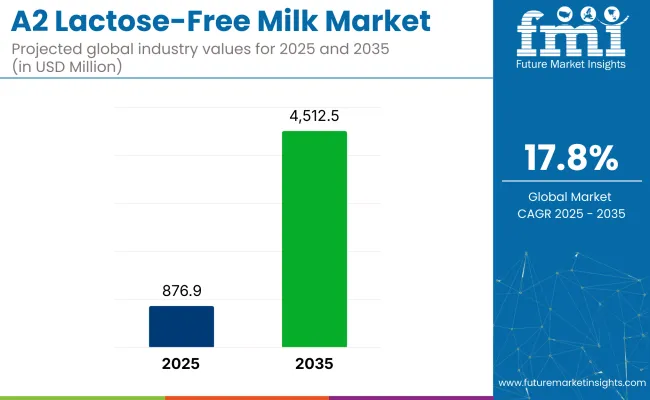

The A2 lactose-free milk market is experiencing rapid growth with USD 876.5 million in 2025 and USD 4,512.5 million by 2035. Demand is expected to grow at a CAGR of 17.8%, driven by increasing consumer demand for lactose-free alternatives. The liquid form of A2 milk is projected to dominate due to its convenience and easy incorporation into everyday diets.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 876.9 million |

| Projected Value (2035F) | USD 4,512.5 million |

| Value-based CAGR (2025 to 2035) | 17.8% |

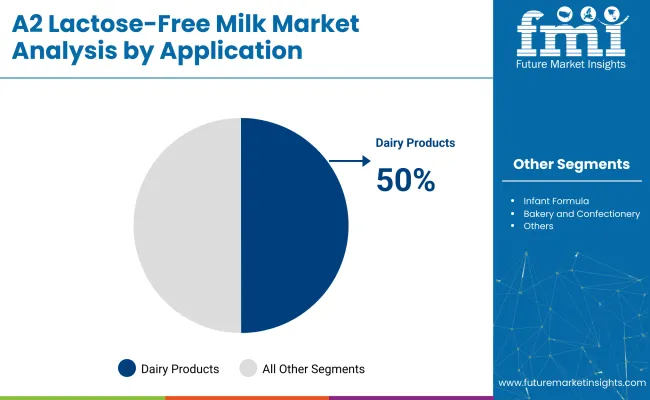

The dairy products segment, which includes butter, cheese, yogurt, and milk powder, is expected to hold the largest application share as these products are staples in most diets. Plastic bottles and pouches are forecasted to lead the packaging segment due to their convenience, low cost, and widespread availability.

As more consumers adopt lactose-free diets for health reasons, the industry for A2 lactose-free milk will continue to expand, particularly in regions with growing middle-class populations such as China, India, and the USA

In a 2023 statement to Reuters, David Bortolussi, CEO of The a2 Milk Company, acknowledged the growing challenges in the Chinese industry for A2-based infant formula, noting, “The China IMF market has become increasingly challenging as a result of lower birth rates and increased competitive intensity.” This comment reflects the external pressures faced by the A2 lactose-free milk segment in key international markets, even as demand for premium and natural dairy alternatives continues to rise globally.

The industry holds varying shares within its parent markets. In the dairy products market, it accounts for approximately 7-10%, driven by the growing preference for A2 protein milk, which some consumers find easier to digest.

Within the broader functional foods and beverages market, A2 lactose-free milk makes up about 1-2%, as it contributes to digestive health but competes with other functional beverages. In the milk alternatives market, it holds a niche share of around 5-7%, targeting consumers seeking lactose-free options without resorting to plant-based alternatives.

In the health and wellness market, its share is about 3-4%, as it aligns with the demand for health-focused dairy products. In the organic food market, A2 milk represents 1-3%, appealing to consumers looking for natural and minimally processed options.

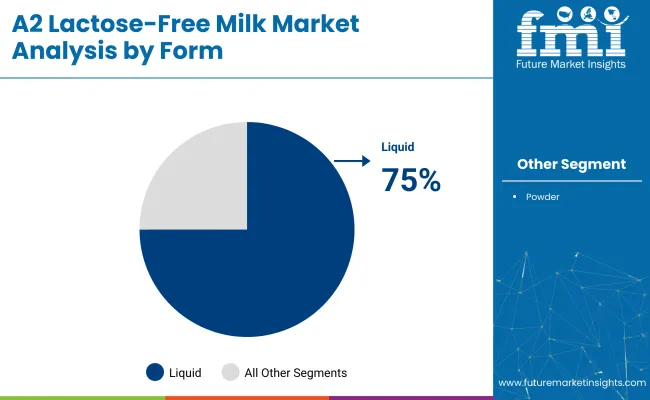

The industry is dominated by liquid form, projected to capture 75% of the industry share. Dairy products, such as butter, cheese, and yogurt, are expected to lead the application segment with a 50% share. Plastic bottles and pouches will dominate packaging at 32%, while B2Cdistribution channels will lead at 45% industry share.

Liquid A2 lactose-free milk is expected to hold the largest share, 75%, of the industry in 2025. The convenience of liquid form, combined with its wide applicability in daily consumption, drives its popularity. Liquid A2 milk can easily be incorporated into beverages, cereals, and cooking, making it an everyday staple for many consumers.

As the demand for lactose-free products rises, especially in health-conscious industries, liquid A2 milk will continue to dominate. Additionally, the ease of distribution and packaging for liquid forms contributes to its industry-leading position.

Dairy products, including butter, cheese, yogurt, milk powder, and ice cream, are projected to capture 50% of the industry share in 2025. These products are widely consumed, and the demand for lactose-free versions is growing as more consumers seek alternatives to traditional dairy.

The increasing focus on healthier lifestyles and the popularity of lactose-free diets contribute to the rising consumption of lactose-free dairy items. The dairy industry’s adaptation to these trends, with products such as lactose-free yogurt and cheese, will continue to drive growth in the industry.

Plastic bottles and pouches are expected to capture 32% of the industry in 2025. This packaging type is favored due to its lightweight, cost-effective, and easily recyclable nature, making it ideal for mass production and distribution. Plastic bottles and pouches offer convenience for consumers, especially in ready-to-drink formats. The widespread use of these packaging options in retail and online stores further enhances accessibility to A2 lactose-free milk. The growing adoption of eco-friendly and sustainable practices in packaging will also contribute to the continued dominance of plastic bottles and pouches.

The B2C (business-to-consumer) segment is projected to lead the distribution channel for A2 lactose-free milk, capturing 45% of the industry share in 2025. This channel includes retail stores, supermarkets, convenience stores, and online platforms.

The increasing preference for online shopping and home delivery services is boosting the demand for A2 milk through digital platforms, while physical retail outlets continue to play a significant role in product availability. As the consumer base for organic and health-conscious products grows, B2C sales channels will continue to be the primary method of distributing A2 Lactose-Free Milk.

The industry faces challenges, including substantial investments in processing technologies and limited access to markets with low lactose awareness. Regional variations in dairy consumption habits, paired with the premium pricing of A2 milk, are potential barriers to its wider adoption, particularly in developing economies. Despite these hurdles, the growth trajectory of A2 lactose-free milk is being bolstered by a niche yet expanding consumer base focused on clean-label and functional foods.

Increasing Health Consciousness and Demand for Lactose-Free Products

The industry is growing due to increased awareness of lactose intolerance and the rising demand for healthier food choices. Many consumers are seeking alternatives to traditional milk due to digestive issues. A2 milk is becoming popular, especially in regions with high lactose intolerance, and is aligned with trends toward clean eating, health-conscious diets, and premium organic products.

High Production Costs and Limited Awareness in Some Regions

A key challenge for the industry is the high cost of production, as A2 milk requires a specialized environment and specific dairy farming techniques. These factors increase production expenses, leading to higher retail prices. Additionally, while awareness is rising in certain regions, A2 milk remains relatively unknown in some emerging industries, limiting its widespread adoption.

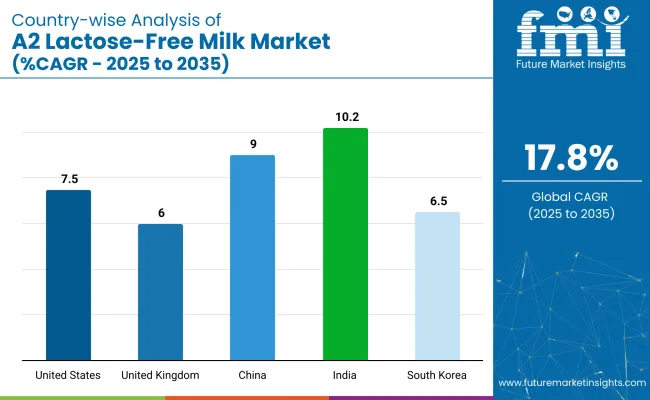

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.5% |

| United Kingdom | 6 % |

| China | 9.0% |

| India | 10.2% |

| South Korea | 6.5% |

The global A2 lactose-free milk market is set to grow at an impressive CAGR of 18.2% from 2025 to 2035. The United States, with a CAGR of 7.8%, demonstrates steady growth driven by increasing consumer awareness of lactose intolerance and a shift towards healthier dairy alternatives. The United Kingdom follows with a CAGR of 5.6%, supported by a gradual increase in demand for lactose-free dairy options, despite more conservative growth rates.

China, within the BRICS grouping, is forecast to expand rapidly, with a CAGR of 9.3%, driven by an increasing middle class and greater health consciousness. In India, also a member of BRICS, the market is set to grow at a remarkable CAGR of 11.5%, supported by rising awareness of lactose intolerance, expanding urban populations, and growing demand for health-conscious dairy products. South Korea, part of ASEAN, is experiencing healthy growth with a CAGR of 6.8%, reflecting the shift in dietary habits towards lactose-free options.

While OECD countries maintain steady growth, India is emerging as the fastest-growing market, highlighting the significant impact of emerging economies like BRICS and ASEAN on the future of the A2 lactose-free milk market. The report provides an in-depth analysis of over 40 countries, with a particular focus on top-performing OECD, BRICS, and ASEAN nations.

The United States is projected to grow at a CAGR of 7.5% in the industry. Rising health awareness and the increasing prevalence of lactose intolerance are key drivers of this growth. As consumers in the USA become more health-conscious, many are turning to lactose-free options, with A2 milk gaining popularity due to its digestive benefits.

Retail outlets and e-commerce platforms are expanding their offerings to cater to the rising demand for lactose-free dairy products. Companies like Horizon Organic and The A2 Milk Company are leading the charge, offering a range of lactose-free options to meet consumer demand.

The United Kingdom is expected to grow at a CAGR of 6.0% in the industry. As awareness of lactose intolerance and the benefits of lactose-free milk rises, UK consumers are increasingly adopting A2 milk as an alternative to traditional dairy. Retailers and online platforms are expanding their range of lactose-free milk products, with a focus on organic and premium options.

The UK industry is also seeing growing interest in plant-based alternatives, with A2 milk being promoted as a healthier choice for individuals who are sensitive to lactose. The trend towards health and wellness will continue to drive the industry forward.

China is expected to grow at a CAGR of 9.0% in the industry. As the Chinese industry increasingly shifts towards health-conscious diets, the demand for lactose-free milk options, including A2 milk, is on the rise. Growing awareness about the health benefits of A2 milk, coupled with an increasing prevalence of lactose intolerance in urban populations, is contributing to industry growth.

The expansion of retail channels and the rising middle class, particularly in major cities like Beijing and Shanghai, are expected to drive the demand for lactose-free milk, with more brands entering the industry to meet this need.

India is expected to experience the fastest growth in the industry, with a projected CAGR of 10.2%. The rise in disposable incomes and an increasing focus on health are fueling the demand for lactose-free products. In India, where lactose intolerance is highly prevalent, A2 milk is gaining popularity as a healthier alternative to traditional milk.

The growing adoption of dairy alternatives in urban areas, along with rising awareness of the health benefits of A2 milk, will continue to drive industry expansion. Companies are increasingly focusing on offering A2 milk products tailored to local tastes and preferences.

Demand in South Korea is projected to grow at a CAGR of 6.5% in the industry. As South Koreans increasingly embrace health-conscious diets, the demand for lactose-free milk alternatives is on the rise. A2 milk, with its easier digestibility, is becoming a popular choice for individuals who experience discomfort with regular milk.

The growing interest in functional foods and beverages, along with the increased availability of A2 milk in retail outlets and online stores, is further fueling the industry. As more South Koreans seek healthier dairy alternatives, A2 Lactose-Free Milk consumption is expected to grow steadily.

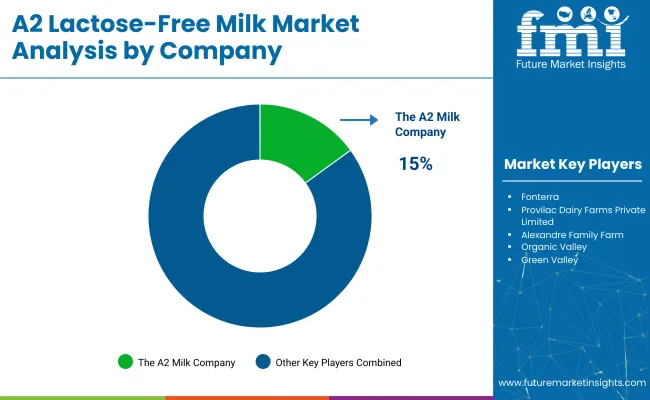

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as The A2 Milk Company, Horizon Organic, and Fonterra lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across North America, Europe, and Asia.

Key players including Shoonya Farms, Provilac Dairy Farms Private Limited, and Alexandre Family Farm offer specialized A2 milk products tailored to specific consumer preferences and regional industries. Emerging players, such as Organic Valley, Green Valley, and MooGoo Milk Company, focus on innovative formulations and premium offerings, expanding their presence in the growing A2 milk market.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 876.9 million |

| Projected Industry Size (2035) | USD 4,512.5 million |

| CAGR (2025 to 2035) | 17.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million liters for volume |

| Form Segmentation | Powder, Liquid |

| Application Segmentation | Infant Formula, Dairy Product (Butter, Cheese, Yogurt, Milk Powder, Ice Cream, Others), Bakery and Confectionery, Milk and Milk-based Beverages |

| Packaging Segmentation | Tetra Packs, Glass Bottles, Plastic Bottles and Pouches, Cans |

| Distribution Channel Segmentation | B2B, B2C (Store-based Retailing, Hypermarkets/Supermarkets, Grocery Stores, Convenience Stores, Specialty Stores), Online Retailing |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | The A2 Milk Company, Shoonya Farms, Horizon Organic, Fonterra, Provilac Dairy Farms Private Limited, Alexandre Family Farm, Organic Valley, Green Valley |

| Additional Attributes | Dollar sales by form, application, packaging type, and distribution channel, rising demand for lactose-free dairy alternatives, increasing adoption in infant formula and bakery products, regional trends in e-commerce and specialty retail for lactose-free milk, growing awareness about lactose intolerance. |

The industry is segmented into liquid and powder.

The industry is segmented into infant formula, dairy products (Butter, Cheese, Yogurt, Milk Powder, Ice Cream, Others), bakery and confectionery, and milk and milk-based beverages.

The industry is segmented into tetra packs, glass bottles, plastic bottles and pouches, and cans.

The industry is segmented into B2B, B2C (store-based retailing, hypermarkets/supermarkets, grocery stores, convenience stores, specialty stores), and online retailing.

The industry is segmented into North America, Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand, and Australia.

The industry size is projected to be USD 876.9 million in 2025 and USD 4,512.5 million by 2035.

The expected CAGR is 17.8% from 2025 to 2035.

Dairy Products are expected to hold a 50% industry share in 2025.

The leading company, The A2 Milk Company, holds a 15% industry share.

India is expected to grow at a CAGR of 10.2% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A2 Milk Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

A2P Messaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

A2 Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA