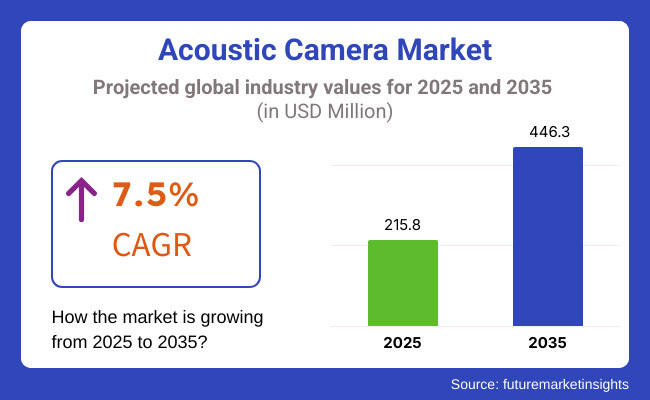

The Acoustic Camera Market is estimated to record high growth from the year 2025 to 2035 because of increasing demand for the localization of the source of the sound, detection of faults, and noise mapping in different sectors. The market will grow from USD 215.8 million in 2025 to USD 446.3 million by the year 2035 with a compound annual growth rate (CAGR) of 7.5% in the forecasted period.

Among the major market drivers is the rising need for industrial and urban noise monitoring. As the industry expands and urbanization intensifies, regulatory authorities and institutions are demanding higher noise pollution regulations, and companies are forced to install advanced sound detection and localization technology.

Acoustic cameras that provide precise sound imaging and real-time noise measurement have widespread usage in fault diagnosis of industrial equipment, vehicle faults, and monitoring of infrastructure. In addition, with major advances in machine learning and artificial intelligence, the effectiveness of acoustic cameras is continuously on the rise, and they are being increasingly utilized across various sectors like automotive, aerospace, and manufacturing.

The market is segmented by type and application. Based on type, the market includes Handheld/Tablet Type and Microphone Array Type. Based on application, the key segments are Energy and Power, Aerospace, Automotive, Manufacturing, Electronics and Appliances, Building and Infrastructure, and Education and Research.

Among the applications, the automotive sector is set to dominate the market due to increased use of acoustic cameras to test automobile noise, diagnose faults, and ensure quality in engine and component testing. With electric vehicles (EVs) and autonomous driving technologies on the rise, sound detection and noise diagnostics have become inevitable for automakers.

Acoustic cameras are used in detecting undesirable noise, vehicle performance optimization, and complying with stringent rules on NVH (Noise, Vibration, and Harshness) analysis. Additionally, as competition rises in the EV segment, players are focusing more on silent drive system improvement and active noise cancellation, further fueling demand for acoustic camera solutions in the automotive industry.

Explore FMI!

Book a free demo

North America is a premium market for acoustic cameras because the region has leading industrial economies, robust automotive and aerospace industries, and major investments in noise monitoring and sound mapping solutions. The United States and Canada have established defense, transportation, and smart city infrastructure, all of which are foremost adopters of acoustic imaging technology.

The development of acoustic cameras is spurred by stringent noise pollution regulations adopted by the Environmental Protection Agency (EPA) and the increasing need for predictive maintenance in manufacturing industries.

The North American automotive and aerospace industries also employ acoustic cameras for quality control, fault detection, and aerodynamic testing, thereby contributing to market growth. The focus of the region on the integration of AI and IoT with audio analysis technology is propelling advancements in real-time noise detection and monitoring systems.

European region accounts for a 08% share of overall acoustic camera market, for the market demand is significantly generated from Germany, France and the United Kingdom. The demand for Acoustic Cameras is fueled by the Automotive and Industrial manufacturing sectors in the region, which utilize these devices for mechanical defect detection, improving machine performance, and improving worker safety.

Germany was renowned for precision engineering and motor car manufacturing and has invested enormously in acoustic imaging technology to facilitate more effective manufacturing and noise countermeasures. European Union regulation of environmental noise has also promoted increased use of acoustic cameras for urban planning and smart city applications.

The area's intense concentration on sustainability has led to eco-friendly transportation networks where acoustic cameras are applied in noise mapping of roads and railroads to achieve conformity with the levels of noise pollution. Applications of acoustic imaging in wind turbine monitoring for renewable energy schemes are fast emerging in Europe as a trend.

Rapid industrialization, urbanization, and increasing investment in infrastructure development will drive the Asia-Pacific region to the fastest growth in the acoustic camera market. Manufacturing and use of acoustic imaging technology: China, India, Japan, South Korea. China has its large manufacturing credit for its use of acoustic cameras for predictive maintenance, improved machine downtimes, and workplace safety.

Rising noise pollution in urban areas of India and regulatory requirement of industrial noise monitoring are acts as key drivers for the demand of acoustic camera in environmental monitoring system. Japan and South Korea, however, technology giants of the world, are actively pursuing the integration of acoustic cameras in automotive R&D, robotics testing, and consumer electronics testing. Still, cost sensitivity of markets along with localization of product development to cater to distinctive regional needs continues to be a major driver of influence on adoption quantities in the market.

Challenge

High Cost and Technical Expertise Requirements

Some of the dominant challenges for the acoustic camera business are the hefty upfront price tag of the system and the requisite technical sophistication of experts to apply and analyze acoustical images. This makes adoption more difficult and widespread, as budget restrictions for small and mid-sized industries make it hard to invest in acoustic cameras.

Electric methods have low sensitivity, while fast] imaging technologies overshadow other imaging ones; the hardware solution; the level of acoustic data that could only analyze acoustic data, which could be challenging for industries that only have limited knowledge of acoustic imaging methods. To reach wider markets, manufacturers must overcome the hurdle of lowering the cost of acoustic cameras and making them easier to use.

Opportunity

Expansion in Smart Cities and Industrial IoT Applications

The increased adoption of smart city initiatives and integration of Industrial IoT (IIoT) will be the major growth opportunity for the acoustic camera market. City governments and authorities are increasingly using acoustic cameras to make noise maps, monitor traffic and provide public safety. Using IoT-enabled acoustic imaging technology, industries are also improving predictive maintenance, enhancing quality control, and complying with noise regulations.

AI-based acoustic analysis technology is also pushing the acoustic camera's ability by applying to various industrial fields such as automatic fault detection and real-time sound visualization. With the growing need for data-driven decisions, the acoustic camera market will see substantial growth in commercial and industrial markets.

Growing acoustic source detection from industrialists, technological advances in non-destructive testing coupled with various safety regulation across automotive, aerospace and manufacturing had a notable impact on acoustic camera market between 2020 and 2024.

The high-resolution acoustic imaging systems are utilized due to the demand for real-time visualization of sound in industrial applications and the growth of smart city initiatives. In addition, AI-based noise analysis for predictive maintenance and machine diagnostics was a very prominent trend.

Between 2025 and 2035, the market for acoustic cameras will experience groundbreaking growth with the introduction of AI-based acoustic analysis, quantum-assisted sound imaging, and the deployment of 5G-enabled wireless acoustic monitoring systems. Acoustic imaging utilizing deep learning algorithms will facilitate more accurate real-time noise classification and localization, thus intensifying industrial and environmental monitoring applications.

Future acoustic cameras will feature AI-based sound anomaly detection, edge computing for in-device acoustic processing, and cloud-based noise mapping. Acoustic cameras on drones will be used with greater frequency in industries to conduct remote structural health monitoring, wind turbine inspection, and environmental scanning of noises on a large scale. Quantum-accelerated acoustic imaging will allow ultra-sensitive detection of sounds in the areas of medical diagnosis, military surveillance, and aerospace industries.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter industrial noise regulations, workplace safety standards, and environmental noise legislation. |

| Technological Advancements | AI-based noise categorization, handheld high-resolution acoustic cameras, and beamforming. |

| Industry Applications | Automotive, aerospace, industrial diagnostics, and environmental noise monitoring. |

| Adoption of Smart Equipment | AI-driven sound localization, real-time noise visualization, and MEMS microphone array innovation. |

| Sustainability & Cost Efficiency | Expensive devices hindering SME adoption, greater need for low-power solutions. |

| Data Analytics & Predictive Modeling | Predictive noise analysis with AI support, cloud storage of data, and real-time acoustic diagnostics. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased demand for compact and portable models. |

| Market Growth Drivers | Growing demand from automotive, aerospace, and industrial automation markets. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-based noise control legislation, block chain-based tracking of compliance, and tighter smart city noise monitoring legislation.. |

| Technological Advancements | Quantum-based sound imaging, AI-based anomaly detection, and 5G-based real-time acoustic monitoring. |

| Industry Applications | Expansion into smart cities, healthcare diagnostics, military surveillance, and drone-based acoustic mapping. |

| Adoption of Smart Equipment | Edge computing for on-device analysis, AR/VR acoustic visualization, and cloud-integrated noise mapping. |

| Sustainability & Cost Efficiency | Innovation in energy-efficient acoustic sensors, green materials, and affordable smart monitoring solutions. |

| Data Analytics & Predictive Modeling | Predictive modeling with quantum enhancement, decentralized AI-based noise monitoring, and block chain-protected acoustic data tracking. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized manufacturing through 3D printing, and block chain-supported quality assurance. |

| Market Growth Drivers | AI-driven real-time acoustic diagnostics, expansion into next-generation smart cities, and sustainability-driven noise control solutions. |

In the United States, the market for acoustic cameras is growing as a result of the strong aerospace and defense industries, as well as strict noise pollution regulations. Demand for sophisticated noise mapping and sound source localization in urban planning and industrial processes further drives market expansion.

Use of acoustic cameras for aircraft noise measurement and military reconnaissance, application in smart city initiatives to control and measure environmental noise, application in predictive maintenance to identify anomalies in equipment using sound analysis, incorporation of real-time acoustic imaging systems improves diagnostic capabilities are some of the key growth drivers for the market in United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.3% |

The market for UK acoustic cameras is dominated by a heavy reliance on measuring environmental noise and complying with high regulations on noise levels. The push for reducing noise in the transport sector, especially in rail transport and city mass transit, necessitates acoustic imaging technology.

Some of the United Kingdom Market Growth Factors include application in monitoring and preventing noise caused by trains and buses, utilization in determining the noise effect when buildings are being constructed to ensure that regulations are met, efforts by the government to map urban noise pollution and decrease it, research by academicians and industry players on emerging acoustic sensing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

The EU acoustic camera market is fueled by extensive environmental policies and a robust industrial sector. Germany, France, and Italy are among the countries that dominate manufacturing and automotive sectors, where acoustic cameras play a critical role in noise analysis and quality control.

Application in vehicle noise testing and NVH (Noise, Vibration, and Harshness) analysis, application in factories for detection and alleviation of noise sources, compliance with EU noise directives requires sophisticated monitoring equipment, work on MEMS microphone arrays and real-time acoustic imaging systems are some of the most important growth potential for the market within European Union

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.4% |

Japan's acoustic camera industry is dominated by its highly developed electronics and automotive sectors. Precision engineering and quality control concerns in the nation lead to increased adoption of acoustic imaging for the testing and development of products.

Sound anomaly detection in consumer electronics for product quality, cabin noise and component vibration testing in vehicles, application in monitoring construction site noise to reduce public disturbance, development of compact, high-resolution acoustic cameras for various applications are some of the major growth drivers for the market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

South Korea's acoustic camera market benefits from a dynamic industrial sector and growing emphasis on workplace safety. The country's role as a major electronics and shipbuilding hub necessitates the use of acoustic imaging for equipment maintenance and noise compliance.

Some of the Market Growth Drivers here are detection of noise sources in ships to improve design and passenger comfort, application of noise monitoring to safeguard workers' hearing and meet safety regulations, application in fault detection in electronic components using acoustic signatures and efforts towards encouraging the use of advanced monitoring technologies in industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Handheld/tablet-type and microphone array-type segments capture the largest share in the market for acoustic cameras as industries go for sophisticated sound visualization technologies to enhance noise identification, product testing, and industrial diagnostics.

Acoustic imaging products are vital to structural defect detection, noise pollution minimization, and safety checks in different sectors, and they are a necessity for manufacturing companies, automotive industry players, power plants, and infrastructure maintenance services.

Acoustic cameras in tablet and handheld configurations have become one of the most rapidly expanding acoustic imaging markets with portable, simple solutions for instantaneous detection of noise sources. In contrast to fixed installations of acoustic imaging, these portable devices provide in-field diagnosis with on-the-go convenience so that users can find leaks in sound, document mechanical vibration, and detect structural flaws accurately.

Growth in need for on-site noise measurement at factories, power stations, and transportation hubs has spurred the application of handheld acoustic cameras with industries seeking mobility, flexibility, and real-time inspection. More than 60% of field engineers and maintenance experts are prioritizing handheld acoustic cameras because of ease of operation, thus driving firm demand for this segment.

Increasing usage of high-res imaging technologies like advanced digital MEMS microscopes, real-time 3D sound visualization software, and machine learning-based noise classification has lifted market demand while guaranteeing finer diagnostic accuracy as well as better acoustic monitoring.

The convergence of IoT-based handheld acoustic cameras, with cloud-based noise analytics, remote real-time monitoring, and predictive maintenance features, has further enhanced adoption, ensuring greater operational efficiency and less downtime.

Industry-specific handheld acoustic camera solutions have been developed, with ruggedized designs for extreme environments, waterproof enclosures for outdoor use, and infrared integration for thermal-acoustic analysis, which has maximized market growth to make it more accessible and applicable.

