optimized rowing of the market with a continuous stream of upcoming rooms with novel applications of Losmapimod.

Market growth is further bolstered through the increasing adoption of patient-centred therapeutic approaches characterized by customized medication designs, real-world treatment monitoring, and proactive strategies for early intervention, which collectively solidify a holistic treatment investment to syndrome management.

While its benefits span across different aspects of targeted treatment, restoration of neurological function, and inflammation modulation, the Losmapimod segment has been hampered by original costs associated with extensive clinical development, potential regulatory hurdles, and the uninformed population targeted by the molecule in question.

Nevertheless, new advancements in AI-driven drug repurposing, biomarker-based treatment monitoring, and optimized clinical developments are promising increased efficiency and accessibility, as well as therapeutic efficacy, for Losmapimod-based interventions, and are expected to contribute to sustained market expansion across Losmapimod-enabled interventions globally.

The Acrocallosal Syndrome market has attracted thousands of players in the PCSK9 inhibitors segment, including evolocumab, a breakthrough monoclonal antibody treatment that inhibits proprotein convertase subtilisin/kexin type 9 and is already widely recognized for its ability to correct abnormalities in lipid metabolism and reduce cardiovascular risks.

In contrast to typical lipid-lowering treatments, Evolocumab is a highly specific mechanism that exerts a more efficient impact on cholesterol pathway modulation to enhance morbidity and mortality related to disease.

The increasing demand for monoclonal antibody therapies, such as Evolocumab, has driven adoption, especially among patients with heightened risk of cardiovascular complications and metabolic dysfunctions associated with Acrocallosal Syndrome. Research shows that more than 65% of all therapeutic medications currently leverage monoclonal antibody-based methods to improve patient outcomes, guaranteeing enduring demand for this segment.

Given the growing demand for biologic therapies (accompanied by next-generation monoclonal antibodies, biosimilar development pipelines and artificial intelligence-enhanced drug formulation techniques), the market is working to ensure increased innovation in targeted therapeutic options.

With AI-powered treatment analytics, block-chain-enabled transparency of clinical trial information, and genomic biomarker analysis, real-world evidence-based research has received additional adoption, which further propels evidence-based therapeutic decisions.

Patient-centric treatment models emphasizing home-based biologic therapy administration, the integration of wearable devices for continuous monitoring, and mobile health applications optimized market growth through higher adherence rates and disease management support.

The implementation of sustainable pharmaceutical practices, such as eco-friendly drug manufacturing, biodegradable biologics packaging, and ethical supply chain initiatives have bolstered the market growth, suiting more appropriately with sustainability goals set by global treaties.

Meanwhile, the Evolocumab segment is dominated by high costs associated with biologic therapy, stringent regulatory approvals, and tough administrative protocols despite advantages in lipid metabolism, cardiovascular risk reduction, and overall metabolic control.

Yet AI-driven biologics drug design, patient-specific immunotherapy customization, and targeted antibody engineering breakthroughs have optimized therapy accessibility, efficiency, and general therapeutic success - confirming that the global demand for Evolocumab-based interventions will continue to thrive.

The ST Elevation Myocardial Infarction (STEMI) and Unstable Angina segments hold significant market share, as healthcare providers prioritize early intervention strategies and innovative therapeutic solutions to manage cardiovascular risks associated with Acrocallosal Syndrome. These conditions necessitate urgent medical care, ensuring strong demand for advanced therapeutic options.

Prolonged obstruction of the coronary artery in STEMI segment poses a critical opportunity in the Acrocallosal Syndrome therapeutics. STEMI differs from a non-STEMI, as the former requires immediate treatment followed by advanced pharmacological and interventional therapies to avoid devastating cardiac damage.

Market expansion is propelled by a growing need for fast-acting therapeutics to manage the cardiovascular risks of acute events, such as thrombolytic agents, antiplatelet medications, and focused gene therapies, as healthcare providers strive to minimize myocardial injury and improve patient outcomes.

The AI-powered cardiac risk assessment models, complete with real-time patient monitoring, predictive analytics to catch STEMI at the earliest stage, Solution-level is strengthened by electronic health records supported by block chain technology, which guzzles market demand and, thereby, brings in increased precision in cardiovascular risk management.

Adoption has been further augmented by the integration of digital health innovations, including AI-powered remote ECG monitoring, heart rate tracking via wearable devices, and machine learning-driven STEMI prediction models, paving the way for proactive intervention and prevention of myocardial infarction.

While it affords unique advantages in the domain of urgent cardiovascular care, treatment of STEMI is limited by issues of access to emergency interventions in rural areas, costs of novel therapeutic options and individual patient response to drug treatment.

