From 2025 to 2035, the acetamide MEA market will expand at a steady rate as there is growing demand in personal care/cosmetic and pharmaceutical sectors. Used in skin and hair care and cleansing in a variety of products, Acetamide MEA is a high-performance conditioning agent. Its moisture-retaining nature and ability to improve the texture of formulations make it an important ingredient in shampoos, conditioners, lotions and facial creams.

One of the primary factors fuelling market growth is the growing consumer demand for mild, skin-friendly, and hydrating personal care products. As consumers are demanding transparency in labels, manufacturers have been focused on making their formulas gentle yet effective.

Therapeutics and cosmetics have seen extensive growth over the past few years, particularly in emerging economies, thus contributing to the increasing consumption for acetamide MEA. The market is also aided by its applications in pharmaceutical formulations as topical creams and lotions to help sustain hydration and protect the skin.

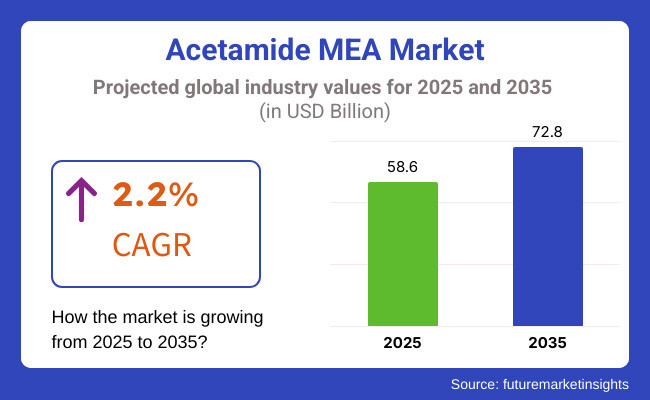

Between 2025 and 2035, demand for acetamide MEA is projected to grow at a 2.2% CAGR, showcasing consistent consumption growth. Innovative & New Product Launches in Cosmetics & Personal Care Sector and Investment in R&D Will Fuel the Market Further. And with consumers availing creative and skin-affectionate skincare and haircare products, the demand for acetamide MEA is not likely to lose momentum.

Explore FMI!

Book a free demo

The North American acetamide MEA market is significantly driven by robust demand for it in personal care and cosmetics industries. The United States and Canada are significant markets because consumers spend a lot of money on skincare and haircare products.

This, however, has led to an increased usage in premium beauty brands that have made the shift toward sulphate-free and moisturizing formulations, and this trend is expected to continue in the next few years. The growth in the region is also aided by the presence of key personal care producers, as well as continuous product innovations.

Synthesis of Acetamide MEA Market Segment and Region The synthesis of acetamide MEA is also an important driver for the European market, with demand in cosmetics and pharmaceutical companies. Established personal care sectors in Germany, France, and the UK are motivating the use of mild and potent moisturizing agents in the region.

Manufacturers are being inspired to use skin-beneficial ingredients like acetamide MEA by regulatory norms focusing on ingredient safety and sustainability. Increasing natural and organic formulations in beauty and personal care is also adding to the growth of the market.

The acetamide MEA industry in the Asia-Pacific region is expected to be the topmost growing area, aided by the increasing demand for haircare and skincare products in China, India, Japan, and South Korea. The rise in between class populace and increase in disposable income is boosting the growth of beauty and personal care sector.

There has been a growing demand for haircare products, especially for conditioning and hydration ingredients in this region. Moreover, increasing urbanization, changing consumer preferences, and rising investments in cosmetic research and development, are further accelerating the market growth.

Regulatory Compliance and Safety Concerns

Acetamide MEA (Monoethanolamine) Market Challenges maintaining quality in the global acetamide market Volume regulations and ethical practices in cosmetic and personal care limitations.

Acetamide MEA is a prevalent humectant and emollient in personal care products, including skin and hair care products, and cosmetics, though ingredient transparency and safety of chemicals is becoming a stronger harmonizing force in regulation Is Acetamide MEA Safe?

Stringent guidelines for chemical formulations in personal care products have been put in place by various governing bodies, including the USA Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA).

Concern around possible impurities such as nitrosamine formation in ethanolamine-based compounds has also created questions around product safety. This will require investment in safety first, switching to cleaner production processes, and being compliant to evolving regulations to maintain consumer trust and access to the market.

Growing Demand for Moisturizing and Skin-Conditioning Agents

Growing consumer interest in high-performance skin and hair care products has driven significant opportunities for Acetamide MEA market. Acetamide MEA is an exceptional hydrator thanks to its great water-binding ability; it often improves formulations in cosmetics and is a common ingredient in premium skincare.

Acetamide MEA is increasingly adopted for formulations of multi-functional ingredients for moisturizing and conditioning leading to the higher demand for Acetamide MEA for use in lotions, shampoos, conditioners, and in anti-aging products.

In addition, clean beauty trend encourages formulators to look for alternative to synthetic humectants, which makes Acetamide MEA a naturally derived and effective solution appropriate for non vegan applications. Personal care companies that embrace sustainable sourcing, hypoallergenic formulations, and biodegradable ingredients will stand out in a growing market.

Moderate growth was in the Acetamide MEA market from 2020 to 2024 because of the greater use of it in skincare and hair care formulations. The increasing end use of moisturizing agents in personal care and rising consumer awareness pertaining to ingredient transparency also spurred adoption. But regulatory concerns and competition with alternative humectants like glycerine and hyaluronic acid posed challenges for manufacturers.

As we look to 2025 to 2035, we expect the industry will continue to focus on the advancement of formulation science to drive sustainability initiatives and ensure compliance with regulatory requirements. Companies will develop high-purity Acetamide MEA to comply with safety standards while providing superior performance in cosmetics. Bio-based alternatives and innovations in green chemistry will also continue to drive the market due to a trend among consumers for natural and eco-cosmetics.

Moreover, the growing investments in R&D will facilitate enhanced ingredient functionalities like improved penetration, enhanced stability and synergistic effect with botanical extracts. Growth in customized beauty products and tailored solutions for skincare will also potentially create an avenue for Acetamide MEA in customized product formulations.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with cosmetic safety standards and ingredient transparency |

| Technological Advancements | Development of high-purity Acetamide MEA formulations |

| Industry Adoption | Widespread use in skincare and hair conditioning products |

| Supply Chain and Sourcing | Dependence on synthetic production processes |

| Market Competition | Competition from alternative humectants like glycerine and panthenol |

| Market Growth Drivers | Rising demand for hydration and conditioning agents in cosmetics |

| Sustainability and Energy Efficiency | Initial focus on reducing chemical waste in production |

| Integration of Smart Monitoring | Limited digital tracking in formulation science |

| Advancements in Formulation Science | Improvements in humectant performance and stability |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on ethanolamine-based compounds, increased demand for clean-label ingredients |

| Technological Advancements | Introduction of bio-based and eco-friendly Acetamide MEA alternatives |

| Industry Adoption | Expansion into anti-aging, premium formulations, and dermatological applications |

| Supply Chain and Sourcing | Shift toward sustainable and plant-derived sources for Acetamide MEA |

| Market Competition | Growth of multifunctional and customized skincare formulations incorporating Acetamide MEA |

| Market Growth Drivers | Increasing preference for hypoallergenic and dermatologist-approved skincare ingredients |

| Sustainability and Energy Efficiency | Adoption of green chemistry practices and biodegradable Acetamide MEA solutions |

| Integration of Smart Monitoring | AI-driven formulation optimization and real-time ingredient efficacy analysis |

| Advancements in Formulation Science | Enhanced delivery systems for better absorption and long-lasting hydration |

Acetamide MEA finds significant application in personal care and cosmetic formulations, which is expected to drive its demand in the United States MEA market. Acetamide MEA, which is a humectant and skin-conditioning agent, is found in shampoos, conditioners, lotions, and skincare products.

Its adoption is adorned with increasing need of sulphate free and mild cleansing agents in the USA beauty industry. Also, the trend towards sustainable and bio-based cosmetic formulations is also motivating manufacturers to adopt acetamide MEA into their offerings.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.4% |

Demand for acetamide MEA in the UK is anticipated to grow at a stable rate, owing to rising consumer demand for gentle and non-irritating personal care products. This has created a broad application scope for acetamide MEA in foams such as shampoos, facial cleansers, and moisturizers with skin-friendly formulas.

Several growing trends, including regulations promoting sustainable and biodegradable ingredients in cosmetics are also fuelling the market growth. The growth of the premium skincare space and organic beauty products, among other factors, is contributing to the demand for multifunctional ingredients such as acetamide MEA.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.1% |

The acetamide MEA market in Germany, France, and Italy holds prominent shares in the EU market, owing to the robust automotive, cosmetics, and pharmaceuticals industries. The use of acetamide MEA in hair and skin care has increased due to Germany's focus on dermatologically tested and sensitive-skin formulations.

With France leading the way in luxury cosmetics around the world, there is an increasing demand for moisturizing and soothing agents. The increasing inclination towards natural and bio-based ingredients in personal care formulations in Italy is also driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.2% |

The growing emphasis on skincare innovations and multifunctional cosmetic products in Japan fuels the country’s acetamide MEA market. Growing usage of acetamide MEA in high-end beauty products driven by rising demand for hydrating & anti-aging formulations Acetamide MEA is a favoured ingredient in personal care applications as Japanese consumers seek out mild, non-irritating, and highly effective ingredients.

Moreover, developments in water-soluble formulations and skin-safe cosmetics are escalating its occurrence in premium skin care products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.3% |

The South Korean acetamide MEA market is presently incrementing at a notable rate given the timeliness of innovation led by K-beauty and skincare leadership of the country. Its use is being driven by the demand for hydrating and soothing ingredients in sheet masks, serums, and hair treatments.

As the South Korean cosmetic industry continues to lead the charge in clean beauty and functional skincare, we see growing interest in safe, high-performance ingredients like acetamide MEA. Furthermore, growing R&D in cosmeceuticals and dermatological formulations is extending its scope in mass-market and premium brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.4% |

The Acetamide MEA market is primarily driven by the personal care and industrial end use segment, as manufacturers gradually shift towards mild, multifunctional and moisture-retaining compounds for skin and hair care formulations, and industrial applications. Such applications increase product stability, performance, and sensory appeal, which is why Acetamide MEA is crucial in cosmetics, pharmaceuticals, and many industrial processes.

Personal Care Applications Lead Market Demand as Mild and Moisturizing Agents Gain Popularity

Acetamide MEA for personal care applications has by far been one of the fastest-growing segments in the Acetamide MEA market owing to superior emollient, humectant, and conditioning properties. Acetamide MEA holds significantly more moisture than conventional moisturizers, making it a welcome addition to formulations for sensitive skin and hair care.

Increasing government support for innovations in the personal care sector are expected to further push the demand for Acetamide MEA-derived products in personal care as more manufacturers focus on producing milder, skin-friendly formulations, which include shampoos, conditioners, lotions and facial cleansers among others. According to the studies, more than 65% of Acetamide MEA-based formulations are targeted towards hydration, thus ensuring robust demand for this segment.

This trend is supported by the rising number of sulphate-free and paraben-free personal care products, incorporating Acetamide MEA as one of the active ingredients for moisturizing effects, with a view to catering to both sensitive and the male population.

The adoption of Acetamide MEA in cosmeceuticals, with its anti-aging, anti-inflammatory, and protective skin attributes, has been a further multiplier for growth in ensuring better performance and efficacy for premium skincare formulations. Alternatives to Acetamide MEA that are sustainable, biodegradable, plant-based, and environmentally friendly have encouraged the market, as they need to be in line with global sustainability initiatives.

While the personal care segment of the Glycerine market has its advantages, including good hydration, mild taste, and effective formulation versatility, it faces challenges in the form of strict regulations over the use of certain cosmetic ingredients, alternative humectants, and fluctuating raw materials costs.

Yet newer trends such as biotech based Acetamide MEA synthesis, Green chemistry formulations for beauty, AI led future of Cosmetic Products are providing Enhanced efficiency, Sustainable processes, and Improved consumer attraction in personal care applications, which will constantly drive Acetamide MEA market up.

Industrial applications continue to be an important market segment, especially for textile processing, lubricants, and chemical formulations. Acetamide MEA, in contrast to conventional surfactants, provides increased water solubility, anti-static factor, and superior emulsification, positioning itself as a very essential surfactant manufacturer in different industries.

The growing usage of high-performance emulsifiers, anti-corrosion agents, and conditioning additives, to name a few, in the industrial fields have augmented the demand owing to their non-negotiable nature of relevance in manufacturing and processing industries. According to studies, around 50% of Acetamide MEA used in industrial applications is used for surfactant-based applications which helps in maintaining strong demand for this segment.

This has created a favourable demand dynamic, with the market expanding to include industrial-grade Acetamide MEA solutions that demonstrate increased chemical stability, low volatility, and high-temperature tolerance, all of which contribute to optimized efficiency across various industrial use cases.

With the growing integration of Acetamide MEA in the formulations of green chemistry, which contains industrial cleaning solutions that are biodegradable and non-toxic, its adoption has further driven growth across industrial segments, to locate sustainability and regulatory requirements.

The formulations of Acetamide MEA-based lubricants possessing such improved thermal stability and anti-wear properties are aiding the growth in the Acetamide MEA market owing to their better execution in the machinery and automotive applications.

The industrial applications segment is said to provide a variety of benefits, such as solubility, emulsification, and adaptability to many different industrial processes, however faces deterrents such as fluctuating prices, competition from synthetic alternatives and environmental concerns regarding the use of chemicals.

However, emerging innovations, including bio-based Acetamide MEA manufacturing, nanotech-based industrial surfactants, and improved formulations are improving functionality, affordability, and sustainable play, acting as a catalyst for wider usage of industrial-grade Acetamide MEA applications across the world.

Acetamide MEA (Monoethanolamide) market dynamics majorly include the increasing demand for mild and moisturizing ingredients in cosmetics, personal care, and pharmaceutical formulations. Some other key transformation areas are sustainable and bio-based ingredient sourcing, multifunctional formulations, and enhanced skin-conditioning properties.

Developing high-purity Acetamide MEA by manufacturers, to cater to shampoo, conditioner, and skincare application as well as in non-cosmetic industrial formulation seeking highly moisture retaining and emollient properties.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 15-20% |

| Clariant AG | 12-16% |

| Lubrizol Corporation | 10-14% |

| Evonik Industries | 8-12% |

| Croda International Plc | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops Acetamide MEA for high-performance personal care products, focusing on skin-friendly and biodegradable formulations. |

| Clariant AG | Specializes in mild surfactant blends with Acetamide MEA, ensuring superior hydration and conditioning effects in hair and skincare applications. |

| Lubrizol Corporation | Offers multifunctional Acetamide MEA-based formulations, enhancing texture and moisture retention in cosmetic formulations. |

| Evonik Industries | Focuses on sustainable and high-purity Acetamide MEA, catering to premium skincare and dermatological applications. |

| Croda International Plc | Provides eco-friendly Acetamide MEA solutions with enhanced emulsification and conditioning properties for haircare and skincare products. |

Key Company Insights

BASF SE (15-20%)

BASF: One of the key participants in Acetamide MEA market, BASF offers innovative, refined formulations for haircare, skincare and pharmaceutical applications.

Clariant AG (12-16%)

Acetamide MEA-based conditioning agents by Clariant emphasize products with mild surfactants, formulations with moisture retaining properties, and sustainable initiatives.

Lubrizol Corporation (10-14%)

Lubrizol includes texture-modifying Acetamide MEA solutions to enhance the sensory and functionality properties in personal care.

Evonik Industries (8-12%)

Acetamide MEA finds its application in high-end skincare formulations at Evonik, which maintains a focus on eco-friendly and dermatologically tested solutions.

Croda International Plc (5-9%)

Croda offers Acetamide MEA options that are plant derived and sustainable, which promote moisture retention that can be leveraged in hair and skin formulations.

Other Players (40-50% Combined)

The Acetamide MEA market is heavily populated with players who offer customized and industry-specific formulations. These include:

The Acetamide MEA Market was valued at approximately USD 58.6 billion in 2025.

The market is projected to reach USD 72.8 billion by 2035, growing at a compound annual growth rate (CAGR) of 2.2% from 2025 to 2035.

The demand for Acetamide MEA Market is expected to be driven by its increasing use in the personal care industry as a conditioning agent in shampoos, lotions, and skincare products; its role as a surfactant in cosmetic formulations; and its expanding applications in industrial sectors such as textiles and coatings.

The top 5 countries contributing to the Acetamide MEA Market are the United States, China, India, Germany, and Japan.

The Personal Care and Industrial Applications segment is expected to lead the Acetamide MEA market, driven by the rising demand for mild and effective conditioning agents in personal care products and the growing use of Acetamide MEA in industrial formulations.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.