The implementation of sustainable and environmentally friendly noise monitoring practices, with low-energy use handheld equipment, rechargeable battery systems, and eco-friendly acoustic data storage devices, has further supported market growth, ensuring closer compliance with international environmental and safety standards.

In spite of its portability advantage, deployment ease, and low cost, the handheld/tablet-type market has limitations like lower microphone array density, lower resolution than fixed systems, and vulnerability to ambient noise conditions. New developments in AI-based sound filtering, real-time adaptive acoustic imaging, and more advanced wireless connectivity for synchronization of data are making efficiency, precision, and convenience better, promoting sustained growth of the handheld acoustic camera market across the globe.

Microphone array-type acoustic cameras have become widely adopted in the marketplace, especially within aerospace, automotive, and heavy industry, as manufacturers increasingly utilize high-density microphone arrays to measure intricate sound patterns and conduct high-precision noise diagnostics.

Microphone array-type acoustic cameras differ from handheld offerings by offering increased spatial resolution, greater frequency range coverage, and more profound acoustic analysis, which makes them an industrial quality control and environmental noise monitoring necessity.

Increased demand for mass-market noise source localization, including aircraft engine diagnosis, automotive NVH testing, and power plant turbine inspection, has driven the use of microphone array-type acoustic cameras, as manufacturers focus on high-accuracy acoustic imaging technology. Research shows that more than 70% of acoustic diagnostics across aerospace and automotive industries are based on microphone array systems, driving robust demand for this market segment.

The growth of AI-driven acoustic analysis with machine-learning-based noise distinction, real-time defect prediction, and sound pattern recognition has fortified market demand, guaranteeing increased diagnostic capabilities and lower maintenance costs.

The use of next-generation MEMS-based microphone arrays with ultra-sensitive sensors, miniaturized multi-channel designs, and high-speed signal processing has also driven increased adoption, guaranteeing improved accuracy and increased application space.

The creation of industrial-grade microphone array acoustic cameras with durable construction for high-temperature applications, modular scalability for tailored array configurations, and improved digital connectivity for smooth data integration has maximized market growth, providing higher industrial applicability.

The implementation of regulation-compliant noise monitoring systems, including ISO-approved acoustic measurement tools, environmental noise control structures, and government-endorsed noise pollution testing tools, has bolstered market growth, making better compliance with industry regulations and workplace safety protocols.

In spite of its strengths in high-accuracy diagnostics, wide field of application, and improved sound source localization, the microphone array-type category has challenges of high initial capital expenditure, involved data processing needs, and reliance on acoustic environments that are controlled.

With developments in AI-powered noise analytics, real-time deep acoustic learning, and cloud-based multi-sensor acoustic cameras, affordability, usability, and industrial uptake are becoming better, guaranteeing sustained growth for microphone array-type acoustic imaging solutions across the globe.

The automotive and aerospace segments represent two major market drivers, as industries increasingly integrate acoustic camera technologies into their product development, safety testing, and quality control processes.

The automotive market has been one of the most popular use fields for acoustic cameras, giving vehicle manufacturers the opportunity to detect acoustic anomalies, increase vehicle comfort, and increase engine performance using real-time sound analysis. Unlike other traditional vehicle sound testing, acoustic cameras deliver state-of-the-art sound source location, allowing engineers to locate and correct unwanted vibration and structural resonance with precise accuracy.

Growing need for electric vehicle (EV) noise optimization, including cabin acoustic refinement, drivetrain noise elimination, and external pedestrian sound simulation, has driven adoption of acoustic cameras within automotive design and manufacturing. Though offering benefits in sound source visualization, vehicle noise optimization, and structural integrity analysis, the automotive industry is challenged by high integration prices, data complexity for multi-sensor analysis, and real-time computational constraints.

Nonetheless, new technologies for AI-driven acoustic simulation, cloud-based automotive noise analysis, and edge computing for in-vehicle acoustic diagnosis are enhancing efficiency, accuracy, and accessibility, promising sustained market growth for automotive acoustic camera applications globally.

In the aerospace industry, there has been a strong uptake across the industry, particularly from aircraft manufacturers, defense sector businesses and regulatory bodies, with industries increasingly using acoustic imaging technology to determine aircraft engine performance, identify defects in structures and mitigate flight noise. Unlike conventional sound-measuring tools, acoustic cameras offer real-time, non-intrusive acoustic measurement system, thereby augmenting safety and operability for aerospace devices.

In the aerospace development and research sectors, there is a growing requirement for aeroacoustics testing with reduced jet engine noise and vibration of fuselages, as well as the optimization of advanced cabin aircraft acoustics in order to prioritize performance improvement and noise reduction; this growth has contributed towards the rapid adoption of acoustic cameras for aerospace development and research.

In spite of its strength in precise diagnostics, improved safety, and optimized aircraft efficiency, the aerospace industry is confronted with the hurdles of substantial research and development expenses, intricate integration with current testing infrastructure, and regulatory limitations on experimentation noise testing.

Nonetheless, new technologies in AI-based aeroacoustics analysis, compact portable acoustic cameras for in-field diagnostics, and real-time flight noise sensing systems are enhancing feasibility, flexibility, and efficacy to ensure ongoing growth for aerospace-specific acoustic imaging solutions globally.

The market for Acoustic Camera is experiencing robust growth as industries increasingly deploy advanced sound imaging solutions for noise source localization, machine condition monitoring, and quality inspection. Sophisticated microphone arrays and real-time visualization software embedded in acoustic cameras find extensive application in automotive, aerospace, industrial, and environmental monitoring applications.

Growing emphasis on noise pollution control, stringent industrial regulations, and predictive maintenance requirements are driving growth in the market. The leading producers are focusing on developing high-resolution, AI-driven acoustic imaging solutions to facilitate enhanced accuracy, efficiency, and speed.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Brüel & Kjær (HBK) | 18-22% |

| Siemens Digital Industries Software | 14-18% |

| FLIR Systems (Teledyne FLIR) | 10-14% |

| Norsonic AS | 8-12% |

| gfai tech GmbH | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Brüel & Kjær (HBK) | Offers high-end acoustic cameras with superior beamforming technology for accurate noise source location in industrial and automotive sectors. |

| Siemens Digital Industries Software | Provides AI-based acoustic imaging solutions coupled with digital twin technology for industrial automation and predictive maintenance. |

| FLIR Systems (Teledyne FLIR) | Provides portable, compact acoustic cameras for machine diagnostics, leak detection, and industrial safety solutions. |

| Norsonic AS | Produces acoustic cameras with high spatial resolution for environmental noise mapping and building acoustics. |

| gfai tech GmbH | Provides modular acoustic camera systems with real-time sound visualization software for R&D and field applications. |

Key Company Insights

Brüel & Kjær (HBK) (18-22%)

Brüel & Kjær leads the acoustic camera segment with a comprehensive range of high-accuracy noise source identification solutions. Its technologies are applied universally in automotive, aerospace, and manufacturing sectors for enhancing product quality and regulatory compliance on noise. The company's robust R&D emphasis and world-wide distribution chain provide it an edge over competition.

Siemens Digital Industries Software (14-18%)

Siemens is one of the main players in the market for acoustic cameras, incorporating AI and digital twin technology in its solutions. Its software-based solutions enable real-time noise assessment and preventive maintenance, which makes it sought after by industrial and energy clients. Its market leadership is enhanced by strategic partnerships and technological advancements.

FLIR Systems (Teledyne FLIR) (10-14%)

FLIR Systems, now part of Teledyne Technologies, specializes in thermal and acoustic imaging solutions. Its portable and easy-to-use acoustic cameras are widely adopted in industries requiring quick and accurate noise detection, such as utilities, HVAC, and mechanical engineering. The company continues to expand its product line to enhance accessibility and affordability.

Norsonic AS (8-12%)

Norsonic specializes in environmental and building acoustics. Its acoustic cameras are optimized for high-resolution noise mapping, and they are suitable for urban planning, construction, and environmental monitoring. The precision and adherence to international noise standards by the company make it a favorite in regulatory use.

gfai tech GmbH (6-10%)

gfai tech GmbH is a leading provider of modular acoustic camera systems, offering customizable solutions for research and field applications. Its advanced beamforming technology enables users to visualize sound in real-time, making it valuable for industrial troubleshooting and product development. The company continues to expand its global footprint through strategic collaborations.

Other Key Players (30-40% Combined)

Several other companies contribute to the Acoustic Camera market by providing specialized solutions and regional expertise. Notable players include:

The market is estimated to reach a value of USD 215.8 million by the end of 2025.

The market is projected to exhibit a CAGR of 7.5% over the assessment period.

The market is expected to clock revenue of USD 446.3 million by end of 2035.

Key companies in the Acoustic Camera Market include Brüel & Kjær (HBK), Siemens Digital Industries Software, Norsonic AS, gfai tech GmbH, FLIR Systems (Teledyne FLIR).

On the basis on application, automotive and aerospace to command significant share over the forecast period.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Border Security Technologies Market Growth - Trends & Forecast 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.