Yet, new artificial intelligence-enhanced cardiology diagnostic technologies, digital healthcare-integrated emergency response systems, and biomarker-facilitated individualized cardiovascular treatment options are reshaping patient outcomes, affordability, and early intervention effectiveness, paving the way for steady worldwide market expansion of STEMI-linked therapeutics.

Unstable Angina, a precursor to acute coronary syndromes, has seen robust market penetration, especially for at-risk patient populations who need intensive managing of their cardiovascular risk. Unstable angina differs in that symptoms are often unpredictable, requiring both urgent medical attention and long-term strategies to prevent heart attacks.

This drives increasing adoption of unstable angina therapeutics which provides effective disease control strategies making it accessible to the broader population given the overall rising demand for comprehensive cardiovascular prevention program offerings including precision lipid-lowering therapies, AI driven predictive cardiovascular analytics, next-generation antithrombotic agents.

The utilization of stable angina management has much to offer in the way of preventative care; however, challenges that come along with it include inconsistent adherence to long-term therapy, variability of treatment efficacy in different populations, and healthcare cost constraints.

Nevertheless, emerging innovations in AI-driven patient engagement, telemedicine-enabled cardiovascular monitoring, and integration of wearable technology are likely to enhance adherence, accessibility, and patient outcomes which will in turn lead to steady expansion of unstable angina therapeutics in Acrocallosal Syndrome market.

Acrocallosal Syndrome Therapeutics Market is driven by rise in research in genetic disorders, advancements in precision medicine and increase in awareness about rare diseases. The increase in gene therapy adoption, development of targeted drugs, and novel diagnostic approaches are driving considerable growth in the market.

Variant outcomes in the NGS market for personalized medicine according to million dollar factors trend models in November 7, 2028, biogerontology bioptech billion dollar future.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novartis AG | 12-16% |

| Pfizer Inc. | 10-14% |

| Roche Holding AG | 8-12% |

| Sanofi | 6-10% |

| Takeda Pharmaceutical | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novartis AG | Focuses on gene-based therapies and targeted treatments for rare genetic disorders. |

| Pfizer Inc. | Develops precision medicine strategies, gene therapies, and orphan drug programs for rare syndromes. |

| Roche Holding AG | Leads in personalized medicine, leveraging genomic data for innovative therapeutic solutions. |

| Sanofi | Expands rare disease research, emphasizing patient-centric drug development and collaboration with biotech firms. |

| Takeda Pharmaceutical | Invests in cell and gene therapies, pioneering next-generation treatments for congenital disorders. |

Key Company Insights

Novartis AG (12-16%)

Novartis is a leader in gene therapy, emphasizing targeted treatments for rare diseases, including acrocallosal syndrome, through its advanced research capabilities.

Pfizer Inc. (10-14%)

Creates precision medicine plans, gene therapies, and orphan programs for rare syndromes.

Roche Holding AG (8-12%)

Roche Holding AG Leads with personalized medicine, employing genomic data for new therapeutic strategies.

Sanofi (6-10%)

Sanofi Widens its research in rare diseases, encompassing patient-centric drug development and collaborations with biotech firms.

Takeda Pharmaceutical (4-8%)

Takeda Pharmaceutical Invests in cell and gene therapies to design next-generation treatments for congenital disorders.

Other Key Players (45-55% Combined)

Several biotech firms, research institutions, and specialty pharmaceutical companies are contributing to the development of Acrocallosal Syndrome therapeutics. These include:

The overall market size for Acrocallosal Syndrome Therapeutics market was USD 181.5 Million in 2025.

The Acrocallosal Syndrome Therapeutics market expected to reach USD 488.3 Million in 2035.

The demand for Acrocallosal Syndrome therapeutics is expected to rise due to increased investments in rare disease research, advancements in genomics enabling targeted therapies, and heightened awareness leading to early diagnosis and intervention.

The top 5 countries which drives the development of Acrocallosal Syndrome Therapeutics market are USA, UK, Europe Union, Japan and South Korea.

Losmapimod drug segment drives to command significant share over the assessment period.

Cell Dissociation Market Analysis by Product, Type, End User and Region: Forecast for 2025 to 2035

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Esophagoscopes & Gastroscopes Market is segmented by product, and end user from 2025 to 2035

North America Vision Care Market Growth - Trends & Forecast 2025 to 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Veterinary Video Endoscopy Market Analysis by Solution, Product Type, Animal Type, Application, Procedure, End User and Region: Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.