With rising consumer consciousness about health and increasing preference for plant-derived and natural dairy products, the worldwide A2 milk market is poised for continuous growth in the forecasted years. A2 milk comes from cows that naturally produce only the A2 beta-casein protein, as opposed to conventional milk, which has both A1 and A2 beta-casein.

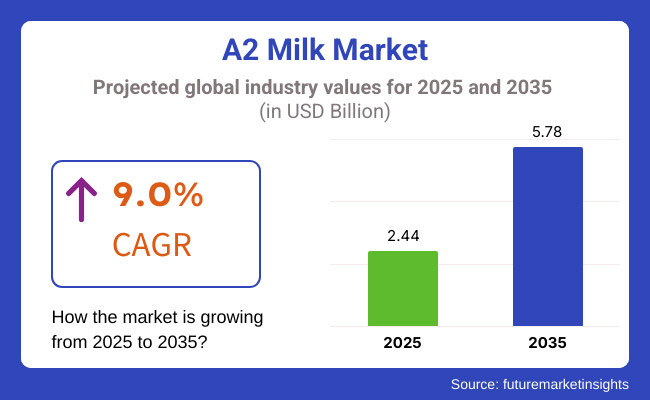

This separation has created demand among those who feel discomfort from regular milk and want to still partake in the dairy's nutritional value. The market is also fueled by increased interest in functional foods and beverages, increasing availability of products across all major regions, and a growing preference for premium dairy and dairy products. The same was valued at USD 2.44 Billion (2025) and is estimated to witness a CAGR of 9.0% in the market size, reaching USD 5.78 Billion (2035).

Explore FMI!

Book a free demo

In North America, a major factor contributing to the growth of the A2 milk market in North America is increasing health consciousness among consumers and the growing trend for digestive wellness. The USA and Canada are significant contributors, with more retail stores and websites carrying A2 milk products. With continuous innovations in dairy farming practices and a strong emphasis on consumer education, these endeavors are anticipated to maintain North America's leadership position in the A2 milk market.

Natural and functional dairy trend across Europe is catching fire as A2 milk makes its entrance. Countries including the United Kingdom, Germany and France are seeing rising demand for A2 milk, driven by heightened awareness both of the product’s distinctive qualities and of its ability to relieve discomfort among people with sensitivity to A1 beta-casein.

A mature dairy sector coupled with a regulatory framework fostering innovative products are helping the writing on the wall, and the timing is perfect. Furthermore, European dairy manufacturers have launched a series of A2 milk-based products in different variants, be it milk powders, infant formulas, or yogurts, to help reach a broader base and encourage long-term adoption.

The Asia-Pacific market for A2 milk is witnessing high growth mainly due to the high portion of the lactogen population in this region, seeking dairy alternatives as well high disposable incomes, attributes health and wellness. China, Australia, and India are among the countries leading the regional expansion, with Australia as the source of numerous A2 milk brands, particularly.

The increasing demand for high-end dairy products and infant formulas in China has driven the consumption of A2 milk. A2 milk is also gaining traction in India’s extensive dairy industry, bolstered by a traditional preference for local cow breeds that produce A2 milk. Asia-Pacific is anticipated to be one of the most influential regions for the world A2 milk market as the regional industry matures.

The A2 Milk Market faces several challenges despite increasing demand; the limited genetic lines of A2 cows and the necessity to test genetics for milk purity present supply challenges. In addition, high production costs, volatile raw material prices, and strict dairy industry regulations pose financial and operational pressures on producers. Another challenge is consumer education knowledge about A2 milk’s advantages over traditional milk is still developing, particularly in emerging markets.

Despite these challenges, increasing requirements for dairy products that are less complex to digest and high health consciousness among consumers are driving the market growth. The increasing incidence of lactose intolerance and dairy-related digestive issues has led to the market for A2 milk as an alternative to regular milk.

Increased marketing campaigns, positioning as a premium product, and introducing product variants, including A2 milk-based infant formula and other products such as cheese and yogurt, are also aiding market expansion. Businesses investing in sustainable dairy farming, advanced breeding techniques, and strategic partnerships with retailers and e-commerce companies will benefit from shifting consumer preferences.

The growth can be attributed to the growing health issues and the rising demand for lactose-free and easy-to-digest dairy products from 2020 to 2024 in the A2 Milk Market. Momentum in the market was also due to expansion initiatives in the global market, especially in North America, Europe, and Asia-Pacific, and diversification of the product portfolio into A2-based infant nutrition and dairy derivatives.

Looking ahead to 2025 to 2035, the market is predicted to go deeper into mainstream dairy segments, driven by technology penetration: dairy farming technology, genetic research, and sustainable production practices. Digital marketing, direct-to-consumer (DTC) sales, and functional food trends will define the next growth phase. Moreover, the rising government support for organic and specialty dairy products and regulatory harmonization around A2 milk labeling will only boost consumer confidence and market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with evolving dairy regulations, initial steps toward standardizing A2 certification. |

| Consumer Trends | There is a rising demand for digestive-friendly dairy products but limited mainstream penetration. |

| Industry Adoption | Growth in specialized dairy farms focusing on A2 milk production and early genetic testing adoption. |

| Supply Chain and Sourcing | Reliance on selective breeding and controlled supply chains with limited scalability. |

| Market Competition | Dominance by niche players and premium brands, with traditional dairy companies testing A2 product lines. |

| Market Growth Drivers | Growth fueled by health-conscious consumers, lactose-intolerant demographics, and premium dairy demand. |

| Sustainability and Energy Efficiency | Limited focus on sustainability, with early adoption of organic and grass-fed A2 dairy initiatives. |

| Integration of Smart Technologies | Early-stage digital marketing and e-commerce penetration, with basic supply chain digitization. |

| Advancements in Product Offerings | Focus on liquid A2 milk, with early expansion into yogurt, infant formula, and dairy-based beverages. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulatory frameworks ensure transparency, standard labeling requirements, and global trade harmonization. |

| Consumer Trends | Expansion into mass-market dairy segments with enhanced consumer education and product accessibility. |

| Industry Adoption | Advanced breeding programs, AI-driven dairy management, and large-scale A2 dairy operations. |

| Supply Chain and Sourcing | Expanded global supply chains with technological advancements in dairy genomics and sustainable farming practices. |

| Market Competition | Widespread adoption by major dairy brands, increased competition, and private-label A2 milk offerings. |

| Market Growth Drivers | Accelerated adoption is driven by functional food trends, increased retail availability, and government incentives. |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral dairy farming, zero-waste production, and eco-friendly packaging. |

| Integration of Smart Technologies | AI-driven dairy optimization, blockchain-enabled milk traceability, and smart farm automation. |

| Advancements in Product Offerings | Diversification into probiotic-rich A2 products, plant-A2 hybrid dairy alternatives, and personalized nutrition solution |

As consumers seek potential digestive benefits from alternative dairy products, the USA A2 milk market is growing on the health-conscious agenda. As more shoppers discover A2 beta-casein protein and its potential benefits over regular milk, the demand for A2 in supermarkets and online is exploding. The growth in demand has prompted key players to invest in product innovations and marketing strategies tailored to changing consumer preferences.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.2% |

In the United Kingdom, the market for A2 milk is growing steadily as A2 milk has more health benefits compared to regular A1 milk, and A2 milk has healthier alternatives. Market growth is driven by the availability of A2 milk in retail stores and a growing consumer preference for natural, additive-free nutrition. Consumers are also impacted due to digital marketing campaigns promoting the health benefits of A2 milk.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.8% |

A2 milk is making inroads as consumers emphasize digestive health and the adoption of clean-label dairy products. Demand is rising in countries such as Germany and France, where disposable income levels are rising, and specialty dairy products are becoming more accessible. Several strategic alliances between dairy producers and retailers are enabling some penetration in new marketplaces.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.0% |

The demand for Japan’s A2 milk market is driven by the country’s growing elderly population and their appetite for easy-to-digest dairy products. Many leading dairy brands are now launching A2 milk-based substitutes in different packaging formats to meet the different needs of consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.9% |

In South Korea, A2 milk, a premium option for lactose-intolerant consumers, is also gaining popularity. This has improved the accessibility of products with the gradual rise of e-commerce platforms and digital grocery services. The long-term growth of the market is also predicted to be fostered by governmental initiatives promoting gut health and dietary balance.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.1% |

The market for A2 milk keeps growing as consumers seek healthier alternatives that are reputed to be easier to digest and more nutritious. Market players segment their offerings using two main dimensions, nature and form.

The marketplace as it naturally separates organic from conventional A2 milk, allowing both to cater to different consumer segments and regulatory environments. Market by form is segmented in liquid and powder A2 Milk, which serves the product for consumers' various consumption habits and distribution channels.

The producers of A2 milk have a two-way approach to satisfy the consumers. The difference is that organic A2 milk meets strict organic certification standards with products free of synthetic pesticides, hormones, and antibiotics. Organic A2 milk consumers are typically among the purist types of consumers with concern for the environment.

These purchasers appreciate the transparency in sourcing and production practices that come with organic certification. To back their organic labels, producers invest in sustainable farming practices, animal welfare and rigorous quality controls. Environmental and ethical considerations in consumer decision-making have resulted in favorable prices posts for organic A2 milk.

In contrast, conventional A2 milk appeals to a wider consumer base that appreciates the intrinsic advantages of A2 protein in their diet without the lifelong commitment to organic pricing. Traditional A2 milk producers utilize proven dairy farming practices compliant with standard safety and quality regulations while focusing on the distinct advantages offered by A2 proteins.

This segment is a premium-seeking micro-niche that enjoys economies of scale and is often available more widely, bringing A2 milk to all consumer groups, particularly consumers who focus mostly on digestive benefits and nutritional value. Producers are driving further innovation with a growing market through processing enhancements, consistency and pricing.

The fact that A2 milk is not only natural but also a form that responds to the diverse consumer needs. The main product for consumption, Liquid A2 milk, occupies the entire market. Households and food service organizations rely on liquid A2 milk for its freshness, taste, and instantaneous nutrients.

To address everyday consumer needs, producers closely scrutinize their products' continual cold chain management, enhancing their packaging solutions, and testing various innovative flavor additions. Liquid A2 milk continues to perform well in urban and suburban areas, aided by an increasing health literacy and trend towards functional foods.

Powder A2 milk is meant for consumers and industries that are more concerned about convenience, shelf life, and range of products. Manufacturers employ advanced drying techniques to convert liquid A2 milk into powder, while maintaining nutritional integrity and prolonging product shelf-life. A2 powdered milk is especially useful when refrigeration is difficult or for long-distance distribution.

It is used in processed foods, baby food, and food supplements, offering a versatile ingredient suitable for incorporating different formulations. And, as the need for convenience, portability, and on-the-go options for dairy products increases in the market, powdered A2 milk offers a practical and appealing solution, retaining the specific advantages of A2 proteins while allowing for flexible logistics options.

The global A2 milk market is growing with rising demand from consumers for digestible dairy products, non-lactose options, and health benefits. Furthermore, more companies are investing in AI-powered dairy production analytics, A2 protein genetic testing in cows, and sustainable dairy farming practices to improve nutritional quality, supply chain, and consumer outreach.

The market participants include dairy factories, organic milk producers, health food companies, and specialized dairy cooperatives that constantly promote technological improvements in dairy genomics, AI-enabled herd management, and high-end dairy product innovation.

Market Share Analysis by Key Players & Dairy Brands

| Company Name | Estimated Market Share (%) |

|---|---|

| The a2 Milk Company | 35-40% |

| Nestlé S.A. (A2 Infant Formula & Dairy Products) | 12-16% |

| Danone S.A. (A2 Milk Expansion in Functional Dairy Market) | 10-14% |

| Freedom Foods Group Limited | 8-12% |

| Fonterra Co-operative Group | 5-9% |

| Other Dairy Producers & Specialty A2 Milk Brands (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| The A2 Milk Company | Pioneers in A2 protein-based milk production, AI-driven dairy herd selection, and global A2 milk market expansion. |

| Nestlé S.A. | Develops A2 infant formula, functional dairy beverages, and AI-powered dairy supply chain innovations. |

| Danone S.A. | Specializes in A2-based probiotic dairy products, gut-health-enhancing dairy solutions, and plant-based dairy alternatives. |

| Freedom Foods Group | Focuses on A2 milk product diversification, including lactose-free dairy and organic milk solutions. |

| Fonterra Co-operative Group | Invests in A2 protein dairy research, sustainable dairy farming practices, and A2 dairy ingredient solutions. |

Key Market Insights

The A2 Milk Company (35-40%)

Leaders in A2 protein milk manufacturing, AI technology-driven dairy herd management, and international expansion of the A2 milk market.

Nestlé S.A. (12-16%)

Its A2 infant formula, functional dairy beverages, and AI-driven dairy supply chain innovations.

Danone S.A. (10-14%)

BioSciences Specializes in A2 foundation probiotics dairy products, intricate gut health dairy solutions, and plant-based dairy substitutes.

Freedom Foods Group (8-12%)

Emphasis on A2 milk product diversification, including lactose-free dairy and organic milk solutions.

Fonterra Co-operative Group (5-9%)

Supports research on A2 protein dairy, sustainable dairy farming practices, A2 dairy ingredients solutions.

Other Key Players (20-30% Combined)

Next-gen dairy innovations, AI-supported dairy analytics, and the environmentally friendly mass production of A2 milk have been fueled by several dairy brands, organic milk producers, and niche A2 milk brands. These include:

The overall market size for A2 milk market was USD 2.44 Billion in 2025.

The A2 milk market is expected to reach USD 5.78 Billion in 2035.

The demand for A2 Milk is expected to rise due to increasing consumer preference for digestive-friendly dairy products, growing awareness of the potential health benefits of A2 beta-casein protein, and expanding product availability across retail and online distribution channels. Additionally, rising lactose intolerance cases and the perception of A2 milk as a premium dairy alternative are driving market growth.

The top 5 countries which drives the development of A2 milk market are USA, UK, Europe Union, Japan and South Korea.

By Nature to command significant share over the assessment period.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.