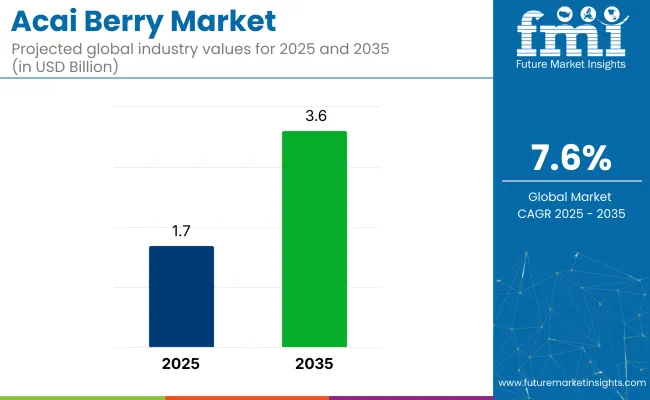

The acai berry market is forecasted to expand significantly, reaching USD 3.6 billion by 2035 from USD 1.7 billion in 2025, reflecting a growth rate of 7.6% annually. The industry is experiencing strong growth, driven by the increasing popularity of acai-based products in food & beverages and dietary supplements.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 3.6 billion |

| CAGR (2025 to 2035) | 7.6% |

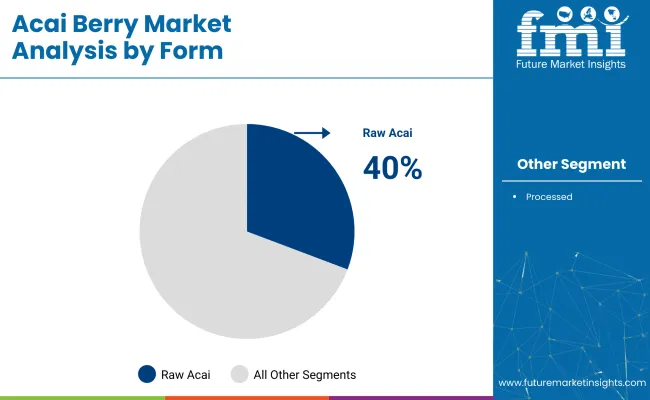

Raw acai remains the preferred form due to its natural health benefits and versatility in various food and beverage applications. The rise in health-conscious consumers and the growing trend for organic and non-GMO products are further supporting industry expansion.

In a 2024 interview with The Australian, Renan Fretes Pinto, CEO of Oakberry, emphasized the brand's commitment to becoming a leader in the acai industry, stating, “We want to position ourselves as the reference point - when you think of acai, you think of Oakberry.” Oakberry's rapid expansion plans in Australia reflect the growing demand for high-quality, organic acai products, aiming to open 200 stores within five years.

The industry holds a small but notable share within its parent markets. Within the superfoods market, acai berries account for approximately 3-5%, driven by their popularity in health-focused diets. In the functional foods and beverages market, acai holds about 2-3%, as it is often used in smoothies, juices, and energy drinks for its nutritional benefits.

In the organic food market, acai’s share is higher, contributing around 5-7%, due to its positioning as a natural, antioxidant-rich food product. Within the nutraceuticals market, acai berries make up approximately 1-2%, primarily through supplements and health products. In the frozen foods market, acai-based products like bowls and purees account for around 4-6%, as demand grows for convenient, nutritious frozen options.

The industry's growth is fueled by rising awareness of Acai's health benefits, including its antioxidant properties and ability to improve overall well-being. As demand for organic, non-GMO, and vegan products increases, Acai’s prominence in food, beverages, and health supplements will continue to grow.

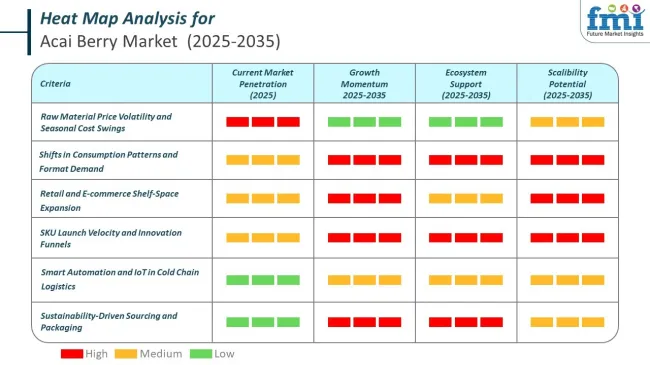

The centre of global açaí supply is still Pará and Amapá, but field operations are no longer entirely machete-and-canoe. Vision drones and low-orbit imagery are now guiding harvest crews toward the ripest palm clusters, trimming labour time and food waste. According to the Brazilian Institute for Geography and Statistics, frontier co-operatives using yield-prediction algorithms cut uncollected fruit by nearly 12 % last season.

Flash-freezing and freeze-drying once relied on operator “feel.” Now, sensor loops and digital twins stabilise output quality round the clock. According to the Federal University of Pará, AI-driven dryer controls lifted powder yield by two percentage points while shaving energy use by eight percent.

The technology playbooks vary, yet a clear pattern links the largest labels.

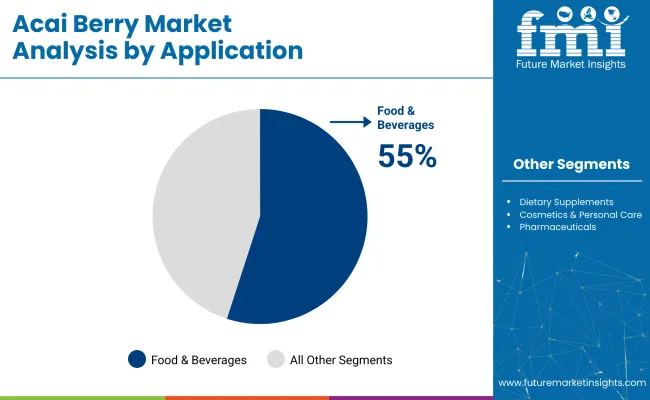

The industry’s growth is driven by raw acai (40% share) and food & beverages (55% share). Organic claims play a major role in product positioning, contributing to the industry's expansion, especially in health-conscious regions.

Raw Acai is expected to dominate the industry, holding 40% of the industry share in 2025. Known for its exceptional health benefits, raw acai remains the preferred choice for health-conscious consumers seeking natural, nutrient-dense options. Its versatility in various forms, including smoothies, juices, and desserts, contributes to its industry dominance.

Raw acai is often promoted as the most authentic form, retaining the full spectrum of antioxidants and nutrients, which appeals to both consumers and food manufacturers. As the global demand for natural and organic ingredients grows, raw acai is likely to remain the dominant segment.

The food & beverages industry is set to lead the industry with 55% of the industry share in 2025. As consumers become more health-conscious, acai is increasingly used in products such as smoothies, juices, energy bars, and snacks.

The growing trend for plant-based, organic, and superfoods is boosting the use of acai in the food and beverage sector. Manufacturers are adding acai to a variety of products to cater to the rising demand for nutrient-rich, functional foods. As the industry for healthy, on-the-go food options expands, acai’s role in the sector will continue to grow, especially in health-focused industries like North America and Europe.

The organic segment is projected to capture 40% of the industry share in 2025. With growing consumer demand for products free from chemicals, pesticides, and genetically modified organisms (GMOs), organic acai is seen as the healthier option. The industrie for organic acai is expanding, particularly as consumers prioritize naturaly sourced ingredients.

Companies are increasingly advertising acai products as organic, aligning with global trends, healthier eating habits, and transparency in food production. As more consumers seek products that align with their values of health, organic acai will continue to play a key role in the industry’s growth.

Demand for ready-to-eat products like acai bowls, smoothies, and juices is growing, driven by convenience. There is increasing demand for sustainably sourced and ethically produced acai products among eco-conscious consumers. However, supply chain limitations and price volatility could pose challenges to growth.

Growing Demand for Nutrient-Dense Superfoods and Health-Conscious Products

The industry is experiencing robust growth as health-conscious eating becomes a central trend. Acai, recognized for its rich antioxidant profile and multiple health advantages, has solidified its position as a top-tier superfood. With increasing consumer demand for nutrient-rich ingredients, acai is now a go-to addition to smoothies, juices, and snack products, thanks to its energy-boosting, skin-rejuvenating, and metabolism-boosting properties.

As more individuals embrace plant-based and organic diets, the demand for natural, clean-label products like acai continues to surge. This growing preference for health-boosting ingredients ensures the continued expansion of the functional foods industry, where acai remains a popular choice.

Supply Chain Challenges and Price Instability

Despite the surge in demand, the industry grapples with significant challenges linked to supply chain inefficiencies and price fluctuations. Acai berries are primarily sourced from the Amazon rainforest, where environmental factors like weather conditions and crop yields can significantly impact availability and cost.

Furthermore, logistical issues-such as transportation delays and inadequate storage infrastructure-exacerbate the industry's price instability. The heightened demand for organicly sourced acai products adds additional pressure to supply chains, potentially driving up production costs and limiting scalability. These challenges are likely to prevent price stability and hinder broader industry expansion.

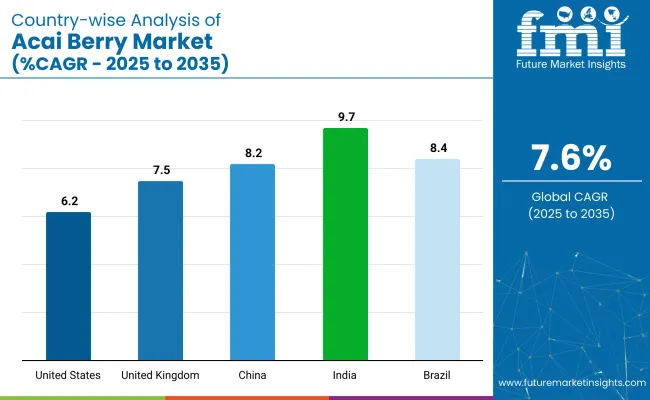

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

| United Kingdom | 7.5% |

| China | 8.2% |

| India | 9.7% |

| Brazil | 8.4% |

The global acai berry industry is projected to grow at a CAGR of 7.6% from 2025 to 2035. In the OECD region, the United States shows steady growth with a CAGR of 6.2%, driven by rising consumer demand for healthy, antioxidant-rich superfoods and greater awareness of the health benefits of acai berries. The United Kingdom follows with a CAGR of 7.5%, benefiting from the clean eating trend and the growing popularity of functional foods, including acai berries, among health-conscious consumers.

ASEAN is seeing strong growth, with India leading at the highest CAGR of 9.7%, fueled by growing interest in plant-based diets and expanding middle-class purchasing power. China, part of BRICS, demonstrates rapid expansion at 8.2%, driven by increasing health awareness and rising demand for trendy superfoods like acai berries. Brazil, the native home of acai berries, experiences steady growth at 8.4%, benefiting from the increasing global demand for acai products and its key role in supplying the international market.

India and China stand out as the fastest-growing markets, signaling a shift toward BRICS and ASEAN countries as key players in shaping the future of the industry. The report covers an in-depth analysis of 40+ countries, focusing on the top-performing OECD, ASEAN, and BRICS nations. The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The United States is projected to grow at a CAGR of 6.2% in the industry. As the demand for superfoods rises, Acai is becoming increasingly popular in the USA, driven by its perceived health benefits. The strong presence of health-conscious consumers and the growing interest in functional foods have contributed to the rapid adoption of Acai in beverages, smoothies, and dietary supplements. The USA industry is also supported by the expansion of e-commerce platforms and the growing availability of Acai-based products in mainstream retail stores, further fueling industry growth.

The United Kingdom is expected to grow at a CAGR of 7.5% in the industry. Increasing awareness of superfoods and the growing demand for organic ingredients in food products are key factors contributing to Acai’s rising popularity in the UK

As the demand for healthy and functional foods continues to rise, Acai is being used in a variety of applications, including smoothies, juices, and energy bars. The growing trend of plant-based diets in the UK further supports the industry growth, as more consumers are looking for nutrient-rich, natural alternatives to traditional snacks and beverages.

China is expected to experience a CAGR of 8.2% in the industry. Increasing consumer awareness about the health benefits of superfoods are major drivers of this growth. Acai is being increasingly incorporated into beverages, health supplements, and plant-based snacks.

As the demand for health-conscious and organic products grows in China, Acai is becoming more popular, especially in urban centers like Beijing and Shanghai. The growing e-commerce sector and expanding retail distribution will further drive the availability and consumption of Acai-based products in China.

India is projected to grow at the fastest pace in the industry, with a CAGR of 9.7%. Rising awareness about superfoods and increasing adoption of healthy eating habits among the younger population are driving demand for Acai in India.

More consumers are turning to plant-based, nutrient-rich products, and Acai fits perfectly into this growing demand. The rise of e-commerce platforms in India is enhancing accessibility to Acai products. The health benefits of Acai, including improved immunity and antioxidant properties, are expected to continue fueling its growth in India.

Brazil is expected to experience a CAGR of 8.4% in the industry. As one of the largest producers of Acai, Brazil’s domestic industry is thriving due to both local consumption and export opportunities. Increasing awareness of the health benefits of Acai, along with a rising demand for natural and organic ingredients, is driving the industry's growth.

With a strong local production base and growing export demand, Acai is becoming a major component in Brazil’s food and beverage industry. The rise of health-conscious consumers is contributing to the increasing consumption of Acai-based products, particularly in urban areas.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as The Berry Company Limited, Amafruits, and NacttiveGlobalA lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across food, beverage, nutraceutical, and cosmetic sectors.

Key players including Terrasoul Superfoods, Acai of America Inc., and Ecuadorian Rainforest, LLC offer specialized formulations tailored to specific applications and regional industries. Emerging players, such as Navitas Organics, KOS BareOrganics®, and PITAYA FOODS, focus on innovative extraction technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Estimated Industry Size (2025E) | USD 1.7 billion |

| Projected Industry Value (2035F) | USD 3.6 billion |

| Value-based CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and tons or liters for volume |

| Form Segmentation | Raw, Processed (Frozen, Powder, Juice, Pulp and Purees) |

| Application Segmentation | Food & Beverages (Bakery, Confectionery, Infant Formula, Snacks, Desserts, Juices and Nectars, Squash and Smoothies), Dietary Supplements, Cosmetics & Personal Care, Pharmaceuticals |

| Claims Segmentation | Organic, Non-GMO, Gluten-Free, Dairy-Free, Nut-Free |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | The Berry Company Limited, Amafruits, NacttiveGlobalA, Terrasoul Superfoods, Acai of America Inc., Ecuadorian Rainforest, LLC, Navitas Organics, KOS BareOrganics®, PITAYA FOODS, Mountain Rose Herbs, Acai Roots, Inc., Acai Frooty, Acai Exotic LLC, Açaí Express, Sunfood Superfoods, Naked Juice Company, New Acai Amazonas, Nativo Aca, The Açaí Lab, Organique Acai |

| Additional Attributes | Dollar sales by form, application, and claims, increasing consumer preference for organic and non-GMO acai berry products, growing demand for acai-based beverages and dietary supplements, regional trends in acai berry cultivation and import/export dynamics, technological innovations in acai berry processing. |

As per Form, the industry has been categorized Raw and Processed (Frozen, Powder, Juice and Pulp and Purees)

As per the Application, the industry is Food & Beverages (Bakery, Confectionery, Infant formula, Snacks, Desserts, Juices and Nectars, Squash and Smoothies) Dietary Supplements, Cosmetics & Personal Care and Pharmaceuticals

Organic, Non-GMO, Gluten-Free, Dairy free Nut free are key claims selling the products

Industry analysis has been carried out in key countries of the regions such as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global industry size is estimated to be USD 1.7 billion in 2025 and USD 3.6 billion by 2035.

The expected CAGR is 7.6% from 2025 to 2035.

The Berry Company Limited is the leading company in the industry, holding a 10% industry share.

India has the highest CAGR in the industry at 9.7%.

The projected CAGR for the United States is 6.2% from 2025 to 2035.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA