Growth of the absorbent booms & socks industry can be attributed to the growing demands in spill containment, industrial safety, and environmental protection sectors. The key growth drivers have been advcanements in the absorption capabilities of materials, initiatives for sustainability, and compliance with regulations. Eco-friendly material providers, high-absorption technology firms, and those offering multi-purpose applications are among the companies finding a competitive edge in this rapidly changing market.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

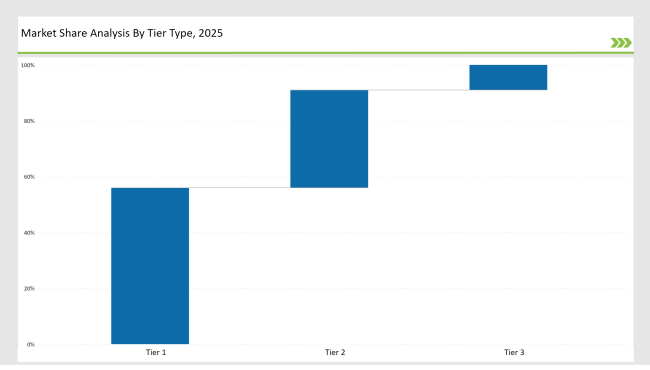

Tier 1: Leading manufacturers, including New Pig, Brady Corporation, and SpillTech, hold 56% of the market share. These companies dominate through superior production techniques, innovation in spill containment solutions, and extensive global distribution networks.

Tier 2: Mid-sized players, such as SPC (Specialty Products Company), Oil-Dri Corporation, and Chemtex, account for 35% of the market. They attract customers with cost-effective spill control solutions, customizable absorbents, and high-performance materials.

Tier 3: Regional and niche manufacturers hold 9% of the market, focusing on specialized solutions such as biodegradable absorbents, oil-only booms, and high-capacity socks for hazardous spills.

Global Market Share by Key Players (2025)

| Category | Market Share % |

|---|---|

| Top 3 (New Pig, Brady Corporation, SpillTech) | 22% |

| Rest of Top 5 (SPC, Oil-Dri Corporation) | 18% |

| Next 5 of Top 10 | 16% |

The demand for absorbent booms & socks is influenced by various industrial and environmental applications:

Manufacturers are innovating to offer specialized solutions:

Leading manufacturers have driven innovation with sustainable materials, high-absorption capabilities, and advanced spill containment designs.

Year-on-Year Leaders

Companies aiming to thrive in the absorbent booms & socks industry should focus on sustainability, efficiency, and innovation. Key strategic areas include:

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | New Pig, Brady Corporation, SpillTech |

| Tier 2 | SPC, Oil-Dri Corporation, Chemtex |

| Tier 3 | Green Boom, Abasco, UltraTech International |

Leading manufacturers continue to invest in sustainable materials, technological enhancements, and spill containment innovations.

| Manufacturer | Latest Developments |

|---|---|

| New Pig | Introduced advanced high-absorption socks for industrial spills (March 2024). |

| Brady Corporation | Launched eco-friendly absorbents for environmental cleanup (August 2023). |

| SpillTech | Expanded its oil-only boom portfolio for offshore applications (May 2024). |

| SPC | Developed cost-effective absorbent socks for chemical spills (November 2023). |

| Oil-Dri Corporation | Focused on high-performance absorbents for industrial leak control (February 2024). |

Sustainability, efficiency, and customization are shaping the absorbent booms & socks industry. Leading brands leverage these factors to maintain market leadership:

The absorbent booms & socks industry will evolve toward improved absorption technology, sustainability, and enhanced spill response capabilities. Key focus areas include:

The industry is expanding due to increasing environmental regulations, the need for effective spill containment, and advancements in eco-friendly absorbent materials.

Key industries include oil & gas, manufacturing, marine cleanup, and emergency response teams that require rapid spill absorption solutions.

Companies are integrating biodegradable materials, high-absorption technology, and AI-driven spill detection for real-time containment.

Explore Plastic Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.