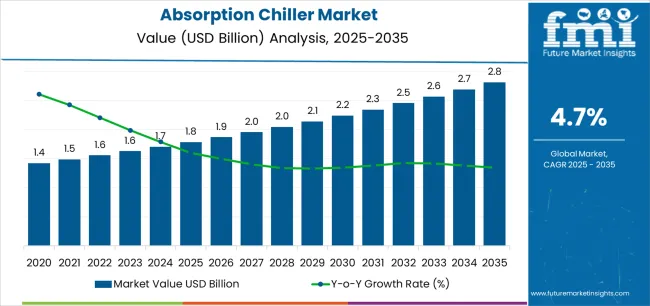

The Absorption Chiller Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The Absorption Chiller market is witnessing significant growth driven by the increasing demand for energy-efficient and environmentally friendly cooling solutions across industrial, commercial, and institutional sectors. The future outlook for this market is shaped by the rising focus on reducing greenhouse gas emissions and optimizing energy consumption in HVAC systems. Adoption of alternative power sources and advanced cooling technologies is fueling the transition from conventional compression chillers to absorption-based systems.

Increasing investments in sustainable infrastructure, coupled with government incentives promoting clean energy and efficient cooling solutions, are further supporting market expansion. Technological advancements, including the integration of smart control systems and enhanced heat exchange efficiency, are enabling absorption chillers to deliver reliable and cost-effective performance.

Additionally, the growing emphasis on renewable energy utilization and combined heating, cooling, and power systems has created opportunities for market players to develop innovative solutions As industries and commercial establishments prioritize energy conservation and operational efficiency, the absorption chiller market is expected to maintain steady growth in both developed and emerging regions.

| Metric | Value |

|---|---|

| Absorption Chiller Market Estimated Value in (2025 E) | USD 1.8 billion |

| Absorption Chiller Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

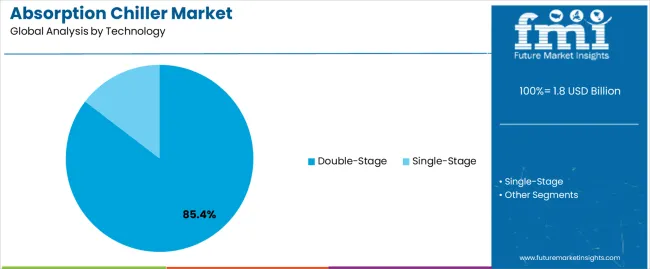

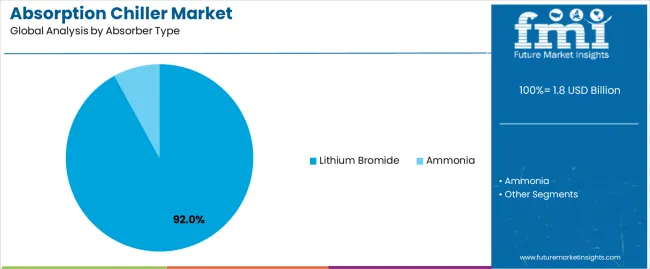

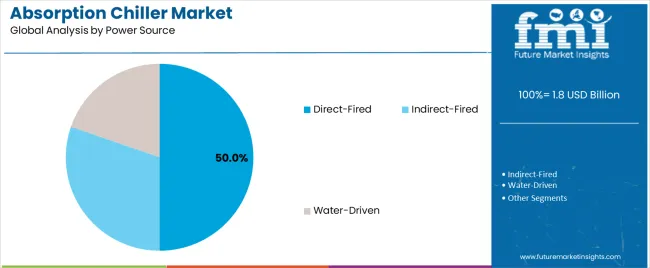

The market is segmented by Technology, Absorber Type, Power Source, and Application and region. By Technology, the market is divided into Double-Stage and Single-Stage. In terms of Absorber Type, the market is classified into Lithium Bromide and Ammonia. Based on Power Source, the market is segmented into Direct-Fired, Indirect-Fired, and Water-Driven. By Application, the market is divided into Non-Industrial, Commercial, Residential, Industrial, Petroleum, Food And Beverages, Power, Chemicals, Pulp And Paper, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The double-stage technology segment is projected to hold 85.4% of the absorption chiller market revenue share in 2025, making it the leading technology type. This dominance is driven by the superior efficiency and cooling capacity offered by double-stage systems compared to single-stage alternatives.

The segment has benefited from advancements in system design and material optimization, which improve thermal performance and reduce energy consumption. High demand for large-scale industrial and commercial cooling applications has reinforced the adoption of double-stage absorption chillers.

Furthermore, their ability to integrate with various power sources and heat recovery systems enhances operational flexibility, making them attractive for energy-conscious end-users The widespread implementation of energy efficiency regulations and sustainability initiatives continues to support the growth of this segment.

The lithium bromide absorber type segment is expected to account for 92.0% of the absorption chiller market revenue share in 2025, positioning it as the dominant absorber type. This growth is driven by lithium bromide’s high absorption efficiency, thermal stability, and compatibility with water as a refrigerant, which enables consistent and reliable cooling performance.

The segment has gained traction in large commercial and industrial facilities due to its scalability and ability to meet high-capacity cooling demands. Additionally, continuous improvements in corrosion resistance and system maintenance practices have strengthened adoption.

The growing focus on environmentally sustainable refrigerants and energy-saving solutions further accelerates the uptake of lithium bromide-based absorption chillers, ensuring their leading position in the market.

The direct-fired power source segment is anticipated to hold 50.0% of the absorption chiller market revenue share in 2025, making it a significant contributor to overall growth. This segment has been driven by its ability to utilize readily available heat sources such as natural gas, steam, or waste heat from industrial processes, enabling cost-effective and reliable cooling.

The adoption of direct-fired systems has been accelerated by the need for flexible and decentralized cooling solutions in commercial and industrial applications. Enhanced integration with energy management systems and the ability to operate in tandem with other sustainable technologies have further supported the segment’s growth.

As energy efficiency and operational cost reduction remain critical priorities for end-users, the direct-fired power source segment continues to play a central role in the expansion of the absorption chiller market.

The table below exhibits a comparative assessment of the variation in the anticipated CAGR for the absorption chiller industry over the semi-annual periods spanning from the base year (2025) to the current year (2025). The examination of the compound annual growth rate presents the shifts in the performance and divulges its revenue realization patterns.

The examination assists organizations in gaining a better understanding of the industry and its growth trajectory over the period. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December. In the first half (H1) of 2025 to 2035, it is estimated to surge at a CAGR of 4.1% followed by a spike in the growth rate during the second half (H2) taking the CAGR to 5.3%.

| Particular | Value CAGR |

|---|---|

| H1 | 4.1% (2025 to 2035) |

| H2 | 5.3% (2025 to 2035) |

| H1 | 4.2% (2025 to 2035) |

| H2 | 5.6% (2025 to 2035) |

Progressing in the following period, from H1 2025 to H2 2035, the CAGR is likely to dip to 4.2% in the first half (H1) and then surge to 5.6% in the second half (H2). In the first half (H1), the industry is anticipated to experience a decrease of 10 BPS while in the second half (H2), it is estimated to witness an increase of 30 BPS.

Increasing Adoption of Solar-powered Absorption Chillers to Create Growth Opportunities

The increasing adoption of solar-powered absorption refrigerating machines across various end-use industries is a significant growth driver for the absorption chiller market. Solar-powered absorption cooling systems utilize solar thermal energy to provide efficient cooling, aligning with the global push toward renewable energy and sustainability.

The high adoption is particularly notable in commercial buildings as well as manufacturing and healthcare sectors where there is a rising demand for energy-efficient and environmentally friendly cooling solutions. The use of solar energy reduces operational costs and dependency on traditional power sources, making these chillers an attractive option for companies looking to lower their carbon footprint.

For instance, the installation of solar-powered absorption chillers by Johnson Controls at the newly constructed Greenfield Industrial Park in California is a part of the park's commitment to sustainable development and energy efficiency. Johnson Controls, a leading provider of smart building technologies, supplied these chillers to TechCore Inc., a prominent industrial developer.

The project demonstrates how companies are turning to solar-powered absorption cooling systems to meet their cooling needs while adhering to environmental regulations and reducing energy costs. This development underscores the growing potential and innovation in the industry.

Surging Focus on Decarbonization Accelerating Adoption of Unique Chillers

The push toward decarbonization in the food and beverage industry is catalyzing a significant shift toward advanced absorption refrigerating machines. Traditionally driven by high-energy demand and reliance on combustion fuel-powered systems, this industry presently faces mounting pressure to reduce its carbon footprint.

Absorption cooling systems offer a compelling solution by harnessing waste heat, a prevalent byproduct in food processing, to generate cooling without the use of high-GWP refrigerants like ammonia. These innovative chillers can achieve temperatures as low as 23°F using a water-lithium bromide refrigerant cycle, surpassing conventional systems in efficiency and safety.

The integration of absorption refrigeration units with combined heat and power (CHP) systems enables the simultaneous production of chilled water and electricity, maximizing energy utilization and cost savings.

By leveraging waste heat sources as low as 70°F, these chillers optimize operational efficiency and contribute significantly to industrial decarbonization efforts outlined in the United States Department of Energy’s (DoE) roadmap. As regulatory pressure and consumer demand for green practices intensifies, the adoption of unique absorption chillers is poised to accelerate, driving growth and innovation.

Manufacturers are Providing Consulting Services for Product Maintenance and Operation

Absorption refrigerating machines require high maintenance in comparison to electric chillers. For instance, in lithium bromide-based absorption cooling systems, it is necessary to prevent the crystallization of refrigerants to ensure the efficient working of the system.

Few players in the global absorption refrigeration unit segment are providing operation and maintenance consulting services. They are hence creating a substantial opportunity for manufacturers to gain consumer loyalty while increasing their share.

For instance, Trane provides extensive aftermarket support, wherein service personnel ensure that the designated unit operator thoroughly understands absorption system operation, unit capabilities, and limitations. Factory-trained absorption service personnel are located throughout the country to support Trane chillers and perform periodic routine maintenance programs, as well as troubleshoot equipment if necessary.

Continuous Improvements in Electric Chiller Technology May Restrict Growth

The industry faces significant challenges owing to the continuous improvements in electric chiller technology. Electric chillers have become increasingly efficient and cost-effective, making these strong competitors of absorption refrigerating machines.

Recent innovations in electric chillers, such as variable-speed drives and smart controls, have significantly enhanced their performance and energy efficiency. These technological developments enable electric chillers to operate efficiently under varying load conditions.

They also assist in reducing energy consumption and operating costs. This makes them an attractive option for several industries, adversely affecting the share of absorption cooling systems.

A recent example of one such advancement is the launch of the MECH-iF Air Cooled Chiller by Mitsubishi Electric. The MECH-iF chiller range offers capacities from 345kW to 921kW and is available with R1234ze (G04) or R513A (G05) refrigerant and brand-new proprietary screw variable speed compressors.

The global absorption chiller market size was USD 1.4 billion in 2020. It grew at a CAGR of 2.1% from 2020 to 2025 and was valued at USD 1.8 billion in 2025.

The industry, before the COVID-19 pandemic, was experiencing steady growth driven by increasing industrialization, especially in emerging economies. Absorption refrigeration units, known for their ability to utilize waste heat and reduce electricity consumption, became popular in commercial buildings, industrial facilities, and district cooling systems during the historical period.

Technological innovations, coupled with stringent environmental regulations promoted the use of eco-friendly cooling technologies, contributing to expansion. Industries such as food and beverage, petrochemicals, and pharmaceuticals require precise temperature control and therefore were the significant consumers of absorption refrigerating machines, which fostered growth.

The COVID-19 outbreak imposed lockdown measures and restrictions in prominent regions like Asia Pacific and Europe. This LED to massive disruptions in manufacturing and sales, dampening the growth rate. Despite these challenges, sectors such as healthcare and pharmaceuticals experienced an increased demand for absorption chillers to maintain critical environments, thereby partially offsetting the overall negative impact of the pandemic.

The absorption chiller market is set to reach a value of USD 1.8 billion in 2025. It is predicted to surge at a CAGR of 4.9% in the assessment period to reach a size of USD 2.8 billion by 2035.

The industry showed signs of recovery and growth in the post-pandemic period. This rebound can be attributed to factors, including the resumption of industrial activities. Increasing focus on energy efficiency and sustainability is prompting industries to invest in green technologies. Government initiatives and incentives for energy-efficient solutions have further boosted growth.

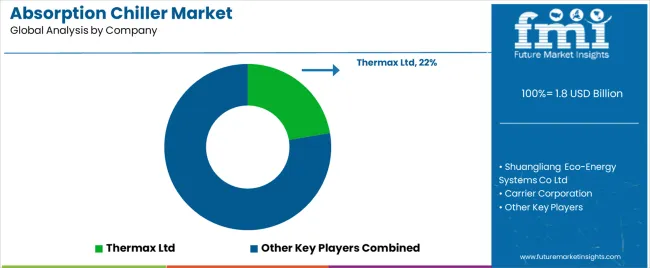

Tier 1 companies comprise organizations with a revenue of above USD 30 million. They capture a significant share ranging from 30% to 45% globally. These companies are characterized by high production capacity and an extensive product portfolio.

Businesses in Tier 1 are distinguished by their expertise in manufacturing and a broad geographical reach, which is underpinned by a robust consumer base. They provide a wide range of services and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Shuangliang Eco-Energy Systems Co. Ltd., Thermax Ltd, LG Electronics, Carrier Corporation, Kawasaki Thermal Engineering Co., Ltd., Kirloskar Pneumatic Company Ltd., and Johnson Controls Hitachi Ltd.

Tier 2 includes most of the mid-sized companies operating at the local level. These enterprises serve niche sectors and have a revenue below USD 30 million. Businesses in Tier 2 are notably oriented toward fulfilling the demands of the local sector.

Tier 3 consists of small-sized players that have a limited geographical reach. Firms in this segment are considered unorganized, denoting a sector characterized by a lack of extensive structure and formalization compared to organized competitors.

The section provides businesses with an overview of the industry on a country-by-country basis. It consists of a detailed examination of the potential trends and opportunities. This examination consists of key factors, potential challenges, and forecasts impacting the demand, production, and consumption of the product within each country. It aims to assist organizations make informed decisions and develop effective strategies customized for individual countries.

Brazil is set to emerge as a dominating country during the assessment period with an estimated CAGR of 6.3%. India, China, and Canada are projected to follow behind to become the leading countries with projected CAGRs of 5.4%, 4.6%, and 4.2% respectively.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Brazil | 6.3% |

| India | 5.4% |

| China | 4.6% |

| Canada | 4.2% |

| Japan | 4% |

Growth of the absorption chiller market in India is being driven by the country’s increasing focus on energy efficiency along with the need to reduce carbon emissions. They are an attractive option for industries and commercial buildings aiming to minimize their environmental impact. Government programs, such as the India Cooling Action Plan, the Kigali Amendment, and the Montreal Protocol have facilitated development in the country.

The increasing need for air conditioning in commercial and industrial settings has also boosted sales as absorption cooling systems provide a dependable and environmentally responsible cooling option. Mahan Energen Limited's anticipated 1600 MW ultra-supercritical power plant expansion, as well as Haldia Petrochemicals' USD 10 billion oil-to-chemicals project, is set to lead to an increasing usage of absorption refrigeration units that are important for regulating process cooling and ensuring proper temperatures.

The development of new industrial settings, such as Rallis India Limited's water-soluble fertilizer plant, demonstrates the trend of incorporating modern cooling systems to improve operating efficiency. These developments, coupled with a continued emphasis on sustainability and energy conservation, are set to drive growth in India at a CAGR of 5.4% to reach USD 2.8 million by 2035.

Leading companies like Thermax USA have provided absorption cooling solutions to reputed organizations like NASA, Lockheed Martin, IBM, and different educational institutions. This helps in demonstrating the system's dependability and effectiveness in both commercial and governmental applications. Future growth in the country is likely to be driven by increasing investments in new power plants, data centers, and manufacturing plants.

Projects such as the Natrium Advanced Reactor Demonstration in Wyoming and AWS's USD 11 billion data center complex in Indiana are set to create a significant need for absorption cooling systems that can handle cooling demands efficiently. Google's USD 2 billion data center project and PPG's USD 300 million investment in innovative manufacturing procedures are further projected to increase the demand for efficient cooling systems.

The aforementioned developments, coupled with the ongoing emphasis on sustainability and energy efficiency, are anticipated to propel the absorption chiller market in the United States. The country is projected to reach a value of around USD 340.4 million by 2035, exhibiting a CAGR of 3.6% in the assessment period.

Growth of the absorption chiller market in China has been historically driven by the country's rapid industrialization, which resulted in high energy usage. The country has greatly benefited from the extensive use of absorption refrigerating machines in several sectors, such as commercial buildings, industrial plants, and district cooling systems. China's leading position in the global manufacturing sector and its significant investments in infrastructure projects have further propelled demand for these cooling solutions.

Growth in the country is particularly attributed to substantial investments in new power plants, chemical plants, and other industrial set-ups. Prominent projects like Shin-Etsu Chemical's new silicon products plant in Zhejiang Province, ZEISS Group's new research and development and manufacturing site in Suzhou, and DOMO Chemicals' TECHNYL® polyamide production plant in Jiaxing will likely require efficient cooling solutions to maintain optimal temperatures.

China's leadership in refining capacity in addition to projects like Yulong and Jieyang, are anticipated to further boost demand for absorption cooling systems. These developments, coupled with China’s continued emphasis on industrial expansion and sustainability, are likely to drive growth. The country is projected to account for around 70.5% of the share in East Asia by 2025.

The section offers enterprises insightful data and analysis of the two leading segments. Segmentation of these categories assists organizations to gain a better understanding of the dynamics and invest in the beneficial zones.

In terms of technology, the double-stage segment is anticipated to lead with a value share of 85.4% in 2035. Lithium bromide is projected to dominate in terms of absorber type with a value share of 92.5% in the same year.

| Segment | Double-stage (Technology) |

|---|---|

| Value Share (2035) | 85.4% |

Double-stage absorption chillers are set to lead the technology segment with a value share of 84.4% in 2025. This growth is attributed to their superior efficiency and performance compared to single-staged chillers. These absorption refrigerating machines employ a two-step method to extract heat from the chilling medium and consume less energy in the process. This helps them to function at greater efficiency levels.

Double-stage absorption cooling systems are considered ideal for large-scale commercial and industrial applications where cost and energy-saving measures are essential. These chillers are recommended for establishments with substantial and continuous cooling demands, such as data centers, hospitals, and sizable industrial plants. These fields have a high demand to manage advanced cooling loads and maintain stable temperatures, which can be easily attained through double-staged chillers.

The double-stage segment is projected to grow significantly over the forecast period with a CAGR of 5.1%. This momentum is primarily credited to the increasing demand for high-efficiency cooling solutions from end-users. Demand for dependable and efficient cooling systems is being driven by the rapid expansion of large-scale industrial manufacturing, chemical production, and power generation.

Increasing focus on cutting operational costs and carbon footprints encourages the use of double-staged absorption refrigeration units. These chillers offer better performance and are more cost-efficient compared to single-staged chillers. Their ability to increase energy efficiency and sustainability are prominent factors behind businesses adopting double-stage absorption chillers over single-stage.

| Segment | Lithium Bromide (Absorber Type) |

|---|---|

| Value Share (2035) | 92.5% |

Lithium bromide-based absorption refrigeration systems are highly efficient, making these ideal for large-scale central air conditioning applications. The high chemical reactivity of lithium bromide (LiBr) with water (as a refrigerant) helps the compound to absorb water with a very high affinity.

Water, in that respect, is subjected to flash boiling under vacuum conditions at temperatures invariably below freezing point as a way of cooling the evaporator or the chilled water coils. As water vapor collects and threatens to disturb the vacuum, lithium bromide absorbs it, preserving the vacuum conditions required for continuous operation. This procedure makes lithium bromide a key component for assuring the performance and dependability of absorption chillers.

The lithium bromide segment is projected to witness significant growth over the forecast period with a revenue of USD 2.8 billion. It is set to rise at a CAGR of 6% through 2035. The widespread adoption of lithium bromide-based absorption chillers is augmented by their high efficiency and reliability. Consumers are also creating an ever-growing demand for coolers that are free of harmful emissions yet economical in terms of power consumption.

Key players in the industry, including Thermax Ltd, Shuangliang Eco-Energy Systems Co Ltd., Carrier Corporation, Trane Inc., and Johnson Controls are actively enhancing their presence and competitiveness through different strategies. They are incorporating unique technologies like variable-speed compressors and intelligent controls in their products. At the same time, they are increasingly integrating renewable energy sources to improve energy efficiency and environmental sustainability.

Manufacturers are introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. They are heavily investing in research and development activities to innovate and improve their absorption chiller technologies. Their primary focus is on enhancing energy efficiency, developing advanced control systems, and optimizing heat transfer to cater to evolving consumer demands.

Innovations in technologies are set to give companies a competitive edge in the market. They are diversifying their product portfolios to stand out in the global market. They are also offering absorption chillers of varying capacities and configurations for multiple requirements.

Businesses are likely to target specific industries to cater to the specialized cooling requirements. Consumers prefer companies that can offer comprehensive solutions, including installation, maintenance, and consumer support services. Market reach and distribution networks also play a crucial role.

Companies with a well-established global presence can reach a wide consumer base. Maintaining consumer loyalty and trust is critical as customer relationships play a substantial role in shaping the competitive landscape of the industry.

Industry Updates

Based on technology, the industry is divided into single-stage and double-stage.

By absorber type, the industry is segmented into lithium bromide and ammonia.

Three key power sources include direct-fired, indirect-fired, and water-driven.

Two important applications include non-industrial and industrial. The non-industrial segment is further divided into commercial and residential. The industrial segment is classified into petroleum, food and beverages, power, chemicals, pulp and paper, and others.

Information about key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa is provided.

The global absorption chiller market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the absorption chiller market is projected to reach USD 2.8 billion by 2035.

The absorption chiller market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in absorption chiller market are double-stage and single-stage.

In terms of absorber type, lithium bromide segment to command 92.0% share in the absorption chiller market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Atomic Absorption Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Atomic Absorption Spectrometer Market Growth - Trends & Forecast 2025 to 2035

Xylose Absorption Tests Market

Automotive Energy Absorption (EA) Pads Market Size and Share Forecast Outlook 2025 to 2035

Blast Chillers Market Size and Share Forecast Outlook 2025 to 2035

Scroll Chiller Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Brewing Chiller Market Trend Analysis Based on Type, Application, End-User, and Region 2025 to 2035

Adsorption Chillers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chiller Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Draught Beer Chiller Market Size and Share Forecast Outlook 2025 to 2035

Instant Wine Chillers & Refreshers Market

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Countertop Blast Chiller Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Heaters and Chillers Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA