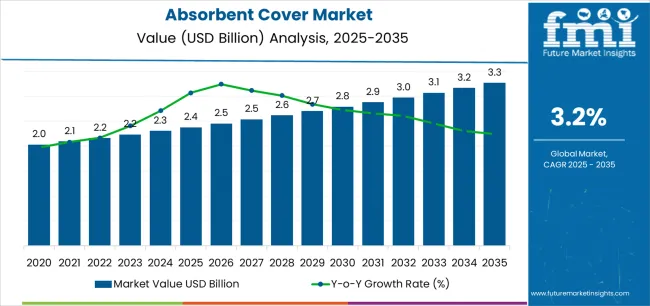

The Absorbent Cover Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The Absorbent Cover market is experiencing steady growth driven by the increasing demand for advanced hygiene products and patient care solutions. The future outlook for this market is shaped by rising awareness regarding health and personal hygiene, particularly in developed and emerging regions. Continuous innovation in materials and production technologies has enhanced the absorbency, comfort, and durability of covers, supporting their adoption across various applications.

The growing geriatric population, coupled with an increase in the prevalence of chronic health conditions, is driving demand in healthcare and personal care segments. Additionally, the focus on environmentally sustainable materials and compliance with safety and regulatory standards is encouraging manufacturers to develop next-generation absorbent covers.

Rising investments in healthcare infrastructure, coupled with the expanding diaper and incontinence care markets, further support the market’s expansion As consumer expectations shift towards higher comfort, performance, and convenience, the Absorbent Cover market is expected to witness sustained growth opportunities across both commercial and healthcare sectors.

| Metric | Value |

|---|---|

| Absorbent Cover Market Estimated Value in (2025 E) | USD 2.4 billion |

| Absorbent Cover Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

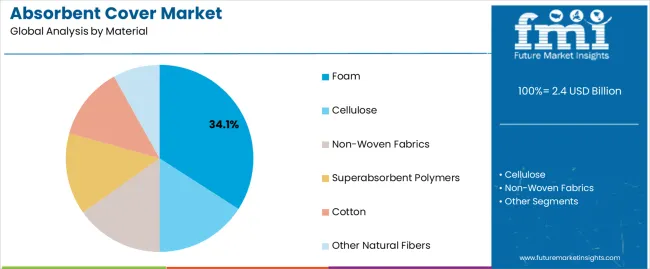

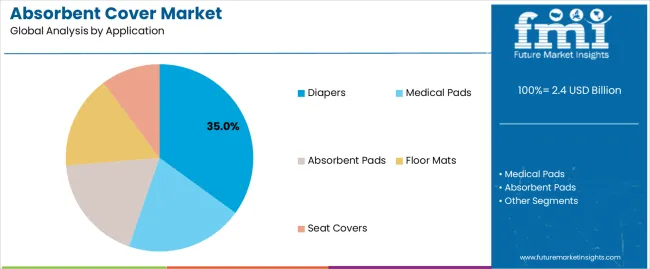

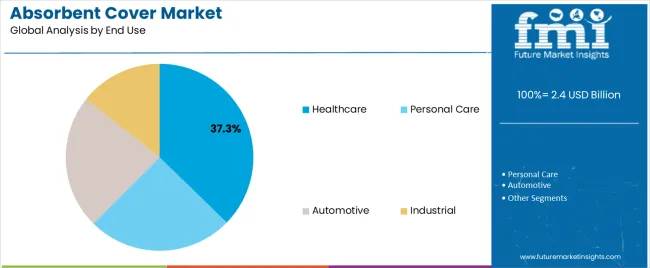

The market is segmented by Material, Application, and End Use and region. By Material, the market is divided into Foam, Cellulose, Non-Woven Fabrics, Superabsorbent Polymers, Cotton, and Other Natural Fibers. In terms of Application, the market is classified into Diapers, Medical Pads, Absorbent Pads, Floor Mats, and Seat Covers. Based on End Use, the market is segmented into Healthcare, Personal Care, Automotive, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The foam material segment is projected to hold 34.10% of the Absorbent Cover market revenue share in 2025, establishing it as a leading material type. This growth is driven by the high absorbency and cushioning properties of foam, which enhance comfort and efficiency in hygiene products. Foam covers provide superior leak protection and maintain structural integrity under extended use, making them highly suitable for diapers and other absorbent applications.

Additionally, innovations in foam processing have improved its adaptability and cost-effectiveness, further supporting market adoption. The segment benefits from increasing consumer preference for high-performance materials that combine comfort with functionality.

Furthermore, manufacturers’ investments in research and development have enabled the production of foam covers that meet stringent healthcare standards, reinforcing their use across medical and personal care products The combination of performance, comfort, and reliability continues to make foam the preferred choice in the Absorbent Cover market.

The diapers application segment is expected to account for 35.00% of the Absorbent Cover market revenue share in 2025, making it the leading application. Growth in this segment is influenced by rising demand for infant and adult diapers driven by population growth, urbanization, and increased awareness of hygiene. Advanced absorbent covers improve leak protection, comfort, and skin safety, which are critical factors for consumer acceptance.

Additionally, innovations in design and material technology have enhanced product performance, enabling better fit, flexibility, and moisture management. Increasing parental focus on infant care and the rising prevalence of incontinence among adults have further accelerated demand for high-quality diaper products.

The integration of sustainable and hypoallergenic materials also contributes to consumer preference for products in this segment Overall, the performance benefits and growing demand for hygienic solutions underpin the dominance of the diapers application in the Absorbent Cover market.

The healthcare end-use industry segment is anticipated to account for 37.30% of the Absorbent Cover market revenue in 2025, establishing it as the leading industry segment. This growth is driven by the increasing need for high-quality absorbent products in hospitals, nursing homes, and home healthcare settings. Absorbent covers are valued for their ability to provide comfort, prevent skin irritation, and maintain hygiene for patients with limited mobility or chronic conditions.

The rising geriatric population and the growing prevalence of incontinence and other medical conditions are driving adoption in this segment. Additionally, healthcare facilities are increasingly prioritizing patient safety, infection control, and operational efficiency, which has accelerated the use of advanced absorbent covers.

Innovations in material science and production techniques have enhanced performance, durability, and compliance with healthcare standards These factors collectively support the continued dominance of the healthcare end-use industry in the Absorbent Cover market.

The below table presents the expected CAGR for the global absorbent covers market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 3.7%, followed by a slightly lower growth rate of 3.3% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 | 3.7% (2025 to 2035) |

| H2 | 3.3% (2025 to 2035) |

| H1 | 3.2% (2025 to 2035) |

| H2 | 3.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 3.2% in the first half and remain relatively moderate at 3.7% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

Development of Covers Made of Organic Polymers are in Trend

Environmental sustainability concerns are estimated to be a driving force behind the popularity of organic absorptive coverings, especially those made of biodegradable polymers and bioplastics. Such eco-friendly substitutes are anticipated to be essential in metropolitan settings since these places struggle with waste management, pollution, and climate change.

Natural decomposition of biodegradable polymers and bioplastics lessens their environmental effect and the amount of waste that ends up in landfills. Because they are adaptable and resilient to a range of weather situations, organic materials are perfect for covering surfaces such as cars, outdoor furniture, and rooftops. The organically modified covers keep their structural integrity, repel water, and withstand UV rays.

Organic covers support green infrastructure initiatives, shielding surfaces from harsh weather, enhancing energy efficiency, stormwater management, and improving urban aesthetics. Future research and innovation are anticipated to enhance design, durability, and affordability, making organic absorbent covers an essential part of urban terrains.

Research and Development in SAPs and Material Science

Improvements in SAP and material science breakthroughs present promising prospects for absorbent covers, with SAP-based materials envisioned to improve the packaging process.

Materials that both absorb and hold onto water are known as superabsorbent polymers (SAPs), and because of their special qualities, they may be used in a wide range of applications. Hydrogel-based SAPs, which are utilized in wound dressings, hygiene goods, and agriculture, are the result of recent developments in SAP technology. SAPs also improve the strength, resilience to cracks, and durability of concrete.

Aerogels with SAP components, known for their low density and high porosity, benefit from SAP integration, offering enhanced water absorption, thermal insulation, and lightweight properties.

The developed SAPs are estimated to modify diaper cores by absorbing urine, preventing leakage, and maintaining skin health. They also enhance soil water retention, improving crop yield in arid regions.

High Expenditure on Research and Development Limits the Industry

The price of raw materials, especially absorbent polymers, which are expensive for manufacturing, and have an impact on the demand for absorbent protections.

While working with such complex substances to maintain the pace of production, new entrants are anticipated to invest in novel research and development for cheap and high-quality polymer alternatives.

Manufacturers are anticipated to seek affordable and sustainable raw materials for absorbent sheets to reduce costs, consequently hindering the growth of the absorbent cover industry.

The global absorption cover market size was USD 2 billion in 2020. It is estimated to report a CAGR of 2.7% from 2020 to 2025 and was valued at USD 2.4 billion in 2025. The industry, before the global pandemic, was experiencing stealth development in terms of industrialization, especially in emerging economies such as India and China.

After the period of pandemic, the sector is anticipated to face several hardships due to the interruption of supply chain operations and industrial processes. As a result, the market's growth rate is considerably constrained throughout the anticipated period.

Specialized innovations in production and material science, coupled with stringent environmental regulations, LED to the adoption of eco-friendly technologies, promoting growth in industries like healthcare, petrochemicals, and pharmaceuticals that require precise temperature control.

The pandemic is estimated to cause disruptions in manufacturing and sales in Asia Pacific and Europe, affecting growth rates. However, sectors like healthcare and pharmaceuticals saw increased demand for absorption covers to maintain critical environments, partially offsetting the pandemic's widespread adverse impact.

In the post-pandemic era, industry experienced recovery and growth, compelled by the resumption of industrial activities, increased focus on energy efficiency and sustainability, and government initiatives and incentives for green technologies, which further boosted growth.

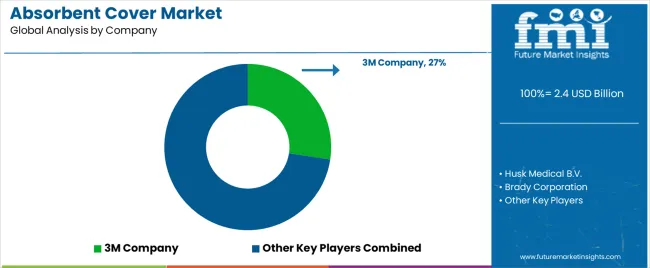

Tier 1 companies comprise market leaders with high production capacity and a wide product portfolio. They specialize in manufacturing and reconditioning, offering a variety of series, including reconditioning, recycling, and manufacturing using the latest technology, meeting regulatory standards, and providing the highest quality.

Prominent companies within Tier 1 include big players such as Brady Corporation, Medline Industries, LP, Husk Medical B.V., and other.

Companies in the Tier 2 category with a sizable revenue share and a strong provincial presence such as Sirane Ltd, Gusmer Enterprises, Inc., and Enviroguard Solutions. Because of their specialized product offerings and localized impact, they maintain their competitiveness in the sector even if they are not as internationally strong as firms in the Tier 1 type are.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

Establishments are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below discusses the country-level forecast for the absorbent cover industry.

The demand from emerging regions of Asia-Pacific such as India and China is projected to thrive in the forthcoming decade, highlighting the CAGR of 4.9% and 4.4%, respectively. The demand for the United States is anticipated to report a CAGR of 2.9% by 2035. The industry in Spain is estimated to register a CAGR of 3.4%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| Canada | 2.8% |

| Germany | 2.7% |

| Spain | 3.4% |

| China | 4.4% |

| India | 4.9% |

The demand for absorbent sheets in the United States is anticipated to exhibit a CAGR of 2.9% by 2035. Regional institutions are anticipated to develop novel innovations in the development of high-quality absorption covers. For such endeavors, the players are utilizing creative ways to improve production.

For instance, Purdue University researchers are developing biodegradable superabsorbent materials using cellulose extracted from industrial hemp. The material is ideal for products requiring high absorbency due to its molecular structure, which can be modified to boost water retention capabilities.

The Purdue process to refine the cellulose extract from hemp involves a carefully designed sequence of treatments. The material could also be used in additives that help soil retain water, offering a sustainable alternative to traditional super absorbents.

The development of the manufacturing plants in India is envisioned to upsurge by the country’s focus on sustainable materials for healthcare products. The demand from India is estimated to register a CAGR of 4.9% by 2035.

The establishments in India are anticipated to invest in research and development initiatives in material science.

For instance, Indian garment manufacturer Shahi Exports and the Hong Kong Research Institute of Textiles and Apparel (HKRITA) are conducting pilot research in India to develop a regenerative agricultural process using cotton textile waste.

HKRITA’s project is designed to stabilize the output of cotton crops, encourage reusing worn out fabrics for production of high-quality garments and come up with a green substitute for superabsorbent polymers made from petrochemicals.

The pharmaceutical industry in Spain is envisioned to demand absorption sheets, which are essential for creating various medical products. The demand is anticipated to report a CAGR of 3.4% by 2035. The sheets play a crucial role in the manufacturing of pharmaceutical items such as wound dressings, medical padding, and other related products where moisture absorption is vital.

In Spain, the proliferation of absorption sheets suggests that there could be potential for its production because of the demand for improvements in medical and healthcare products. Pharmaceutical companies’ demands for these sheets have increased as they help ensure that medical supplies’ quality and strength are preserved.

The section contains information about the leading segments in the absorbent cover industry. In terms of material, the foam segment is estimated to account for a share of 34.1% in 2025. In terms of end use, the healthcare sector is projected to dominate by holding a share of 37.3% in 2025.

| Material | Foam |

|---|---|

| Value Share (2025) | 34.1% |

The absorbent cover industry is envisioned to see a rise in demand for foam materials due to their unique properties, such as their ability to provide cushioning, insulation, moisture absorption, comfort, impact resistance, and protection against external elements. In 2025, the foam material is projected to acquire a revenue share of 34.1%.

Foam is being used in various industries due to its versatility and customization, with manufacturers incorporating it into mattress covers, automotive interiors, and medical pads, and the growing interest in eco-friendly foam alternatives.

| End Use | Healthcare |

|---|---|

| Value Share (2025) | 37.3% |

The healthcare sector is projected to drive innovations in specific absorbent materials in 2025, emphasizing on their antimicrobial properties, hypoallergenic characteristics and environmentally friendly alternatives. Health care institutions are the main users of these products, commanding a global share of 37.3%.

The demand for absorbent sheets in the industry is caused primarily by the superior materials used, providing comfort at its best. Hospitals, clinics and homes depend on these sheets to avoid spillage as well as keep them clean.

The absorbent cover market is estimated to experience consolidation, with numerous small and local manufacturers competing for global recognition. As competition intensifies, key players are strategically positioning themselves to gain a competitive edge. They use strategies such as mergers and acquisitions, collaborations and partnerships, product launches, and portfolio strengthening to enhance their market share and product offerings.

Mergers and acquisitions involve integrating resources, expertise, and customer bases, while collaborations facilitate knowledge exchange and technological advancements. New product launches, such as improved materials, enhanced functionality, or eco-friendly options, are crucial for staying ahead. Portfolio strengthening involves diversifying products to cater to diverse customer needs, ensuring resilience against market fluctuations.

As consumer preferences evolve and sustainability gains prominence, adaptability, and innovation will be paramount for triumph in the dynamic absorbent cover market.

Recent Industry Developments in Absorbent Cover Market

In terms of material, the industry is separated into superabsorbent polymers (SAPs), cellulose, non-woven fabrics, foam, cotton, and other natural fibers.

Based on the application, the industry is integrated into medical pads, diapers, absorbent pads, floor mats, and seat covers.

End use industries of the product are healthcare, personal care, automotive, and industrial.

Key countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa (MEA) have been covered in the report.

The global absorbent cover market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the absorbent cover market is projected to reach USD 3.3 billion by 2035.

The absorbent cover market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in absorbent cover market are foam, cellulose, non-woven fabrics, superabsorbent polymers, cotton and other natural fibers.

In terms of application, diapers segment to command 35.0% share in the absorbent cover market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Absorbent Cover Providers

Absorbent Glass Mat (AGM) Battery Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Absorbent Booms & Socks

Absorbent Booms and Socks Market Analysis – Growth, Demand & Forecast 2025-2035

Absorbent Tray Liners Market

Super Absorbent Polymer Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Cover Crop Seed Mixes Market Size and Share Forecast Outlook 2025 to 2035

Cover Crop Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Cover Caps Market Size and Share Forecast Outlook 2025 to 2035

Recovered Paper Market

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Car Cover Industry

AI-Driven eDiscovery – Enhancing Legal & Compliance Operations

eDiscovery solution Market

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Slip Cover Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Wall Covering Product Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA