The Absorbent Cover industry is expanding rapidly as healthcare, industrial safety, and environmental protection drive demand. Manufacturers are integrating high-performance absorbent materials, smart moisture control technologies, and eco-friendly compositions to enhance efficiency and meet regulatory requirements.

Companies prioritize customization, automation, and sustainability to stay ahead. The industry is shifting toward biodegradable, ultra-absorbent, and antimicrobial covers that comply with hygiene and environmental standards. Businesses are also adopting smart absorbent covers with moisture detection to improve performance and reduce waste.

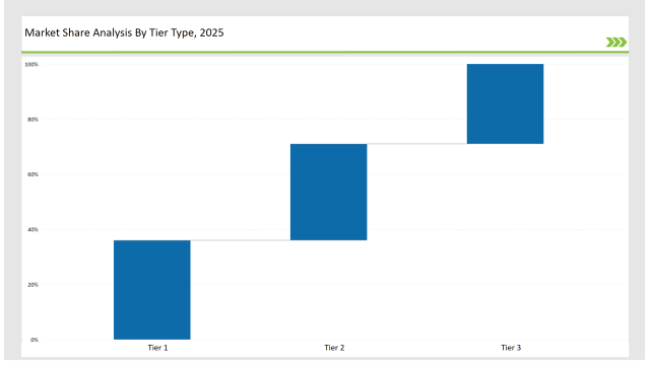

Leading players such as 3M, Kimberly-Clark, and Berry Global collectively hold 36% of the market share, leveraging their expertise in high-performance nonwoven materials and global distribution networks.

Tier 2 competitors like Ahlstrom-Munksjö, Henkel, and Texwipe account for 35% of the market share, focusing on cost-effective, durable, and advanced absorbent cover solutions for healthcare, industrial, and consumer applications.

Tier 3 consists of regional and niche players specializing in localized production, innovative material formulations, and compliance-driven designs, holding 29% of the market share. They lead in biodegradable fibers, high-absorbency coatings, and AI-driven production monitoring.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Kimberly-Clark, Berry Global) | 16% |

| Rest of Top 5 (Ahlstrom-Munksjö, Henkel) | 12% |

| Next 5 of Top 10 (Texwipe, Suominen, Glatfelter, Freudenberg, DuPont) | 8% |

The Absorbent Cover industry serves diverse sectors where hygiene, protection, and efficiency are critical. Companies integrate moisture resistance, antimicrobial technology, and sustainability to meet industry requirements. Manufacturers enhance durability by reinforcing materials with advanced fiber technology.

Manufacturers refine Absorbent Cover solutions with smart moisture control, antimicrobial protection, and ultra-absorbent fibers. They also implement automated production techniques to enhance customization, durability, and compliance. Companies integrate AI-driven defect detection to maintain high-quality standards.

The Absorbent Cover industry is evolving as companies adopt AI-driven quality control, sustainable fibers, and smart monitoring. Manufacturers enhance protection with antimicrobial coatings, spill-resistant designs, and cloud-based tracking. Firms develop high-performance moisture-locking layers to improve durability. Companies integrate biodegradable polymers to reduce waste. Businesses automate fiber blending techniques to optimize absorbency and efficiency. Companies refine moisture-wicking technology to improve absorption speed. Manufacturers implement AI-driven defect detection to enhance product quality.

Year-on-Year Leaders

Technology suppliers should focus on automation, AI-driven material innovation, and sustainable production to support the Absorbent Cover market's evolution. Strategic partnerships with healthcare, industrial, and environmental sectors will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Kimberly-Clark, Berry Global |

| Tier 2 | Ahlstrom-Munksjö, Henkel, Texwipe |

| Tier 3 | Suominen, Glatfelter, Freudenberg, DuPont |

Leading manufacturers advance Absorbent Cover technology with smart tracking, antimicrobial materials, and automation. They invest in AI-powered material blending, contamination-resistant layers, and enhanced durability. Companies improve absorbency efficiency by integrating rapid fluid-locking mechanisms. They enhance breathability in absorbent covers to maintain user comfort in medical and personal care applications.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched moisture-locking medical absorbent covers in March 2024. |

| Kimberly-Clark | Developed biodegradable and antimicrobial personal care covers in April 2024. |

| Berry Global | Expanded spill-resistant absorbent sheets for industrial use in May 2024. |

| Ahlstrom-Munksjö | Released eco-friendly medical absorbent layers in June 2024. |

| Henkel | Strengthened smart moisture control technology in July 2024. |

The Absorbent Cover industry continues to evolve as major players innovate with high-performance materials, automation, and sustainable production. Companies integrate AI-driven moisture detection, antimicrobial technologies, and biodegradable compositions to enhance performance and compliance. Here’s how key players are shaping the market:

The Absorbent Cover industry will continue adopting AI-powered production, smart moisture tracking, and sustainable materials. Companies will integrate real-time data analytics, automate absorption performance testing, and develop self-cleaning covers for enhanced hygiene and efficiency. Manufacturers will improve absorbent cover durability by integrating reinforced fibers. Firms will enhance antimicrobial properties to ensure higher hygiene standards in healthcare applications. Companies will optimize material composition to increase liquid retention and minimize waste. Businesses will expand research into biodegradable alternatives to further reduce environmental impact.

Leading players include 3M, Kimberly-Clark, Berry Global, and Ahlstrom-Munksjö.

The top 3 players collectively hold 16% of the global market.

The market shows medium concentration, with top players holding 36%.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.