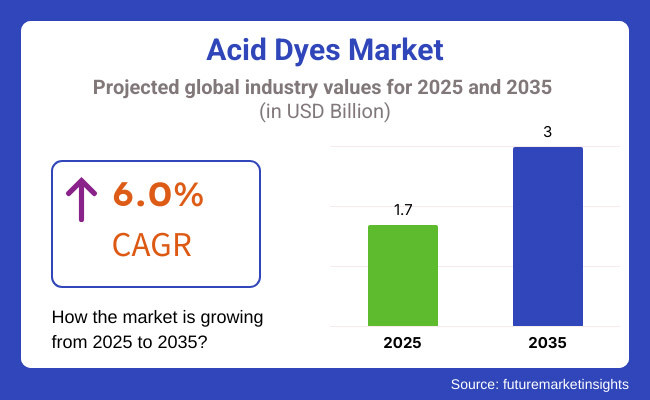

The Acid Dyes Market is anticipated to experience significant growth from 2025 to 2035, fueled by the increasing need for bright and durable dyes in textiles, leather, and the paper sector. The market is anticipated to grow to USD 1.7 billion in 2025 and is likely to expand to USD 3.0 billion by 2035, at a compound annual growth rate (CAGR) of 6.0% during the forecast period.

One of the key drivers for market expansion is the growing textile sector and demand for synthetic fibers. Acid dyes with their good solubility in water and affinity towards protein fibers like wool, silk, and nylon are fast becoming popular in high fashion, upholstery, and industrial uses.

Demand for acid dyes is also rising in the leather sector, where they find extensive application in imparting rich, deep tones in tanning and finishing treatments. Furthermore, innovation in formulations of dyes is improving colorfastness and sustainability, aiding market growth as well.

The market is segmented on the basis of chemical types such as Monoazo and Bisazo, Nitro, Nitroso, Triphenylmethane, Xanthene, Azine, Quinoline, Ketonimine, Anthraquinone, and Phthalocyanin, and dyeing type such as Levelling, Fast, Milling, and Super Milling.

Out of these, milling dyes are prevalent due to their good wash and light fastness, and hence they are most sought after for textile and leather uses. Acid dyes mill, used to a large extent on wool and silk fabrics, has bright and rich shades with a high level of resistance towards harsh washing conditions. Its enhanced bonding features and improved strength position it as the market preference where durability and color are the key issues.

North America is a value-added market for acid dyes because of the very advanced textile, leather, and paper market in the region. The USA and Canada are dominated by high-end specialty dyes producers utilized in high-end textiles, carpets, and industry. Demand for acid dyes is also driven by increasing demand for colorfast, deep colors in synthetic fibers in the fashion and home textiles industries.

North America's stringent environmental laws have also led firms to move towards environmentally friendly dyeing technologies and wastewater treatment plants to minimize industrial pollution. Technological development in biodegradable and non-toxic acid dyes is progressing rapidly, with business firms looking for eco-friendly substitutes for traditional synthetics in the aftermath of enhanced standards of colorfastness and performance.

The majority of the market is held in Europe where Germany, Italy, and the United Kingdom have a high demand for acid dyes. The textiles & leather sectors in Europe are primary consumers of acid dyes in fashion, upholstery & interior car upholstery applications. The acid dyes consistently providing deep, even coloring to leather products are so important to Italy, long celebrated in tanning and dyeing methods.

Meanwhile, strict environmental regulations set by the European Union are driving manufacturers to create low-impact, water-saving dyeing methods. As a result of increasing sustainable interest in both textile production and circular fashion culture, European manufactures have begun to explore bio-based and natural substitutes for traditional acid dyes. They are also being combined with dye recovery and recycling technologies to reduce chemical waste and improve resource efficiency.

Both the textile, leather, and printing industries are rapidly developing which is anticipated to spur growth in the acid dyes market in the Asia-Pacific region at a highest growth rate. Acid dyes are primarily manufactured and consumed in China, India, Japan, and South Korea, and China has the largest size of the market and production capacity.

A key driver for the investment within the acid dyes industry is through the use of acid dyes in the apparel and textiles sector continuing to be a strong pillar for the region led by surging demand local demand for these chemicals alongside their potential for export. India has another major sector which is leather tanning sector in which acid dyes are the workhorses of the tanning sectors and have a major contribution towards good finishes of tan products.

However, the dyeing sectors have, meanwhile, raised concerns over water contamination, which has resulted in the government tightening regulatory standards, especially in India and China, where the two countries are fortifying treatment of wastewater and management of chemicals. Fierce regulatory challenges will be well balanced by strong market development, thanks to greater application of digital and sustainable dyeing technology.

Environmental Pollution and Regulatory Compliance

One of the most significant challenges for the acid dyes market is environmental pollution with respect to dyeing and finishing processes. Chemical dyes disposal and untreated effluent from textile and leather production industries cause water pollution, and therefore governments everywhere in the world have strict regulations.

Complying with environmental regulations requires tremendous investment in wastewater treatment, environmental dyeing procedures, and chemical waste disposal. Furthermore, regulatory environment disparities across regions also render it increasingly difficult for producers to increase their international presence.

Development of Sustainable and Bio-Based Acid Dyes

One prevalent opportunity for the acid dyes market is the rising need for sustainable and eco-friendly textiles solutions. In this background, bio-based acid dyes of renewable and bio-degradable nature from plant extracts and microorganisms have emerged as excellent replacements for synthetic dyes. As an example, ever stick print technology and low-water dyeing technologies are also reducing the environmental footprint of traditional dyeing processes.

While these improvements may require initial investment in biodegradable, non-toxic acid dyes or closed-loop systems to recycle water, fertilizer, waste products or other by-product materials for reuse, they should ultimately allow companies to gain a competitive advantage through participation in the international push for sustainability and meeting global consumer demand for sustainable textile manufacturing.

The use of ecofriendly dyes was emphasized by regulatory agencies such as REACH, which compelled manufacturers to create sustainable acid dyes with minimal environmental impact. The COVID-19 crisis was characterized by supply chain disruptions and fluctuating raw materials prices. However, the market showed strength, thanks to continued demand from important segments such as healthcare textiles and personal protective equipment.

On the sustainability aspect, the next decade will be completely focused on green products and will gradually transition to eco-friendly and biodegradable acid dyes in accordance with global concerns and consumer pressure for environmental-friendly product. Technologies such as digital printing and low-water use processes will begin to take center stage as cheaper and environmentally friendly solutions become available.

The application of nanotechnology in dye making is expected to enhance color brightness and fastness, widening the usage of acid dyes in high-performance textile applications for automotive, aerospace, and medical industries.

Moreover, use of block chain technology for supply chain visibility will ensure ethical sourcing and manufacturing practices, building consumer confidence.” As the sector matures, the challenges of raw material fluctuation and compliance with environmental laws will persist. However, receiving continued research and development as well as strategic partnerships will probably overcome these challenges, resulting in sustainable growth in the acid dyes market in the long run.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on green dyes and sustainable manufacturing processes.. |

| Technological Advancements | Neutral acid dyes with optimized performance development. |

| Industry Applications | Market leadership in textiles, garments, and leather sectors. |

| Adoption of Smart Equipment | Implementation of advanced dyeing machinery for efficiency. |

| Sustainability & Cost Efficiency | Emphasis on minimizing water and energy usage in dyeing operations.. |

| Data Analytics & Predictive Modeling | Minimal application of data analytics for production optimization. |

| Production & Supply Chain Dynamics | Challenges due to COVID-19 disruptions and raw material price fluctuations. |

| Market Growth Drivers | Demand from textile and leather sectors, and a shift towards eco-friendly products. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter environmental regulations, use of biodegradable dyes, and block chain-based compliance monitoring. |

| Technological Advancements | Convergence of nanotechnology, digital printing, and smart textile technologies. |

| Industry Applications | Growing presence in automobile, aerospace, medical textiles, and technical fabrics. |

| Adoption of Smart Equipment | Incorporation of IoT-fitted equipment for real-time tracking and accurate dyeing. |

| Sustainability & Cost Efficiency | Formulation of biodegradable dyes, green dyeing technologies, and waste reduction practices. |

| Data Analytics & Predictive Modeling | Implementation of AI-based predictive maintenance and quality control systems. |

| Production & Supply Chain Dynamics | Strengthening of supply chains through block chain for transparency and resilience against global disruptions. |

| Market Growth Drivers | Innovations in smart textiles, technical fabrics, and increased consumer awareness of sustainable products. |

In the United States, the acid dyes industry is growing driven by the large textile and leather industries, alongside an expanding application for bright, varied colorants. The application of acid dyes as additives in the food industry also accelerates market expansion.

Some of the Market Growth Drivers in United States are the American textile industry is seeing a revival, with emphasis on high-quality, vibrant color fabrics, increasing application of acid dyes in foodstuffs to improve visual appeal, new dyeing techniques enhance efficiency and colorfastness and move towards environmentally friendly dyes is in line with green regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

The UK market for acid dyes is marked by a developed textile industry and tight environmental laws. The requirement of good-quality dyes that are environmentally compliant is a key growth factor.

Stringent policies promote the utilization of low-impact dyes. Excessive demand for bright colors in apparel fabrics. Improved dyeing technologies minimize water and energy usage. Increased export of dyed textiles to overseas markets are some of the key growth drivers in United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

The European market for acid dyes is sustained by the amalgamation of robust textile manufacturing capacities and innovative environmental policies. Nations such as Germany, France, and Italy dominate textile production with a focus on sustainable and quality dye consumption.

Some of the Europe Market Growth Drivers are EU legislation encourages the use of environmental-friendly dyes. Growing utilization of dyed fabric in cars' interiors. Biodegradable and low-toxicity dyes research. Growing demand for colorfully dyed textiles sustainably produced.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

The acid dyes market of Japan is determined by its advanced textile industry and technological advances. The focus of the nation on high-performance textiles, both in fashion and industrial use, pushes the demand for niche acid dyes.

Fashion and industrial demand for colorfast and bright textiles. Advances in formulations for dyes improve quality and methods of application. Application of colored textiles to automobile interiors facilitates market expansion. Classic textile arts still shape demand for dyes are some of the major factors contributing to market expansion in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

South Korea's acid dyes market benefits from a dynamic textile industry and a growing emphasis on sustainable practices. The country's role as a major exporter of textiles necessitates the use of high-quality dyes to meet international standards.

Some of the Market Growth Drivers in south Korea include strong demand for quality textiles in international markets. Use of eco-friendly dyes to comply with environmental standards. Sophisticated dyeing technologies enhance efficiency and minimize waste. Korean fashion influences the demand for varied color ranges.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

The Monoazo and Bisazo dye category, together with the Levelling dyeing type, leads the acid dyes market as companies pursue bright, water-soluble dyes for textile, leather, and paper use. These dyes are instrumental in coloration processes across various industries, improving product quality and competitiveness in the market.

Monoazo and Bisazo Dyes Lead Market Demand as Industries Prioritize Colorfastness and Cost Efficiency

Monoazo and Bisazo dyes are becoming top chemical types in the acid dyes market, providing high dyeing performance for silk, wool, and nylon. Unlike other dye types, these compounds provide high color yield and high dye-fiber interaction, making them suitable for industrial textile uses.

The increasing need for cost-effective and high-performance dyeing technologies has driven market adoption, as textile producers, leather manufacturers, and paper industries require long-lasting and deep coloration processes. Research shows that more than 60% of acid dye usage depends on Monoazo and Bisazo formulations, thus providing strong market traction for these chemical groups.

The growth of innovative acid dye formulations with improved molecular stability, environmentally friendly compositions, and optimized color intensity has reinforced market demand, making these dyes a key part of sustainable and high-efficiency industrial dyeing.

The integration of AI-based dye application systems with automated color matching, precise dye dispersion, and real-time process optimization has further boosted the use of Monoazo and Bisazo dyes, providing for smooth industrial dyeing operations and reduced waste.

The innovation of sophisticated dye stabilization methods, with UV-resistant formulations, high-temperature processing, and prolonged durability for textile use, has maximized market growth, guaranteeing steady demand in worldwide markets.

Though cost-effective, high color retention, and efficient in industrial dyeing, Monoazo and Bisazo dyes are challenged by environmental issues of dye effluents, regulatory compliance, and competition from synthetic dye substitutes. Nevertheless, new developments in biodegradable dye technologies, AI-optimized chemical composition, and eco-friendly dye manufacturing processes are enhancing efficiency, safety, and regulatory compliance, ensuring further growth of these dye types globally.

Levelling Dyes Drive Market Growth as Uniform Dyeing Techniques Gain Industry Preference

Levelling dyes have become increasingly popular in the market, especially among the textile and leather industries, as manufacturers seek even distribution of the dye and controlled absorption for high-quality end products. Contrary to other dyeing processes, levelling dyes provide even coloration without any patches, hence their appeal for high-precision applications involving dyeing.

Increased need for levelling dyes, characterized by increased solubility, better dye migration properties, and lower tendencies to stain, has fueled market adoption since industrial dyeing plants desire efficiency and consistency in coloration operations. Research indicates that more than 50% of acid dye use entails levelling dye methods, a sign of strong demand in the market.

The growth of industry-specific levelling dyeing solutions, including customized dyeing formulas for natural and synthetic fibers, responsive pH-balancing methods, and reduced dyeing cycle times, has improved market access and operational effectiveness.

The integration of digital monitoring of dye application, including AI-driven dye bath analytics, auto-dye-to-fabric ratio adjustments, and IoT-enabled dyeing process monitoring, has also contributed to enhanced market growth, with improved control and efficiency in levelling dye applications.

The evolution of environment-friendly levelling dye formulations with lower water usage, bio-degradable dye molecules, and non-toxic chemical structures has maximized market growth, aligning more effectively with the needs of global sustainability.

Although it excels in even coloration, minimized defects in dyeing, and regulated absorption, the levelling dye market has limitations like high energy demands for dyeing procedures, inconsistent fiber response with different textile fabrics, and reliance on particular dye-fiber interactions.

Yet, new developments in low-energy dyeing technologies, artificial intelligence-based textile dye simulations, and eco-friendly chemical modifications for levelling dyes are improving efficiency, accessibility, and environmental conformity, guaranteeing sustained growth for the levelling dye segment of the acid dyes market.

The Acid Dyes industry is experiencing a gradual yet consistent growth trajectory, driven by increasing demand across textiles, leather, and paper - End use sectors. Due to their high affinity towards protein fibers and synthetic polyamides, acid dyes are widely used in dyeing wool, silk, nylon and specialty fibers.

The fashion sector is expanding, drive-to-consumer use of saturated hues is growing and innovation in textile handling techniques are the most essential factors propelling growth of the market. To remain competitive, major manufacturers highlight sustainable dyeing methodologies, product evolution, and expansion into new sectors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Huntsman Corporation | 14-18% |

| Clariant AG | 12-16% |

| BASF SE | 10-14% |

| Dystar Group | 8-12% |

| Kiri Industries Ltd. | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Huntsman Corporation | Provides high-performance acid dyes with eco-friendly and sustainable formulations for textile and leather applications. |

| Clariant AG | Provides a variety of acid dyes for fashion fabrics, maximizing colorfastness, whiteness, and process productivity. |

| BASF SE | Produces acid dyes with an emphasis on innovation, sustainability, and excellent wash-fastness properties. |

| Dystar Group | Specializes in acid dyes for silk, wool, and synthetic fibers, emphasizing environmental compliance and energy-efficient dyeing. |

| Kiri Industries Ltd. | Leading acid dye supplier, serving global textile manufacturers with cost-efficient and high-quality dye solutions. |

Key Company Insights

Huntsman Corporation (14-18%)

Huntsman leads the acid dyes market with a diverse portfolio of high-performance dyes optimized for textiles, leather, and industrial applications. The company focuses on sustainability, offering eco-friendly dyeing solutions that reduce water and energy consumption. Its global presence and extensive R&D capabilities provide a competitive advantage in the market.

Clariant AG (12-16%)

One of the biggest manufacturers of acid dyes is Clariant that offers innovative dye solutions that enhance color vibrancy, durability and process efficiency. The company has also heavily invested in sustainability practices, developing non-toxic and biodegradable dye solutions aligned with regulatory requirements in leading markets such as Europe and North America.

BASF SE (10-14%)

BASF supplies the textile, leather, and specialty fiber industries with high-quality acid dyes. Its advancements in research and development have enabled innovations in dye stability, wash-fastness, and eco-friendly formulations. It works with fashion brands and manufacturers to promote and bring to market sustainable dyeing technologies.

Dystar Group (8-12%)

Dystar is known for its specialized acid dye offerings tailored for wool, silk, and synthetic fibers. The company emphasizes environmentally friendly dyeing methods, helping manufacturers comply with stringent industry regulations. Dystar’s advanced dyeing technologies enable high efficiency and reduced water usage in textile processing.

Kiri Industries Ltd. (6-10%)

Kiri Industries is amongst the premier manufacturers of acid dyes, shipping affordable solutions across the globe to global markets. With high volumes of production as well as dexterity in working with top-end dyes, the company supplies the booming orders of the leather and textile segments. The areas of emphasis by Kiri Industries are product research and regional spread.

Other Key Players (35-45% Combined)

Several regional and specialized manufacturers contribute to the acid dyes market, providing niche solutions and customized formulations. Notable players include:

The market is estimated to reach a value of USD 1.7 billion by the end of 2025.

The market is projected to exhibit a CAGR of 6.0% over the assessment period.

The market is expected to clock revenue of USD 3.0 billion by end of 2035.

Key companies in the Acid Dyes Market include BASF SE, Huntsman Corporation, Kiri Industries Ltd., Clariant AG, Dystar Group.

On the basis of Chemicals type, Monoazo and Bisazo to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Humic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA